Article referenced in VideoCast above:

Tag: Commodities

Hedge Fund Tips with Tom Hayes – Episode 11

Article referenced in podcast above:

Be in the know. 20 key reads for Tuesday…

- Oil jumps after rout on stimulus hopes, Russian signal on OPEC talks (Reuters)

- Global Markets Are Rising After Trump Hints at Tax Cut Over Coronavirus (Barron’s)

- Stocks Fall More Than 7% in Dow’s Worst Day Since 2008 (Wall Street Journal)

- The Fed Offers Repo Market $50 Billion More to Ease Rate Pressure (Barron’s)

- Russia’s Oil War Has a Political Objective, Says Analyst (Barron’s)

- Interesting: Bullish Percent Transports (Hedge Fund Tips)

- High-Yield Bonds Are Sinking as Bankruptcy Fears Hit the Oil Patch (Barron’s)

- How a Saudi-Russian Standoff Sent Oil Markets Into a Frenzy New York Times)

- As Stock Markets Plunge, Trump Calls for Economic Response to Coronavirus (New York Times)

- Why falling oil prices could boost the Marcellus Shale (Yahoo! Finance)

- Treasurys plunge as Trump floats payroll tax cut amid coronavirus maelstrom (Fox Business)

- Wall Street CEOs to meet at White House (Fox Business)

- New Jersey’s Investment Chief Wants Talent. Here’s How He’ll Get It. (Institutional Investor)

- Lloyd Blankfein Predicts ‘Quick Recovery’ For Markets (Benzinga)

- Cabot Oil & Gas Is One Company Rising in Oil-Sector Carnage (Yahoo! Finance)

- The economy is ‘like a coiled spring’ and a sharp rebound is possible, analysts predict (CNBC)

- Russia to Start Foreign Currency Sales After Ruble Wipeout (Bloomberg)

- These Energy Stocks Were Lighter Than Air Monday (Wall Street Journal)

- Trump Surprised Staff With Vow to Detail Virus Aid Package Today (Bloomberg)

- How the Federal Reserve Can Ease the Coronavirus Panic (Wall Street Journal)

Be in the know. 10 key reads for Thursday…

- Be Like Warren Buffett in Times Like These. Here’s How. (Barron’s)

- Federal Reserve Retools Capital Rules for Largest U.S. Banks (Wall Street Journal)

- Market-Beating Bank CEOs Are a Rare Breed (Wall Street Journal)

- Cramer’s most trusted market indicator says to start buying stocks (CNBC)

- Larry Kudlow Says ‘We’re Not Going to Panic’ Over the Economy (Bloomberg)

- Capitulation Moment? ‘We are giving up on energy’, say Jefferies analysts, who compare beaten-down sector to ‘62 Mets (MarketWatch)

- Oil prices rise on report OPEC agrees 1.5 million barrel-per-day production cut (MarketWatch)

- Buffett-Backed 30-Year-Old Goes to War With Latin American Banks (Bloomberg)

- Exxon CEO sticks to spending targets despite oil downturn (Reuters)

- The Old Dominion “Snapback” Stock Market? (and Sentiment Results) (ZeroHedge)

HFT VideoCast – Stock Market Commentary and Weekly Recap – Episode 18

Article referenced in VideoCast above:

Podcast – Hedge Fund Tips with Tom Hayes – Episode 8

Article referenced in podcast above:

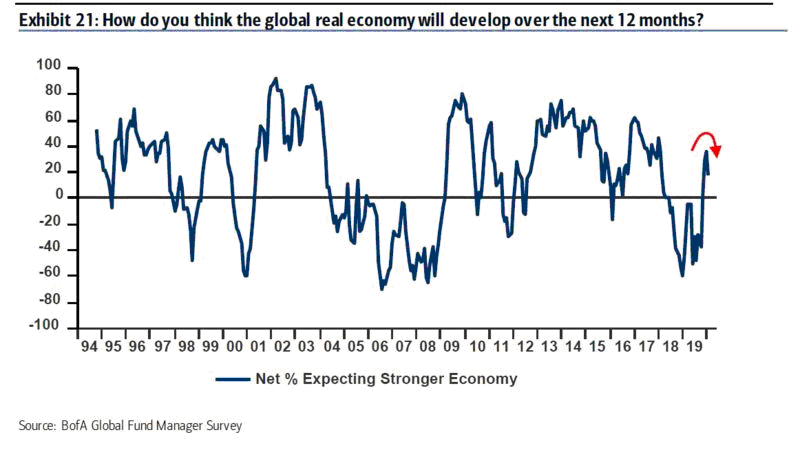

February Bank of America Global Fund Manager Survey Results (Summary)

Data Source: Bank of America

Each month, Bank of America conducts a survey of ~200 fund managers with > $600B AUM. Here are the key takeaways from the survey published on Feb 18, 2020: Continue reading “February Bank of America Global Fund Manager Survey Results (Summary)”

Be in the know. 12 key reads for Saturday…

- Energy Stocks Might Finally Have Hit Bottom (Barron’s)

- Americans Joining Workforce at Record Rate (Wall Street Journal)

- Mike Bloomberg Wants to Build an Influencer Army (Vanity Fair)

- Moore Capital ‘Didn’t Try That Hard’ at Succession (Institutional Investor)

- 20VC: Oaktree Capital’s Howard Marks on The Most Important Skill An Investor Can Have, The Right Way To Think About Price Sensitivity & Where Are We At Today; Take More Risk or Less? (20 min VC)

- How One Value Investor Is Weathering the Strategy’s Underperformance (Institutional Investor)

- As OPEC+ Reels From China Virus, Libya Threatens Knockout Punch (Bloomberg)

- AbbVie Jumps on Strong Earnings. That’s Not the Only Reason. (Barron’s)

- The Mormon Church Amassed $100 Billion. It Was the Best-Kept Secret in the Investment World. (Wall Street Journal)

- FedEx to Start Mixing Express and Ground Operations (Wall Street Journal)

- Week Before Presidents’ Day Bullish since 1990 (Almanac Trader)

- 2020 Ford GT Adds Power And Turns Heads With Stunning ‘Liquid Carbon’ Edition (Maxim)

HFT VideoCast – Stock Market Commentary and Weekly Recap – Episode 16

Article referenced in VideoCast above:

The end of oil, or just the beginning? (and Sentiment Results)

Podcast – Hedge Fund Tips with Tom Hayes – Episode 6

Article referenced in podcast above:

The end of oil, or just the beginning? (and Sentiment Results)