Article referenced in VideoCast above:

Tag: Energy

Hedge Fund Tips with Tom Hayes – Episode 11

Article referenced in podcast above:

Unusual Options Activity – Exxon Mobil Corporation (XOM)

Data Source: barchart

Today some institution/fund purchased 1,000 contracts of Oct $50 strike calls (or the right to buy 100,000 shares of Exxon Mobil Corporation (XOM) at $50). The open interest was just 600 prior to this purchase. Continue reading “Unusual Options Activity – Exxon Mobil Corporation (XOM)”

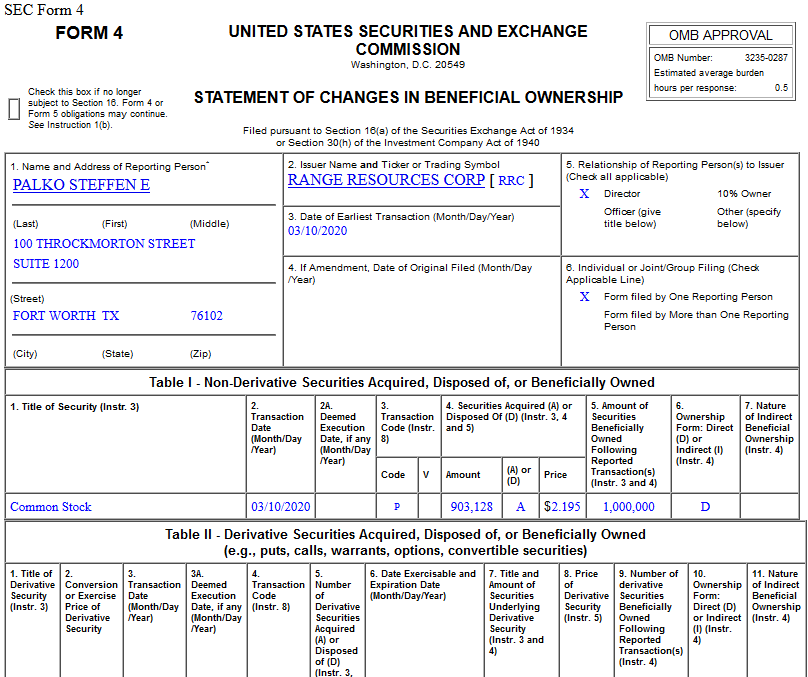

Insider Buying in Range Resources Corporation (RRC)

On March 10, 2019, Stephen Palko – Director of Range Resources Corporation (RRC) – purchased 903,128 shares of RRC at $2.20. His out of pocket cost was $1,982,366.

Be in the know. 20 key reads for Tuesday…

- Oil jumps after rout on stimulus hopes, Russian signal on OPEC talks (Reuters)

- Global Markets Are Rising After Trump Hints at Tax Cut Over Coronavirus (Barron’s)

- Stocks Fall More Than 7% in Dow’s Worst Day Since 2008 (Wall Street Journal)

- The Fed Offers Repo Market $50 Billion More to Ease Rate Pressure (Barron’s)

- Russia’s Oil War Has a Political Objective, Says Analyst (Barron’s)

- Interesting: Bullish Percent Transports (Hedge Fund Tips)

- High-Yield Bonds Are Sinking as Bankruptcy Fears Hit the Oil Patch (Barron’s)

- How a Saudi-Russian Standoff Sent Oil Markets Into a Frenzy New York Times)

- As Stock Markets Plunge, Trump Calls for Economic Response to Coronavirus (New York Times)

- Why falling oil prices could boost the Marcellus Shale (Yahoo! Finance)

- Treasurys plunge as Trump floats payroll tax cut amid coronavirus maelstrom (Fox Business)

- Wall Street CEOs to meet at White House (Fox Business)

- New Jersey’s Investment Chief Wants Talent. Here’s How He’ll Get It. (Institutional Investor)

- Lloyd Blankfein Predicts ‘Quick Recovery’ For Markets (Benzinga)

- Cabot Oil & Gas Is One Company Rising in Oil-Sector Carnage (Yahoo! Finance)

- The economy is ‘like a coiled spring’ and a sharp rebound is possible, analysts predict (CNBC)

- Russia to Start Foreign Currency Sales After Ruble Wipeout (Bloomberg)

- These Energy Stocks Were Lighter Than Air Monday (Wall Street Journal)

- Trump Surprised Staff With Vow to Detail Virus Aid Package Today (Bloomberg)

- How the Federal Reserve Can Ease the Coronavirus Panic (Wall Street Journal)

Be in the know. 10 key reads for Monday…

- NY Fed raises repo limits to ensure ample supply of bank reserves (Reuters)

- Never Mind The Stock Market. The Real Pain Will Be in the Credit Markets. (Barron’s)

- Hedge-fund manager who called the coronavirus market meltdown says selloff is overdone, covers shorts (MarketWatch)

- How the Trump Campaign Took Over the G.O.P. (New York Times)

- Saudi Aramco shares dive, Gulf debt hit as oil price plunges (Reuters)

- Putin Dumps MBS to Start a War on America’s Shale Oil Industry (Yahoo! Finance)

- Virtu Financial founder says stock market is ‘one big opportunity right now’ (CNBC)

- How Tupperware Lost Its Grip on America’s Kitchens (Wall Street Journal)

- All Your Coronavirus Travel Questions Answered (Wall Street Journal)

- What’s Your Workout? A Huge Leap to Replace the Rush of Ice Hockey (Wall Street Journal)

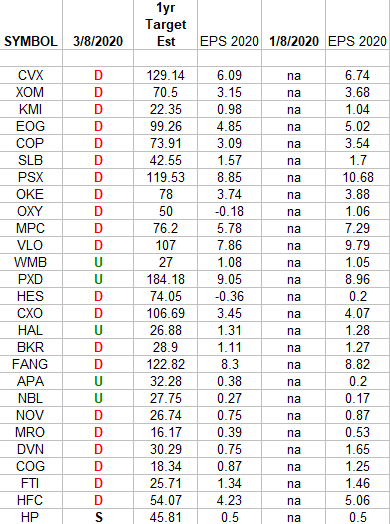

Energy Earnings Estimates/Revisions

In the spreadsheet above I have tracked the earnings estimates for the Energy Sector ETF (XLE). Continue reading “Energy Earnings Estimates/Revisions”

Be in the know. 10 key reads for Sunday…

- Bonds Rally as Stocks Close Lower (Wall Street Journal)

- The US government has never had a better opportunity to truly reshape our economy (Business Insider)

- Wash Your Hands—but Beware the Electric Hand Dryer (Wired)

- The Koenigsegg Gemera is the world’s most wickedly weird hybrid (The Verge)

- Episode 977: Where’s The Vaccine? (NPR Planet Money)

- CRISPR Treatment Inserted Directly into the Body for the First Time (Scientific American)

- Did Passive Investing Fuel A Bubble In Tech Stocks? (Podcast) (Bloomberg Odd Lots)

- A simple guide to the vaccines and drugs that could fight coronavirus (Vox)

- ‘Unclean! Unclean!’: The Questionable History of Quarantines (Popular Machanics)

- Sam Zell Is Buying the Dips in Energy (Chief Investment Officer)

Be in the know. 10 key reads for Saturday…

- 11 Stocks and ETFs for a Post-Virus World (Barron’s)

- Volatility (ValueWalk)

- 12 Dividend Stocks to Buy Amid Turmoil in the Markets (Barron’s)

- Oil Plunges 8% as OPEC Can’t Find Agreement (Barron’s)

- How to Find a Bottom in Industrial Stocks Using Dividend Yields (Barron’s)

- Jack Welch Remembered by Businessweek’s Former Executive Editor (Bloomberg)

- These nine companies are working on coronavirus treatments or vaccines — here’s where things stand (MarketWatch)

- Using Models to Stay Calm in Charged Situations (Farnam Street)

- What Happens to Stocks After a Big Down Month? (A Wealth of Common Sense)

- Should I Sell My Stocks? (The Irrelevant Investor)

HFT VideoCast – Stock Market Commentary and Weekly Recap – Episode 20

Article referenced in VideoCast above:

The Old Dominion “Snapback” Stock Market? (and Sentiment Results)