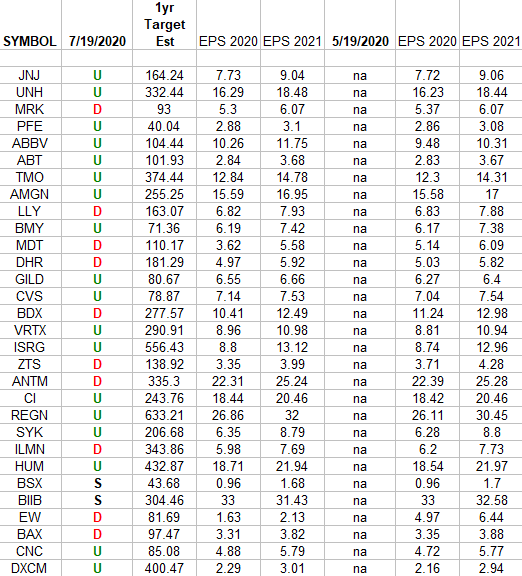

In the spreadsheet above I have tracked the 2020 and 2021 earnings estimates for the Healthcare Sector ETF (XLV) top 30 weighted stocks. Continue reading “Healthcare (top 30 weights) Earnings Estimates/Revisions”

Tag: Earnings

Hedge Fund Tips with Tom Hayes – VideoCast – Episode 39

Article referenced in VideoCast above:

The Eagles, “Long Run” Stock Market (and Sentiment Results)…

Hedge Fund Tips with Tom Hayes – Podcast – Episode 29

Hedge Fund Tips with Tom Hayes – VideoCast – Episode 38

Article referenced in VideoCast above:

The AC/DC “Back in Black” Stock Market (and Sentiment Results)…

Hedge Fund Tips with Tom Hayes – Podcast – Episode 28

Article referenced in podcast above:

The AC/DC “Back in Black” Stock Market (and Sentiment Results)…

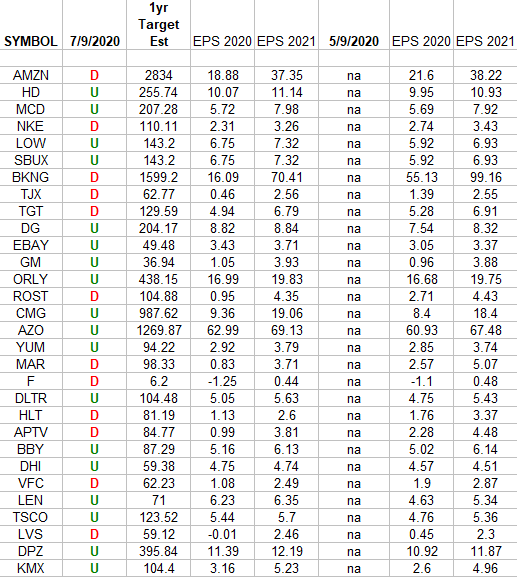

Consumer Discretionary (top 30 weights) Earnings Estimates/Revisions

In the spreadsheet above I have tracked the earnings estimates for the Consumer Discretionary Sector ETF (XLY) top 30 weighted stocks. Continue reading “Consumer Discretionary (top 30 weights) Earnings Estimates/Revisions”

The AC/DC “Back in Black” Stock Market (and Sentiment Results)…

This week we chose AC/DC’s “Back in Black” as our theme song for the Stock Market. Of the major indices, so far the Nasdaq is the first one to make it out of the Red and Back in Black: Continue reading “The AC/DC “Back in Black” Stock Market (and Sentiment Results)…”

Hedge Fund Tips with Tom Hayes – VideoCast – Episode 37

Article referenced in VideoCast above:

The Mötley Crüe, “Home Sweet Home” Stock Market (and Sentiment Results)…

Hedge Fund Tips with Tom Hayes – Podcast – Episode 27

Article referenced in podcast above:

The Mötley Crüe, “Home Sweet Home” Stock Market (and Sentiment Results)…

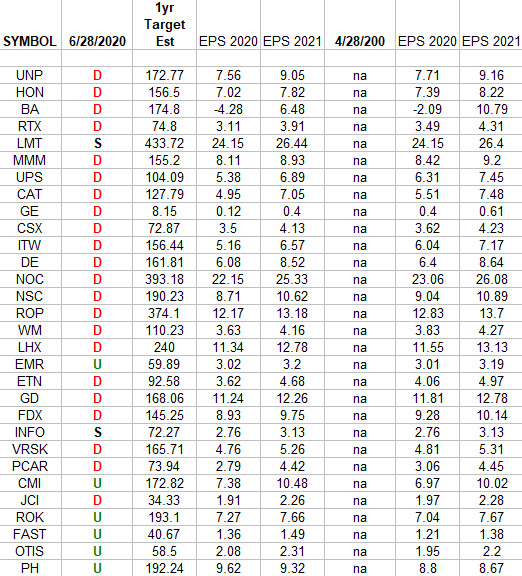

Industrials (top 30 weights) Earnings Estimates/Revisions

In the spreadsheet above I have tracked the 2020 and 2021 earnings estimates for the Industrials Sector ETF (XLI) top 30 weighted stocks. The column under the date 6/28/2020 has a letter that represents the movement in 2020 earnings estimates since the most recent print (4/28/2020). Continue reading “Industrials (top 30 weights) Earnings Estimates/Revisions”