- Jim Cramer: I’m With Warren Buffett on This One (TheStreet)

- China Stocks Are Handily Beating U.S. Since Coronavirus Outbreak. Here’s Why (Bloomberg)

- Billionaire Sam Zell says he is buying some ‘ridiculously low’ stocks in the wild market swings (CNBC)

- ‘Bond King’ Gundlach says Fed panicked and short-term rates are ‘headed toward zero’ (CNBC)

- ValueAct’s Jeffrey Ubben buys BP and says oil company can be ‘part of the solution’ (CNBC)

- OPEC deal in jeopardy as Russia stalls over deepest round of supply cuts since 2008 (CNBC)

- Bullard Says Fed Watching Virus Fallout, Willing to Do More (Bloomberg)

- Fed’s Kaplan thinks U.S. can avoid coronavirus recession as Williams says central bank will keep using tools (MarketWatch)

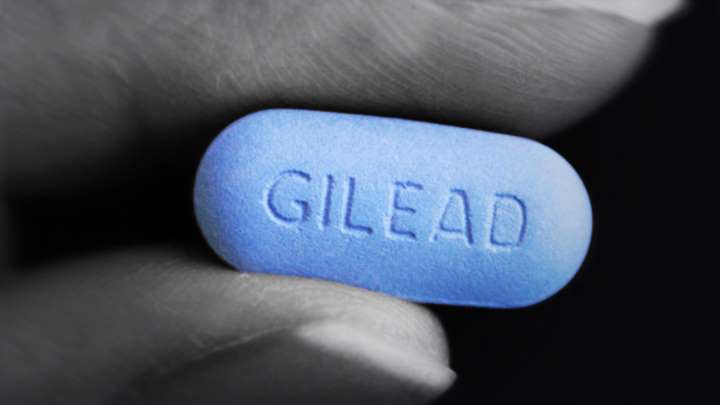

- Can Gilead Change Its Dim Fortunes On An Immuno-Oncology Buyout? (Investors)

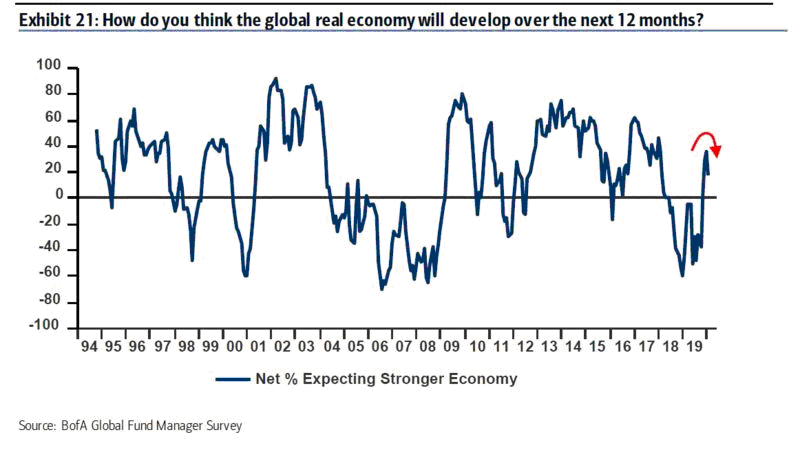

- Global equity outflows hit $23bn on coronavirus fears (Financial Times)