Article referenced in VideoCast above:

The “Crazy Rich Asians” Stock Market (and Sentiment Results)

Article referenced in VideoCast above:

The “Crazy Rich Asians” Stock Market (and Sentiment Results)

Data Source: Factset

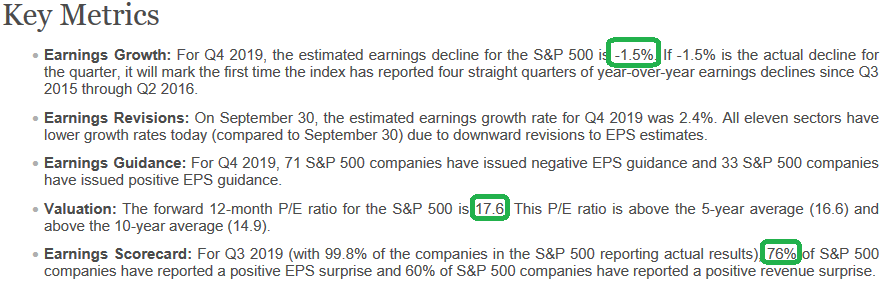

S&P 500 Earnings estimates for 2020 held in strong this week at $178.47 – down modestly from $178.57 last week. While the normal trajectory over the next two weeks – heading into earnings season – would be to lower estimates further, we may find that this time is different. Continue reading “2020 Earnings Estimates Stand Strong”

Today some institution/fund purchased 1,267 contracts of April $35 strike calls (or the right to buy 126,700 shares of BP p.l.c. (BP) at $35). The open interest was just 220 prior to this purchase.

Continue reading “Unusual Options Activity – BP p.l.c. (BP)”

“Crazy Rich Asians” is a 2018 American romantic comedy film directed by Jon M. Chu. The film chronicles a Chinese-American professor who travels to meet her boyfriend’s family and is surprised to discover they are among the richest in Asia. Continue reading “The “Crazy Rich Asians” Stock Market (and Sentiment Results)”

In the spreadsheet above I have tracked the earnings estimates for the Financials Sector ETF (XLF) top 30 weighted stocks. Continue reading “Financials (top 30 weights) Earnings Estimates/Revisions”

In the spreadsheet above I have tracked the earnings estimates for the Healthcare Sector ETF (XLV) top 30 weighted stocks. Continue reading “Healthcare (top 30 weights) Earnings Estimates/Revisions”

In the spreadsheet above I have tracked the earnings estimates for the Consumer Staples Sector ETF (XLP) top 30 weighted stocks. The column under the date 12/9/2019 has a letter that Continue reading “Consumer Staples (top 30 weights) Earnings Estimates/Revisions”

Articles referenced in VideoCast above:

The Taylor Swift “Bad Blood” Energy Market (and Sentiment Results)

Data Source: Factset

Continue reading “2020 Earnings Estimates Holding Strong at 9.8% Growth”

Continue reading “2020 Earnings Estimates Holding Strong at 9.8% Growth”

In previous weeks we discussed being bullish on the general market over the intermediate term, while recognizing and respecting a short term “overbought” condition that could either be worked off in time (grind sideways) or price (short term pullback) to shake out the “late money” that missed the rally from Aug/Sept lows.

Continue reading “The Taylor Swift “Bad Blood” Energy Market (and Sentiment Results)”