Data Source: Finviz

Tag: Energy

Be in the know. 12 key reads for Tuesday…

- Oil Companies Are Finally Pumping Out Cash. That’s Good News for Their Stocks. (Barron’s)

- Buy Occidental Petroleum Stock, Morgan Stanley Says. Its Dividend Is ‘Best-In-Class.’ (Barron’s)

- JPMorgan posts record profit in strong start to US earnings season (Financial Times)

- Citigroup earnings beat expectations on 49% fixed-income trading surge (CNBC)

- For Howard Marks, Investing Is Like a Game (Institutional Investor)

- Hedge fund puts $550m into technology stock option financing (Financial Times)

- EXCLUSIVE: JPMorgan CEO Jamie Dimon praises ‘phase one’ US-China trade deal (Fox Business)

- 2 GM engineers arrested after 100-mph Kentucky joyride in new Corvettes (USA Today)

- Big Commitments for China Energy/Ag Buys in Phase 1 Trade Deal (Reuters)

- Worry over ‘Japanification’ of the economy is overblown (Barron’s)

- Warren Buffett Should Buy FedEx. It’s Cheap and Elephant-Sized. (Barron’s)

- Xi Strikes Optimistic Tone After Riding Out Trade War With Trump (Bloomberg)

Be in the know. 20 key reads for Saturday…

- Biotech Looks for Fireworks in First Quarter to Regain Momentum (Bloomberg)

- Bet on the Big Banks — and Bank of America (Barron’s)

- Davos? Meet Me at Butternut Instead. (Barron’s)

- A New Hot Spot for Oil Could Boost These 4 Companies (Barron’s)

- Davos? Meet Me at Butternut Instead. (Barron’s)

- Biogen Awaits a Decision on a Key Patent. At Risk Is Its Biggest Drug (Barron’s)

- Trump Allies Explore Buyout of Conservative Channel Seeking to Compete With Fox News (Wall Street Journal)

- New Sanctions Power Could Squeeze Remaining Iranian Trade Channels (Wall Street Journal)

- The Internet of Things Is Changing the World (Wall Street Journal)

- Trump Says Iran Had Planned to Attack Four U.S. Embassies (Bloomberg)

- Hummer is back as GM revives name for electric pickup (USA Today)

- S&P 5,000? Why one fund manager says that milestone may be reached sooner than you would expect (MarketWatch)

- These were the most talked-about products at CES (CNN Business)

- Mark Zuckerberg Says He Hunts Wild Boar With a Bow and Arrow (Futurism)

- Penn Jillette on Magic, Losing 100+ Pounds, and Weaponizing Kindness (#405) (Podcast)

- The Four Traits of Successful Asset Managers (Institutional Investor)

- Gradual Improvements Redux (theirrelevantinvestor)

- Client for Life (The Reformed Broker)

- Is Vulnerability a Choice? (Farnam Street)

- Eight lessons from market history (Evidence Investor)

HFT VideoCast – Stock Market Commentary and Weekly Recap – Episode 11

Article referenced in VideoCast above:

The CAKE “Short Skirt, Long Jacket” Stock Market (and Sentiment Results)

In this episode we cover:

- Jobs Report

- Rig Count

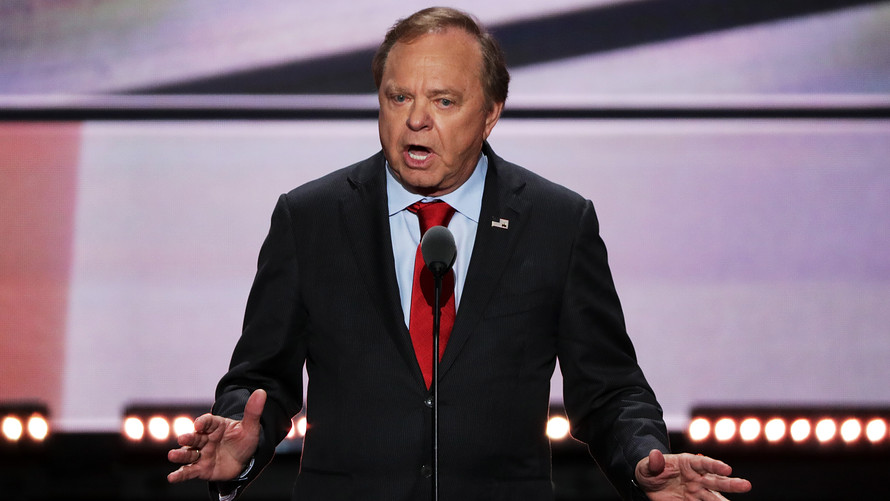

- Harold Hamm on Oil Prices

- General stock market commentary.

- Hemline Indicator

- Valueline Geometric Index – Long Term Implications

- Positioning and sentiment.

- Increased Guidance on tap?

- Fed Liquidity.

- AAII sentiment.

- NAAIM positioning.

- Earnings by Sectors: Energy, Gold Miners, REITs

- S&P and Euro Stoxx 600 earnings.

- Where to find value? What’s Cheap?

- India Small Caps

- Commodities/CRB

- Exploration & Production

- Servicers?

Podcast – Hedge Fund Tips with Tom Hayes – Episode 2

Article referenced in podcast above:

The CAKE “Short Skirt, Long Jacket” Stock Market (and Sentiment Results)

In this episode we cover:

- Jobs Report

- Rig Count

- Harold Hamm on Oil Prices

- General stock market commentary.

- Hemline Indicator

- Valueline Geometric Index – Long Term Implications

- Positioning and sentiment.

- Increased Guidance on tap?

- Fed Liquidity.

- AAII sentiment.

- NAAIM positioning.

- Earnings by Sectors: Energy, Gold Miners, REITs

- S&P and Euro Stoxx 600 earnings.

- Where to find value? What’s Cheap?

- India Small Caps

- Commodities/CRB

- Exploration & Production

- Servicers?

2020 Earnings Estimates: U.S. – DOWN. EUROPE – UP.

Data Source: Factset

2020 Earnings Estimates for the S&P 500 trimmed from 177.77 to 177.64 in the past week. Conversely, the Earnings Estimates for the Euro Stoxx 600 increased by 160bps for 2020 in the past week. Continue reading “2020 Earnings Estimates: U.S. – DOWN. EUROPE – UP.”

Be in the know. 5 key reads for Wednesday…

- Nothing scares Jeffrey Gundlach more than Bernie Sanders (MarketWatch)

- Starbucks, Lowe’s and 6 Other Consumer Stocks That Could Shine in 2020 (Barron’s)

- 3 Oil Stocks to Buy and 1 to Avoid in 2020, According to an Analyst (Barron’s)

- Iran’s Forewarned Strikes Give Trump a Path to Avert All-Out War (Bloomberg)

- Here’s What Could Take the Dow Up to 32,000 in 2020 (24/7 Wall Street)

Be in the know. 10 key reads for Tuesday…

- For India’s Battered Small Caps, Patience Is Virtue, ICICI Says (Bloomberg)

- US debt investors seek protection against inflation (Financial Times)

- Expert: These Will Be The Biggest Hedge Funds Trends Of 2020 (Benzinga)

- How 7-Eleven Struck Back Against an Owner Who Took a Day Off (New York Times)

- New cars hit the LA Auto Show (USA Today)

- Byron Wien makes some bold 2020 calls in his widely followed surprises list including 2 rate cuts (CNBC)

- Bet on these big names to use their scale to squeeze out smaller rivals, says Jefferies (MarketWatch)

- US trade deficit plunges to more than 3-year low (Fox Business)

- RBC Capital Markets Out With First Top Picks Equity List for 2020 (24/7 Wall Street)

- Oil tycoon Harold Hamm predicts 19% jump in U.S. oil prices within six months, ‘regardless of what happens’ in the Mideast (MarketWatch)

Where is money flowing today?

Data Source: Finviz

Be in the know. 7 key reads for Monday…

- U.S. Consumer Tech Sales Projected to Increase 4% in 2020. These Trends Will Drive the Growth. (Barron’s)

- ‘Bad’ Manufacturing Data Contained Good News for Industrial Stocks. Here’s Why. (Barron’s)

- UK economy boosted by ‘greater Brexit clarity’ after conservative win (Fox Business)

- Barron’s Picks And Pans: Amazon, Dine Brands, Walgreens And More (Yahoo! Finance)

- Top Energy Stocks for January 2020 (Investopedia)

- Don’t laugh: Here’s why the ‘great rotation’ from bonds to stocks could finally happen in 2020 (MarketWatch)

- Here’s how the Dow and S&P 500 perform in years after they ring up gains of 20% (MarketWatch)