- Top financiers want Biden to drop out so Bloomberg can win: ’He has no chance’ (Fox Business)

- Oil prices steady but set for weekly gain on supply cut optimism (Business Insider)

- How a Small-Cap Fund Finds Exceptional Growth Overseas (Barron’s)

- Labor Force Participation Rate Mystery: Why Have So Many Americans Stopped Working? (Investor’s Business Daily)

- Veteran strategist eyes health care and financials in anticipation of ‘choppy and frustrating’ markets (MarketWatch)

- FC’s celebrity investors have a chokehold on $300M dividend (New York Post)

- Judy Shelton, Trump’s Fed Nominee, Faces Bipartisan Skepticism (New York Times)

- Doubting America Can Cost You a Lot of Money (Bloomberg)

- EXCLUSIVE: Kudlow reveals when middle class can expect ‘tax cuts 2.0’ (Fox Business)

- Investor complacency sets in while coronavirus spreads (Financial Times)

- Warren Buffett loves using Valentine’s Day to explain why See’s Candies is his ‘dream business’ (Business Insider)

- Value Investing’s Time to Shine Again Is Approaching (Bloomberg)

Tag: Energy

Be in the know. 10 key reads for Thursday…

- Eight Stocks Wall Street Loves for Valentine’s Day (Barron’s)

- What Denny’s CEO Tells Himself In The Mirror Every Day (Investor’s Business Daily)

- Charlie Munger Talks About Chinese Companies, Poor Investment Choices, And Why He Would Never Buy Tesla Stock (Benzinga)

- The Chris Janson “Good Vibes” Stock Market (and Sentiment Results)… (ZeroHedge)

- Kraft Heinz’s Earnings Were Only OK. Why Investors Should Be Happy. (Barron’s)

- Value-Oriented Dividend Stocks Will Pay Investors Who Wait, Strategist Says (Barron’s)

- Time for a cut? OPEC Sees Coronavirus Weighing Heavily on Oil Demand (Wall Street Journal)

- Hedging Strategy Likely Exacerbated Oil’s Fall (Wall Street Journal)

- Trump’s Rosy Economic Growth Forecast Isn’t Crazy (Bloomberg)

- 5 Contrarian Dividend Stocks to Buy as Market Rips to All-Time Highs (24/7 Wall Street)

Yahoo! Finance TV Appearance on Wednesday (Video)

Thanks @SeanaNSmith @GreteSuarez @YahooFinance for having me on today. https://t.co/iBxpOr5OlO

— Thomas J. Hayes (@HedgeFundTips) February 12, 2020

Where is money flowing today?

Data Source: Finviz

Be in the know. 5 key reads for Wednesday…

- Oil Extends Rally Above $50 Amid Signs Virus Spread Is Easing (Bloomberg)

- Ex-Goldman CEO Lloyd Blankfein laid into Bernie Sanders after his New Hampshire win, saying he’ll wreck the economy and let Russia ‘screw up the US.’ (Business Insider)

- U.S. Home-Refinancing Applications Hit Highest Level Since 2013 (Bloomberg)

- Steve Cohen Pulled Down at Least $1.3 Billion in 2019 (Institutional Investor)

- Small-Cap Health Stocks Stand Out in 2020 (Wall Street Journal)

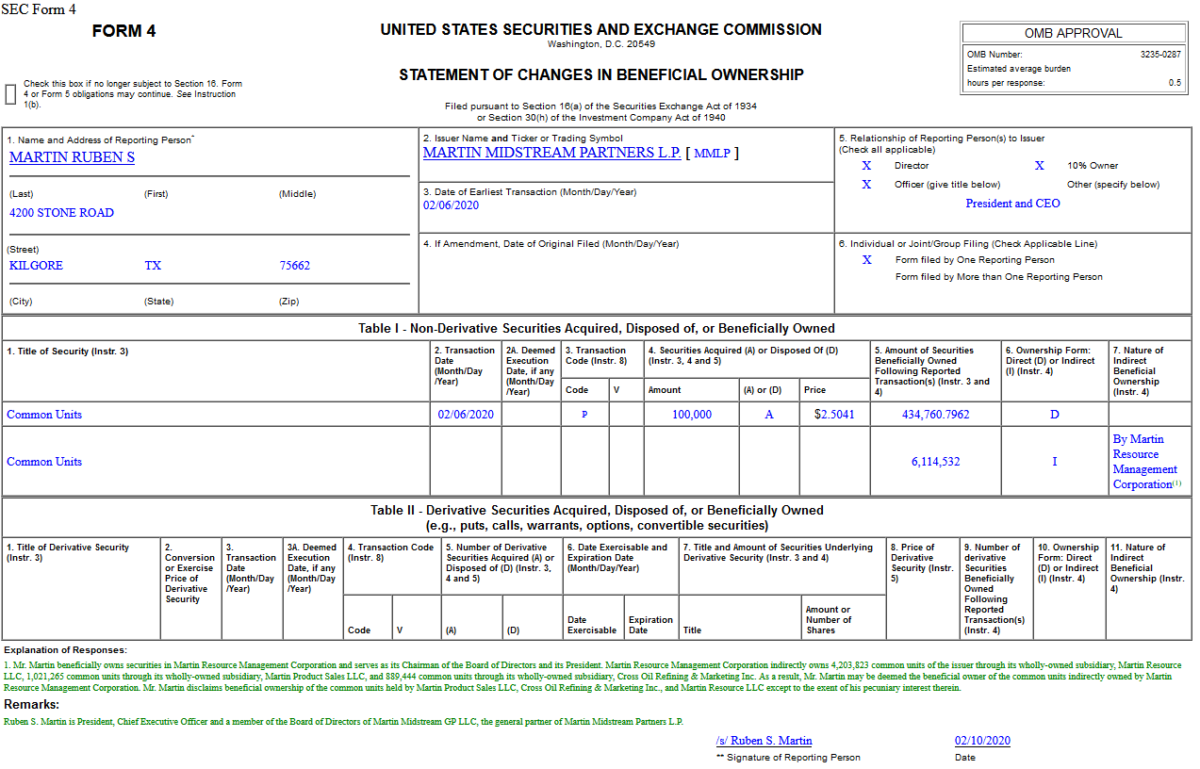

Insider Buying in Martin Midstream Partners L.P. (MMLP)

On Feb 6, 2020, Ruben Martin – President and CEO of Martin Midstream Partners L.P. (MMLP) – purchased 100,000 shares of MMLP at $2.50. His out of pocket cost was $250,410.

Be in the know. 10 key reads for Monday…

- Coronavirus sparks hectic trading in search of treatment (Financial Times)

- Barron’s Picks And Pans: GM, Kraft Heinz, Tesla, Under Armour And More (Benzinga)

- Elliott Management Raises SoftBank Stake, Pushes For Buybacks, Says Market ‘Undervalues’ Portfolio (Benzinga)

- Some Gas Left in the Tank for the Stock Market Rally? (ZeroHedge)

- Goldman Sachs says impact of coronavirus will be ‘limited,’ and these are the stocks to buy if it’s right (MarketWatch)

- Modi’s India is in a slump, but some stocks are worth buying (Barron’s)

- ‘Swing for the fences’: Warren Buffett’s advice headlines Bill and Melinda Gates Foundation’s 20th annual letter (Business Insider)

- FedEx (FDX) Could Save $300M Per Year by Shifting Traffic Through the Ground Network – Bernstein (StreetInsider)

- Simon Property Group Announces $3.6B Acquisition Of Taubman Group (Benzinga)

- Can Opec stop the slide in the oil price? (Financial Times)

Be in the know. 12 key reads for Saturday…

- Energy Stocks Might Finally Have Hit Bottom (Barron’s)

- Americans Joining Workforce at Record Rate (Wall Street Journal)

- Mike Bloomberg Wants to Build an Influencer Army (Vanity Fair)

- Moore Capital ‘Didn’t Try That Hard’ at Succession (Institutional Investor)

- 20VC: Oaktree Capital’s Howard Marks on The Most Important Skill An Investor Can Have, The Right Way To Think About Price Sensitivity & Where Are We At Today; Take More Risk or Less? (20 min VC)

- How One Value Investor Is Weathering the Strategy’s Underperformance (Institutional Investor)

- As OPEC+ Reels From China Virus, Libya Threatens Knockout Punch (Bloomberg)

- AbbVie Jumps on Strong Earnings. That’s Not the Only Reason. (Barron’s)

- The Mormon Church Amassed $100 Billion. It Was the Best-Kept Secret in the Investment World. (Wall Street Journal)

- FedEx to Start Mixing Express and Ground Operations (Wall Street Journal)

- Week Before Presidents’ Day Bullish since 1990 (Almanac Trader)

- 2020 Ford GT Adds Power And Turns Heads With Stunning ‘Liquid Carbon’ Edition (Maxim)

HFT VideoCast – Stock Market Commentary and Weekly Recap – Episode 16

Article referenced in VideoCast above:

The end of oil, or just the beginning? (and Sentiment Results)

Podcast – Hedge Fund Tips with Tom Hayes – Episode 6

Article referenced in podcast above:

The end of oil, or just the beginning? (and Sentiment Results)