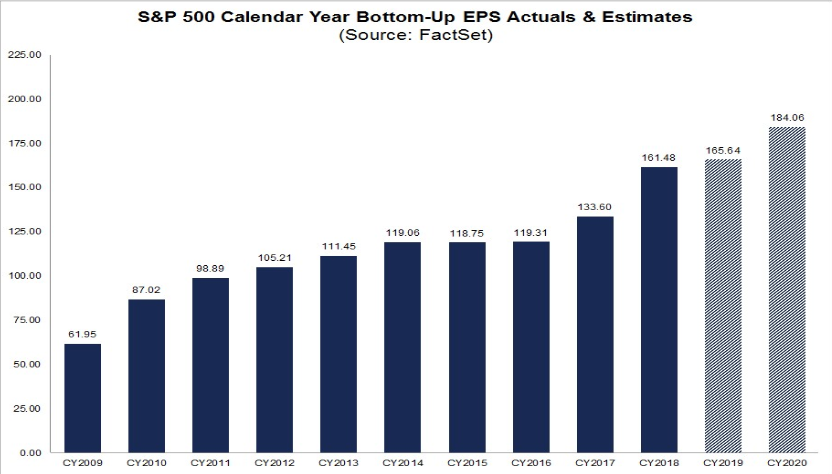

Data Source: Factset

The more I look at the earnings estimates for 2020, the more this is starting to look like 2015-2017. 2015-2016 S&P 500 EPS (Earnings Per Share) was basically flat ($118.75, $119.31) as are 2018-2019 ($161.48, $165.64 est).

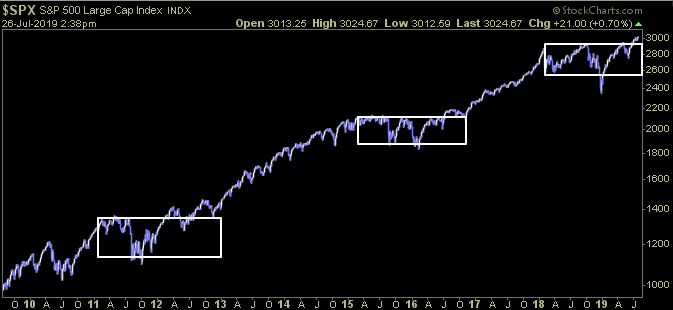

However, if you look at the jump in earnings for 2017 (after 2 years of flat growth and sideways consolidation in the markets 2015-2016) you will start to see the market began to rise in the back half of 2016/early 2017 in anticipation of the 11.9% jump in EPS in 2017 (see S&P chart below).

Similarly, while everyone is saying “but we’re up 20% already this year,” this is misleading because of the huge Fed induced drawdown we experienced in December. We are only 2.8% above where we were at the highs last Fall. 2019 was the year of tough comps (due to the tax cuts in 2018). A lot can go right moving forward (1-3 fed cuts, some positive China progress, a big infrastructure deal in coming months, and potentially a weakening dollar) to support the estimated 11.1% EPS growth for 2020 (similar number to 2017 growth percent referenced above).

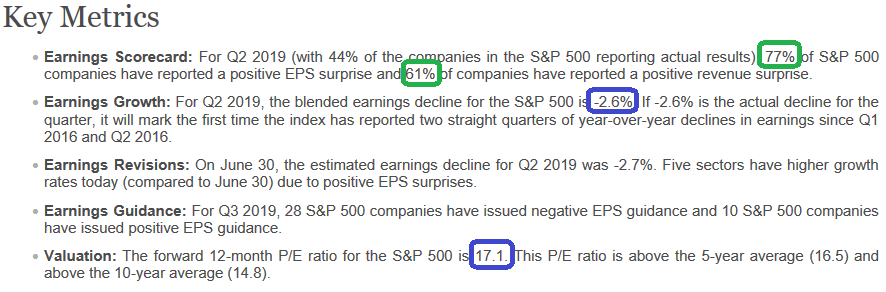

So that’s the big picture, how are earnings going for Q2 so far? Better, is the short answer. Not too hot to take the Fed out of the the picture and not too cold to trigger a recession.

-The beat rate is above average at 77% and the year on year growth rate has improved +.80% to -2.6% from -3.4% from last week*.

-Health Care (100%), Real Estate (86%), and Consumer Staples (85%) have the highest percentages of companies reporting earnings above estimates, while the Utilities (67%) and Consumer Discretionary (67%) sectors have the lowest percentages of companies reporting earnings above estimates.

-The Financials Sector Has Seen Largest Increase in Earnings and Revenue since June 30 (to 4.7% from 0.6% EPS | to 2.8% from 1.8% Revenues).

-Health Care is reporting the highest (year-over-year) earnings growth of all eleven sectors at 4.8%.

-During the upcoming week, 168 S&P 500 companies (including 7 Dow 30 components) are scheduled to report results for the second quarter.

*Factset: The earnings decline of -3.4% published in today’s report for last week (July 19) is different than the -1.9% published in last week’s report due to changes made to the estimates for Boeing for Q2 after publication.