- Libya Oil Shut-In Cost Nation Over $2 Billion Since January (Bloomberg)

- Gilead’s Drug Leads Global Race for Coronavirus Treatment (Bloomberg)

- No OPEC Decision Yet on Oil Cuts, Saudi Energy Minister Says (Bloomberg)

- Breaking Down the Buffett Formula: Berkshire Hathaway’s Returns by the Numbers (Barron’s)

- He Went to a Hockey Game Expecting Dinner. He Wound Up Getting the Win. (Wall Street Journal)

- Supreme Court Seems Ready to Back Pipeline Across Appalachian Trail (New York Times)

- OPEC hasn’t run out of ideas, Saudi energy minister insists as oil prices slump (CNBC)

- Natural gas is crushing wind and solar power — Why isn’t anyone talking about it? (Fox Business)

- Conspiracy Theorists Ask ‘Who Owns the New York Fed?’ Here’s the Answer. (Institutional Investor)

- Krispy Kreme launches ‘national doughnut delivery’ starting Feb. 29 (USA Today)

Tag: Energy

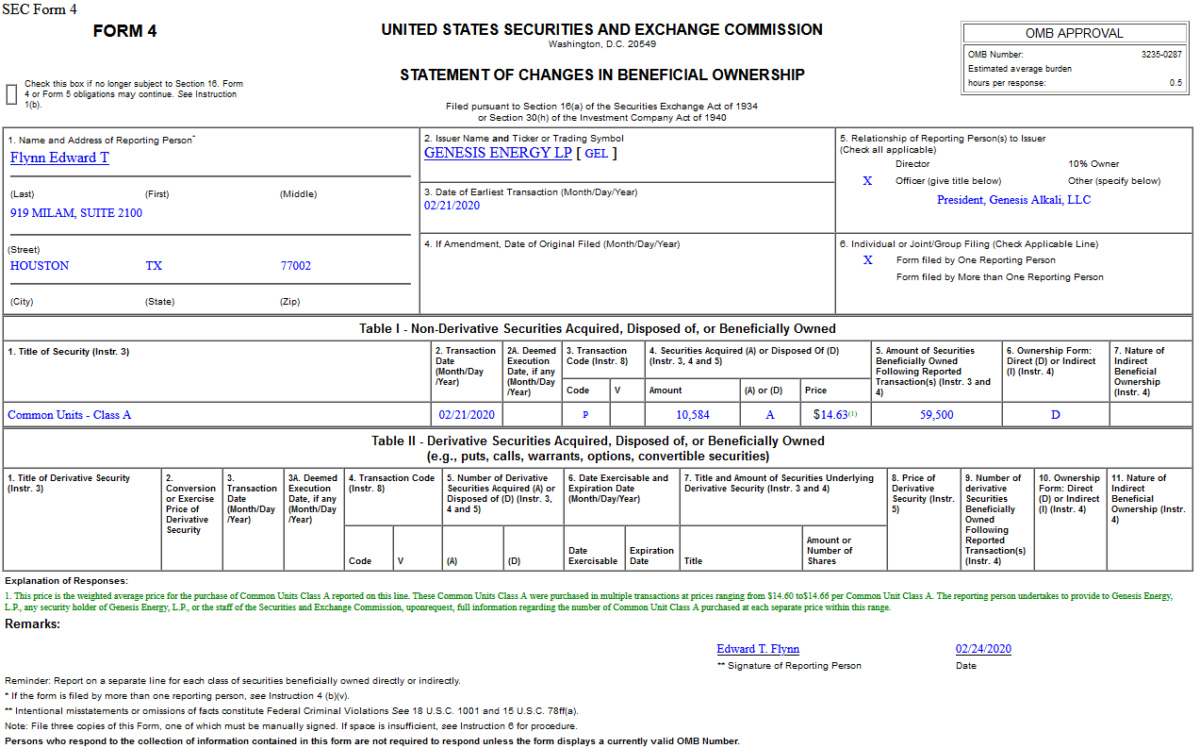

Insider Buying in Genesis Energy, L.P. (GEL)

On Feb 21, 2020, Edward Flynn – President of Genesis Alkali, LLC – purchased 10,584 shares of GEN at $14.63. His out of pocket cost was $154,844.

HFT VideoCast – Stock Market Commentary and Weekly Recap – Episode 18

Article referenced in VideoCast above:

Podcast – Hedge Fund Tips with Tom Hayes – Episode 8

Article referenced in podcast above:

Unusual Options Activity – Occidental Petroleum Corporation (OXY)

Data Source: barchart

Today some institution(s)/fund(s) purchased 10,614 contracts of Sept $42.5-47.5 strike calls (or the right to buy 1,061,400 shares of Occidental Petroleum Corporation (OXY) at ($42.5-47.5). Continue reading “Unusual Options Activity – Occidental Petroleum Corporation (OXY)”

The ‘Short Term’ 10:3 (Risk to Reward) Stock Market

For those of you who have followed us for some time, you know we have been putting out bullish notes since the August 2019 lows. You can review each weekly note under the “Sentiment” category of the site. We called for the end of year “melt-up” just a few weeks after the 2/10 yield curve inverted in early August 2019. Continue reading “The ‘Short Term’ 10:3 (Risk to Reward) Stock Market”

Where is money flowing today?

Data Source: Finviz

Be in the know. 20 key reads for Wednesday…

- Leon Cooperman says the market has become too pessimistic on energy stocks, too euphoric on Tesla (CNBC)

- Junk bond king’s pardon ‘is spectacular’ for Wall Street (Financial Times)

- Record Wall Street rally triggers boom in options (Financial Times)

- Q4 13F Roundup: How Buffett, Einhorn, Ackman And Others Adjusted Their Portfolios (Benzinga)

- The Michael Milken Project (Institutional Investor)

- ‘Very Big Trade Deal’ With India In Progress Ahead Of Visit, Trump Says (Benzinga)

- Building Permits Surge To 13 Year Highs Thanks To Warm Weather In Northeast (ZeroHedge)

- China’s virus-hit industrial cities start to ease curbs, restore production (Reuters)

- Oil up on slowing pace of coronavirus, Venezuela sanctions (Reuters)

- It’s Michael Milken’s World. The Rest of Us Just Live in It. (Barron’s)

- Hedge Funds Keep Backpedaling From S&P 500’s Biggest Winners (Bloomberg)

- What Warren Buffett Might Tell Investors in His Annual Letter This Week (Barron’s)

- Gilead’s Coronavirus Drug Trial Slowed by Lack of Eligible Recruits (Wall Street Journal)

- Fed’s Balance Sheet Dominates What to Watch For in FOMC Minutes (Bloomberg)

- Why Teva’s Grand Turnaround Could Just Be Getting Started (24/7 Wall Street)

- Pound Climbs After Inflation Tempers Risk of a Rate Cut (Bloomberg)

- SoftBank plans to borrow up to $4.5 billion using its domestic telecom’s shares as collateral. (Business Insider)

- Billionaire investor Leon Cooperman ramps up his criticism of Bernie Sanders, calling him a ‘bigger threat’ to the stock market than coronavirus (Business Insider)

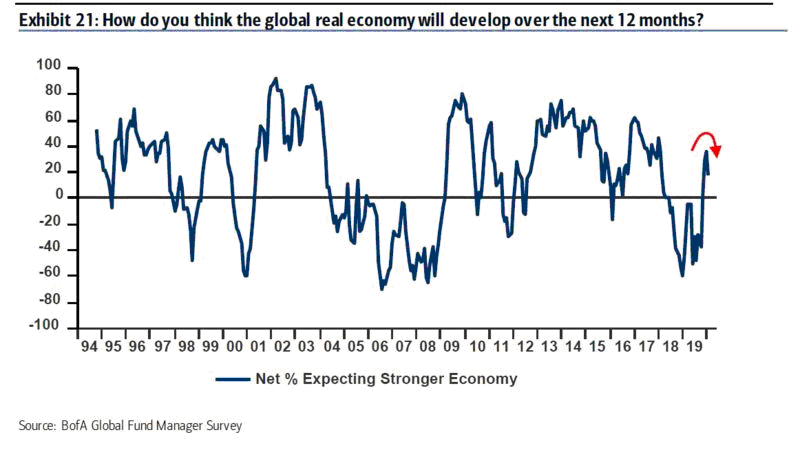

- February Bank of America Global Fund Manager Survey Results (Summary) (Hedge Fund Tips)

- It’s never been this hard for companies to find qualified workers (CNBC)

February Bank of America Global Fund Manager Survey Results (Summary)

Data Source: Bank of America

Each month, Bank of America conducts a survey of ~200 fund managers with > $600B AUM. Here are the key takeaways from the survey published on Feb 18, 2020: Continue reading “February Bank of America Global Fund Manager Survey Results (Summary)”

Podcast – Hedge Fund Tips with Tom Hayes – Episode 7

Article referenced in podcast above:

The Chris Janson “Good Vibes” Stock Market (and Sentiment Results)…