Japanese equities have been all the rage in the last couple of years as the Bank of Japan agreed to be the unofficial Global liquidity provider – while the rest of the world tightened policy to arrest inflation. The gig is up…

BoJ recently raised rates ending a prolonged period of negative interest rates in Japan. The global put they provided as a prolific purchaser of Domestic and Global Equities through ETFs is over. Yield Curve control is finished as the peg is gone and the mandate to buy unlimited JGBs (Japanese Government Bonds) is completed. There will no longer be unlimited printing of yen to buy government bonds – Japanese or otherwise.

Global Central banks have been transparent about their commitment to “Global Coordination.” While Japan played a pivotal role through the West’s bout with inflation (and subsequent aggressive tightening), now that inflation has perked up in Japan and mitigated in the West the roles are reversed. Japan will be less accomodative/more restrictive and no longer a backstop for global bonds and/or equities.

It is time for the Fed, ECB and others to step up and pick up the slack left from BoJ’s removed PUT. Western central banks will start their cutting/easing cycle in coming months (ready or not).

With this regime change, Western Central Banks will have less latitude to remain “data dependent” and “waiting for more evidence” and here’s why:

Yields are creeping up and Western governments cannot risk another “liquidity shock” – or afford to service the massive deficits at high rates:

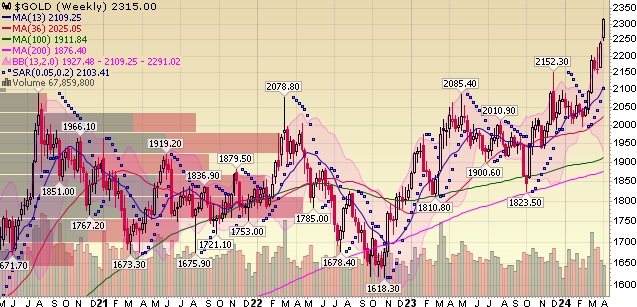

Commodities are starting to sniff out a weaker dollar:

Is the “pause” here?

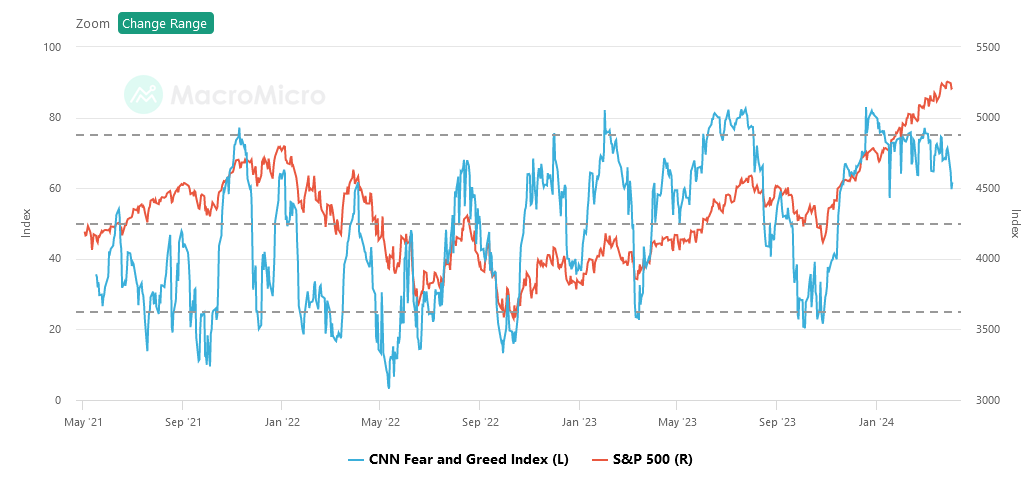

We’ve been talking about an expected healthy pullback for markets in the last few podcast|videocast‘s. Is it finally time?

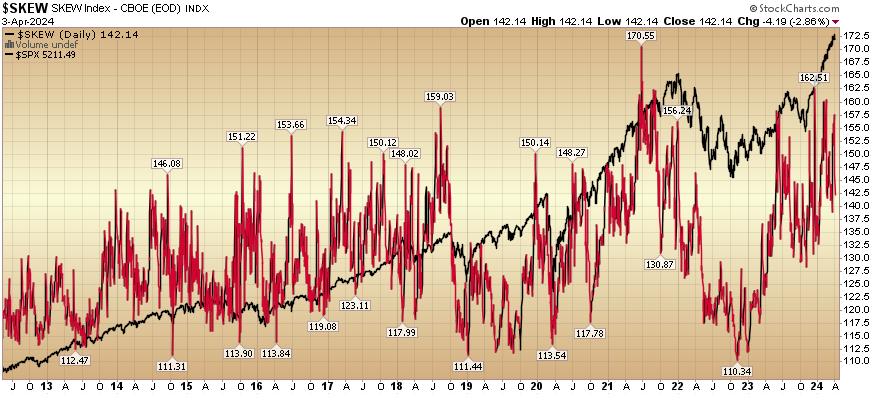

Let’s look at option SKEW. What is skew?

The SKEW index is calculated using S&P 500 options that measure tail risk—returns two or more standard deviations from the mean—in S&P 500 returns over the next 30 days. The primary difference between the VIX and the SKEW is that the VIX is based upon implied volatility round the at-the-money (ATM) strike price while the SKEW considers implied volatility of out-of-the-money (OTM) strikes. (source: Investopedia)

When it has been elevated and starts to come down, it implies the “smart money” is fully hedged and the demand for 2SD tail risk hedges is fulfilled. There is a TENDENCY, not a guarantee – you can see some market weakness following these extremes. We shared how we hedged against this risk last week:

“More to Grow or Time to Go?” Stock Market (and Sentiment Results)…

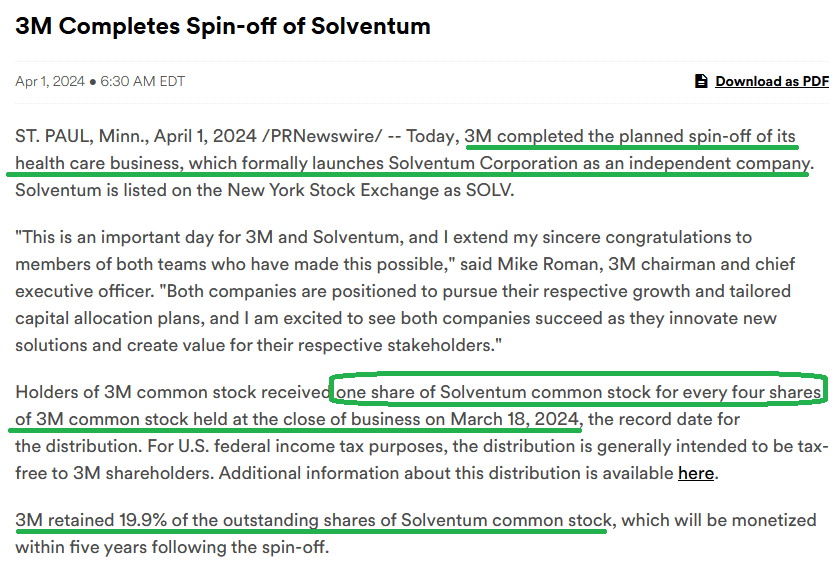

MMM Update

We continue to own both pieces. Here’s a concise explanation of both pieces:

Now onto the shorter term view for the General Market:

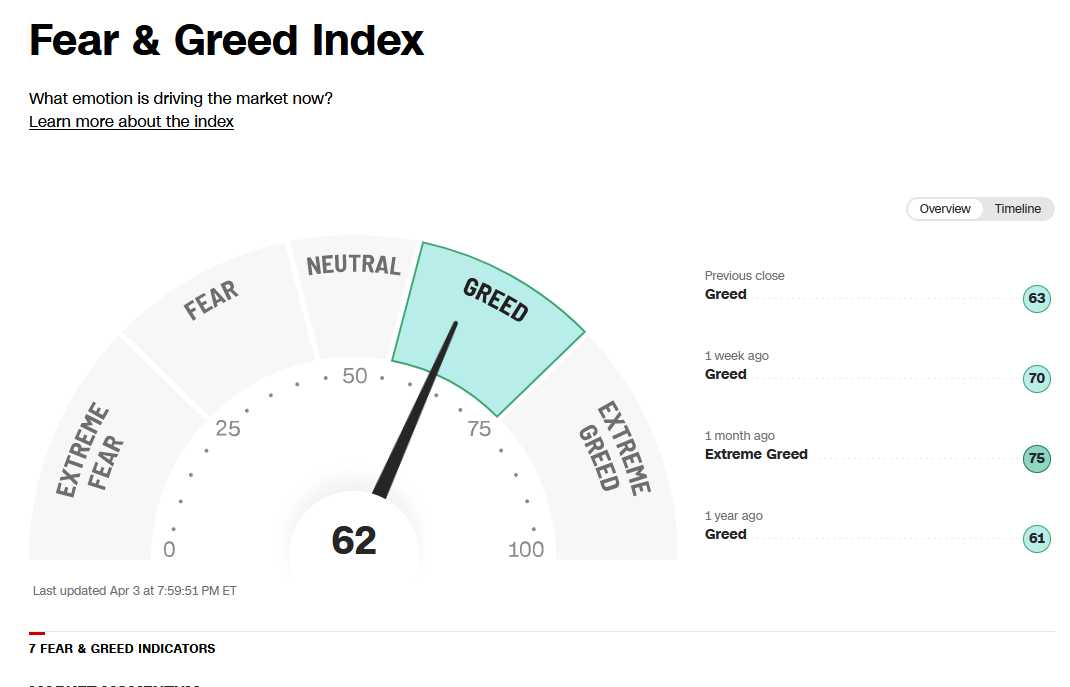

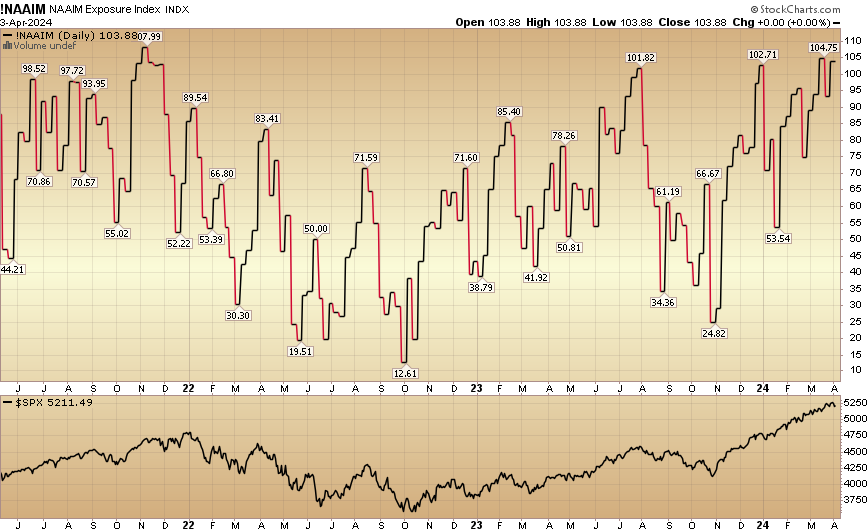

The NAAIM (National Association of Active Investment Managers Index) (Video Explanation) rose to 103.88% this week from 93.22% equity exposure last week.

Our podcast|videocast will be out ON FRIDAY THIS WEEK. Each week, we have a segment called “Ask Me Anything (AMA)” where we answer questions sent in by our audience. If you have a question for this week’s episode, please send it in at the contact form here.

Congratulations to all of the new clients that came in during our early Q1 raise. We will re-open to smaller accounts $1M+ again sometime this quarter. Larger accounts $5-10M+ can access bespoke service beforehand at their preference here.

*Opinion, Not Advice. See Terms