Article referenced in VideoCast above:

Tag: Biotech

Hedge Fund Tips with Tom Hayes – Episode 17

Article referenced in podcast above:

The Kanye West, “Drive Slow” Stock Market (and Sentiment Results)…

HFT VideoCast – Stock Market Commentary and Weekly Recap – Episode 26

Article referenced in VideoCast above:

The Morgan Wallen, “Whiskey Glasses” Stock Market (and Sentiment Results)…

Hedge Fund Tips with Tom Hayes – Episode 16

Article referenced in podcast above:

The Morgan Wallen, “Whiskey Glasses” Stock Market (and Sentiment Results)…

Be in the know. 15 key reads for Monday…

- The Art of the Oil Deal (Wall Street Journal)

- Gilead Sciences (GILD) Remdesivir Study Shows Two-Third of Severe COVID-19 Patients Improved (Street Insider)

- Fed’s Clarida says central bank has tools to avoid deflation: BBG (Reuters)

- Fauci: ‘Rolling re-entry’ possible in May (Fox Business)

- Photo credit: Emily Elconin

- Barron’s Picks And Pans: Berkshire Hathaway, Disney, SoftBank And More (Benzinga)

- OPEC and its allies strike historic agreement to cut nearly 10 million barrels a day (MarketWatch)

- Higher Natural Gas Prices Are On The Horizon (Yahoo! Finance)

- OPEC+ deal saved ‘more than 2 million’ jobs in the US: Russian wealth fund (CNBC)

- Historic OPEC+ cut is Trump’s ‘biggest and most complex’ deal ever: Dan Yergin (CNBC)

- Goldman Sachs abandons its bearish near-term view on stocks, says the bottom is in (MarketWatch)

- U.S. Stabilizes, CDC Says; 70 Vaccines in Progress: Virus Update (Bloomberg)

- Alaska Bought Up Berkshire Hathaway, Walmart, and AMD Stock (Barron’s)

- 12 Stocks That Are Beating the Market During the Coronavirus Crisis—and Can Keep on Growing After (Barron’s)

- Can Cruise Lines and Small Theme Parks Survive? (Barron’s)

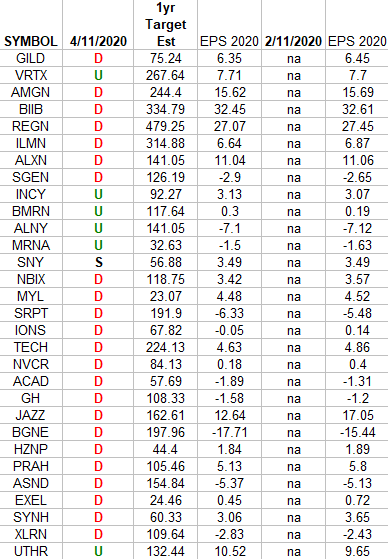

Biotech (top weights) Earnings Estimates/Revisions

In the spreadsheet above I have tracked the earnings estimates for the Nasdaq Biotech ETF (IBB) top 30 weighted stocks. Continue reading “Biotech (top weights) Earnings Estimates/Revisions”

HFT VideoCast – Stock Market Commentary and Weekly Recap – Episode 24

Article referenced in VideoCast above:

Be in the know. 20 key reads for Thursday…

- Oil jumps as Trump talks up truce hopes for Saudi-Russia price war (StreetInsider)

- No One Is Betting in Casinos—Or on Their Stocks ()

- Trump says expects Russia-Saudi oil deal soon, invites US oil chiefs to White House (Reuters)

- Oil rallies as Trump spurs hopes for Russia-Saudi pact (Financial Times)

- Detroit To Be The First City To Roll Out Abbott’s 5-Minute Coronavirus Tests (Benzinga)

- Kroger’s sales jump 30% as shoppers stock up amid coronavirus crisis New York Post)

- Retailers Under Growing Pressure to Let Workers Wear Masks New York Times)

- Mapping the Coronavirus Outbreak Across the World (Bloomberg)

- Walgreens earnings top estimates, says it can’t forecast the impact of coronavirus pandemic (CNBC)

- Trump To Talk Aid For Oil As Big Shale Firm Files For Bankruptcy (Investor’s Business Daily)

- Big Banks Get Temporary Reprieve (Barron’s)

- These 8 Aristocrats Have Safe Dividends. (Safe Being a Relative Term Right Now). (Barron’s)

- A Top Occidental Petroleum Executive Is Out as Company Grapples With Oil Rout (Wall Street Journal)

- The Fed Is Settling Into Its Role as the World’s Central Bank (Wall Street Journal)

- 5 Blue Chip Stocks to Buy Now With Huge Piles of Cash and Very Low Debt (24/7 Wall Street)

- Trump May Join Oil Talks Between Russia And Saudi Arabia (Yahoo! Finance)

- Workers Return to China’s Factories, but Coronavirus Hurts Global Demand (Wall Street Journal)

- Coronavirus Tests Aren’t Hard to Find Everywhere (Wall Street Journal)

- Telemedicine, Once a Hard Sell, Can’t Keep Up With Demand (Wall Street Journal)

- How a Mailman Still Carries On During Coronavirus (Wall Street Journal)

HFT VideoCast – Stock Market Commentary and Weekly Recap – Episode 23

Article referenced in VideoCast above:

The Luke Combs, “Beer Never Broke My Heart” Stock Market (and Sentiment Results)…

Hedge Fund Tips with Tom Hayes – Episode 13

Article referenced in podcast above:

The Luke Combs, “Beer Never Broke My Heart” Stock Market (and Sentiment Results)…