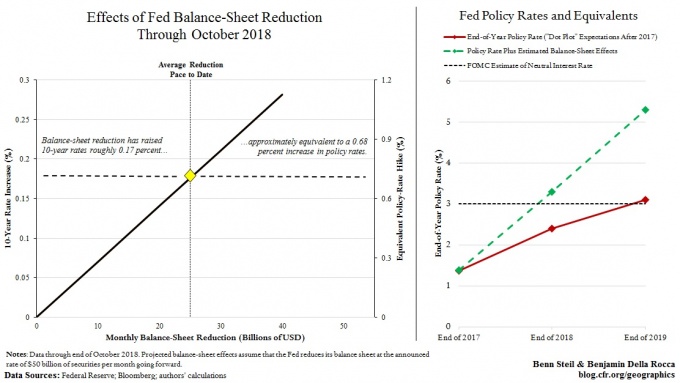

In November 2018, the Council on Foreign Relations did an article that attempted to quantify the impact of the Fed’s balance sheet runoff (Quantitative Tightening): https://www.cfr.org/blog/fed-tightening-more-it-realizes

Quantitative Tightening (balance sheet runoff) simply means that when bonds the Fed held matured, rather than pay them off and replace them with new bonds, they just paid them off.

Here’s how it works: When Treasury securities reach their maturity date, they are paid off by the government; mortgage-backed securities are paid off by Fannie Mae and Freddie Mac. [St. Louis Fed Deputy Director of Research David] Wheelock explained that the Fed had “been going out in the market and replacing those securities with purchases of other securities so as to keep the balance sheet constant. And the idea of unwinding the balance sheet is simply stopping the replacement of securities that mature.” St. Louis Fed

In the CFR article, they pegged the tightening up until that point was equivalent to a 68bps raise in the fed funds rate and could reach as high as the equivalent of a 220bps raise by the end of 2019. Since we got 8 of 13 months completed (Dec 2018-July 2019|article was written in Nov 2018), let’s assume their calculation was correct and the net impact of QT since its inception was~162bps through the end of July 2019 (68bps+93.53bps = 161.53bps), in addition to the nine 25bps raises they did from December 2015-December 2019. This is the equivalent of 412bps of tightening in 4 years.

Today, they reversed direction offering some relief and liquidity moving forward. The Fed balance sheet reduced from $4.47T in July 2017 to $3.8T in July 2019. This is an average of $27B per month in reduced liquidity in the market EACH MONTH for 24 consecutive months. Moving forward (starting tomorrow), when the $3.8T of bonds mature (~$30-50B per month), the government will pay off the bonds and then go into the market and buy $30-$50B a month in bonds (adding additional liquidity to risk assets each month – i.e. recipients of the new cash will have to put money to work in new risk assets).

So while QT added an equivalent of ~168bps of tightening over 24 months or 7bps per month, the reverse is now true. So between now and the next Fed meeting (September 2019) we got a 25bps cut PLUS 7bps equivalent of easing in August and 7bps of easing in September ($60-$100B of new cash pumped into risk assets) yielding the equivalent of ~40bps of relief or an UNWINDING of ~10% of the tightening that was put into place over the past few years.

In other words, just as the Fed underestimated the impact of tightening too quickly and aggressively – yielding slower global growth in the first half of 2019, the market is now underestimating the positive impact the additional $30-$50B/month of liquidity coming back into risk markets (equivalent of a 7bps Fed cut EVERY month for the foreseeable future). Couple that with 2 more 25bps cuts (which will be needed to reverse the short term lull in global growth) and we could have 159bps equivalent of easing in the next 12 months. This will likely be enough gasoline that they can resume tightening once global growth returns (similar to the “mid-cycle adjustment” – executed by Fed Chair Greenspan in 1995 – which extended the cycle by 5 years). After 3 quick “mid-cycle adjustment” cuts in 1995-1996, Greenspan was able to resume tightening in March 1997.

So there you have it my petulant little market – have no fear, liquidity is here…