- The end of oil, or just the beginning? (and Sentiment Results) (ZeroHedge)

- China Just Cut Tariffs on U.S. Goods. Here Are the Products That Benefit. (Barron’s)

- U.S. oil rises as OPEC+ committee calls for deeper cuts to global output amid coronavirus (MarketWatch)

- U.S. Trade Deficit Narrows for First Time in Six Years (Wall Street Journal)

- Adopting a dog? Coors Light offering $100 toward dog adoption fees for Valentine’s Day (USA Today)

- Mattress firm Casper receives sleepy IPO reception (Financial Times)

- China cuts Oil tariffs in half (Reuters)

- Exxon Mobil Won’t Cut Its Dividend. Here’s Why. (Yahoo! Finance)

Tag: Energy

The end of oil, or just the beginning? (and Sentiment Results)

In the past week, sentiment on the Energy Sector has sunk to an all-time low (despite having the highest estimated earnings growth of any sector – for 2020). Several prominent market figures have even called for the end of the sector.

Mark Twain once said, “Reports of my death have been greatly exaggerated.”

Continue reading “The end of oil, or just the beginning? (and Sentiment Results)”

Unusual Options Activity – Southwestern Energy Company (SWN)

Data Source: barchart

Today some institution/fund purchased 626 contracts of Jan 2022 $2 strike calls (or the right to buy 62,600 shares of Southwestern Energy Company (SWN) at $2). The open interest was just 311 prior to this purchase. Continue reading “Unusual Options Activity – Southwestern Energy Company (SWN)”

Yahoo! Finance TV Appearance on Wednesday (Video)

Thank you to Julie Hyman @juleshyman Adam Shapiro @Ajshaps and Pamela Mitchell (producer) for having me on @YahooFinance this morning to talk #energy $XOP $XLE

Thank you to .@juleshyman .@Ajshaps and Pamela Mitchell (producer) for having me on .@YahooFinance this morning to talk #energy $XOP $XLE https://t.co/8kZ40RVkZL

— Thomas J. Hayes (@HedgeFundTips) February 5, 2020

Be in the know. 10 key reads for Wednesday…

- These Are the Top Energy Funds of the Past Decade (Institutional Investor)

- Hedge Fund and Insider Trading News: Ray Dalio, Lee Ainslie, Starboard Value LP, Sound Point Capital Management, First Eagle Investment Management, Coca-Cola Co (KO), Enterprise Products Partners L.P. (EPD), and More (Insider Monkey)

- NYSE Owner Makes Offer to Buy eBay (Wall Street Journal)

- TikTok Eyes Larger Post-Super Bowl Marketing Push (Wall Street Journal)

- Instagram Brings In More Than a Quarter of Facebook Sales (Bloomberg)

- The Trump administration finalizes rule that could shift tariff fights to $6 trillion currency market (Business Insider)

- Why the stock market could jump another 20% this year: Fundstrat (Yahoo! Finance)

- Are Active Funds Better for Fixed-Income Investors? (U.S. News and World Report)

- Trump criticizes ‘failing government schools’ as he pushes school choice (Fox Business)

- OPEC+ delegates weigh new oil cuts as they analyze coronavirus impact (S&P Global)

Be in the know. 10 key reads for Tuesday…

- Biotech Giant Surges On Plan To Test Coronavirus Drug In Humans (Investor’s Business Daily)

- Flu and HIV Drugs Show Efficacy Against Coronavirus (The Scientist)

- The Final Frontier of Streaming: ViacomCBS Launches Star Trek (Barron’s)

- OPEC Scrambles to React to Falling Oil Demand From China (New York Times)

- Oil rebounds on potential for further OPEC+ supply cuts (Street Insider)

- How an Och-Less Och-Ziff Changed Its Attitude, Its Leadership – and Its Name (Institutional Investor)

- Global junk bond issuance hits monthly record (Financial Times)

- Here are the risks to watch in the CLO market, says industry group made famous by ‘The Big Short’ (MarketWatch)

- YouTube brought in $15 billion in advertising revenue in 2019 — 9 times more than Google paid to acquire the site 14 years ago. (Business Insider)

- A Hedge Fund With 29% Return Record Is Shorting Tesla Bonds (Bloomberg)

Be in the know. 10 key reads for Monday…

- Saudis Weigh Large 1M barrel/day Oil Cuts in Response to Coronavirus (Wall Street Journal)

- OPEC+ considering further 500,000 bpd oil output cut: Sources (CNBC)

- Gilead Drug to Undergo Human Trials in China to Cure Coronavirus (Bloomberg)

- Gilead Sciences (GILD) Shares Surges as Remdesivir May Be Effective in Treating Coronavirus (Street Insider)

- Experimental drug for coronavirus to be tested in Wuhan (Global Times)

- Cocktail of flu, HIV drugs appears to help fight coronavirus: Thai doctors (Reuters)

- Toronto patient with 1st confirmed case of coronavirus discharged from hospital (CityNews)

- The ‘Odd’ Part of the Economy That Baffles Steve Schwarzman (Institutional Investor)

- He Really, Really Wants to Win at Cornhole (Wall Street Journal)

- The Rotation To Value Is Inevitable (ZeroHedge)

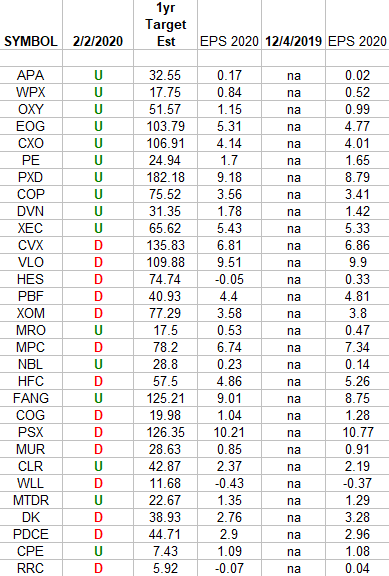

Exploration & Production Sector (XOP) – Earnings Estimates/Revisions

In the spreadsheet above I have tracked the earnings estimates for the Exploration & Production Sector (XOP). I have columns for what the 2020 estimates were: 12/4/2019 and today. Continue reading “Exploration & Production Sector (XOP) – Earnings Estimates/Revisions”

Be in the know. 10 key reads for Saturday…

- 4 Bargains to Be Found Among Stocks Hit by Coronavirus Fears (Barron’s)

- James Bond’s favorite car maker Aston Martin gets rescue investor (New York Post)

- UK formally leaves the European Union and begins Brexit transition period (CNBC)

- What Third Point Is Worried About in 2020 (Institutional Investor)

- S&P 500 wipes out gain for the year on coronavirus fears (Financial Times)

- The Inner Game: Why Trying Too Hard Can Be Counterproductive (Farnam Street)

- How Warren Buffett Made 50% Returns During His Partnership Days | Warren Buffett’s Investment Strategy Explained (Macro-Ops)

- Eight Things I Never Knew About Jack Dorsey (Ramp Capital)

- Ray Dalio Is Still Driving His $160 Billion Hedge-Fund Machine (WSJ)

- Drugmakers Are Racing to Develop a Coronavirus Vaccine (Barron’s)

HFT VideoCast – Stock Market Commentary and Weekly Recap – Episode 15

Article referenced in VideoCast above:

The “‘Great Wall’ of Worry” Stock Market (and Sentiment Results)…