Article referenced in podcast above:

The Morgan Wallen “Chasin’ You” Stock Market (and Sentiment Results)…

Article referenced in podcast above:

The Morgan Wallen “Chasin’ You” Stock Market (and Sentiment Results)…

This week’s Stock Market theme song is Morgan Wallen’s “Chasin’ You.” Managers who were dramatically underweight equities – and missed the rally – were reluctantly forced to succumb to Morgan’s lyrics this week. They scrambled to gain equity exposure and chased the stock market rally: Continue reading “The Morgan Wallen “Chasin’ You” Stock Market (and Sentiment Results)…”

BBC News World Appearance – Thomas Hayes – Chairman of Great Hill Capital – June 3, 2020

Thank you Mariko Oi and Derek Cai for having me on BBC News World tonight to discuss the China/US travel bans and potential resolution.

Article referenced in podcast above:

The Dua Lipa “Did a full 180” Stock Market (and Sentiment Results)…

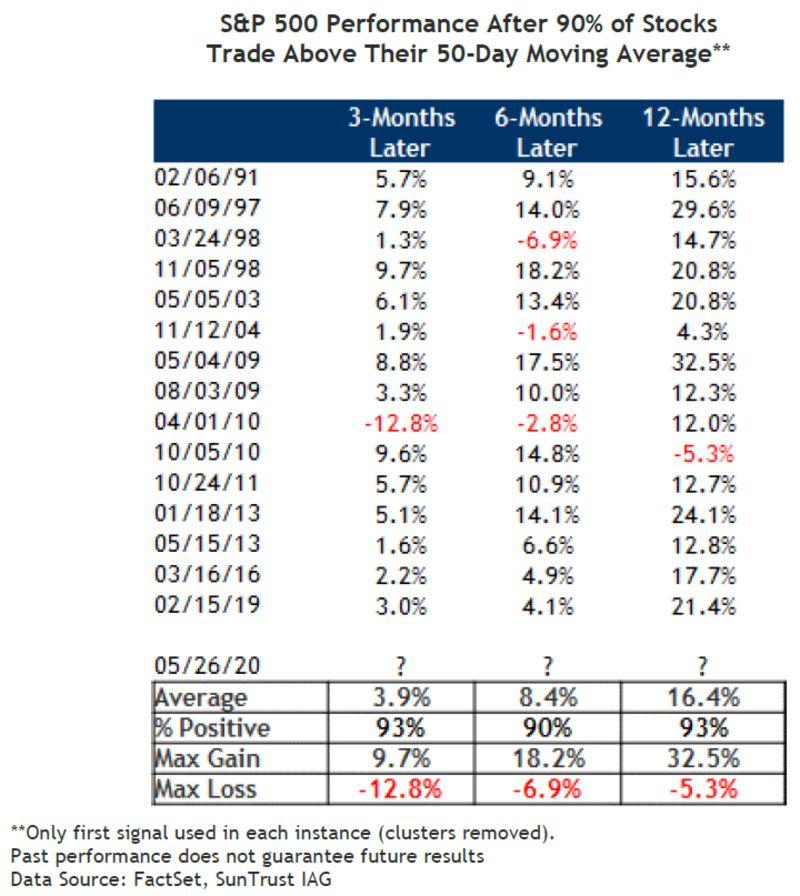

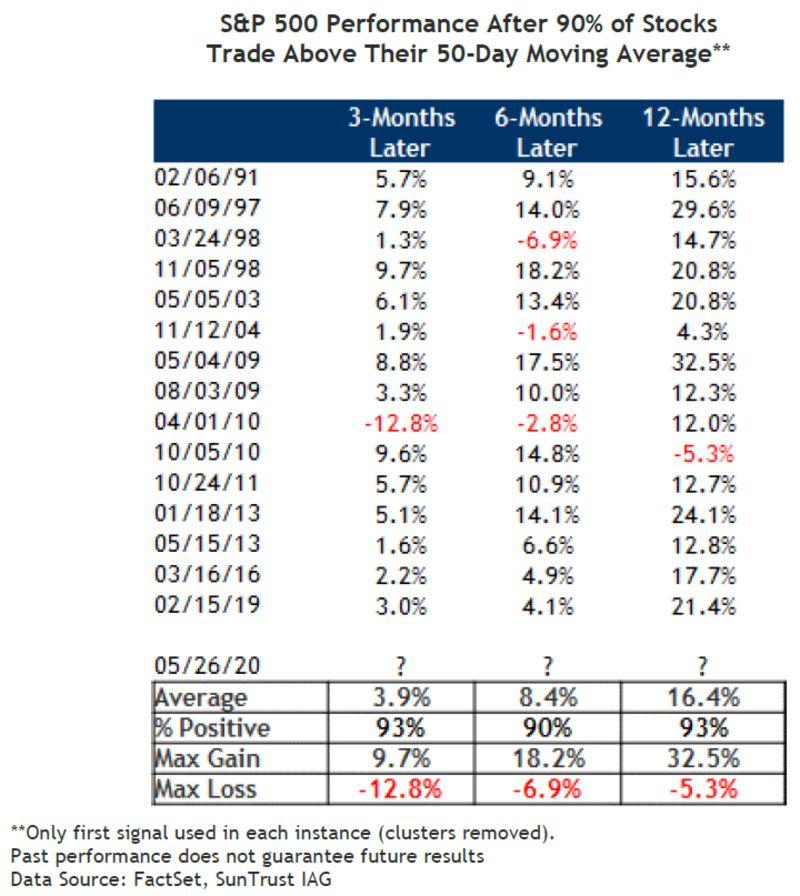

Added Data Table Referenced in this Episode:

Article referenced in podcast above:

The Dua Lipa “Did a full 180” Stock Market (and Sentiment Results)…

Added Data Table Referenced in this Episode:

Article referenced in podcast above:

The Grace Potter “Falling or Flying” Stock Market (and Sentiment Results)…

Article referenced in podcast above:

The Grace Potter “Falling or Flying” Stock Market (and Sentiment Results)…