In trading, all you can do is take statistically advantaged positions and manage risk. Over a series of trades, if you do both well, you will outperform.

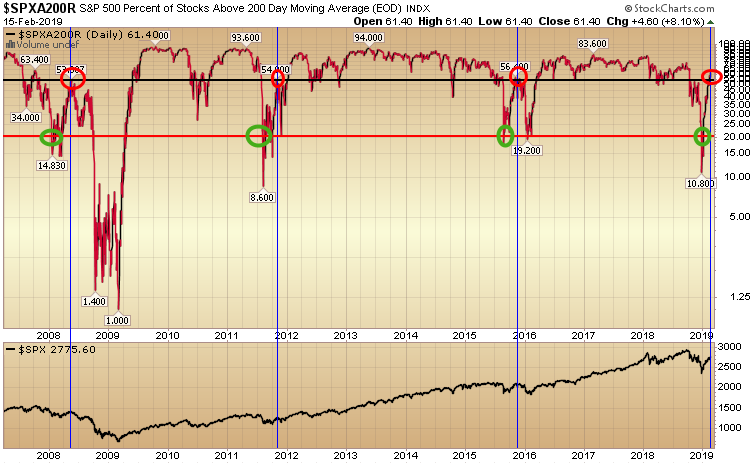

This morning, I had a look at the S&P 500 % of Stocks Above 200 Day Moving Average to get a sense of where we are. While I only have 4 instances to measure, it has 100% recent accuracy so far.

Here’s what it has done: In each instance where the SPX200R has dropped below 20% (of S&P500 stocks above the 200Day moving average), when it rebounded back above 50% (of S&P500 stocks above the 200Day moving average), it always dropped back again to retest 20% (of S&P500 stocks above the 200 Day moving average).

So what does that imply?

It implies we could see a pullback as noted by the 3 previous instances marked by the blue vertical lines. What did the pullback (retest) to the 20% (of S&P500 stocks above the 200Day moving average) mean to the S&P 500 in percentage terms the last three times (S&P 500 in black at the bottom of chart)?

Example 1: From May 15, 2008 (when it rebounded above 50) to September 29, 2008 (when it retested 20), the S&P 500 dropped 22.6%

Example 2: From October 28, 2011 (when it rebounded above 50) to November 23, 2011 (when it retested 20), the S&P 500 dropped 10.36%

Example 3: From November 3, 2015 (when it rebounded above 50) to January 20, 2016 (when it retested 20), the S&P 500 dropped 14.37%

A few things to keep in mind:

1. Despite the nasty retest in all three instances, the market ultimately rebounded and made significant new highs. In both 2016 and 2011 it was right away. In 2008 it took longer.

2. This sample is VERY small. The minimum you ever want to consider is 3 instances. This is the minimum and may be statistically insignificant – but worth noting.

3. As with all indicators they are to be used as a barometer, NOT a crystal ball. It is always helpful to have a handful of indicators working in the background so you can measure where you generally are in terms of extremes.

If you found this post helpful, please consider visiting a few of our sponsors who have offers that may be relevant to you.