- Biotech Looks for Fireworks in First Quarter to Regain Momentum (Bloomberg)

- Bet on the Big Banks — and Bank of America (Barron’s)

- Davos? Meet Me at Butternut Instead. (Barron’s)

- A New Hot Spot for Oil Could Boost These 4 Companies (Barron’s)

- Davos? Meet Me at Butternut Instead. (Barron’s)

- Biogen Awaits a Decision on a Key Patent. At Risk Is Its Biggest Drug (Barron’s)

- Trump Allies Explore Buyout of Conservative Channel Seeking to Compete With Fox News (Wall Street Journal)

- New Sanctions Power Could Squeeze Remaining Iranian Trade Channels (Wall Street Journal)

- The Internet of Things Is Changing the World (Wall Street Journal)

- Trump Says Iran Had Planned to Attack Four U.S. Embassies (Bloomberg)

- Hummer is back as GM revives name for electric pickup (USA Today)

- S&P 5,000? Why one fund manager says that milestone may be reached sooner than you would expect (MarketWatch)

- These were the most talked-about products at CES (CNN Business)

- Mark Zuckerberg Says He Hunts Wild Boar With a Bow and Arrow (Futurism)

- Penn Jillette on Magic, Losing 100+ Pounds, and Weaponizing Kindness (#405) (Podcast)

- The Four Traits of Successful Asset Managers (Institutional Investor)

- Gradual Improvements Redux (theirrelevantinvestor)

- Client for Life (The Reformed Broker)

- Is Vulnerability a Choice? (Farnam Street)

- Eight lessons from market history (Evidence Investor)

Tag: Biotech

HFT VideoCast – Stock Market Commentary and Weekly Recap – Episode 11

Article referenced in VideoCast above:

The CAKE “Short Skirt, Long Jacket” Stock Market (and Sentiment Results)

In this episode we cover:

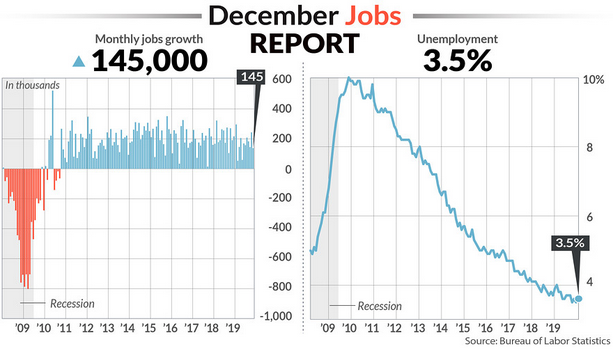

- Jobs Report

- Rig Count

- Harold Hamm on Oil Prices

- General stock market commentary.

- Hemline Indicator

- Valueline Geometric Index – Long Term Implications

- Positioning and sentiment.

- Increased Guidance on tap?

- Fed Liquidity.

- AAII sentiment.

- NAAIM positioning.

- Earnings by Sectors: Energy, Gold Miners, REITs

- S&P and Euro Stoxx 600 earnings.

- Where to find value? What’s Cheap?

- India Small Caps

- Commodities/CRB

- Exploration & Production

- Servicers?

Podcast – Hedge Fund Tips with Tom Hayes – Episode 2

Article referenced in podcast above:

The CAKE “Short Skirt, Long Jacket” Stock Market (and Sentiment Results)

In this episode we cover:

- Jobs Report

- Rig Count

- Harold Hamm on Oil Prices

- General stock market commentary.

- Hemline Indicator

- Valueline Geometric Index – Long Term Implications

- Positioning and sentiment.

- Increased Guidance on tap?

- Fed Liquidity.

- AAII sentiment.

- NAAIM positioning.

- Earnings by Sectors: Energy, Gold Miners, REITs

- S&P and Euro Stoxx 600 earnings.

- Where to find value? What’s Cheap?

- India Small Caps

- Commodities/CRB

- Exploration & Production

- Servicers?

Where is money flowing today?

Data Source: Finviz

Be in the know. 8 key reads for Friday…

- The Stock Market Was Up the First 5 Days of 2020. Here’s What History Says Will Happen Next. (Barron’s)

- After A Sizzling End To 2019, Biotech Stocks Could Soar In 2020 (Investor’s Business Daily)

- Stocks More Than Doubled Over the Last Decade. Many Investors Missed Out. (Institutional Investor)

- Facebook Says It Won’t Back Down From Allowing Lies in Political Ads (New York Times)

- Warren Buffett calls this ‘indispensable’ life advice: ‘You can always tell someone to go to hell tomorrow’ (CNBC)

- The U6 unemployment rate fell to 6.7% to mark the lowest level on record (MarketWatch)

- Fed’s Bullard, Kashkari Favor Holding Interest Rates Steady (Wall Street Journal)

- Top 2019 Stock Picker Spotted Under-the-Radar Tech (Bloomberg)

Where is money flowing today?

Data source: Finviz

Be in the know. 10 key reads for Thursday…

- Red-Hot Biotech Stocks Brace For Key Meeting — Here’s What To Expect (Investor’s Business Daily)

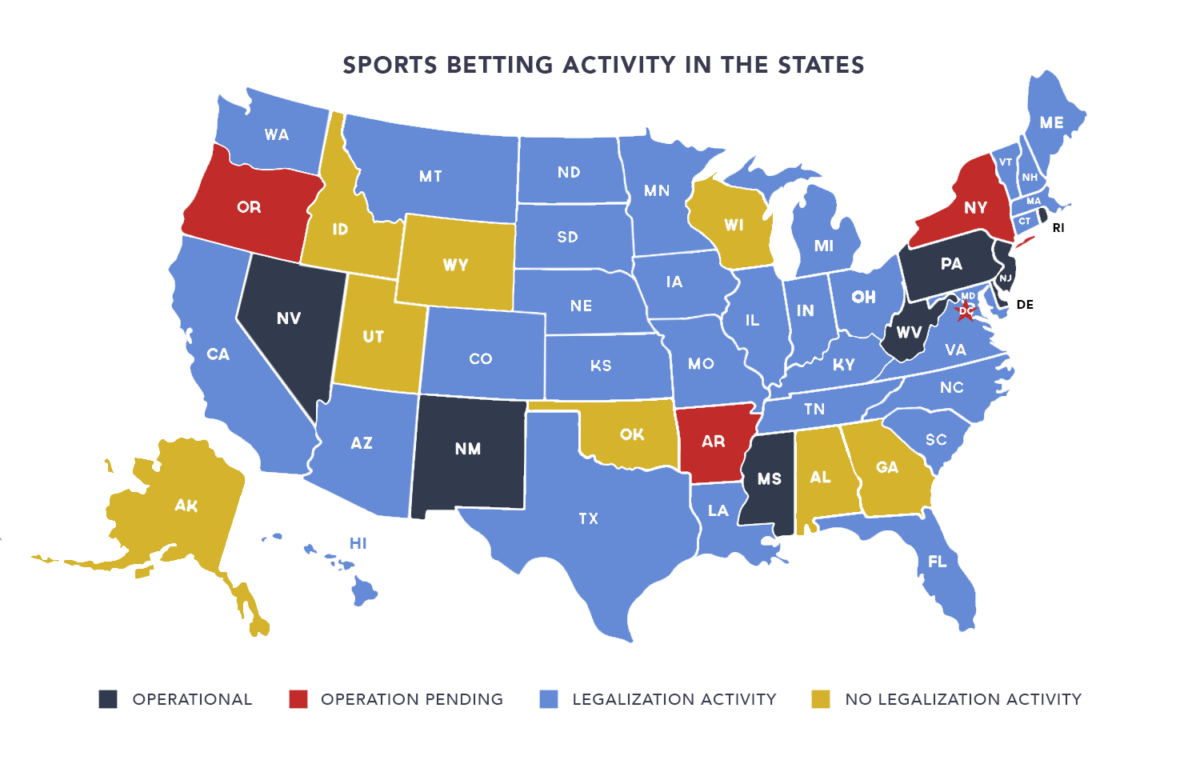

- Legal sports betting: California among states set for 2020 push (Fox Business)

- The CAKE “Short Skirt, Long Jacket” Stock Market (and Sentiment Results) (ZeroHedge)

- Taco Bell Offering $100,000 Salary Amid Mounting Worker Shortage (Bloomberg)

- Defense Stocks Have Climbed on Mideast Tension. The Run Isn’t Over. (Barron’s)

- City bosses reveal their bargains and bubbles for 2020 (Financial News)

- Divergent paths: Oil, natural gas going different directions (for now) (Reuters)

- Pepperidge Farm releasing its first gluten-free products – Farmhouse Thin & Crispy cookies (USA Today)

- XPO Logistics CEO Brad Jacobs Centers His Strategy Around Tech (Investor’s Business Daily)

- To Save Avon, New Owner Comes Calling on Social Media (Wall Street Journal)

Where is money flowing today?

Data Source: Finviz

Be in the know. 10 key reads for New Year’s Eve…

- William Blair Sees Biotech M&A Continuing in 2020; Issues Top 10 Predictions (Street Insider)

- Hedge Fund Tips – Episode 9 – VideoCast. Stock Market Commentary. (ZeroHedge)

- Is Nio a Serious Threat to Tesla in China? (24/7 Wall Street)

- US Home Price Gains Accelerate Again (But Not In San Francisco) (ZeroHedge)

- Dennis Gartman Says Goodbye With One Last Stock Market Warning (Barron’s)

- Warren Buffett on why companies cannot be moral arbiters (Financial Times)

- Soy Heads for Best Month Since 2016 on China Demand Optimism (Bloomberg)

- Apple Was the Dow’s Best Stock in 2019. Here’s What History Says Will Happen Next Year. (Barron’s)

- The Dogs of the Dow was a winning strategy for the decade (Barron’s)

- The Stock Market Is Ending the Year With a Strong December. Here’s What History Says Happens Next. (Barron’s)

Be in the know. 7 key reads for Sunday…

- For Energy, Poor People Deserve To Be Rich (Forbes)

- These biomedical breakthroughs of the decade saved lives and reduced suffering (CNBC)

- Prescription for Disaster ()

- The Work Week, Episode 4: Is The Unemployment Rate Broken? (NPR Planet Money)

- Why Economists Still Don’t Understand Money (Podcast) (Bloomberg)

- Musk’s Boring Co. Vegas Tunnel ‘Hopefully’ Operational in 2020 (Bloomberg)

- Eddie Murphy’s Return to ‘Saturday Night Live’ Made For the Best Episode in Years (Maxim)