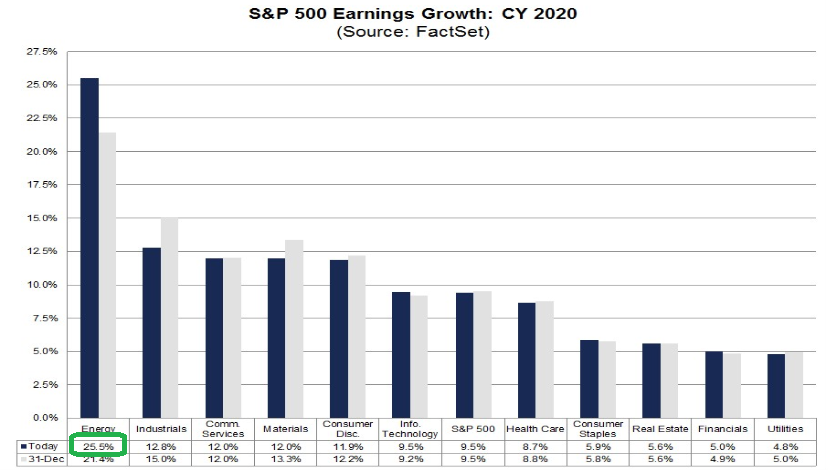

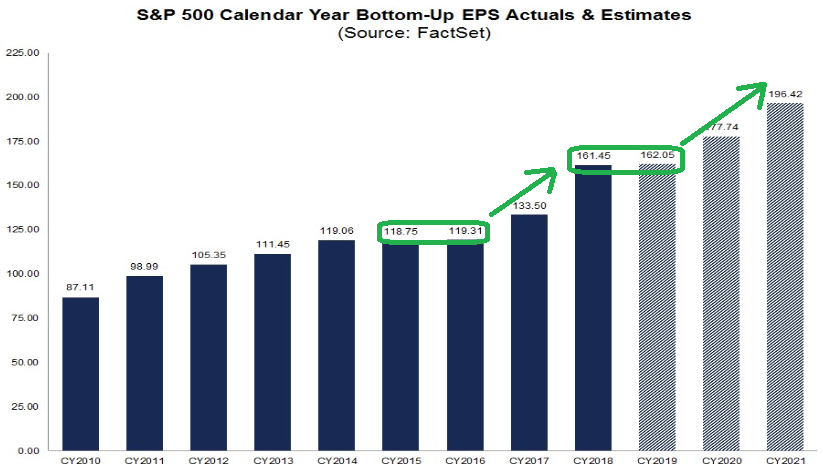

Data Source: Factset

Quick notes on earnings this week. Th most notable change is that 2020 estimates for the Energy Sector went up again this week jumping from 21.4% earnings growth to 25.5% in the past few weeks.

Earnings:

The S&P 500 remains strong at 9.5% EPS growth ($177.41).

Guidance:

The percent of companies issuing negative EPS guidance so far is 58% (7 out of 12). This is below the 5-year average of 70%.