Fox Business

On Friday, I joined Liz Claman on Fox Business to discuss key Market themes we are focused on moving forward. Thanks to Liz, Jake Mack and Kathryn Meyers for having me on:

Watch in HD Directly on Fox Business

On Tuesday, I joined Stuart Varney and Lauren Simonetti on Fox Business to discuss the Port Strike, Middle East tensions and more. Thanks to Stuart, Lauren, Christian Dagger and Preston Mizell for having me on:

Watch in HD directly on Fox Business

Here were my “show notes”:

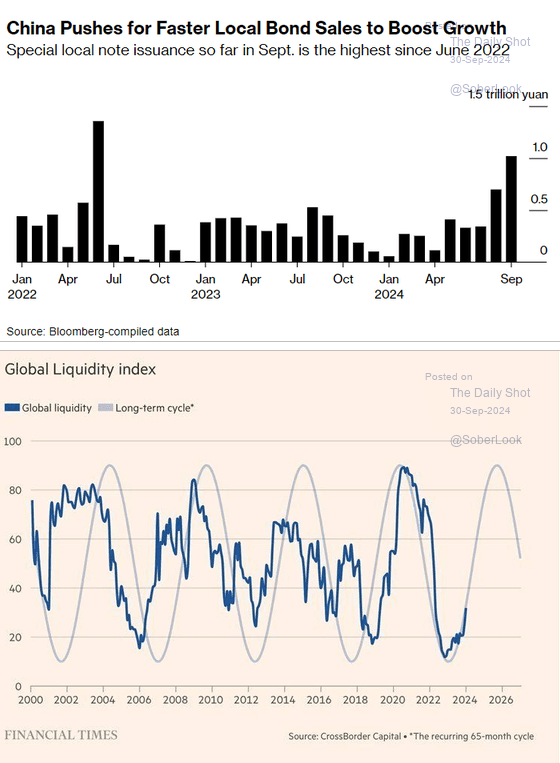

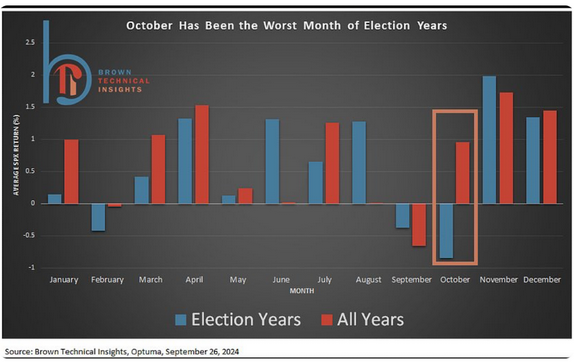

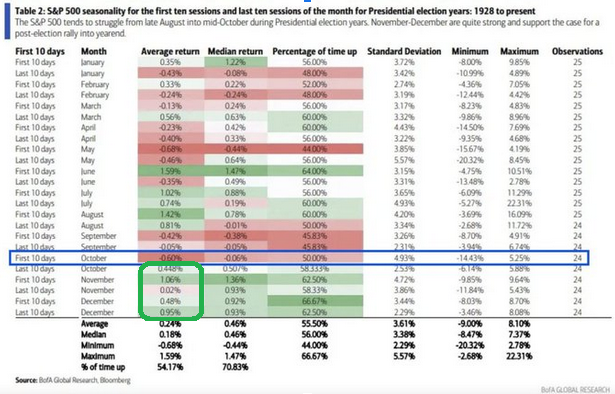

Seasonal Weakness on Tap?

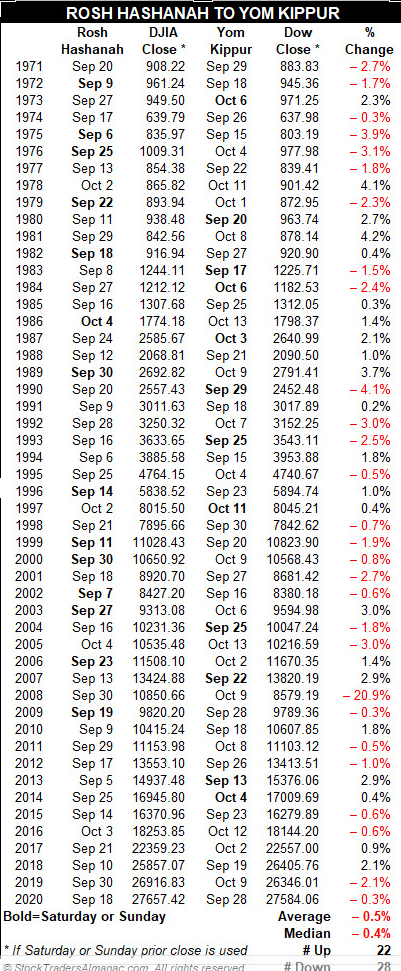

“Sell Rosh Hashanah, Buy Yom Kippur” Oct. 2 – Oct. 11

This is an age old Wall Street maxim has been around for years. Jeff Hirsch of the Stock Trader’s Almanac compiled the data below:

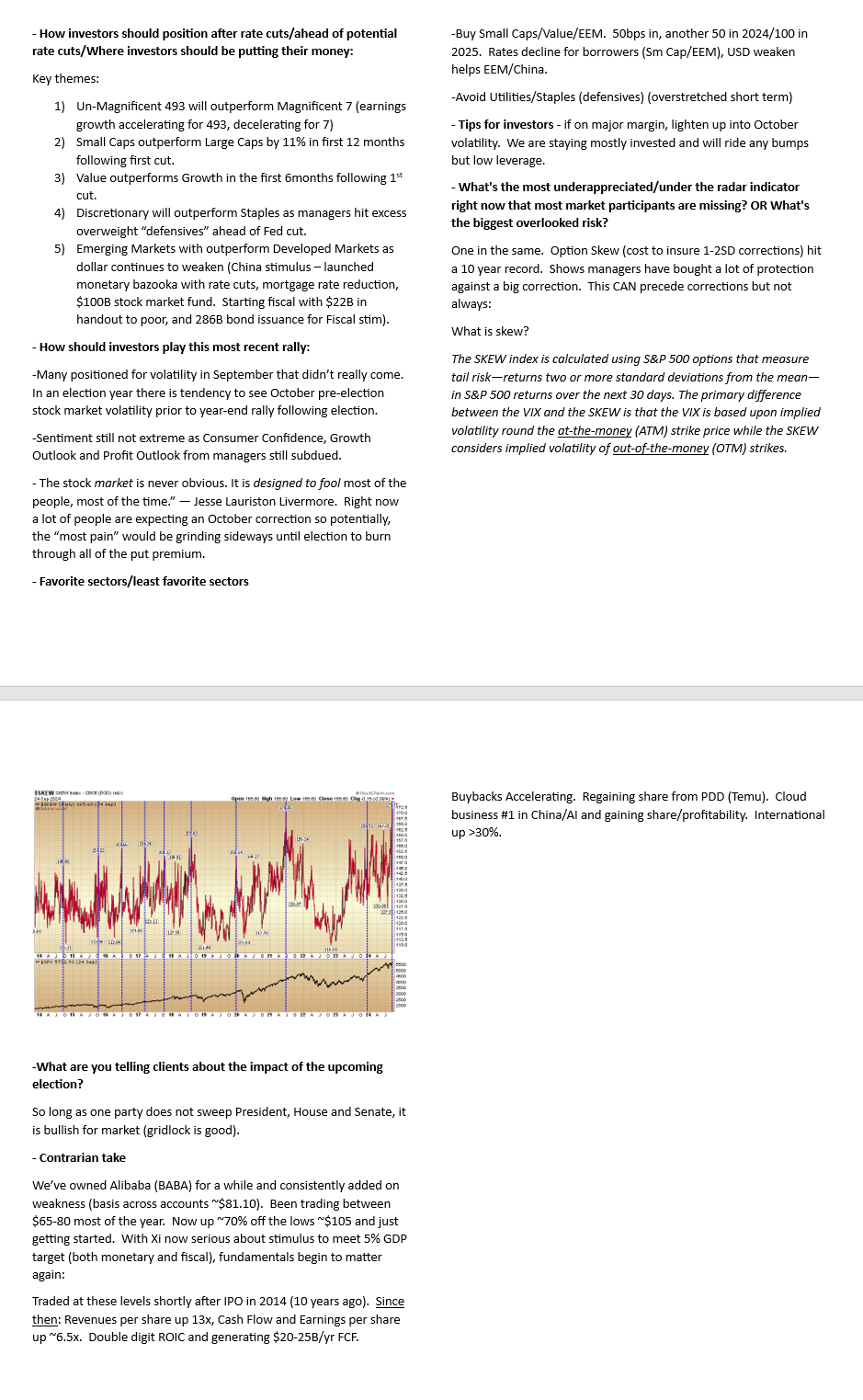

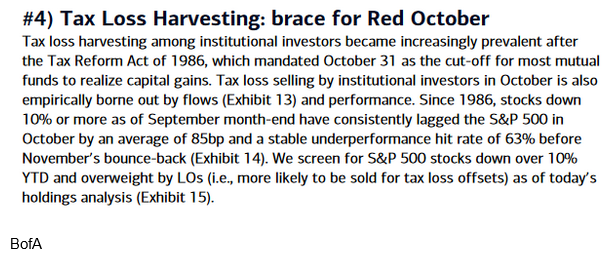

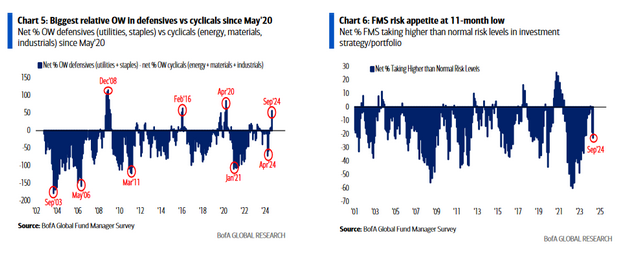

As we stated on Claman and Varney, options SKEW (which we covered last week) is elevated, and several other indicators/seasonality point to potential weakness in October – before the election clears. We have raised some cash/taken profits (sold Solventum stock and took profits on a slew of different option premium that were multi-baggers) to take advantage of any opportunities that pop up in coming weeks ahead of the election.

Source – Scott Brown

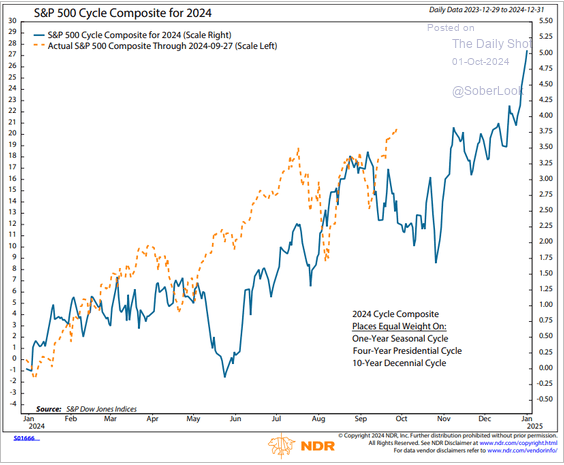

Source – Ned Davis

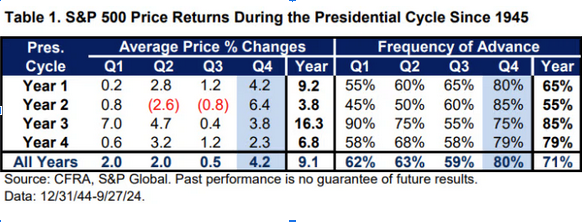

Source: Ryan Detrick

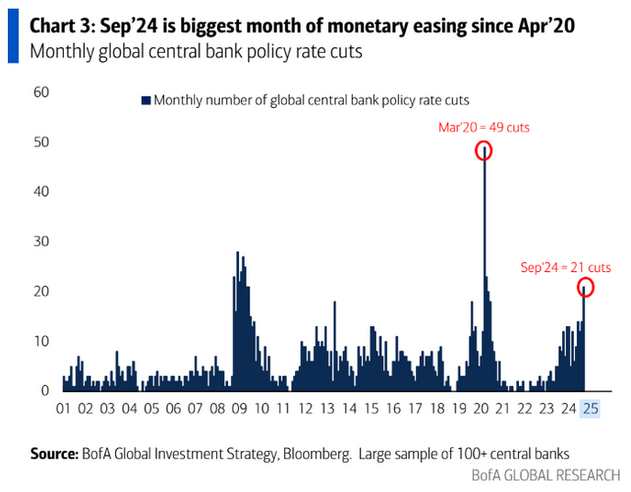

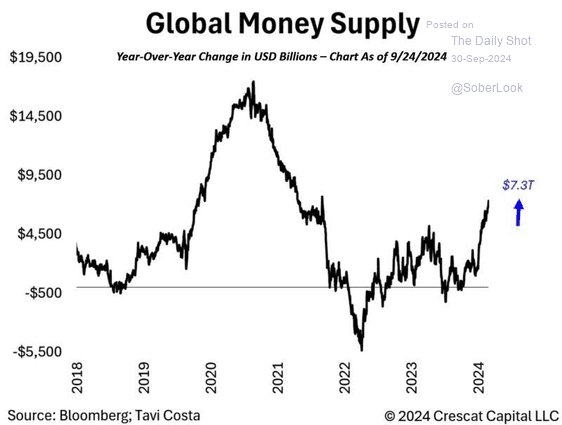

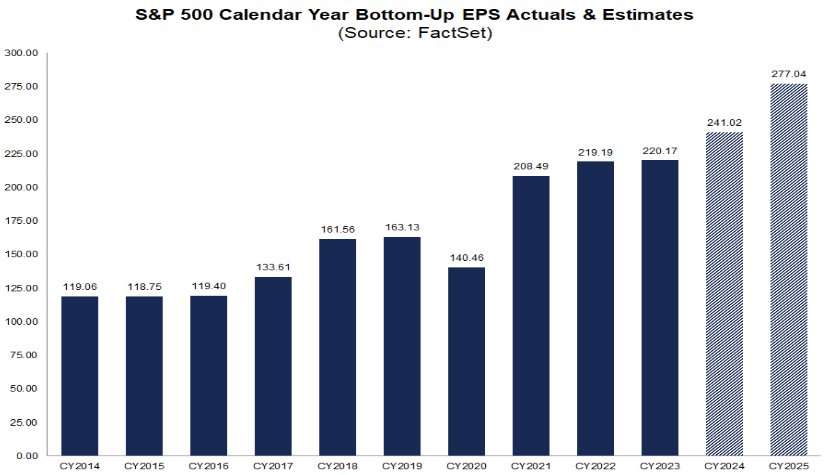

Reasons to Stay Optimistic into Year-End (despite near-term/October potential headwinds)

Now onto the shorter term view for the General Market:

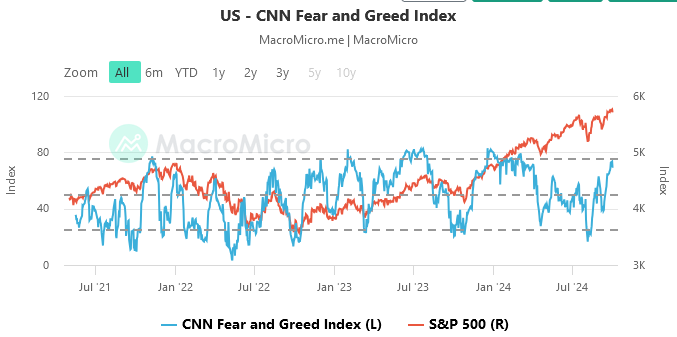

The CNN “Fear and Greed” moved up from 67 last week to 69 this week. You can learn how this indicator is calculated and how it works here: (Video Explanation)

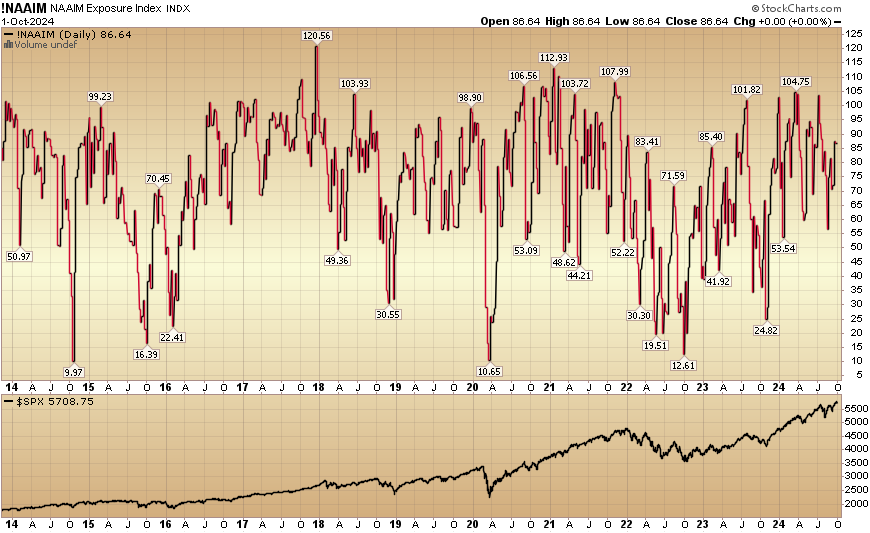

The NAAIM (National Association of Active Investment Managers Index) (Video Explanation) moved down to 86.64% this week from 87.46% equity exposure last week.

The NAAIM (National Association of Active Investment Managers Index) (Video Explanation) moved down to 86.64% this week from 87.46% equity exposure last week.

Our podcast|videocast will be out Thursday night. We have a lot of great data to cover this week. Each week, we have a segment called “Ask Me Anything (AMA)” where we answer questions sent in by our audience. If you have a question for this week’s episode, please send it in at the contact form here.

Congratulations to all of the new clients that came in during our early Q2 and Q3 raises. We are now re-opening to smaller accounts $1M+ again starting today and will remain open for the next two weeks. To see if you qualify and to take advantage of this opening click here. Larger accounts $5-10M+ can access bespoke service at their preference here.

*Opinion, Not Advice. See Terms

Not a solicitation.