Data Source: FactSet

Wall Street has once again set the EPS bar extremely low for Q3 – as they have the past two quarters so that expectations could be meaningfully exceeded (as in Q1 & Q2 results).Last week, we covered the significance of seeing 3 negative quarters of earnings growth and how this setup mirrors Q3 of 2016.

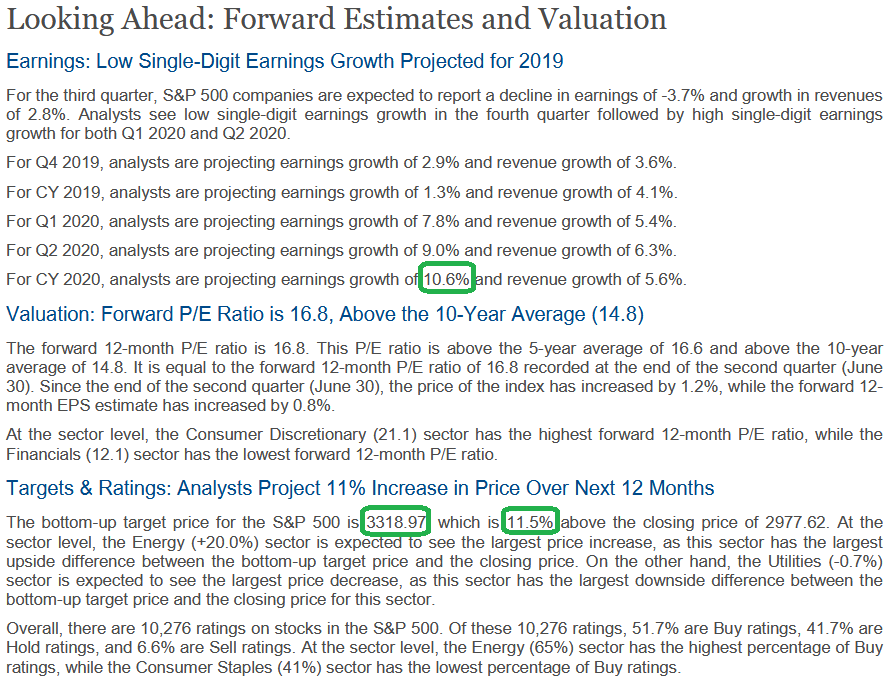

As we saw after flat earnings and price for the S&P 500 (2015-2016), the market started to discount the 11.97% earnings growth for 2017 in late Q3 2016 and early Q4 2016. Following 3 negative quarters of earnings growth, mass pessimism from recency bias and significant underweight positioning toward equities – managers were forced to panic catch-up to their benchmarks as the S&P 500 rallied 36% by Q1 2018. The set-up today is similar.

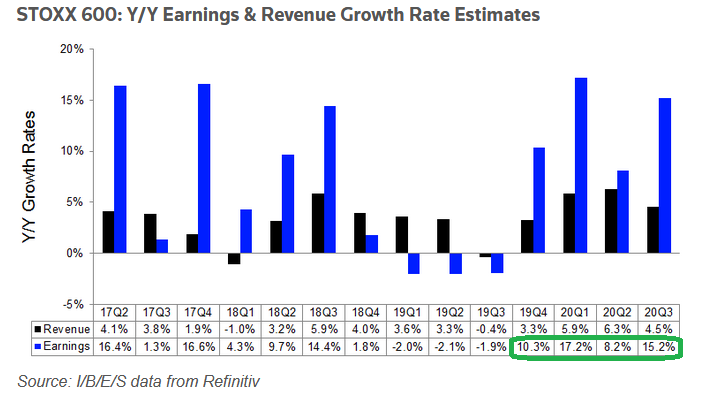

Not only are US S&P 500 earnings projected to grow 10.6% for 2020, but European Stoxx 600 earnings are projected to grow mid-teens.

Data Source for US – FactSet:

Data Source for Stoxx 600 – I/B/E/S data from Refinitiv

With sentiment so low going into earnings season, it sets the table for positive surprises both in earnings and price: