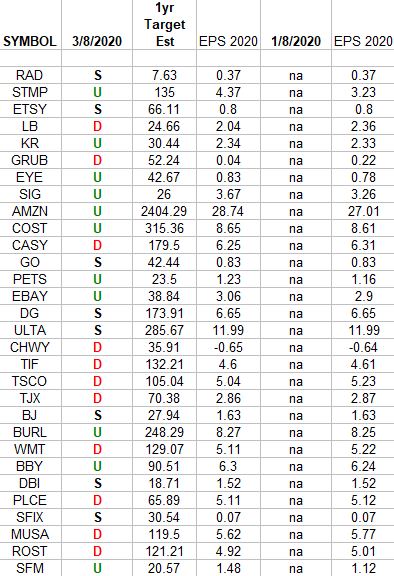

In the spreadsheet above I have tracked the earnings estimates for the Retail Sector ETF (XRT) top 30 weighted stocks. Continue reading “Retail Earnings Estimates/Revisions”

Tag: Earnings

Technology Earnings Estimates/Revisions

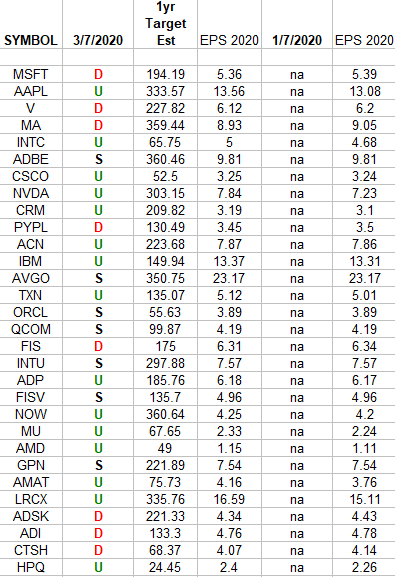

In the spreadsheet above I have tracked the earnings estimates for the Technology Sector ETF (XLK) top 30 weighted stocks. Continue reading “Technology Earnings Estimates/Revisions”

HFT VideoCast – Stock Market Commentary and Weekly Recap – Episode 20

Article referenced in VideoCast above:

The Old Dominion “Snapback” Stock Market? (and Sentiment Results)

Podcast – Hedge Fund Tips with Tom Hayes – Episode 10

Article referenced in podcast above:

The Old Dominion “Snapback” Stock Market? (and Sentiment Results)

Communication Services Earnings Estimates/Revisions

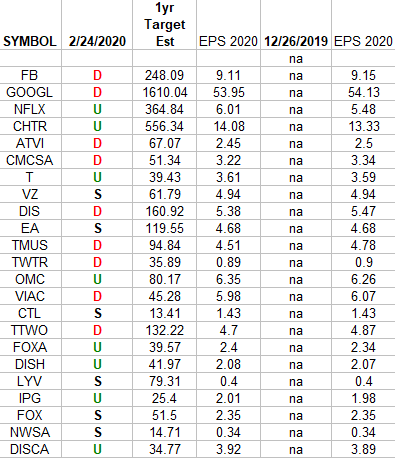

In the spreadsheet above I have tracked the earnings estimates for the Communication Services Sector ETF (XLC). Continue reading “Communication Services Earnings Estimates/Revisions”

HFT VideoCast – Stock Market Commentary and Weekly Recap – Episode 18

Article referenced in VideoCast above:

Podcast – Hedge Fund Tips with Tom Hayes – Episode 8

Article referenced in podcast above:

Be in the know. 20 key reads for Wednesday…

- Leon Cooperman says the market has become too pessimistic on energy stocks, too euphoric on Tesla (CNBC)

- Junk bond king’s pardon ‘is spectacular’ for Wall Street (Financial Times)

- Record Wall Street rally triggers boom in options (Financial Times)

- Q4 13F Roundup: How Buffett, Einhorn, Ackman And Others Adjusted Their Portfolios (Benzinga)

- The Michael Milken Project (Institutional Investor)

- ‘Very Big Trade Deal’ With India In Progress Ahead Of Visit, Trump Says (Benzinga)

- Building Permits Surge To 13 Year Highs Thanks To Warm Weather In Northeast (ZeroHedge)

- China’s virus-hit industrial cities start to ease curbs, restore production (Reuters)

- Oil up on slowing pace of coronavirus, Venezuela sanctions (Reuters)

- It’s Michael Milken’s World. The Rest of Us Just Live in It. (Barron’s)

- Hedge Funds Keep Backpedaling From S&P 500’s Biggest Winners (Bloomberg)

- What Warren Buffett Might Tell Investors in His Annual Letter This Week (Barron’s)

- Gilead’s Coronavirus Drug Trial Slowed by Lack of Eligible Recruits (Wall Street Journal)

- Fed’s Balance Sheet Dominates What to Watch For in FOMC Minutes (Bloomberg)

- Why Teva’s Grand Turnaround Could Just Be Getting Started (24/7 Wall Street)

- Pound Climbs After Inflation Tempers Risk of a Rate Cut (Bloomberg)

- SoftBank plans to borrow up to $4.5 billion using its domestic telecom’s shares as collateral. (Business Insider)

- Billionaire investor Leon Cooperman ramps up his criticism of Bernie Sanders, calling him a ‘bigger threat’ to the stock market than coronavirus (Business Insider)

- February Bank of America Global Fund Manager Survey Results (Summary) (Hedge Fund Tips)

- It’s never been this hard for companies to find qualified workers (CNBC)

Financials (top 30 weights) Earnings Estimates/Revisions

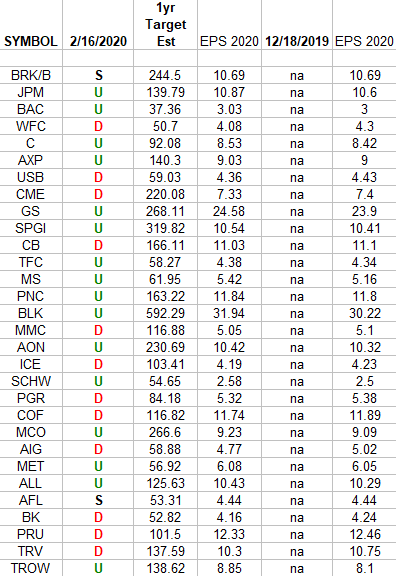

In the spreadsheet above I have tracked the earnings estimates for the Financials Sector ETF (XLF) top 30 weighted stocks. Continue reading “Financials (top 30 weights) Earnings Estimates/Revisions”

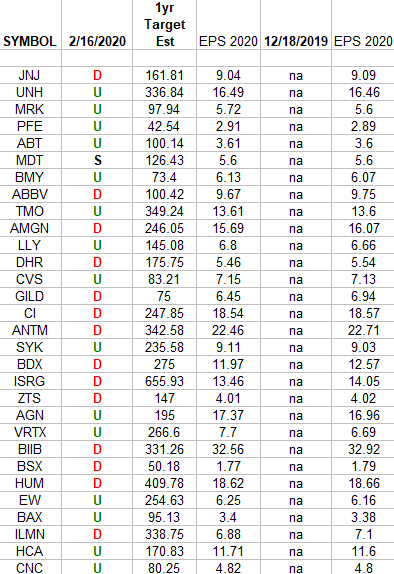

Healthcare (top 30 weights) Earnings Estimates/Revisions

In the spreadsheet above I have tracked the earnings estimates for the Healthcare Sector ETF (XLV) top 30 weighted stocks. Continue reading “Healthcare (top 30 weights) Earnings Estimates/Revisions”