Key Market Outlook(s) and Pick(s)

On Monday, I joined Madison Mills and Brad Smith on Yahoo! Finance to discuss Mag 7, Carry Trade, Rates, JGB, International Stocks, and a lot more. Thanks to Madison, Brad, Justin Oliver, John Hyland, and Taylor Clothier for having me on:

On Tuesday, I joined Stuart Varney on Fox Business “Varney & Co” to discuss Elon Musk, Tesla, Tariffs, DOGE, and Stock Picks. Thanks to Stuart, Christian Dagger and Preston Mizell for having me on:

On Wednesday, I joined Diane King Hall on Schwab Network to discuss Tariffs, Mag 7, Fed, and Stock Picks. Thanks to Diane and Heidi Schultz for having me on:

On Wednesday, I joined J.D. Durkin on NYSE TV to discuss Tariffs, Mag 7, Fed, and Stock Picks. Thanks to J.D., Kristen Scholer, Jeff Cohen, and Melissa Montanez for having me on:

VF Corp Update

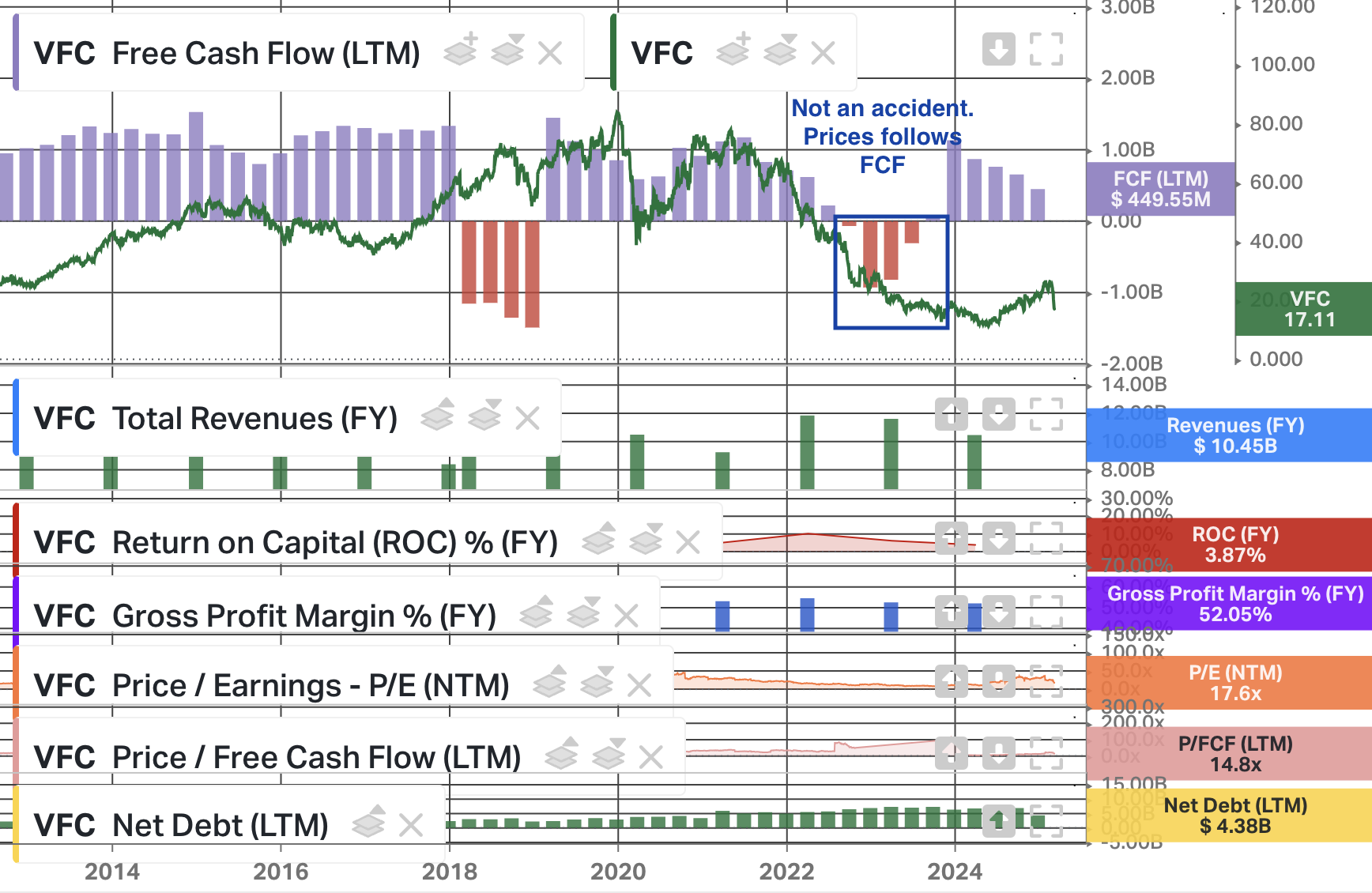

Nearly one year ago, we published “Boring Business Stock Market (and Sentiment Results)…”, laying out our thesis on VF Corp at what seemed like its lowest point. Click the link below to revisit the original article:

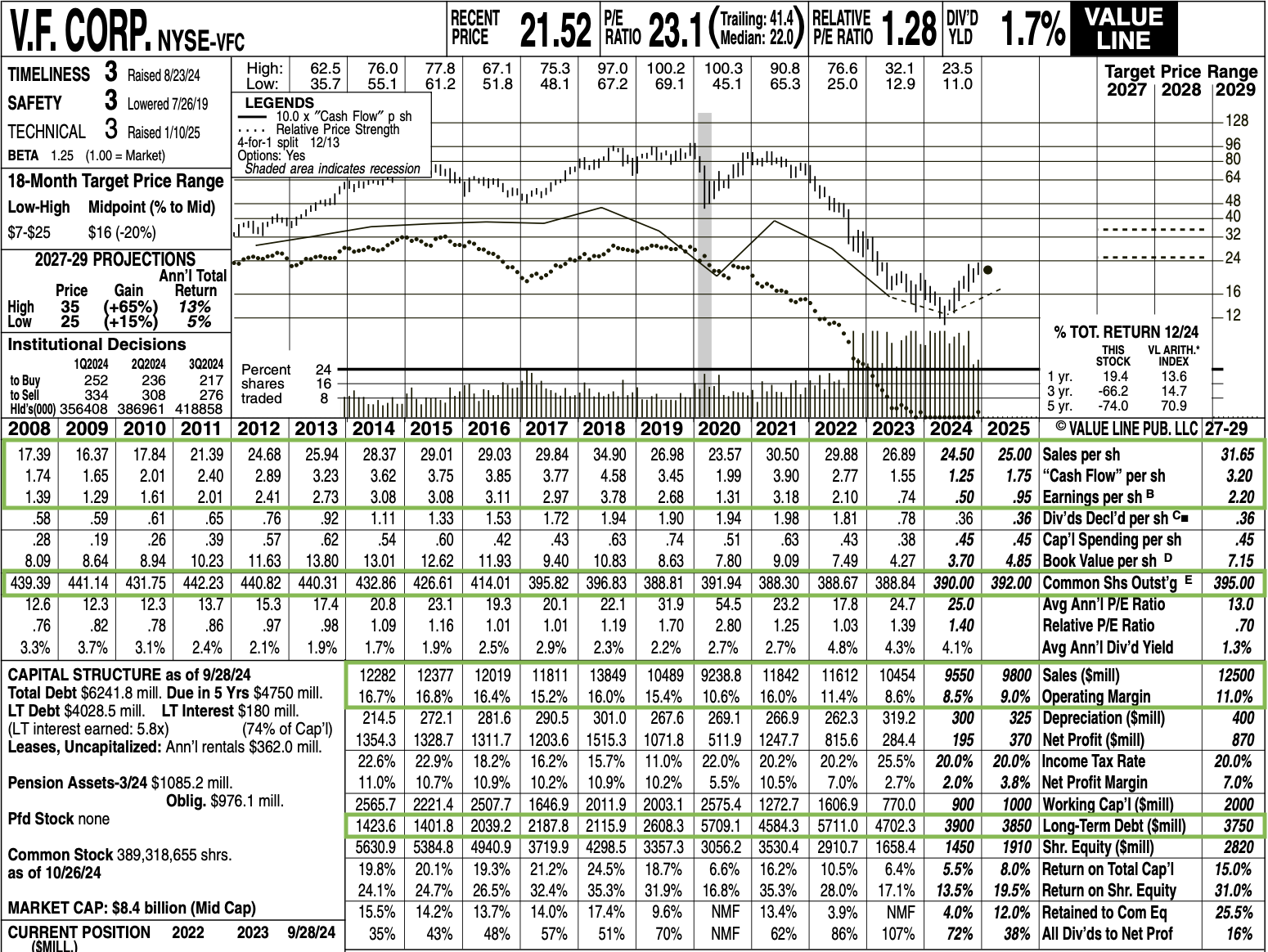

At the time, VF had just reported a brutal Q4. Vans revenues were down 27%, North Face down 5%, Timberland down 14%, and Dickies down 15%. The stock had collapsed below $12, falling below its GFC lows. While investors wrote the stock off as dead, we saw the dislocation as an opportunity. Despite the overwhelming negativity, we laid out a turnaround playbook and a series of events that many thought were inconceivable, earning more than a few double takes. I didn’t earn the “Turnaround Tom” nickname by chance… but as the saying goes, it’s always darkest before dawn.

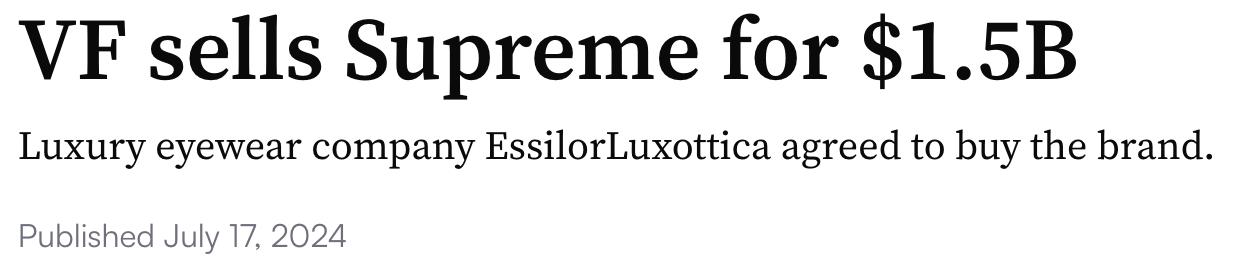

At that point, Bracken Darrell had been at VF for less than a year, but we were pounding the table on his turnaround expertise. His track record speaks for itself. He led Old Spice’s turnaround, tripling its market share and turning it into the category leader it is today. Then, he took over Logitech in 2013 when the stock had fallen more than 80%. Within 7.5 years, it became a 27-bagger, turning a $1M investment into $27M. We said the first major catalyst for VF would be an asset sale, either the Packs Business or Supreme, and that one morning, we’d wake up to the “surprising” news of a multi-billion-dollar deal that would push the stock higher.

We then said, by the grace of God and the hand of Bracken, sales from the remaining segments would actually re-accelerate. And then, we made a prediction that many considered unfathomable: VF would eventually return to a position where they are acquiring new, hot brands again, running the same playbook they’ve been following since 1899.

So, nearly a year since we laid this out, how have things turned out?

Less than two months later, VF reached an agreement to sell Supreme to EssilorLuxottica for $1.5B, sending the stock up nearly 15%.

This past quarter, VF grew total revenues by 2%, marking its fourth consecutive quarter of sequential improvements. North Face grew 5%, Timberland grew 12%, Vans was down 8% but continues to improve sequentially, getting closer to an inflection point, and Dickies improved sequentially, though still down 10%.

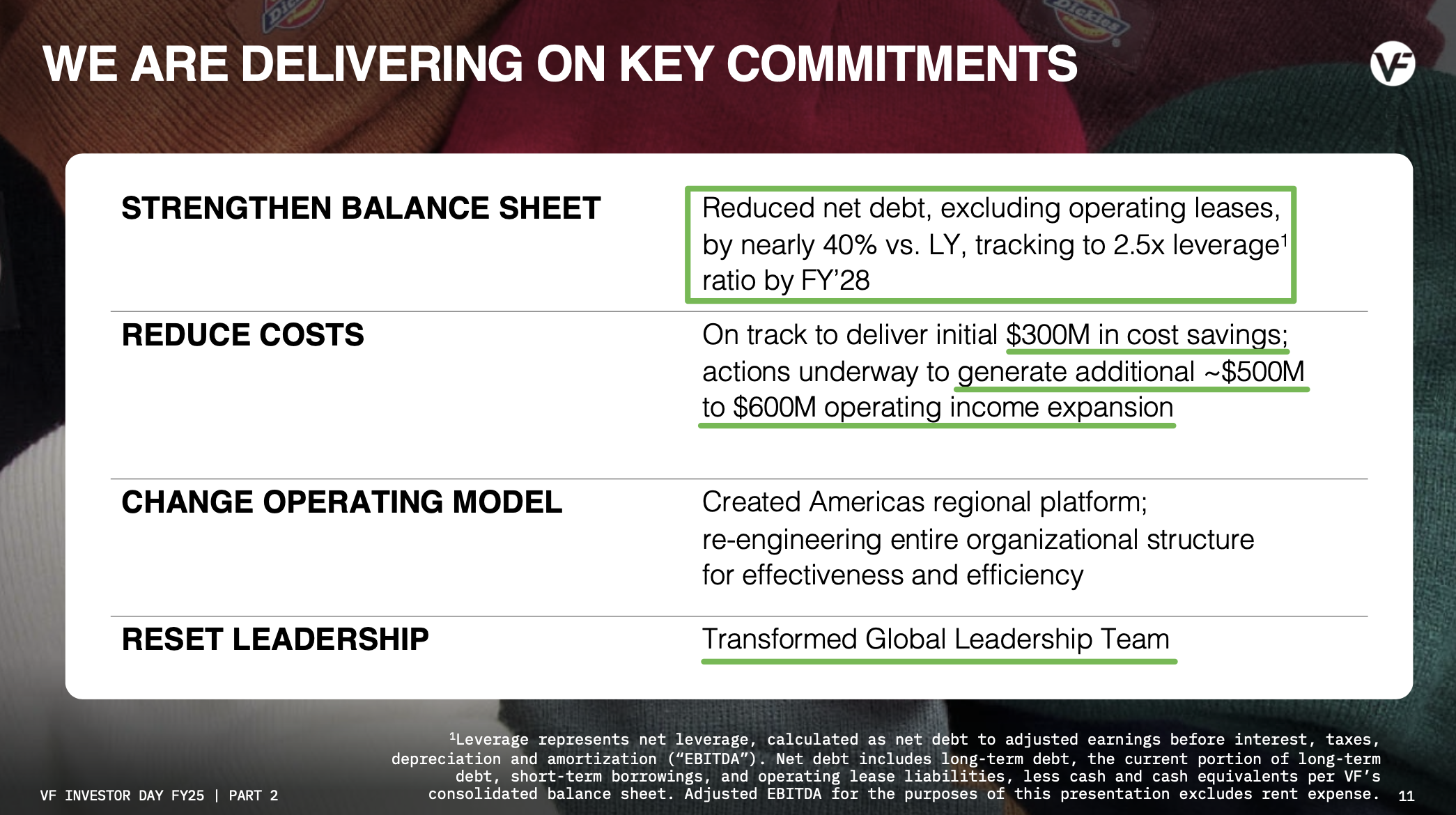

Most importantly, Bracken confirmed the “crazy” idea of VF eventually returning to a position where they’re acquiring new, hot brands, at the latest Investor Day.

The fact is, as Bracken continues to execute, our expectations for VF just keep rising. We see a clear path to a double based on COST SAVINGS ALONE. Let me be clear: VF could see ZERO top-line growth over the next three years and still double from its current levels. Of course, we believe there’s much higher potential, and Bracken Darrell certainly agrees. Just as we made bold predictions last year, we’re doing the same now. We believe that over time, VF will actually climb back to ALL TIME HIGHS. The business will be humming again at a solid mid-single-digit clip and acquiring new brands, just as it has for the past 100+ years. Same playbook, different century.

Now, onto VF’s latest Investor Day…

Investors were frustrated with the lack of long-term guidance and concrete numbers, with no new targets set. But that’s just not Bracken Darrell’s style, and frankly, that’s fine with us. Those who’ve followed us for a while know that many of our favorite CEOs are “sandbaggers-in-chief,” buying into the strategy of under-promising and over-delivering. Bracken Darrell is no different. What ACTUALLY mattered was that VF laid out a clear roadmap for each of its brands, detailing their strategies for growth and the long-term opportunities ahead.

Here’s everything you need to know:

Investor Day Overview

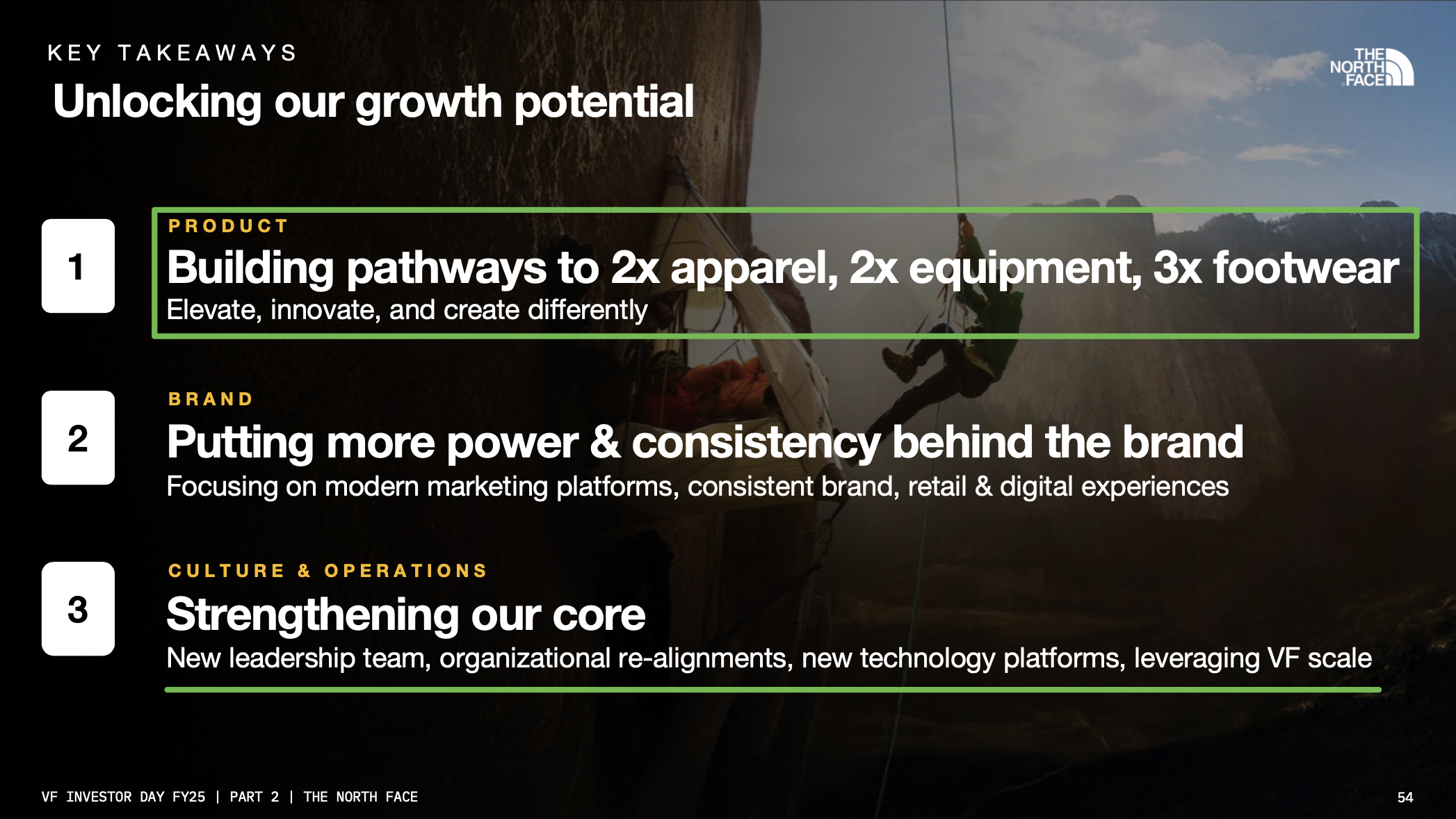

North Face Growth and Expansion

VF outlined a path for the North Face to DOUBLE its apparel and equipment segments and TRIPLE its footwear business. Right now, apparel and equipment account for ~90% of North Face’s revenue, with footwear making up the remaining 10%. Keep in mind, North Face is VF’s largest brand, bringing in $3.67B during 2024. This growth mix implies North Face could reach $7.71B in revenue. For context, VF’s TOTAL REVENUE in 2024 was just $10.45B. While no specific timeline was provided, analysts framed it as 5-10 years during the Q&A, which was not refuted. Even if we assume a 10 year timeline, this still implies a 7.2% top-line growth rate. And keep in mind, this is all happening while VF is guiding for zero growth. Under-promise, over-deliver to the extreme…

In addition to expanding into more repeat-sales categories and doubling down on its athlete-driven focus, North Face will continue to invest in influencer marketing and key collaborations. A prime example is the North Face x Skims collaboration, which generated over 10 billion impressions and sold out across key markets within hours, becoming the FASTEST-SELLING partnership in the company’s history.

Vans Turnaround

A key part of VF’s turnaround is centered around Vans. In 2022, Vans was VF’s largest brand, bringing in $4.16B in revenue, but has since fallen to just $2.78B (-33%). At this point, the heavy lifting of the Vans turnaround is mostly complete. The initial focus had been streamlining channels and inventories, reducing inventory by over 30%, closing unprofitable locations, and moving beyond the value channel, which had grown to make up over 50% of total sales. Over the past year, Vans exited 1,800 value doors while adding 800 non-value doors.

A major catalyst for the turnaround came with the appointment of Sun Choe as brand president in May 2024. Choe previously helped Lululemon grow its revenues fourfold and expand into footwear. With Choe at the helm and the brand’s channels cleaned up, the focus is now on reconnecting with its core audience and driving product innovation. The Knu Skool franchise, which gained momentum in 2024, is now the primary growth driver for Vans. Seeing new products perform well is exactly what you want to see in a turnaround.

The brand is getting back to its core audience by bringing back the iconic Vans Warped Tour for its 30th anniversary. Another huge opportunity is winning back the women’s segment, where revenues have hit an eight-year low. Sun Choe is the perfect leader to buck this trend. Through improvements in marketing and style, a revamped website, and new products targeting women, VF expects the back-to-school season to mark the beginning of sequential improvements. The inflection point for Vans is looking a lot closer than most people think…

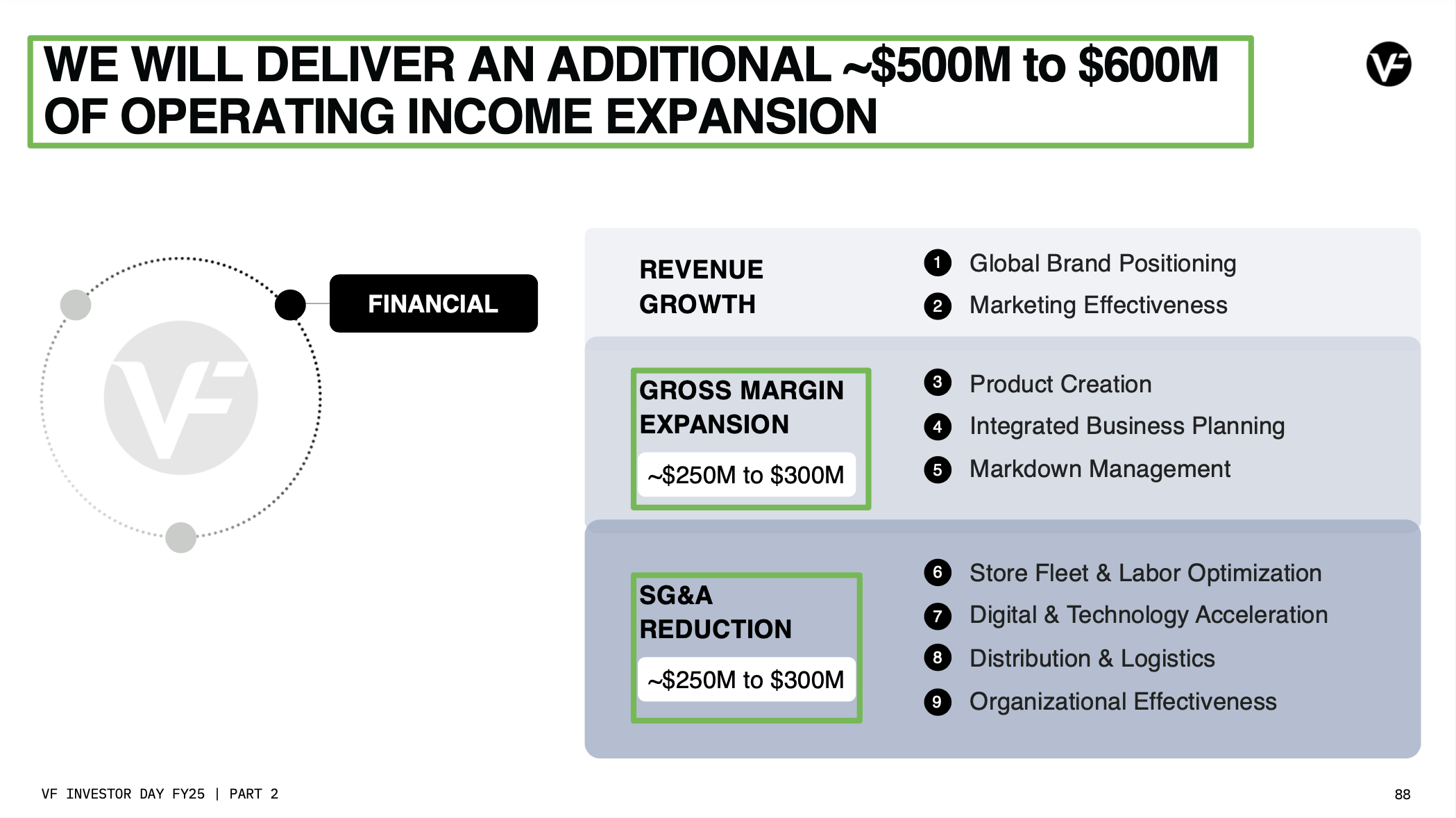

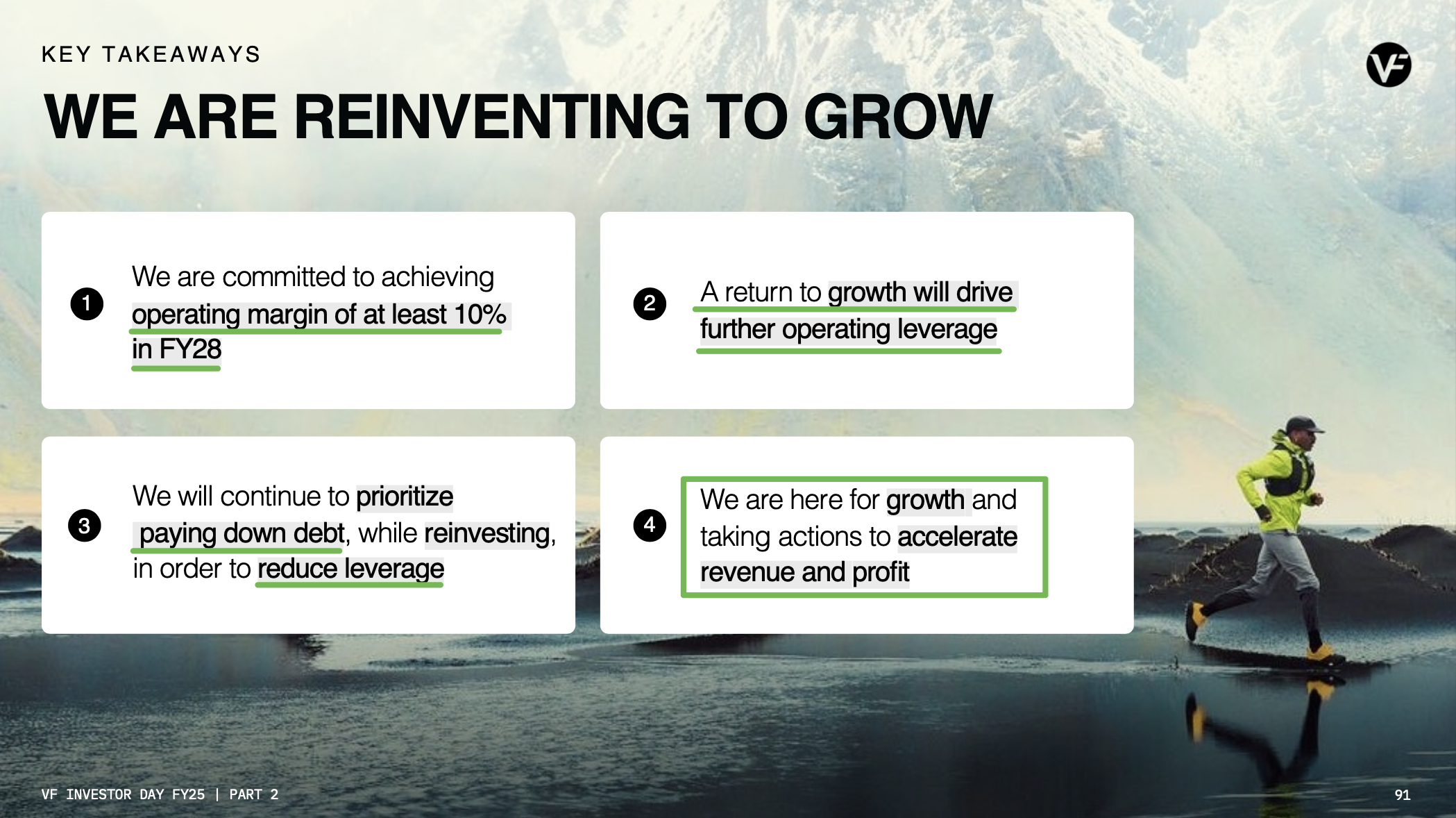

Margin Expansion and Guidance

VF laid out a plan during part one of Investor Day to reach at least 10% operating margins by FY2028, nearly doubling from 2024’s 5.6%. The most important part of this guidance is that it assumes ZERO TOP-LINE GROWTH between now and FY2028. That means cost savings alone would drive approximately $955 million in operating income. After factoring in a normalized tax rate and reduced interest expense from debt repayment, this translates close to $2.00 in earnings per share. Peak or trough multiple, the margin of safety here is HIGHLY ATTRACTIVE.

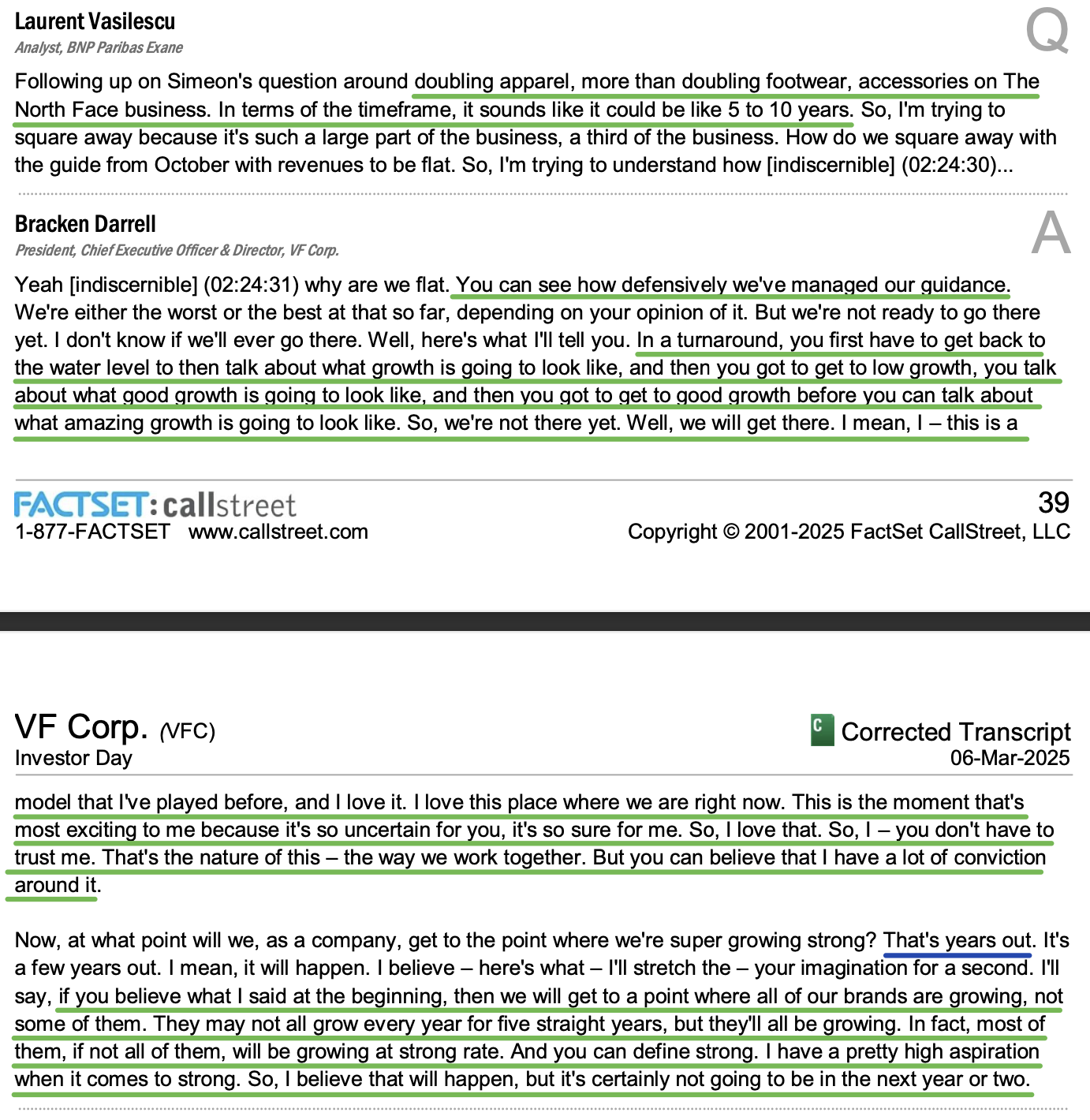

Now, here are a few quotes from Bracken Darrell during Investor Day. Read these, and tell me how likely you think a zero growth scenario really is.

“What’s the next category I can enter, with the Vans brand, with The North Face brand, with Icebreaker? And that gives you new category expansion. So that grows your market. Those 3 things, if you get them all working and almost any business I can think of, on average, you grow double digits. I’m only here to try to grow double digits. I told the board that when I arrived. Now are we going to grow double digits in a year or 2? Probably not. But am I here for that? Absolutely.”

“In a turnaround, you first have to get back to the water level to then talk about what growth is going to look like. And then you got to get to low growth to talk about what good growth is going to look like. And then you got to get to good growth before you can talk about what amazing growth is going to look like. So we’re not there yet. Well, we will get there. I mean this is a model that I’ve played before, and I love it. I love this place where we are right now. This is the moment that’s the most exciting to me because it’s so uncertain for you. It’s so sure for me.”

“If you believe what I said at the beginning, then we will get to a point where all of our brands are growing, not some of them. And they may not all grow every year for 5 straight years, but they’ll all be growing. In fact, most of them, if not all of them, will be growing at a strong rate. And you can define strong. I have a pretty high aspiration when it comes to strong. So I believe that will happen, but it’s certainly not going to be in the next year or 2.”

Simply put, I see a ZERO PERCENT chance that this management group is willing to settle for ZERO GROWTH.

The apparel and footwear market is expected to grow between 3% and 5% over the next 4 to 5 years. With the incredible brands VF has, it is hard to imagine they will not be taking part in that growth.

Here is where it gets interesting. Each incremental $1 billion in revenue drives a 1.5% to 2% improvement in operating margin. Meaning, if VF simply grows at the low end of the market rate, operating income moves north of $1.3 billion. At the high end, EBIT approaches $1.5 billion. In either case, VFC is well on its way to being MUCH MORE than just a double…

Q&A Highlights

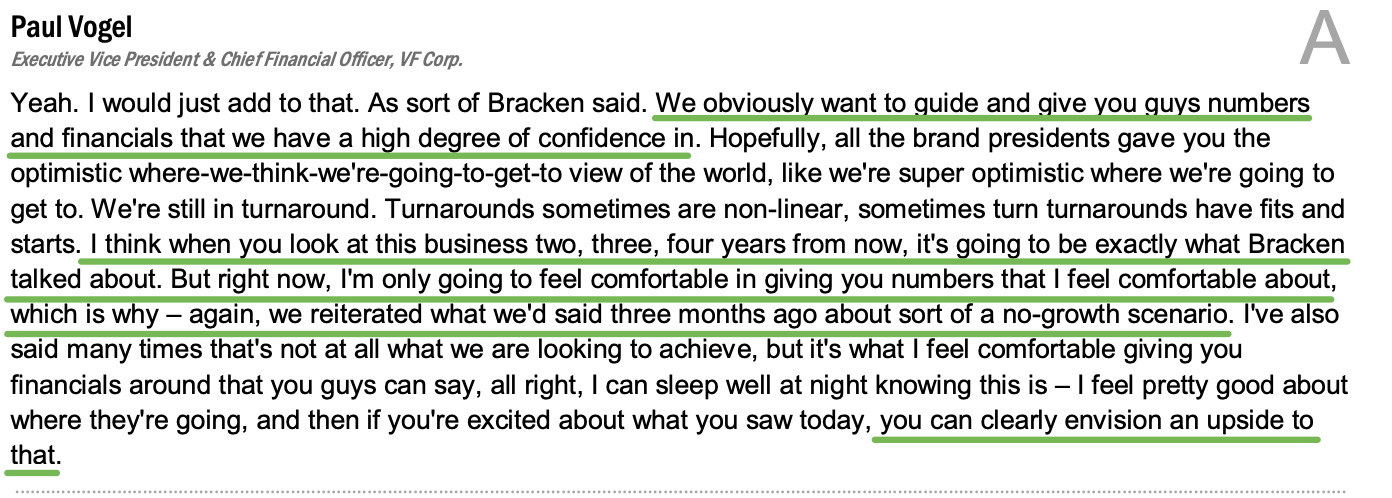

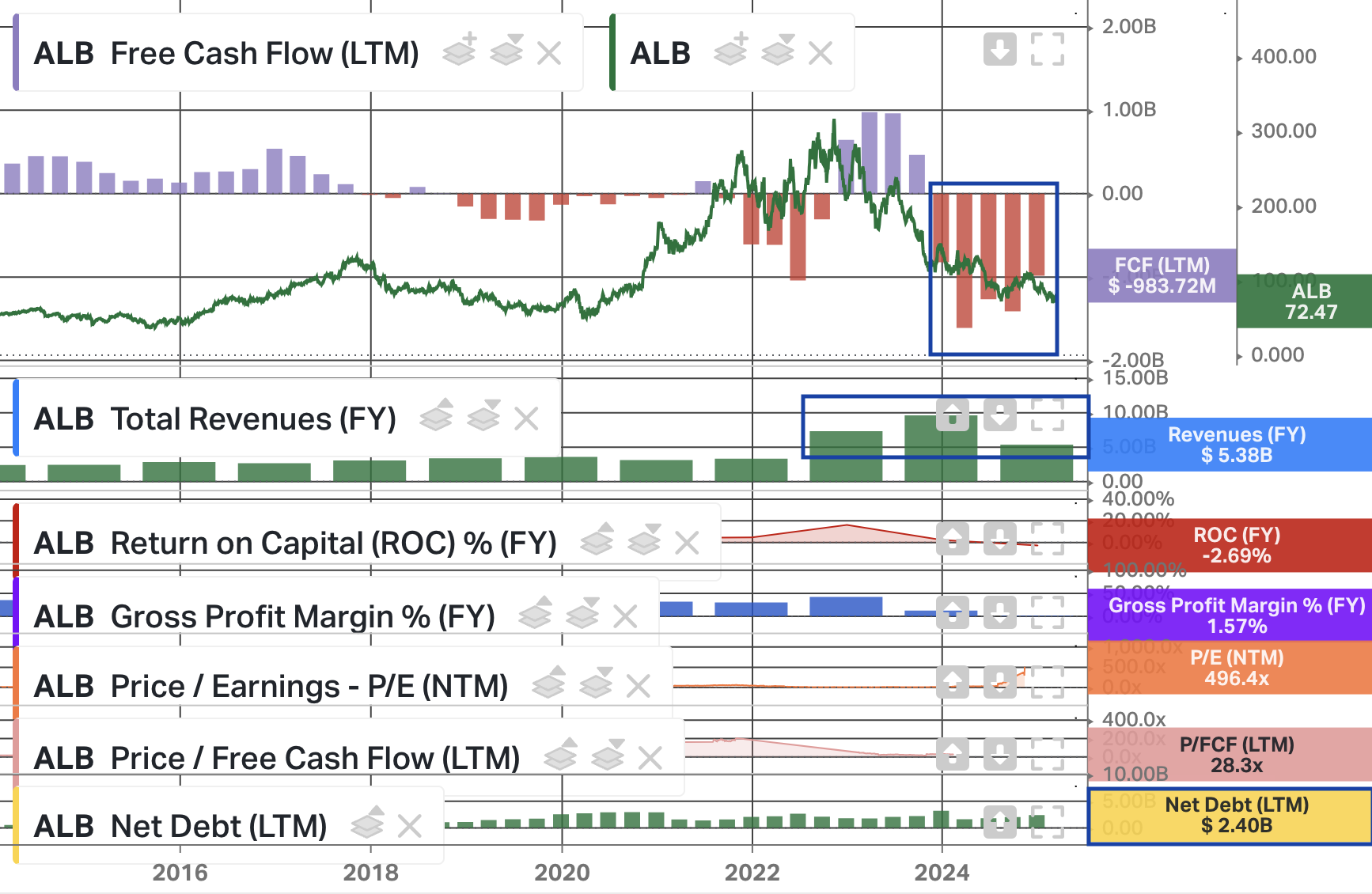

Albemarle Update

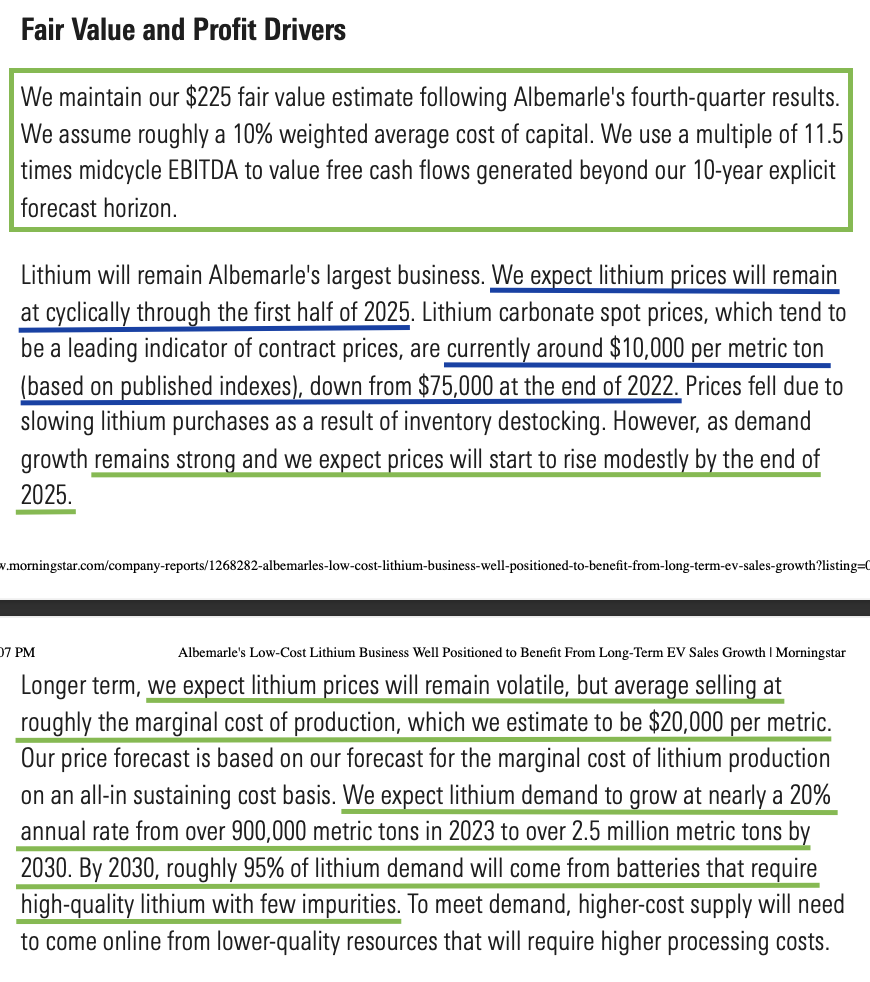

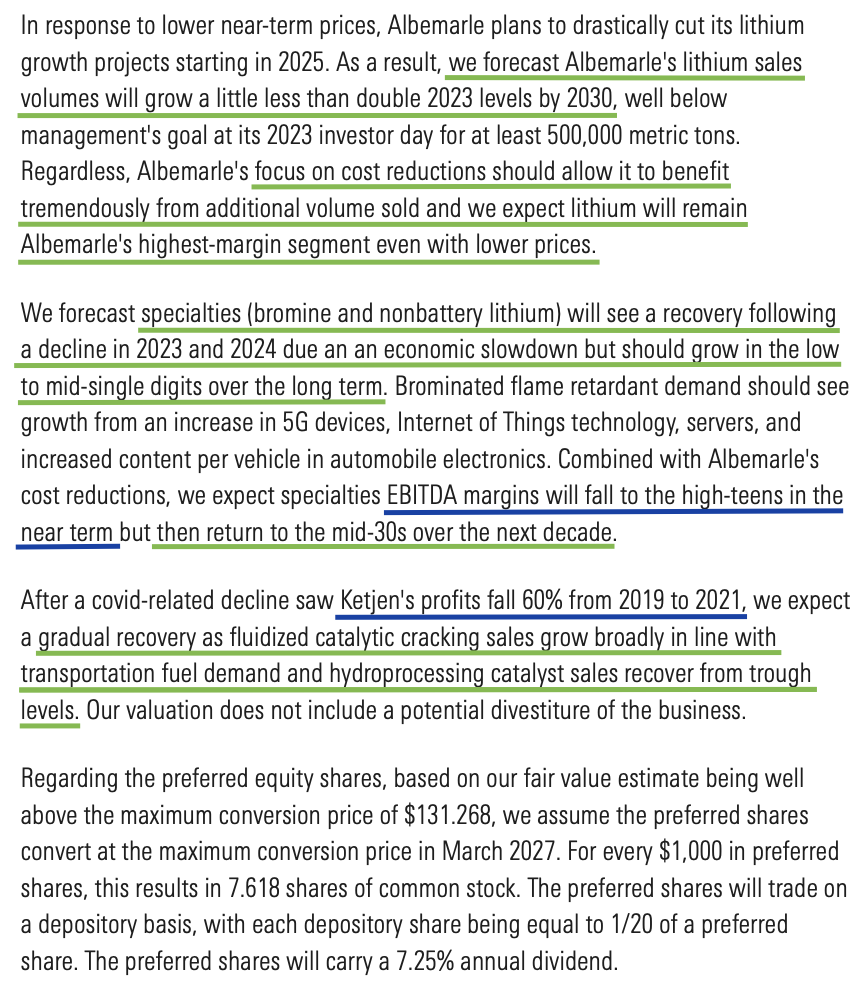

Morningstar Analyst Note

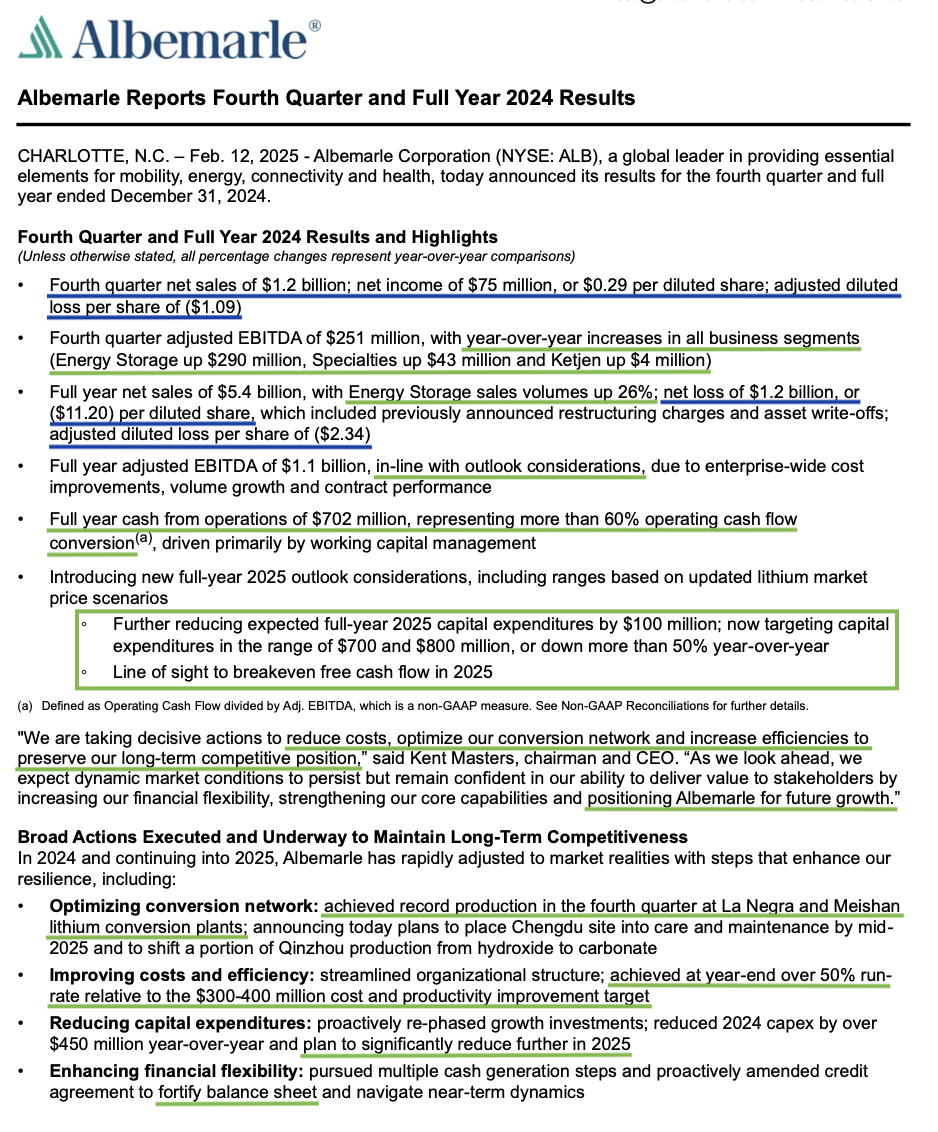

Earnings Results

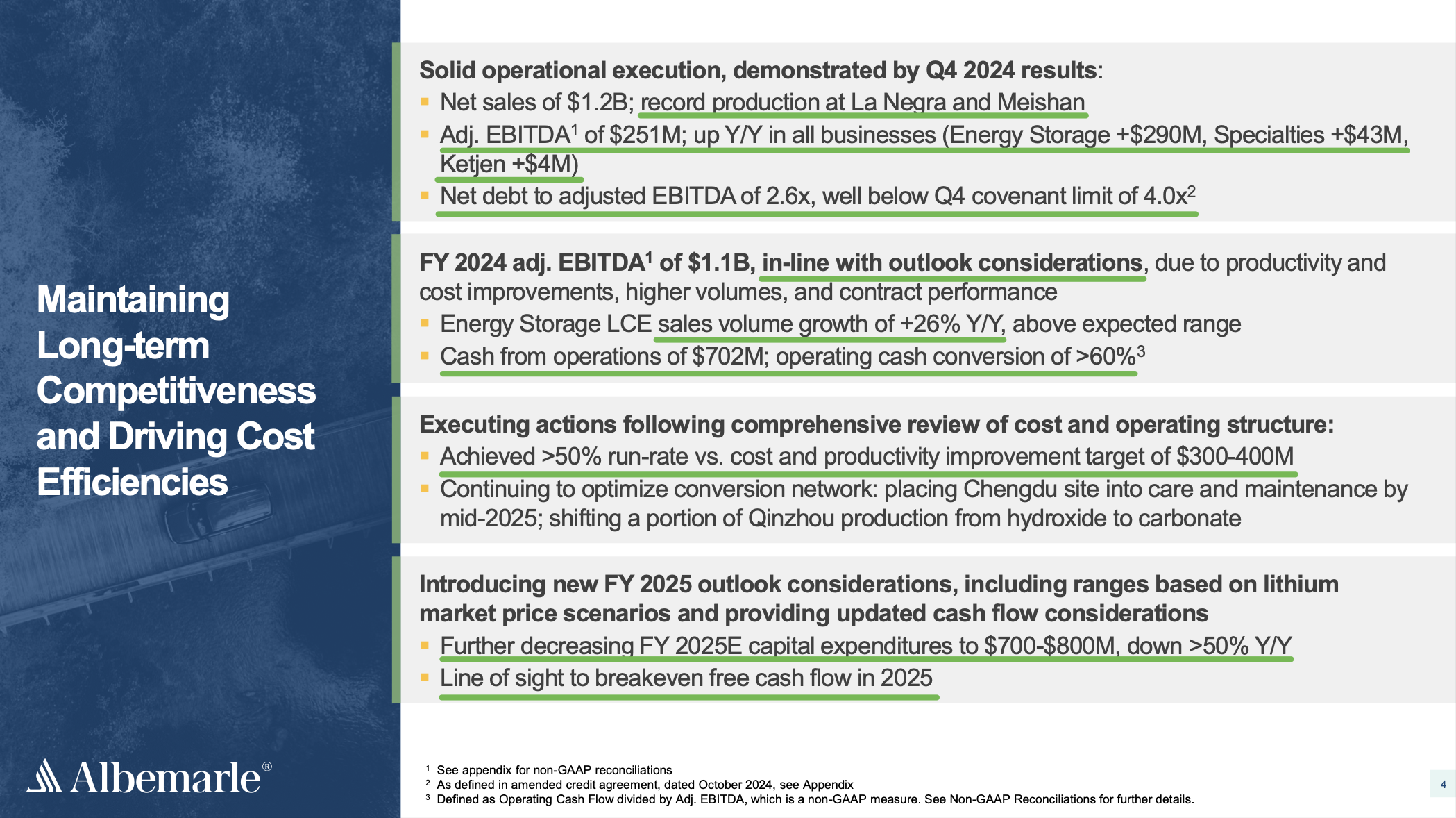

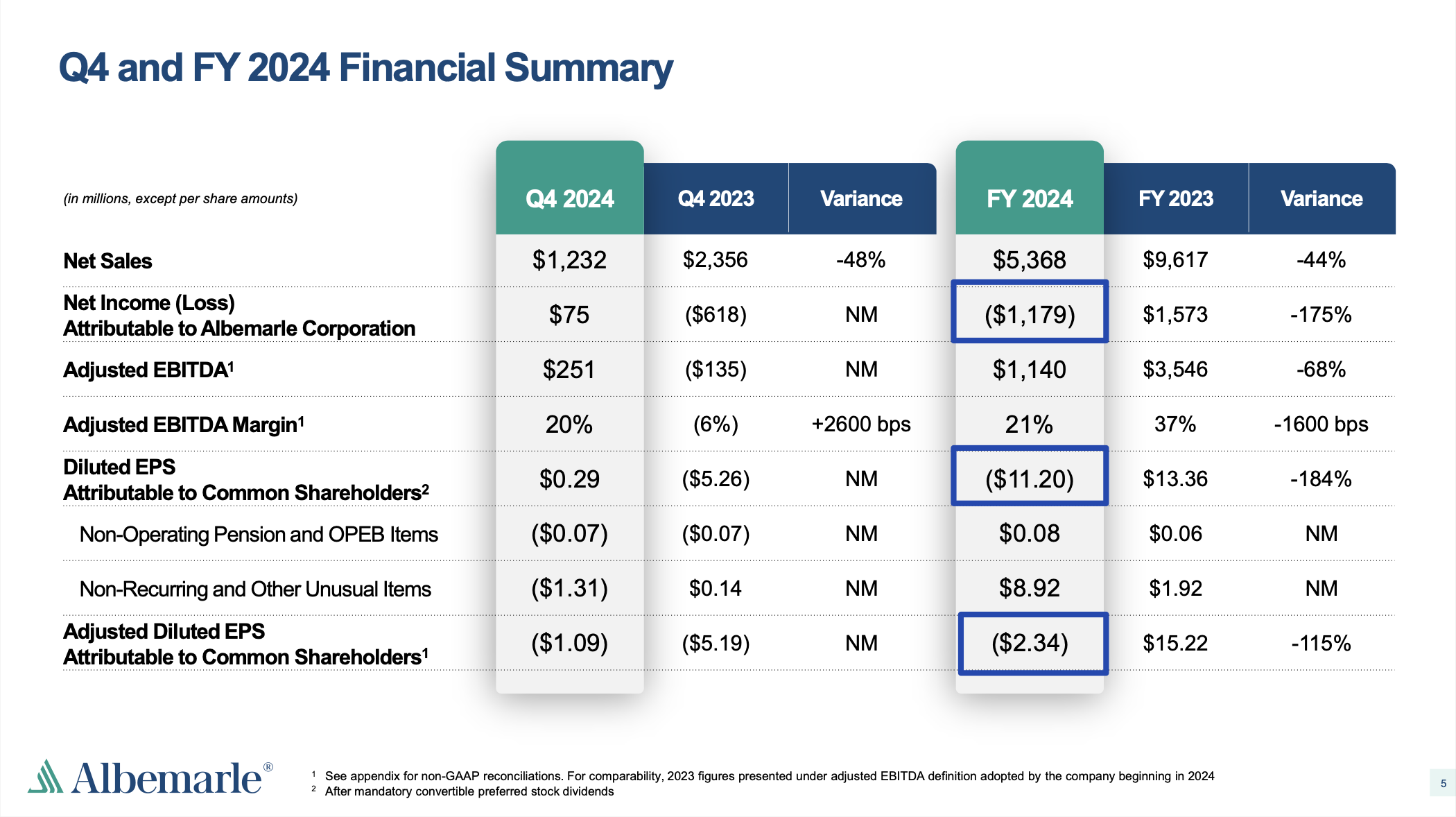

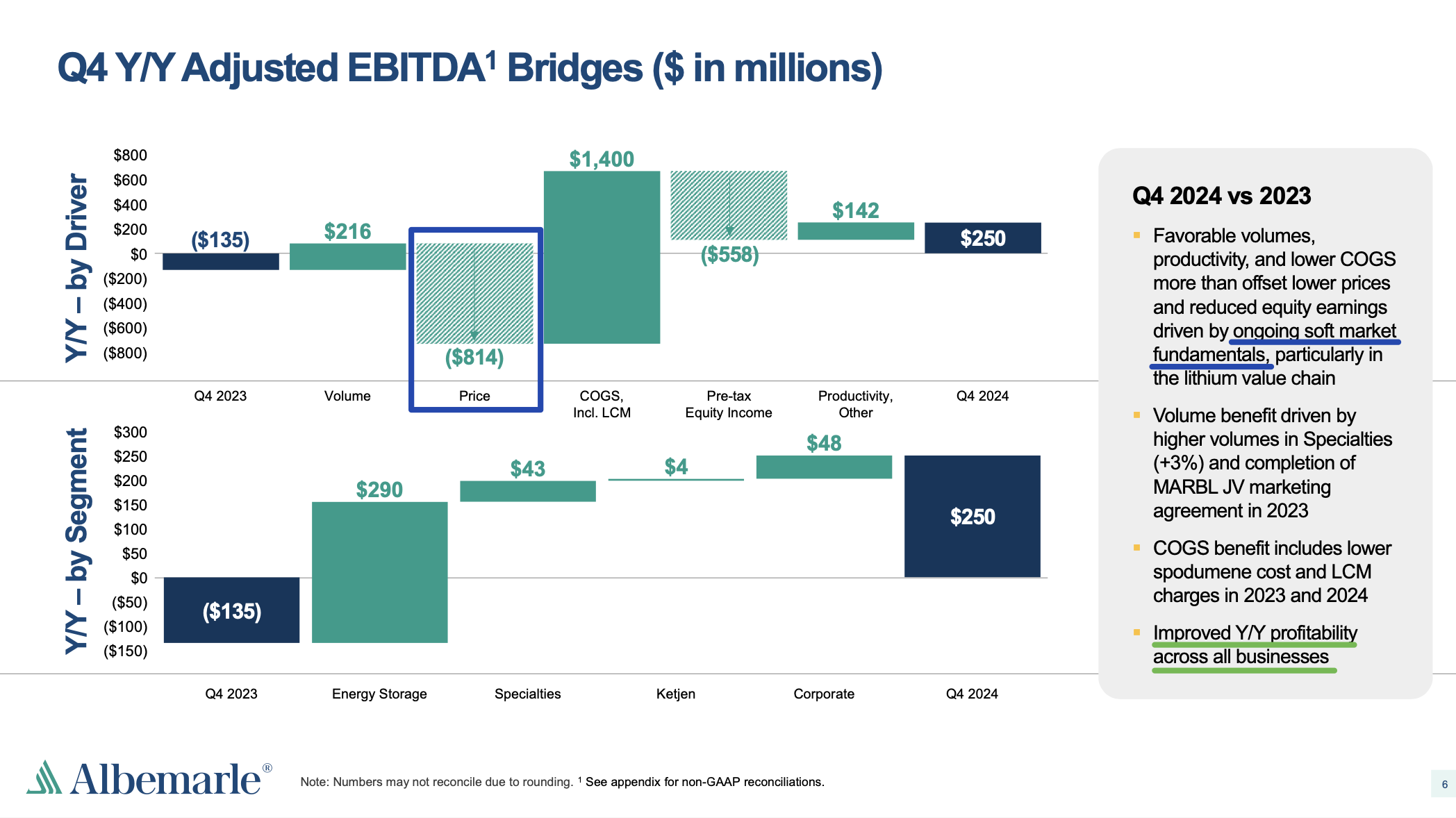

Key Takeaways

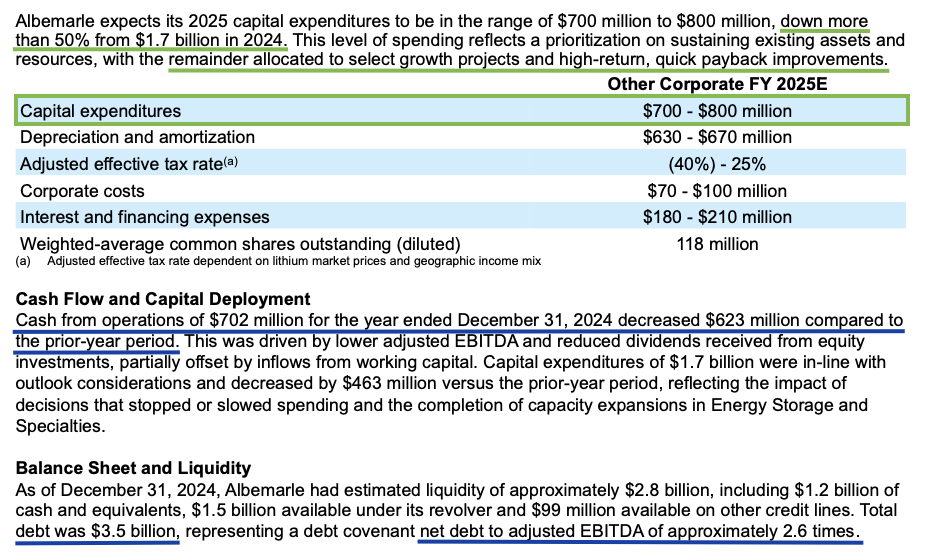

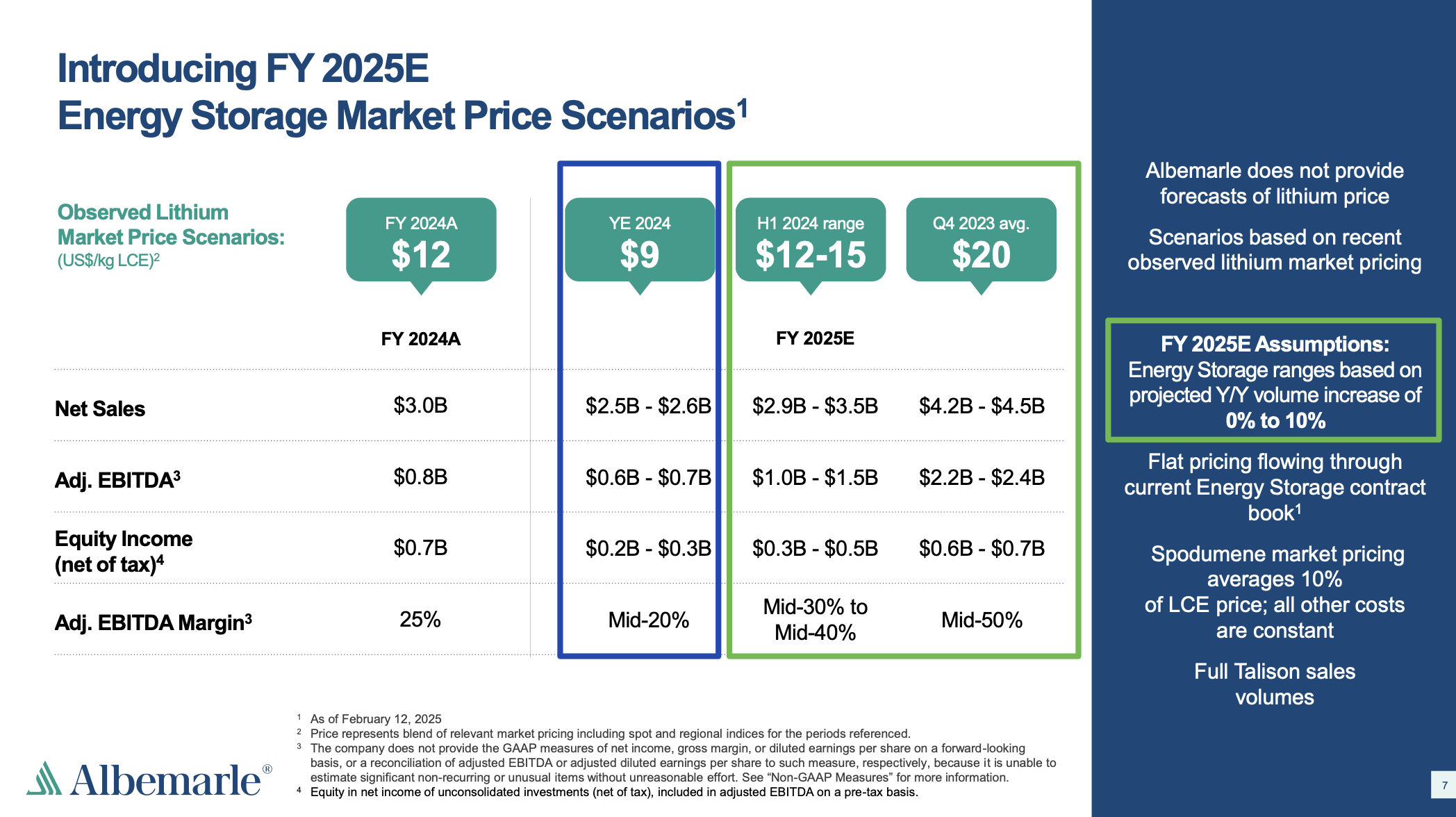

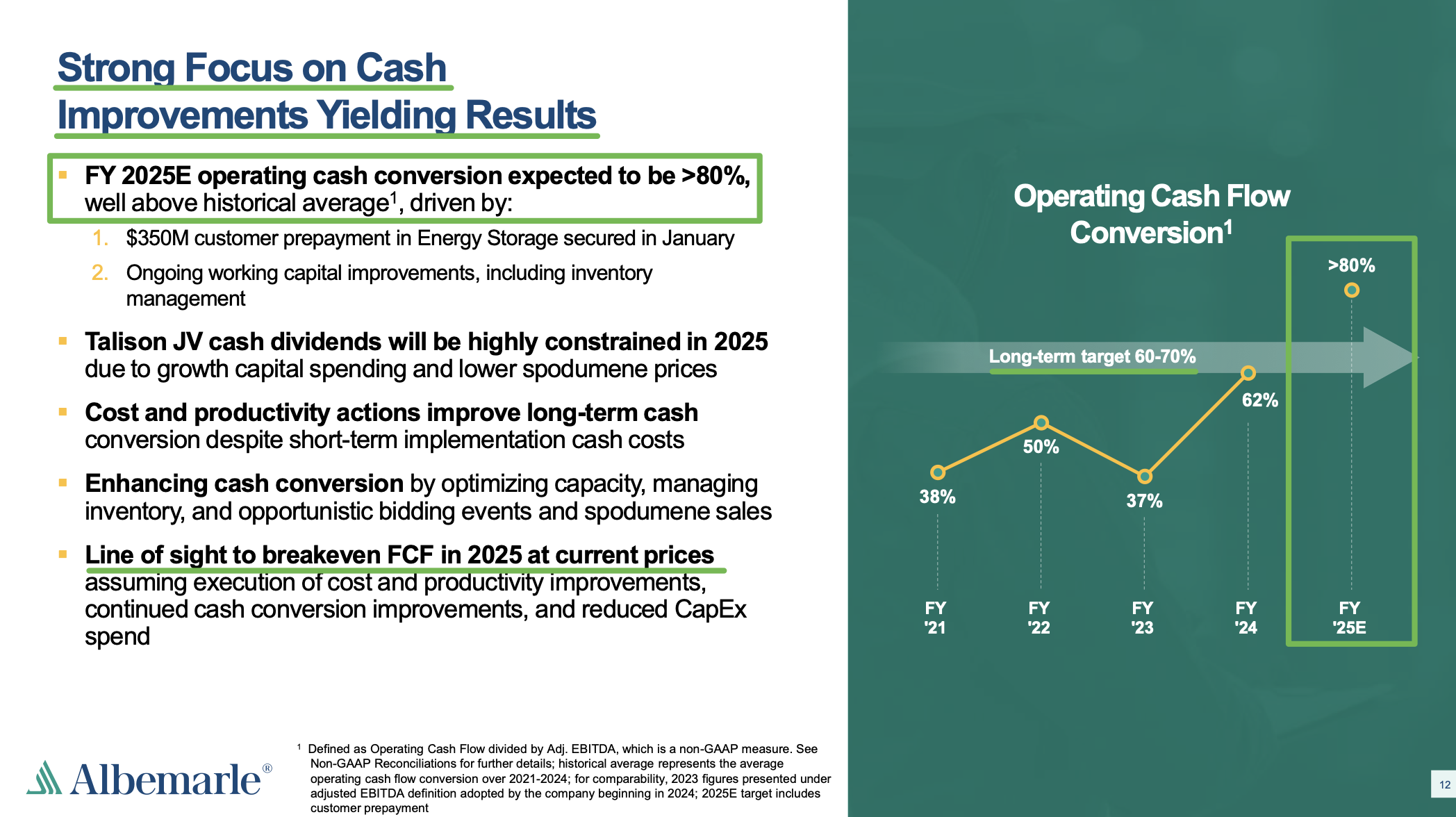

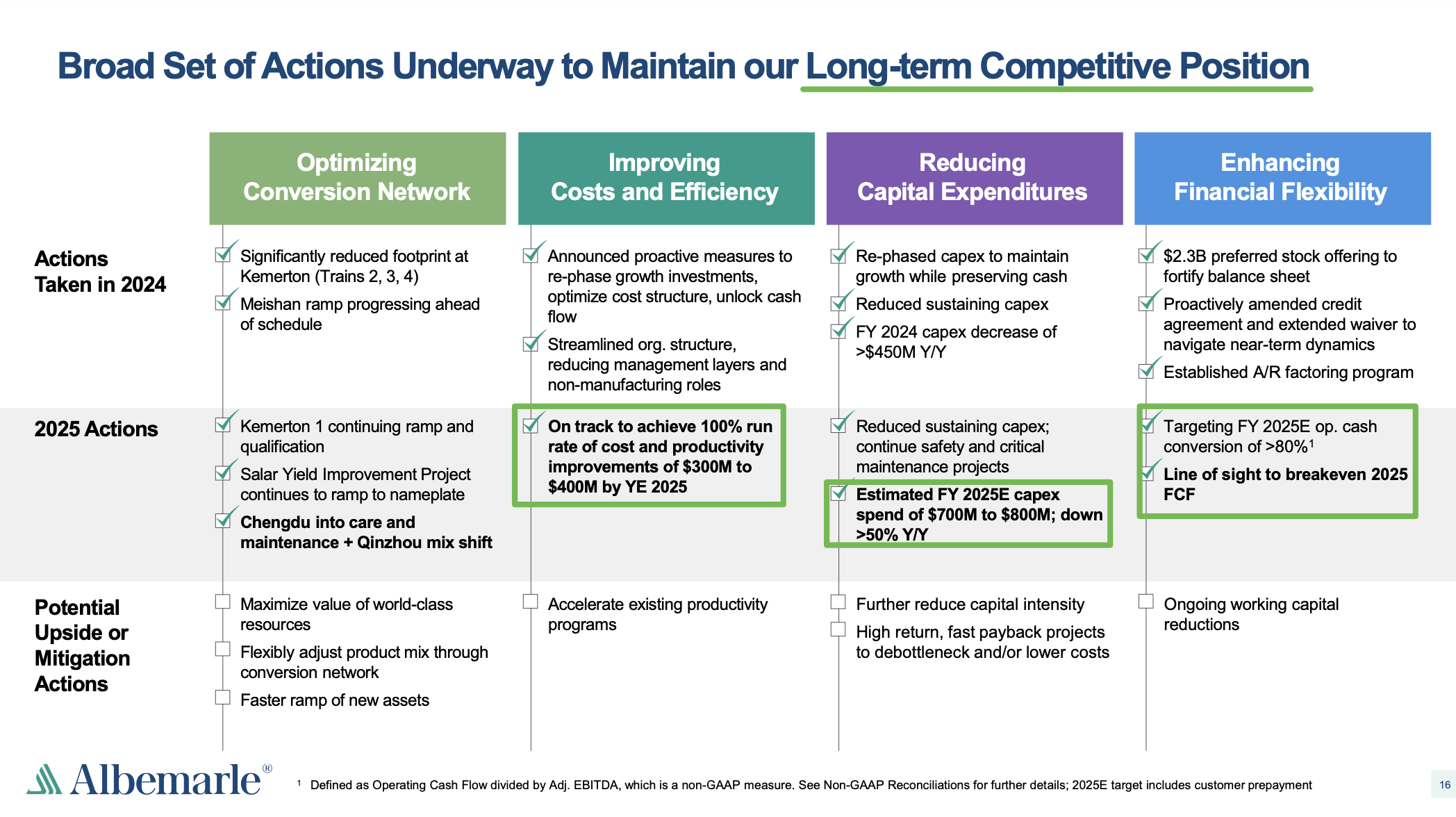

- Full-year cash from operations reached $702M, representing over 60% operating cash flow conversion. Management expects this to exceed 80% in 2025, well above the historical average of 60-70%, and has a clear path to breakeven FCF in 2025 based on current MULTI-YEAR LOW PRICES. Achieving breakeven free cash flow eliminates the need for an equity raise, which management has no plans for.

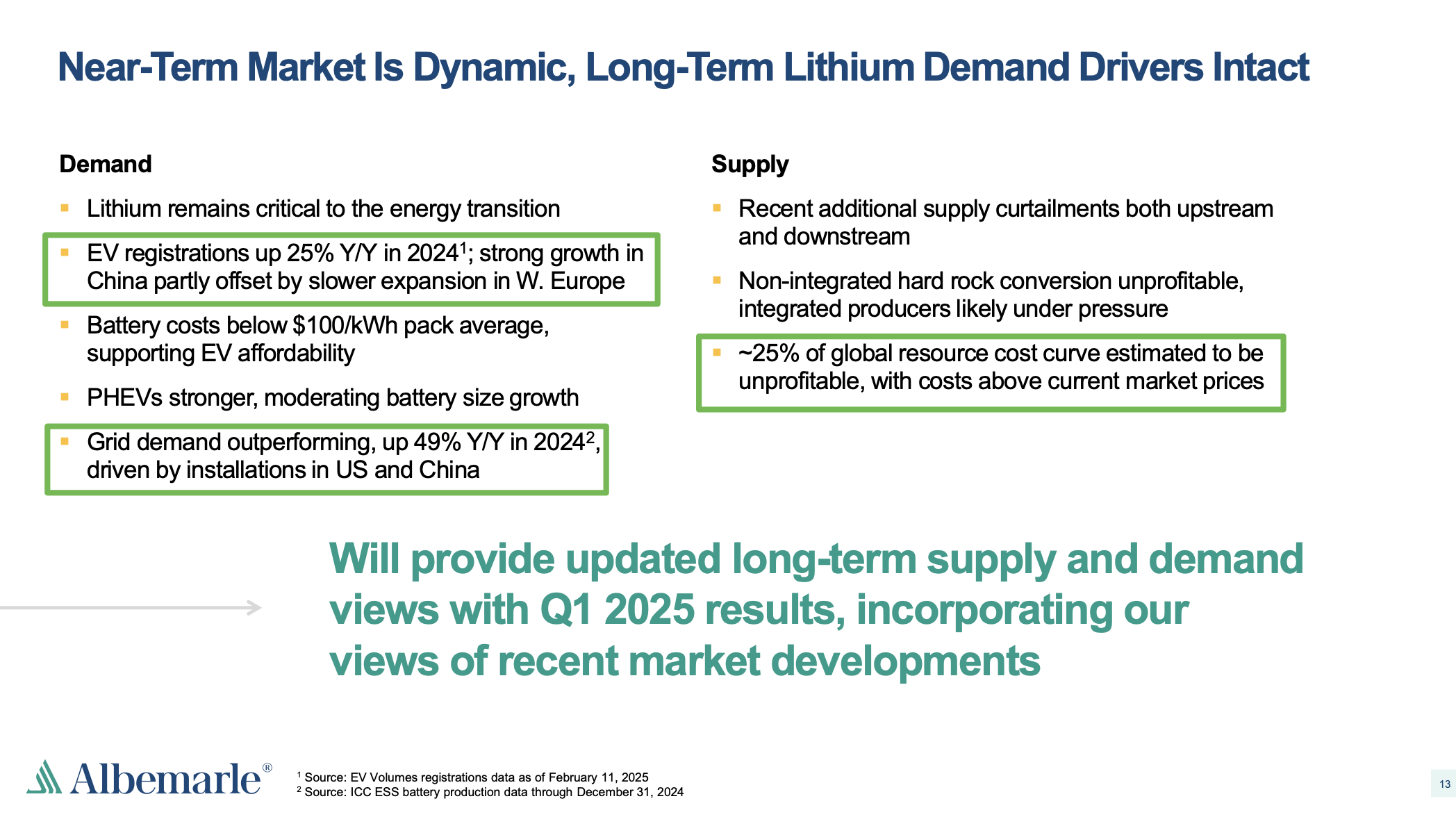

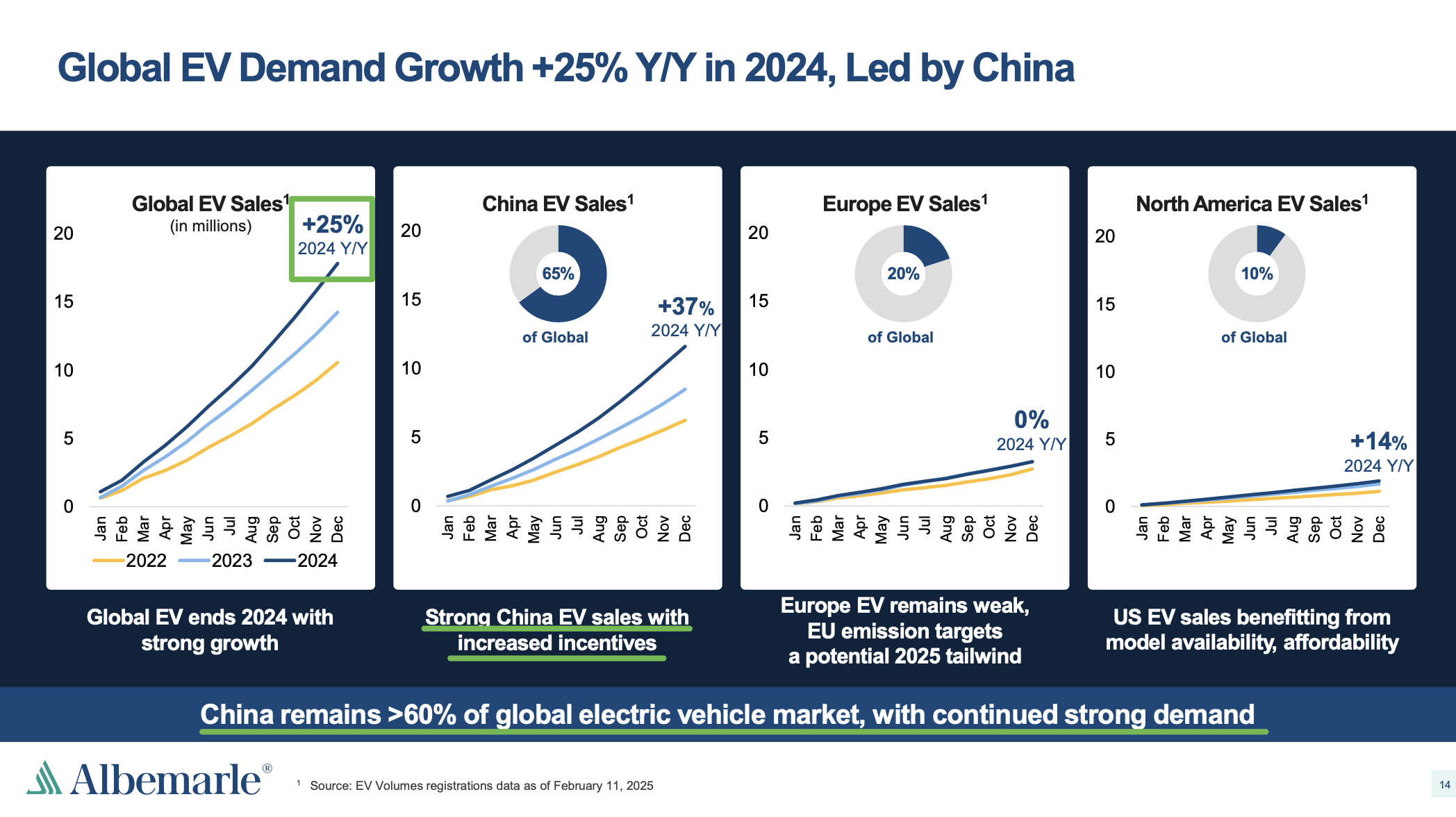

- End-market demand remains strong and continues to grow. Global EV sales increased by 25% YoY in 2024. Grid demand surged 49% YoY, now comprising nearly 20% of global lithium demand, up from less than 5% a few years ago. Management plans to provide updated long-term supply and demand outlooks with Q1 2025 results and continues to expect DOUBLE-DIGIT ANNUAL GROWTH IN GLOBAL LITHIUM DEMAND OVER THE NEXT DECADE.

- Albemarle remains one of the LOWEST COST LITHIUM PRODUCERS GLOBALLY. Management estimates that 25% of the global resource cost curve is either AT OR BELOW BREAKEVEN.

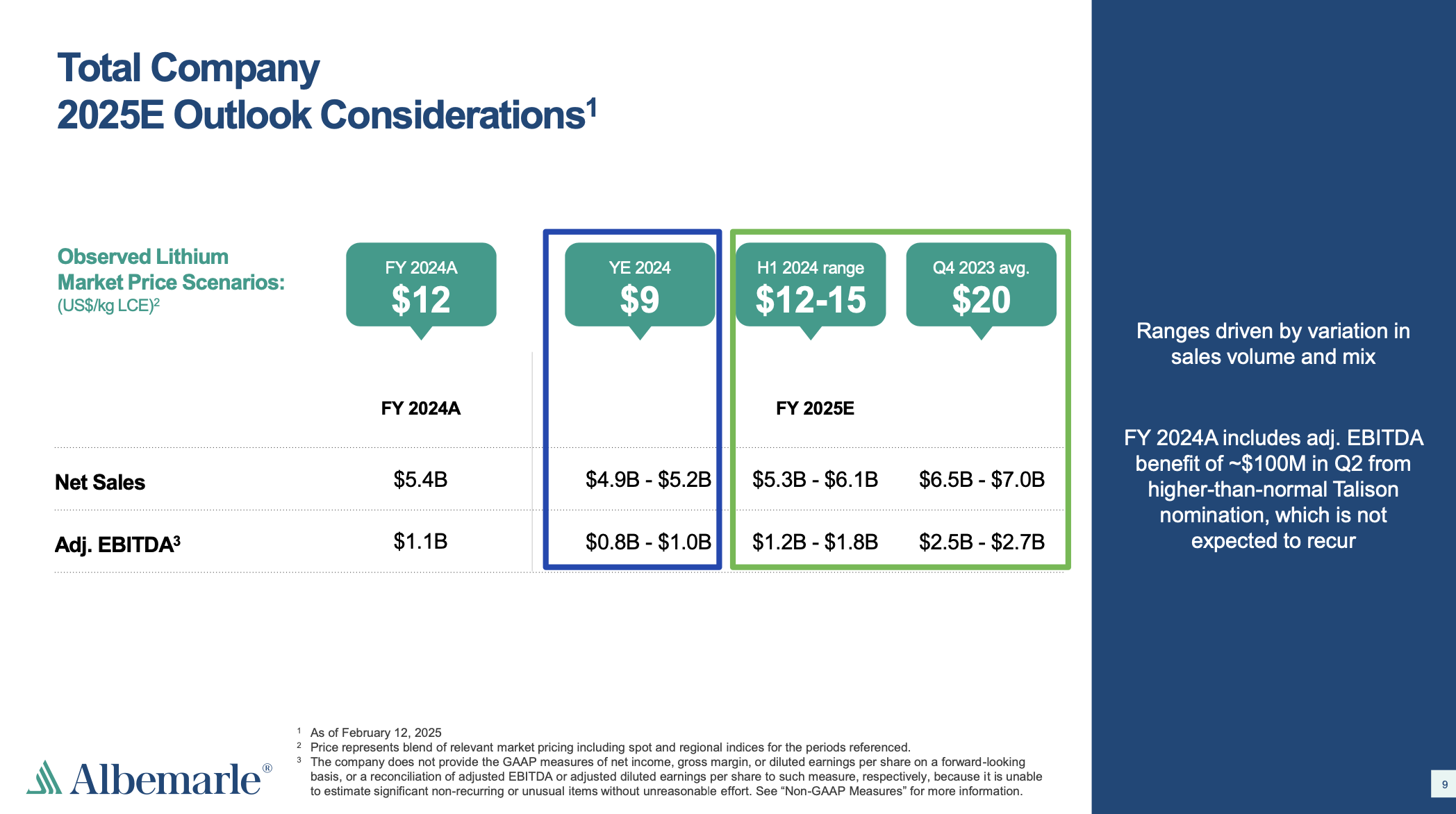

- Management expects to SUSTAIN MARGINS despite LOWER YoY lithium pricing, which averaged ~$12,000 per metric ton in 2024. If market pricing remains at similar levels in 2025, margins are expected to improve from the mid-20% range to the mid-30% range, driven by cost and productivity gains.

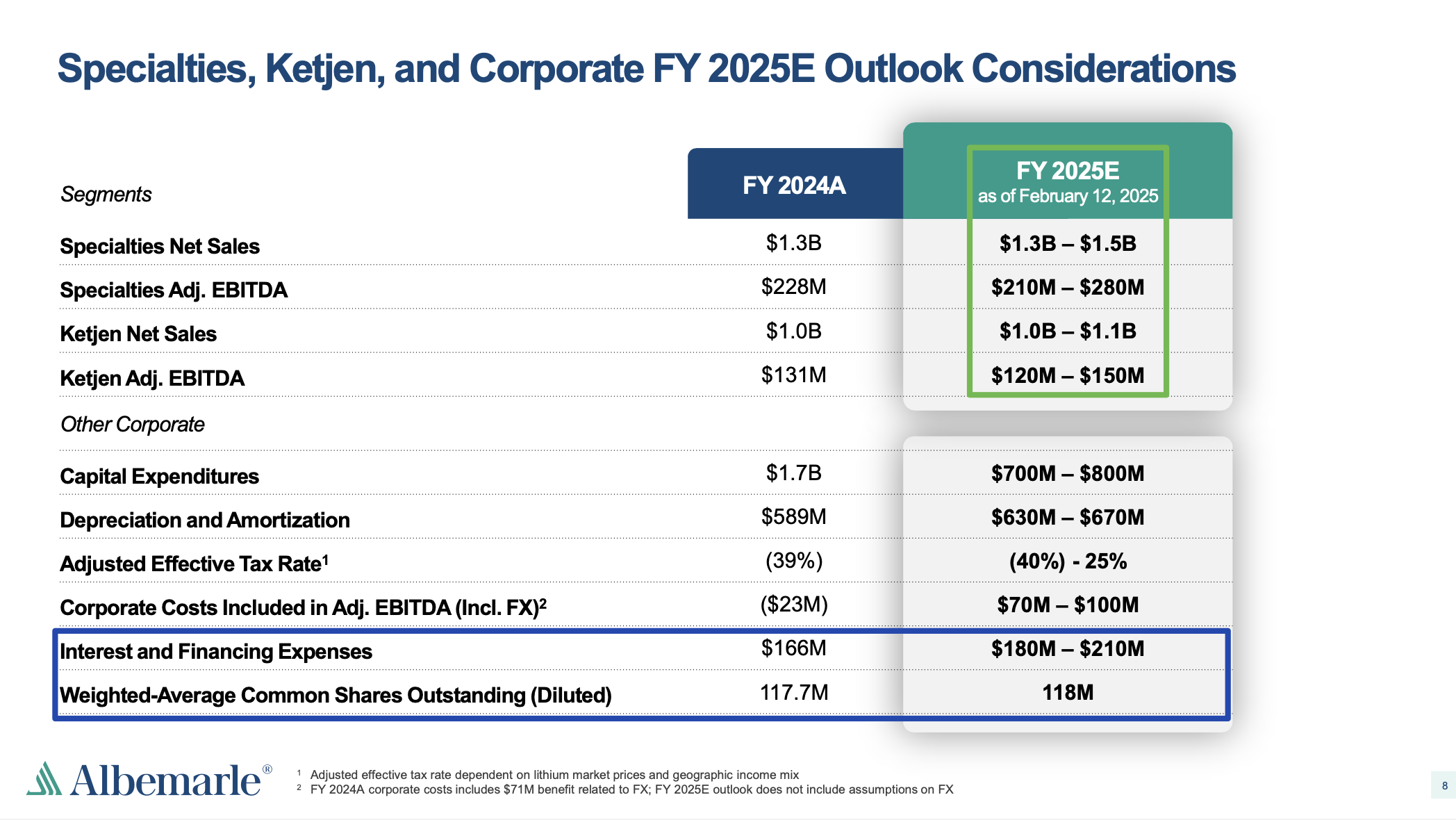

- Management has guided for an additional $100M reduction in capex for 2025, lowering total projected capex to $700M-$800M, less than 50% of 2024 levels. Longer term, management is targeting 4-6% net of sales on a normalized basis.

- The company remains on track to achieve 100% of run-rate cost and productivity improvements of $300M-$400M by the end of 2025.

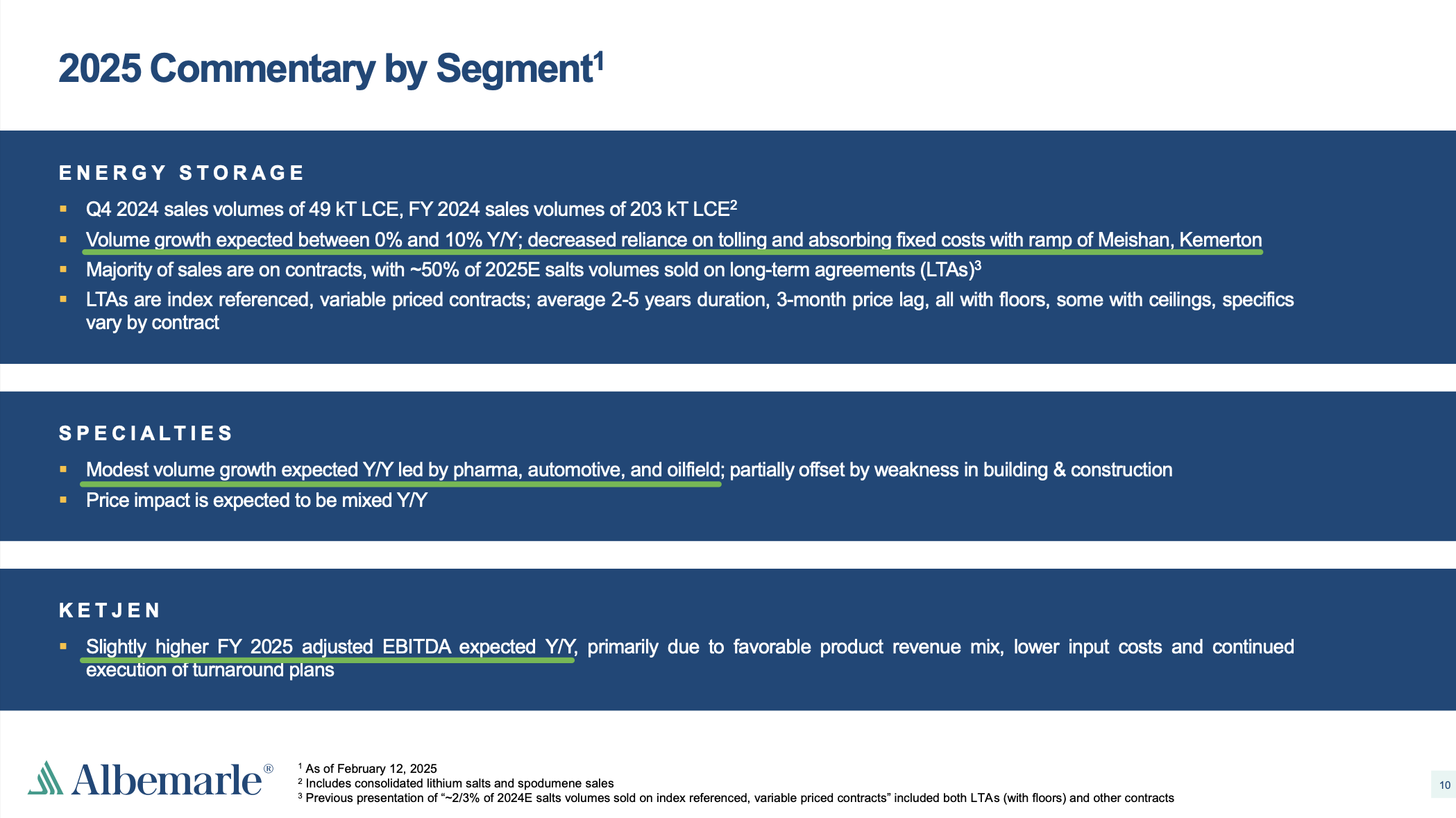

- Energy storage volume growth is expected to range from 0% to 10% YoY. Specialties are projected to see modest volume growth YoY, while Ketjen is expected to achieve slightly higher adjusted EBITDA.

- Contracts continue to perform well, with no significant renewals due this year. Management has reduced reliance on index-based contracts, which previously accounted for nearly two-thirds of agreements, bringing that figure down to ~50% in favor of more long-term agreements with pricing floors.

Earnings Call + Q&A Highlights

General Market

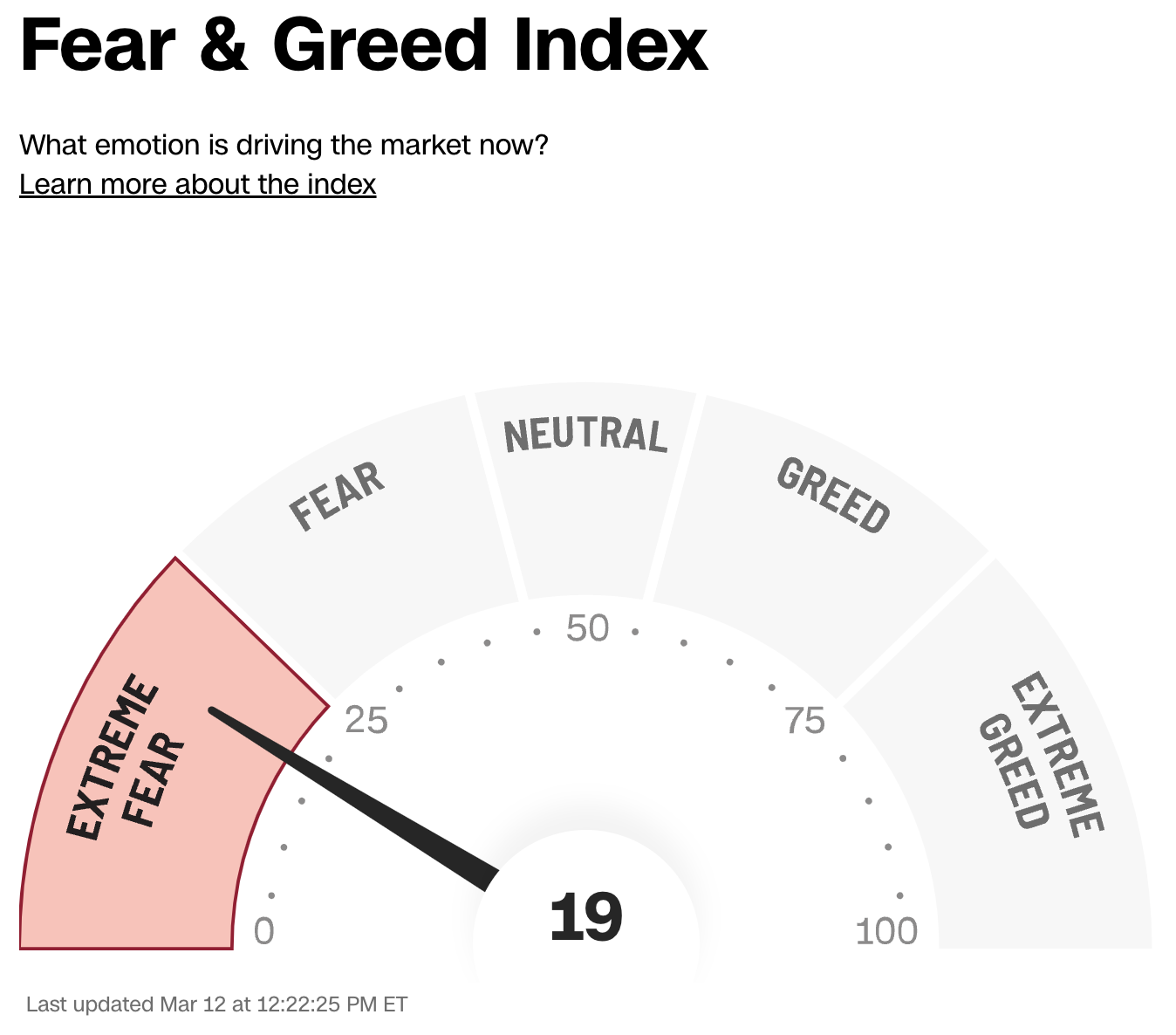

The CNN “Fear and Greed Index” ticked up from 17 last week to 19 this week. You can learn how this indicator is calculated and how it works here: (Video Explanation)

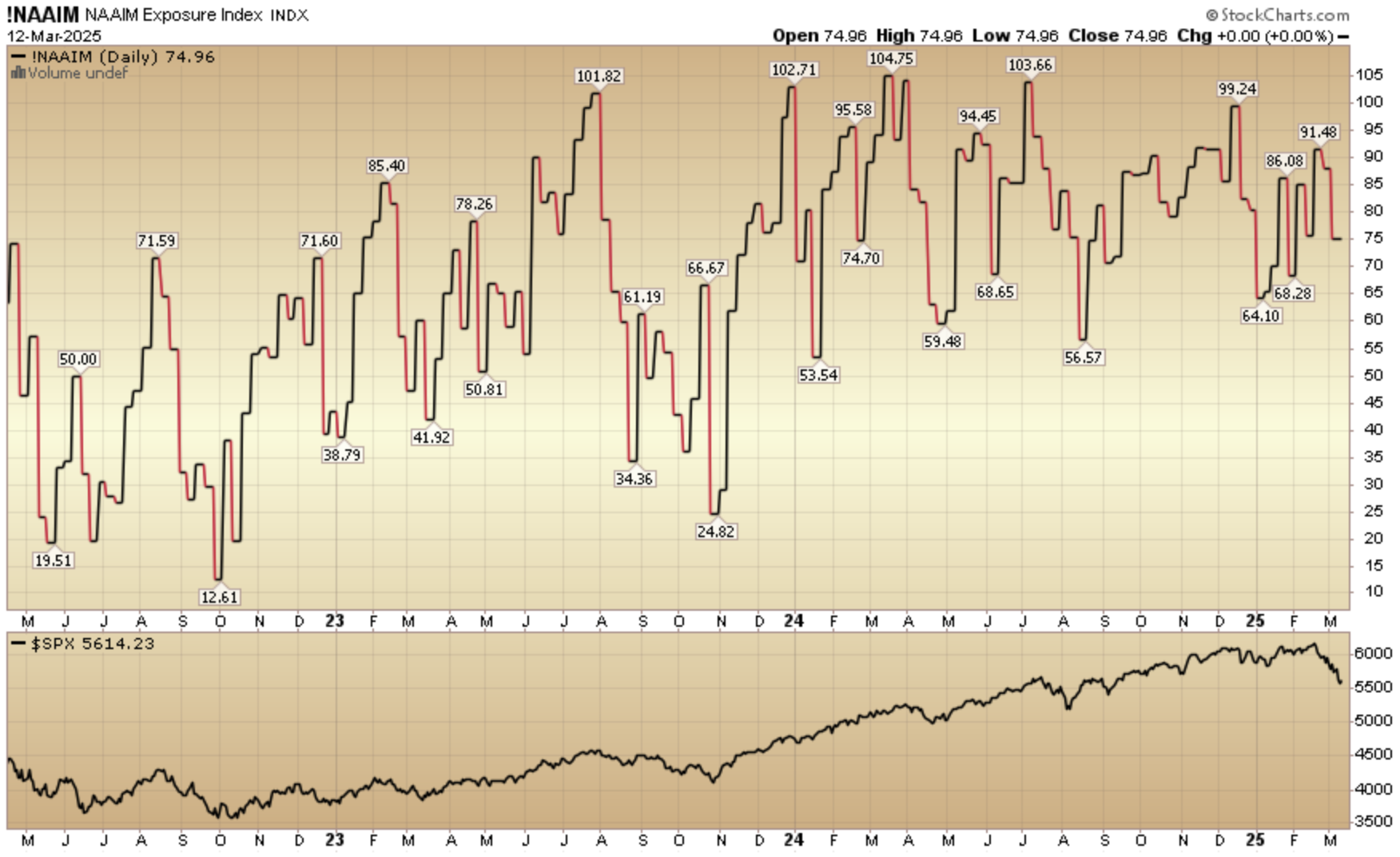

The NAAIM (National Association of Active Investment Managers Index) (Video Explanation) ticked down to 74.96% this week from 87.87% equity exposure last week.

Our podcast|videocast will be out sometime on Thursday or Friday. We have a lot of great data to cover this week. Each week, we have a segment called “Ask Me Anything (AMA)” where we answer questions sent in by our audience. If you have a question for this week’s episode, please send it in at the contact form here

*Opinion, Not Advice. See Terms