In my last few public appearances – since late June – I had been saying we are on the “cusp of a sea change” (un-magnificent 493 would outperform the magnificent 7 in 2H 2024):

Tom Hayes – Fox Business Appearance – Varney & Co. – 7/8/2024

Tom Hayes – Fox Business Appearance – Segment #2 – Cavuto Coast to Coast – 7/9/2024

Tom Hayes – Fox Business Appearance – The Claman Countdown – 6/25/2024

Tom Hayes – Fox Business Appearance – Charles Payne – 6/24/2024

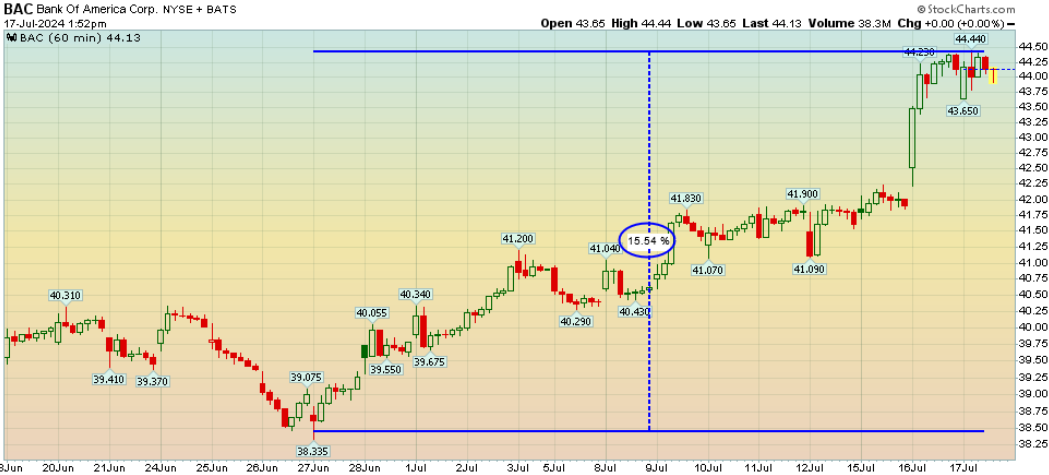

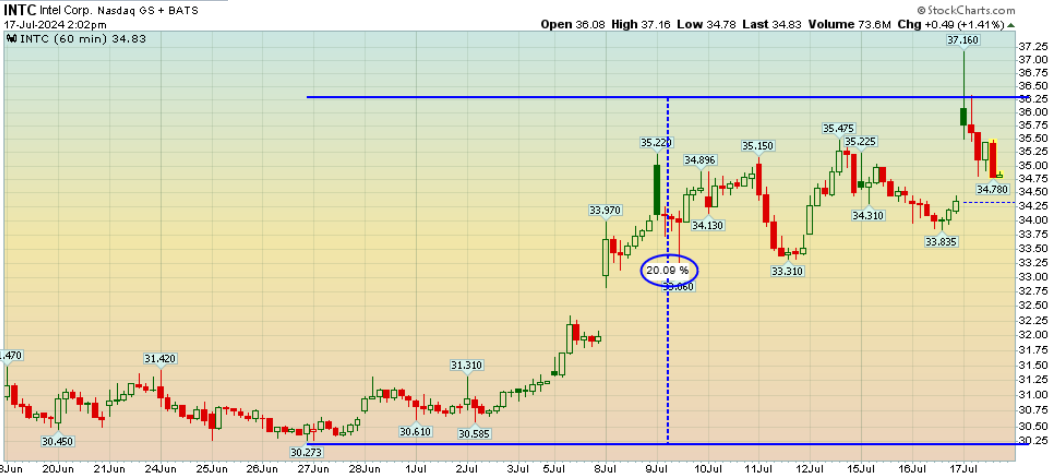

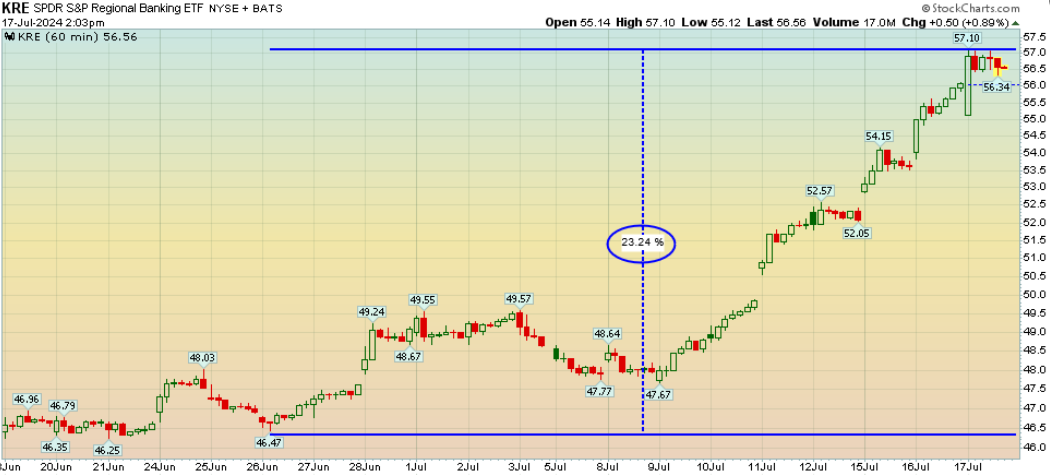

Now it is happening in earnest on the upside (selective holdings and other names we have discussed in our podcast|videocast(s)):

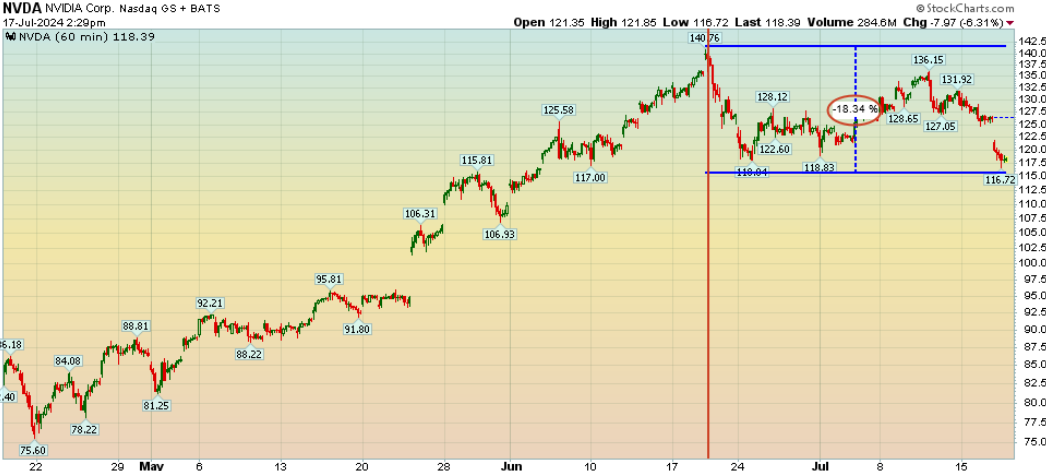

And on the downside:

The red vertical line is June 20 when we published our article “The Next Pain Trade.” You can find it here:

Do you think it’s over, or JUST BEGINNING?!!!

I joined Remy Blaire on Fintech TV at the NYSE yesterday to discuss this exact topic. Thanks to Jeremy Kasdin and Remy for having me on:

Bank of America Fund Manager Survey Update

On Tuesday, we put out a summary of the monthly Bank of America “Global Fund Manager Survey.” This month they surveyed 209 managers with $560B AUM:

July 2024 Bank of America Global Fund Manager Survey Results (Summary)

Here were the key points:

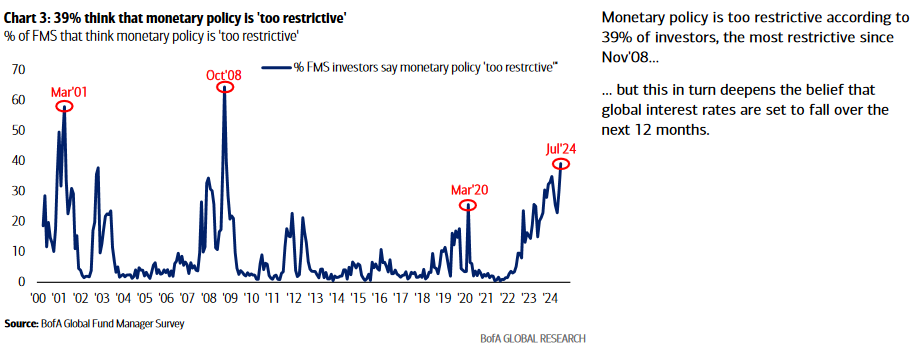

- The most number of survey participants (in 16 years) believe monetary policy is “too restrictive.” The last four peaks in this level of “too restrictive” belief marked at or near bottoms to buy cyclicals, small caps, dividend payers and international stocks. With the Fed Funds rate > 200bps above inflation – we concur with this point of view.

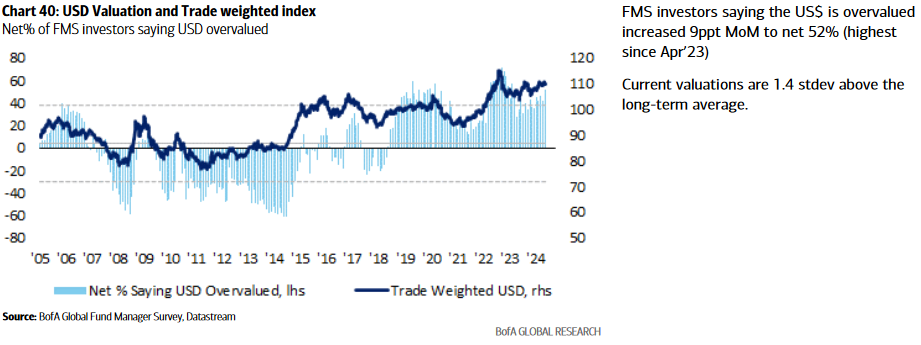

- The valuation of the US Dollar is 1.4 SD above the long term average. This will come down.

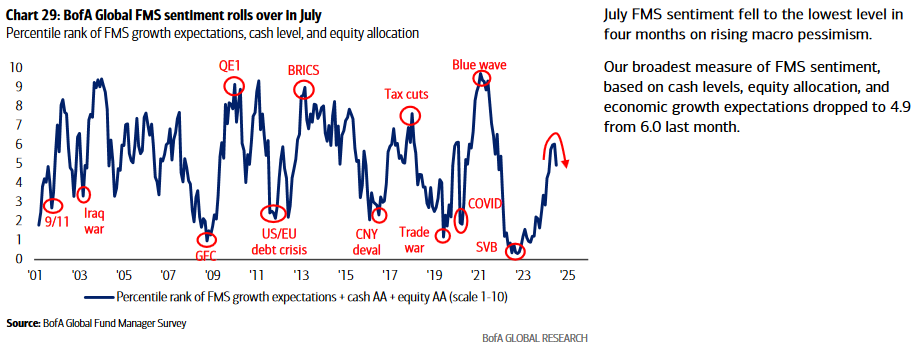

- Sentiment still mixed. Not excessively euphoric.

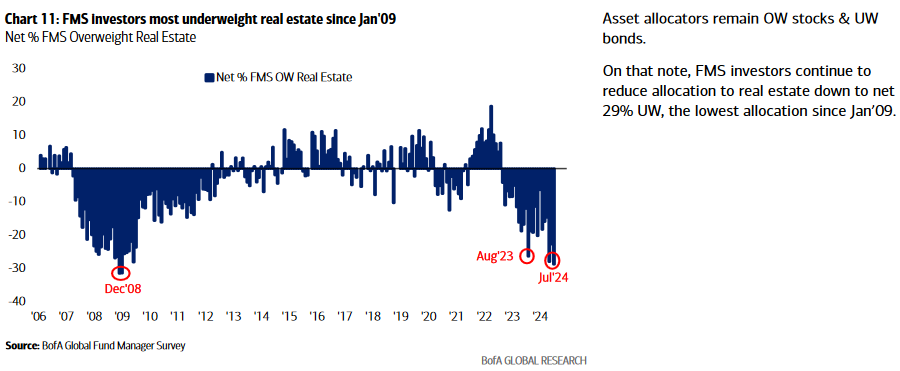

- The least amount of people want to own real estate since Jan 2009.

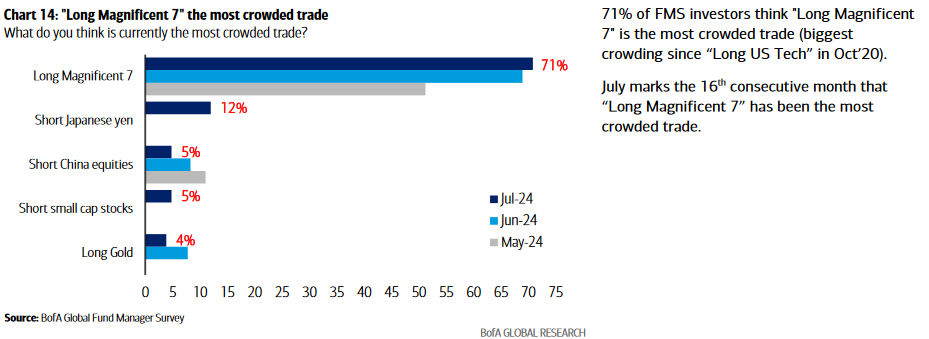

5. The 4 most crowded trades are: Long magnificent 7, Short yen, Short China, Short Small Caps. All 4 are finally beginning to reverse.

5. The 4 most crowded trades are: Long magnificent 7, Short yen, Short China, Short Small Caps. All 4 are finally beginning to reverse.

Now onto the shorter term view for the General Market:

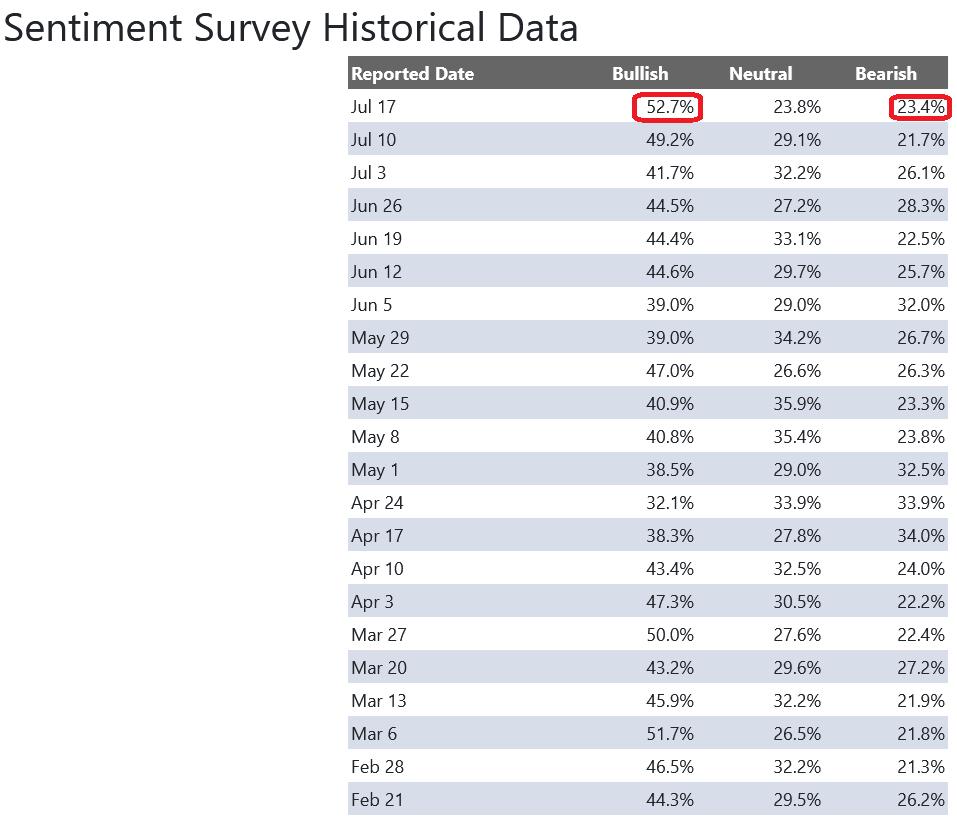

In this week’s AAII Sentiment Survey result, Bullish Percent (Video Explanation) jumped to 52.7 from 49.2% the previous week. Bearish Percent ticked up to 23.4% from 21.7%. Retail investors are becoming too enthusiastic.

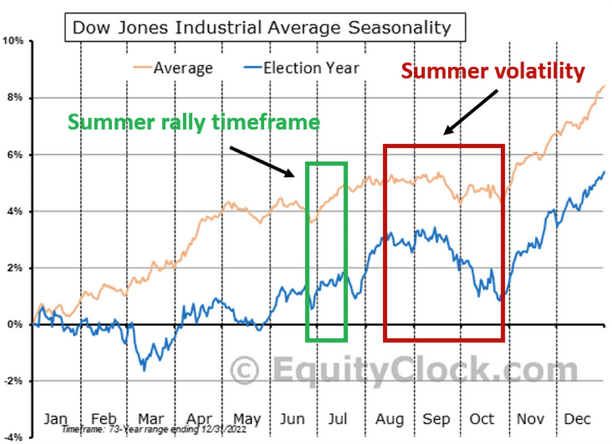

It would not be surprising to see a little continuation of the “mag 7/cap weighted index” volatility for the end of July. It is common in an Election Year:

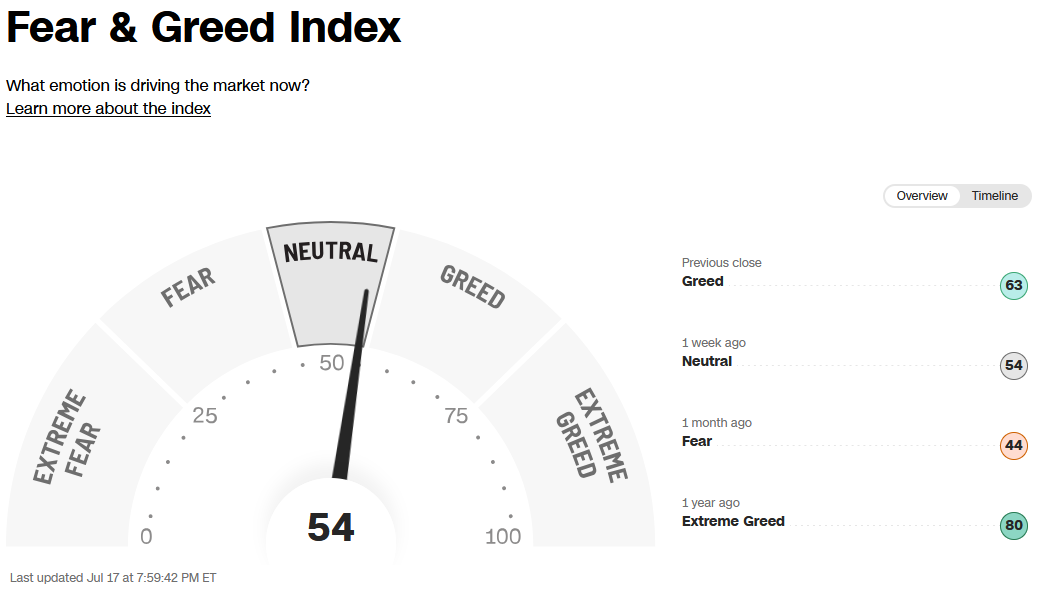

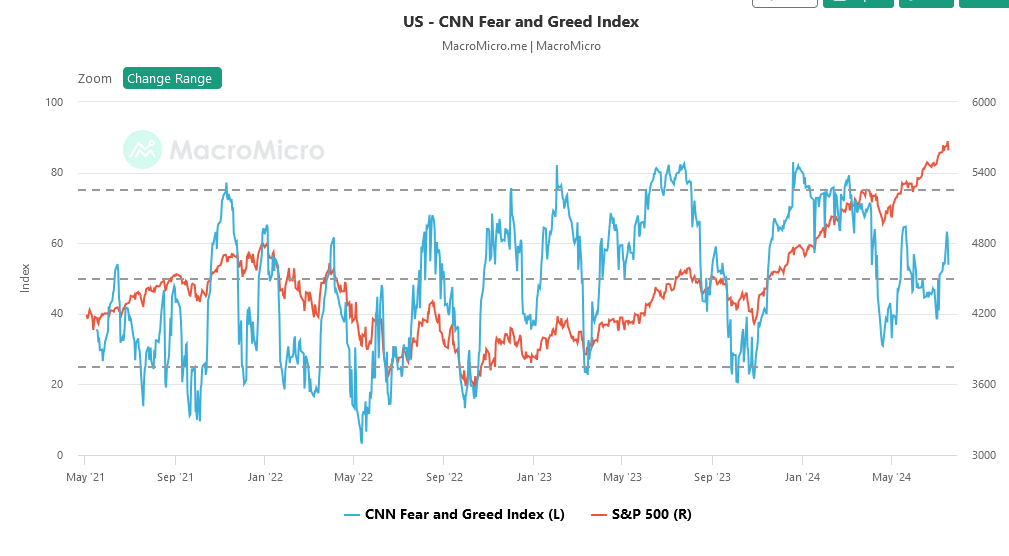

The CNN “Fear and Greed” ticked down from 58 last week to 54 this week. You can learn how this indicator is calculated and how it works here: (Video Explanation)

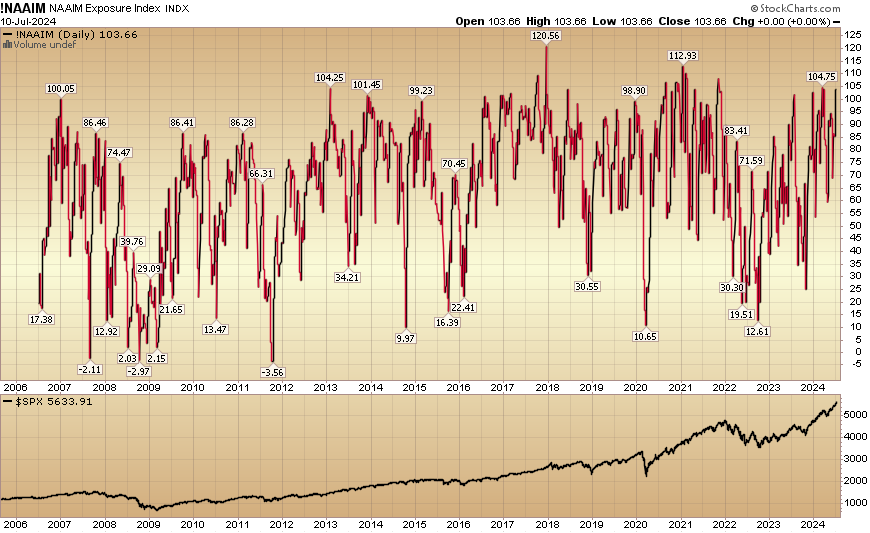

The NAAIM (National Association of Active Investment Managers Index) (Video Explanation) moved down to 93.84% this week from 103.66% equity exposure last week.

The NAAIM (National Association of Active Investment Managers Index) (Video Explanation) moved down to 93.84% this week from 103.66% equity exposure last week.

Our podcast|videocast will be out later tonight. Each week, we have a segment called “Ask Me Anything (AMA)” where we answer questions sent in by our audience. If you have a question for this week’s episode, please send it in at the contact form here.

Congratulations to all of the new clients that came in during our early Q1 and Q2 raises. We re-opened to smaller accounts $1M+ again starting last Thursday and will remain open for the next week. We are grateful for the extreme demand this quarter. To see if you qualify and to take advantage of this opening click here. Larger accounts $5-10M+ can access bespoke service at their preference here.

*Opinion, Not Advice. See Terms

Not a solicitation.