Snatching Defeat From The Jaws of Victory

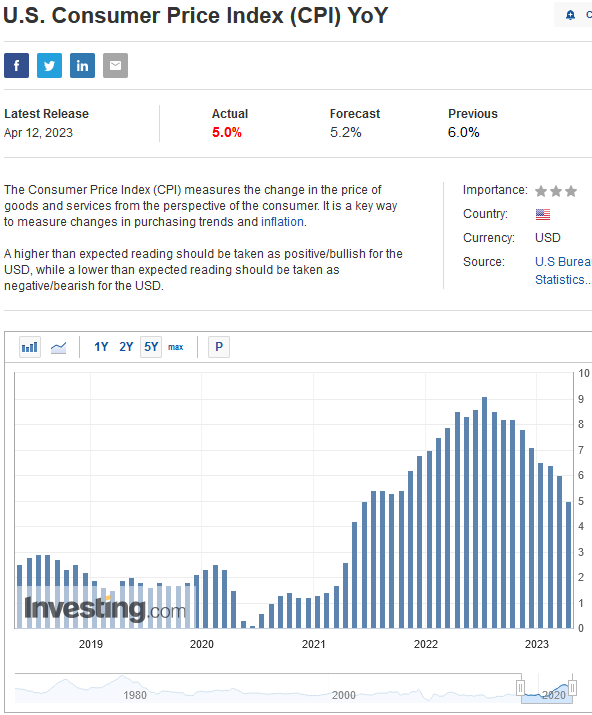

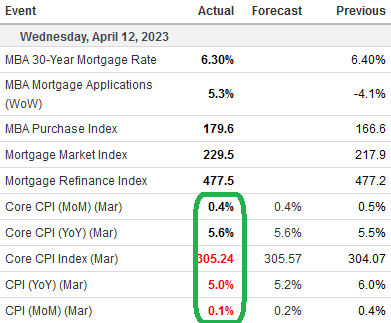

On Wednesday, the market started up nicely on the back of the better than expected CPI prints:

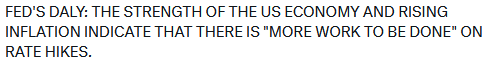

It didn’t take long for the Fed to mess things up (once again) and snatch defeat from the jaws of victory:

It didn’t take long for the Fed to mess things up (once again) and snatch defeat from the jaws of victory:

At ~10AM Richmond Fed President came out with this beauty:

![]()

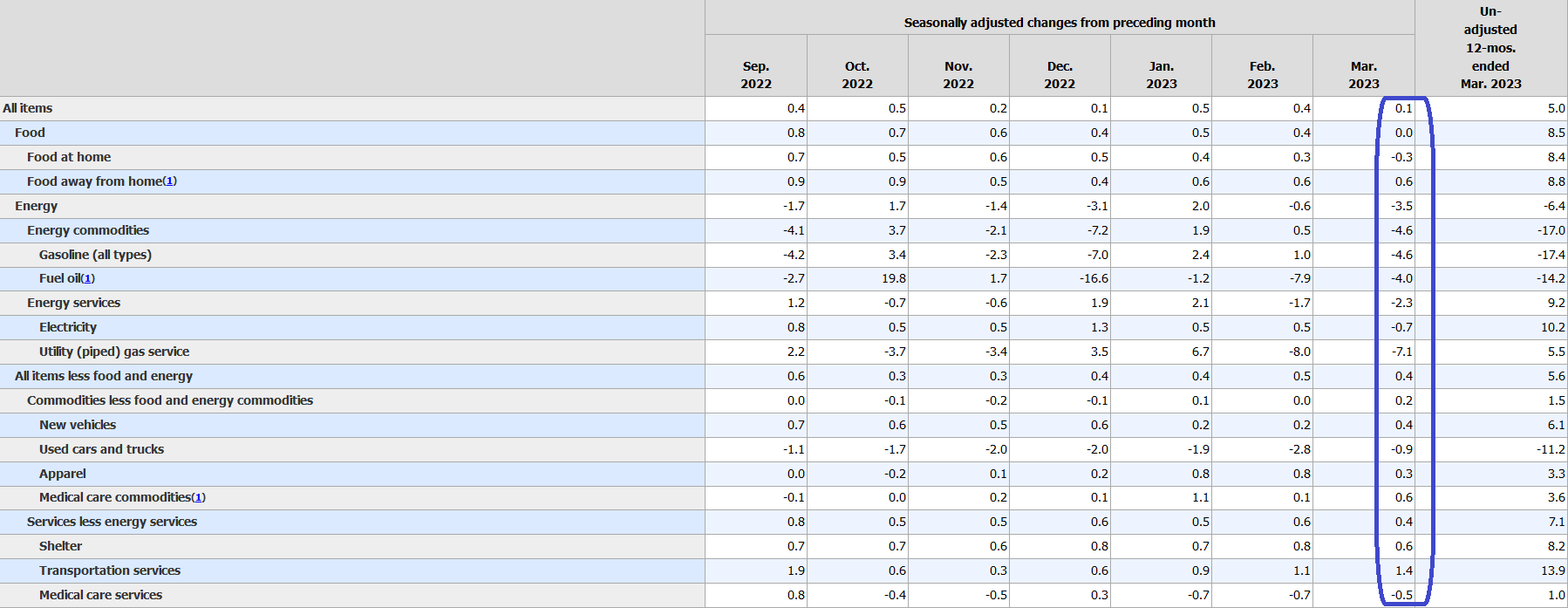

At ~1pm San Francisco Fed President Daly (yes, the overseer of SVB) had this backward looking insight:

I guess we didn’t cause enough portfolio impairment for the banks yet. So far only one has failed in her region. If they push hard enough they can kick First Republic and Pacific West Bancorp off the cliff. Her region will lead the pack for failure. You would think she might be the cautious one moving forward, but I guess “breaking things” is an afterthought. Bureaucrats blame management and taxpayers pick up the tab either through bailouts (direct tax on the middle and upper class) or inflation (indirect tax on the poor).

Finally, at 2:30pm we got the “fed whisperer” (Powell Mouthpiece – Nick Timiraos) drop this bomb in the Wall Street Journal at 2:30pm:

Buffett was out in the morning on CNBC suggesting more banks will fail, but the depositors will be protected. Note, he has not invested in any of the “cheap” regional banks of yet.

Buffett was out in the morning on CNBC suggesting more banks will fail, but the depositors will be protected. Note, he has not invested in any of the “cheap” regional banks of yet.

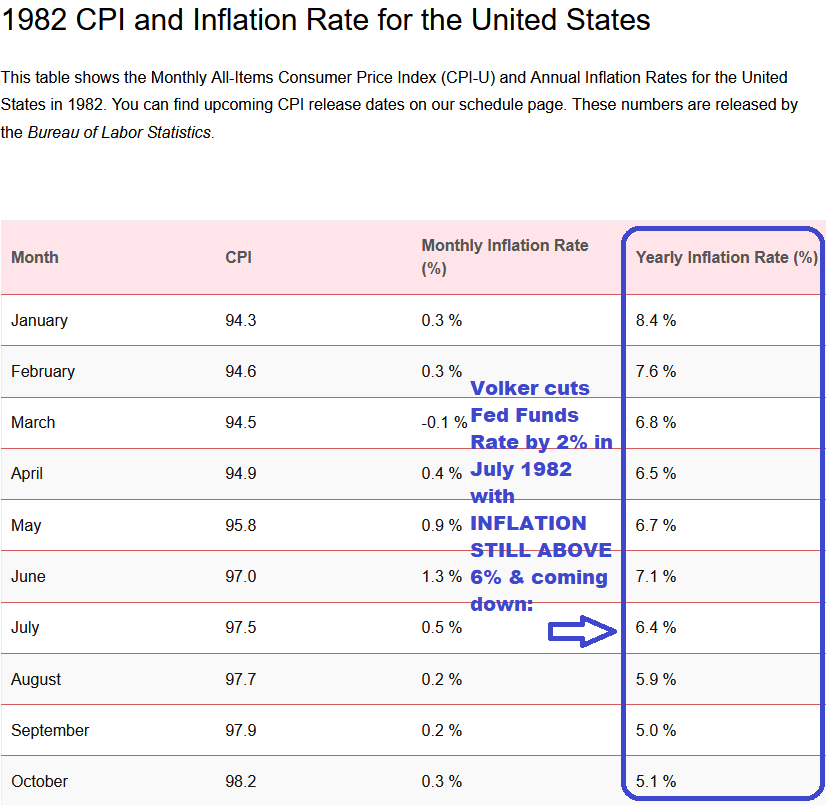

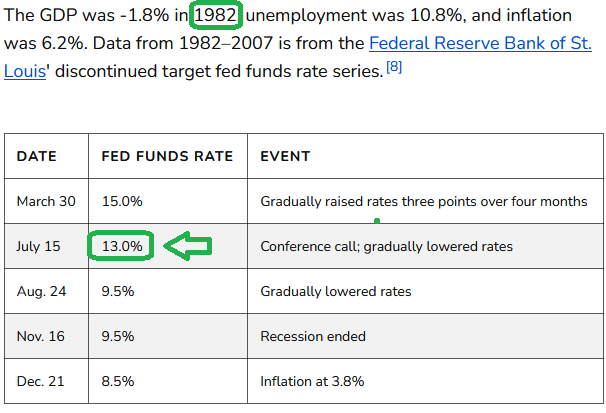

The thing that is so perplexing about Chairman Powell is that while he has repeatedly stated that he aspires to be like Paul Volker (“Keep at It”), it is apparent that he does not understand the history. In 1982, while inflation was STILL ABOVE 6%, Volker cut the Fed Funds Rate by 2% in July 1982:

Here’s what happened next:

A 64% rally for the S&P 500 over the next 12 months…

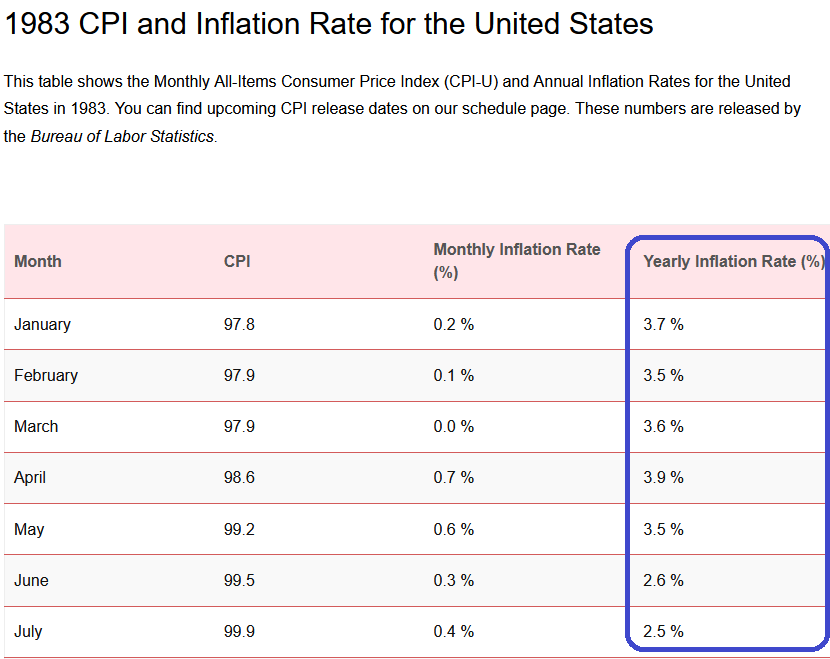

Ahh, but what about inflation you ask? Surely it must have exploded higher with “animal spirits” back in the markets? Try again, inflation collapsed to 2.5% due to the LAGGED EFFECT of the tightening. Volker knew this would happen because he studied, understood, and respected history…

So far it is not clear that Powell understands this concept. I am rooting for him to prove me wrong and pause in time just like his hero did in 1982. He has a chance to be another hero, but he’s cutting it very close to the point of no return. Things are already breaking and the Fed is tone deaf…

Why Was Alibaba Down On Wednesday?

This was the most common question of the day. Here’s the answer:

There were 2 reasons the stock was down:

1. The entire group, led by Tencent (down the most) was down for this reason:

2. SoftBank needs more liquidity from their series of failed investments. More cutting their flowers and watering their weeds. They’ve been selling for about 6 months in the hole, so not real news. Looks like their last tranche. No other liquidity for them as most of their portfolio is in VC and cashflow negative tech. They have no choice.

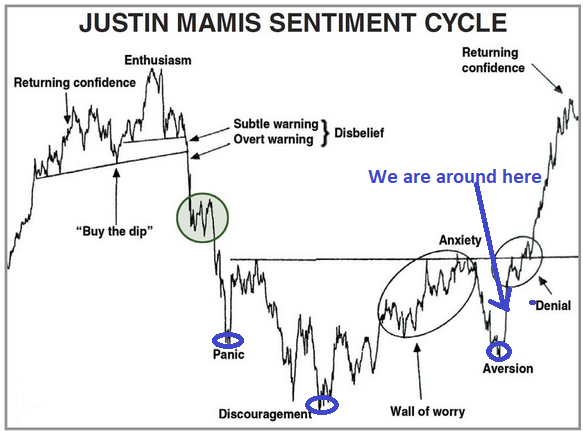

As a reminder from 2 weeks ago’s article, we are in “aversion” headed UP to “denial.” Could we fill the gap at $86 again first? Possible, not probable.

Since we’ve covered the fundamentals many times over, here are our first technical targets, which are miles away from our final targets. $160 is on the basis of filling a gap, $180 is on the basis of a “measured move” from the “inverse head and shoulders.”

I would pay attention to the short term overhead supply between $160-180. This is where everyone will think the move is over because it will stall and pull back for months before making the long term move back to fair value.

While technical analysis is a tool, it is not the answer. It is simply a guide to understand where you might be in the process. We find sentiment and positioning slightly more useful. In this case, the technicals are lining up perfectly with a standard emotional process cycle (by Justin Mamis). We have covered this chart many times in the past:

Recency Bias

There are a ton of charts out that show us why a recession is upon us and therefore the stock market must crash. In most instances they point to the last 20 years and show that because it happened in 2000 and 2008 it must always happen. When you step back and look at a longer timeline, the facts simply don’t bear it out.

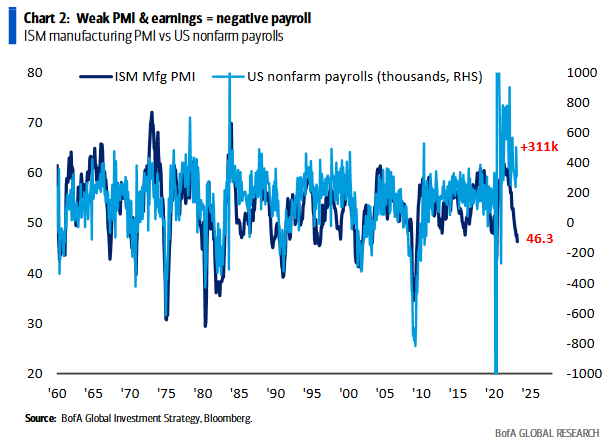

Argument 1: ISM Manufacturing PMI hasn’t been this low since 2008 and 2000. We’re going to crash! It was a lot lower in 1982 and we rallied 64% the next 12 months. Why? The fed CUT rates. Most people are saying if the Fed Cuts we will crash because the Fed is too far behind the curve. Again recency bias from 2008 and 2000.

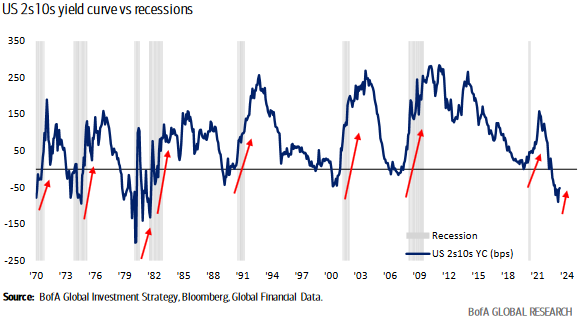

Argument 2: The Stock Market must crash because the yield curve is inverted. See 1982 once again:

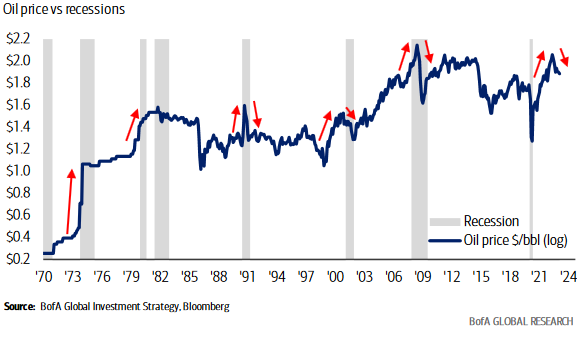

Argument 3: Oil prices not rallying despite supply cut = recession. See 1982:

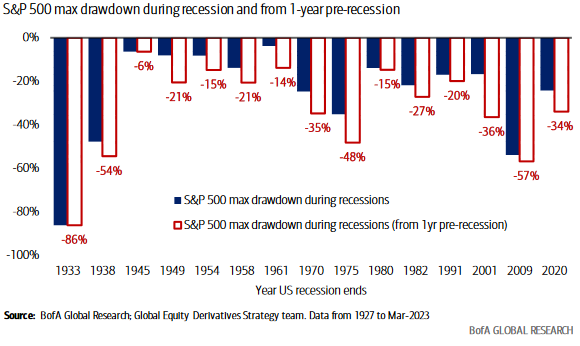

Argument 4: Market drawdown will be lower than October lows once the recession comes. The drawdown of 27% (S&P 500) last year was bigger than the early 90’s recession and the same as the 1982 drawdown.

Auto-Supplier Update

Auto-Supplier Update

One of our top positions is auto-supplier – Cooper Standard. We made our case for the stock on the podcast|videocast in May as well as on Fox Business – “The Claman Countdown” June 7, 2022 with Liz Claman and executed across accounts at ~$5.50 (it is now up ~137% as of yesterday’s close). See the original clip below:

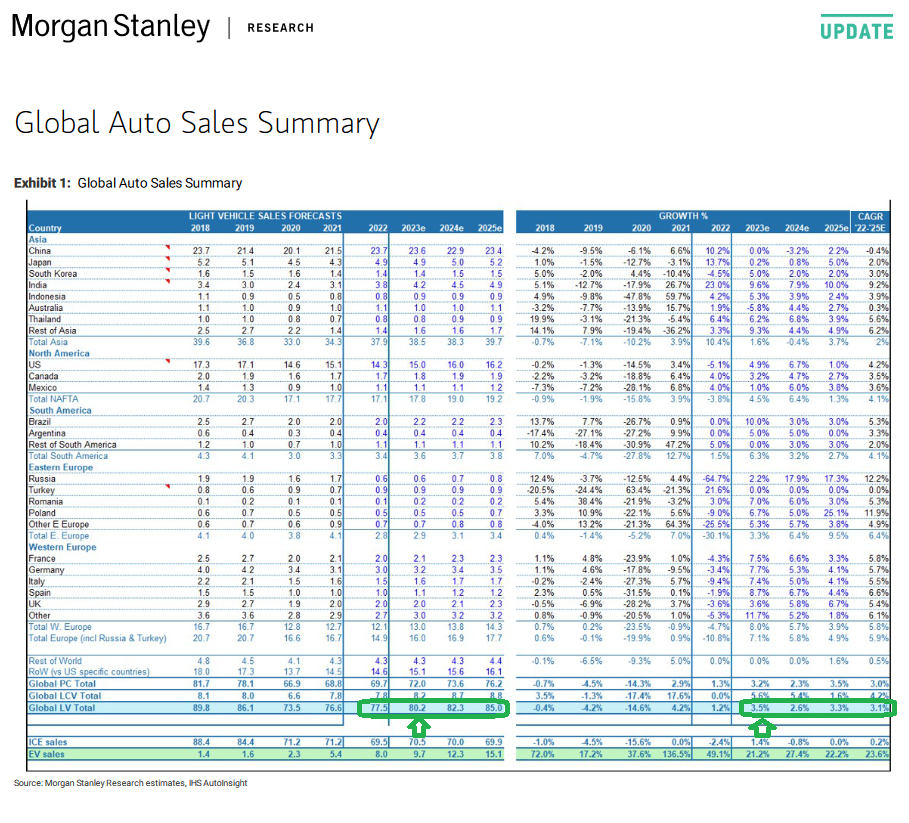

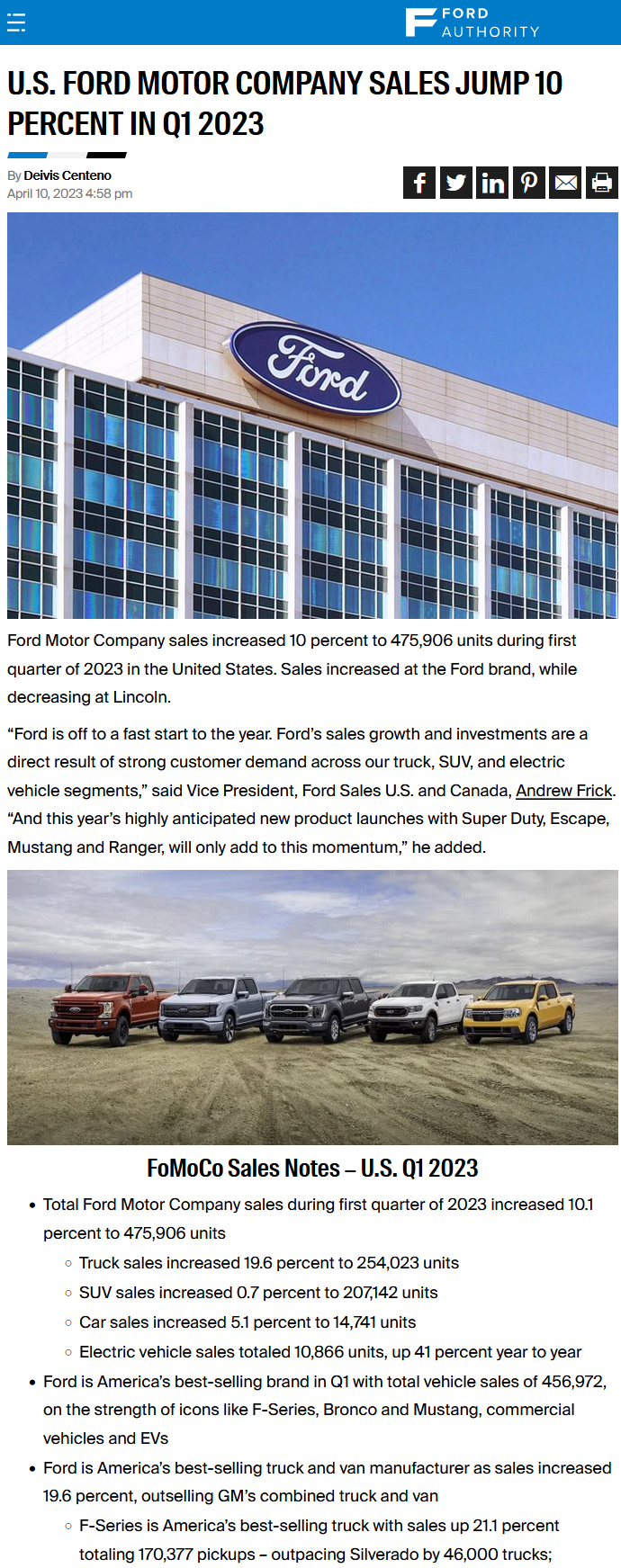

Cooper Standard (CPS) thesis remains in-tact as new auto sales continue to exceed expectations.

Now onto the shorter term view for the General Market:

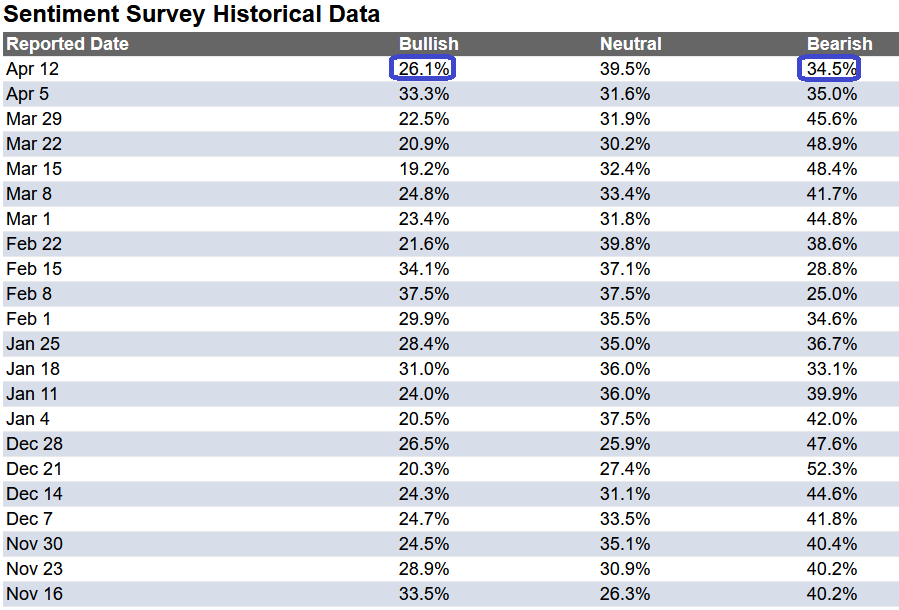

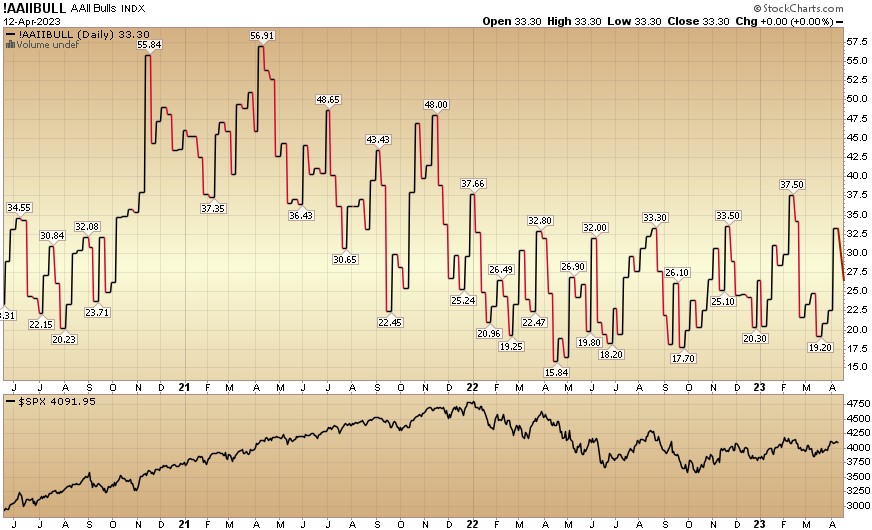

In this week’s AAII Sentiment Survey result, Bullish Percent (Video Explanation) dropped to 26.1% from 33.3% the previous week. Bearish Percent flat-lined to 34.5% from 35%. Retail investor fear is back…

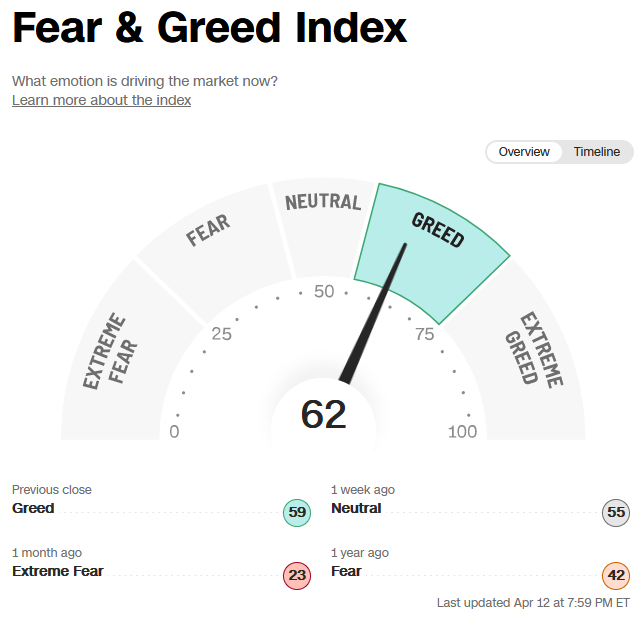

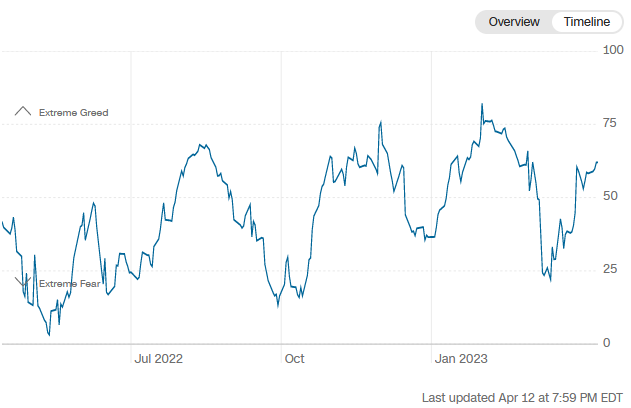

The CNN “Fear and Greed” rose from 53 last week to 62 this week. Sentiment is improving. You can learn how this indicator is calculated and how it works here: (Video Explanation)

The CNN “Fear and Greed” rose from 53 last week to 62 this week. Sentiment is improving. You can learn how this indicator is calculated and how it works here: (Video Explanation)

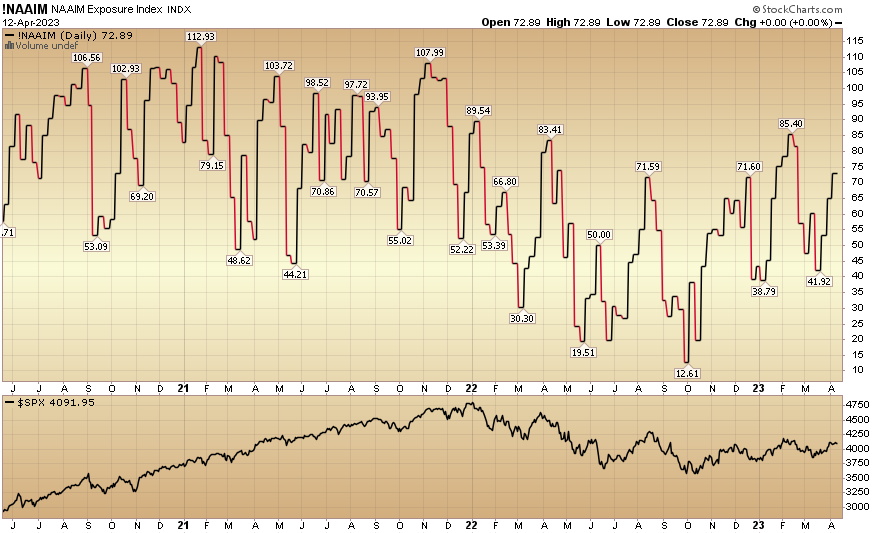

And finally, the NAAIM (National Association of Active Investment Managers Index) (Video Explanation) rose to 72.89% this week from 65.15% equity exposure last week.

And finally, the NAAIM (National Association of Active Investment Managers Index) (Video Explanation) rose to 72.89% this week from 65.15% equity exposure last week.

Our podcast|videocast will be out late today or tomorrow. Each week, we have a segment called “Ask Me Anything (AMA)” where we answer questions sent in by our audience. If you have a question for this week’s episode, please send it in at the contact form here.

*Opinion, not advice. See “terms” above.