- Forget About Dogs Of The Dow, Upgrade To Dobermans (Forbes)

- Hedge Fund Tips – Episode 10 – VideoCast. Stock Market Commentary. (ZeroHedge)

- How Trump Planned the Drone Strike With a Tight Circle of Aides (Bloomberg)

- Here’s what typically happens to the financial markets after major Middle East crisis events (CNBC)

- Billionaires shop at Costco too—see Mark Zuckerberg checking out TVs (CNBC)

- Strait of Hormuz, the world’s biggest oil chokepoint, in focus as Iran tensions flare (MarketWatch)

- Lennar Stock Looks Like a Bargain. Here’s Why. (MarketWatch)

- Large Macy’s Option Trader Betting On A Rebound Year (Benzinga)

- How Uncut Gems Won Over the Diamond District (Vanity Fair)

- Amazon Is a Free-Cash Rocket Ship.Time to Jump on Board. (Barron’s)

- There Are Slim Pickings in the Restaurant Sector. Here’s One Stock Worth Nibbling On. (Barron’s)

- Occidental Petroleum, Walt Disney, Nissan Motor: Stocks That Defined the Week (Wall Street Journal)

- Ten people set to shape Wall Street in 2020 (Financial Times)

- Fed minutes show confidence in 2020 interest rate path (Financial Times)

- Stocks Face New Risks, But Here’s Why It’s Not Time To Flee (Investor’s Business Daily)

Tag: Energy

HFT VideoCast – Stock Market Commentary and Weekly Recap – Episode 10

Article referenced in VideoCast above:

The Earth, Wind & Fire “Shining Star” Stock Market (and Sentiment Results)

In this episode we cover:

- general stock market commentary

- positioning and sentiment

- CNBC and Fox Business quotes from this week

- Increased Guidance on tap?

- Earnings by Sectors

- Energy E&P thesis

- CEO/CFO sentiment

- Fed Liquidity

- AAII sentiment

- NAAIM positioning

- S&P and Euro Stoxx 600 earnings

- Dogs of Dow

- Transports

- Jude Clemente Energy Article in Forbes

- Rig count

Podcast – Hedge Fund Tips with Tom Hayes – Episode 1

Article referenced in podcast above:

The Earth, Wind & Fire “Shining Star” Stock Market (and Sentiment Results)

In this episode we cover:

- general stock market commentary

- positioning and sentiment

- CNBC and Fox Business quotes from this week

- Increased Guidance on tap?

- Earnings by Sectors

- Energy E&P thesis

- CEO/CFO sentiment

- Fed Liquidity

- AAII sentiment

- NAAIM positioning

- S&P and Euro Stoxx 600 earnings

- Dogs of Dow

- Transports

- Jude Clemente Energy Article in Forbes

- Rig count

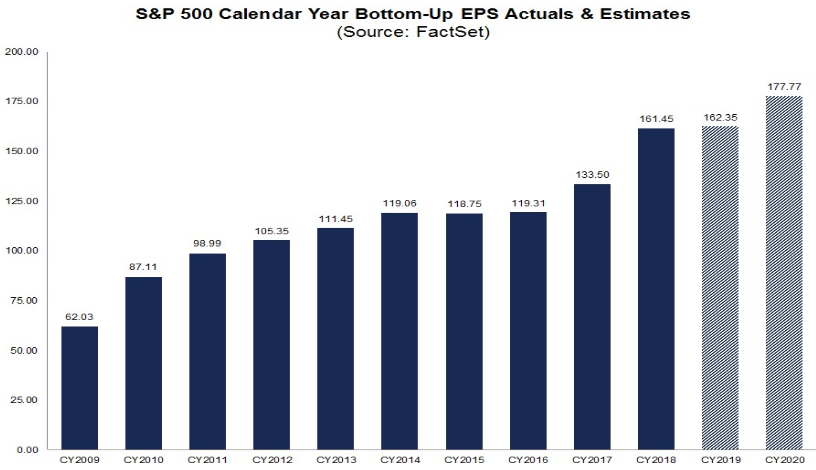

2020 Earnings Estimates: US down modestly, Europe UP

Data Source: Factset

S&P 500 Earnings:

This week, 2020 EPS estimates came down from 178.24 to 177.77. While this is a drop of 26bps, the 2020 Earnings Growth rate stayed up at 9.6% due to a slight down-tick in 2019 estimated results. Q4 2019 Estimates have dropped 10bps (from -1.4% to -1.5% since 12/20). Continue reading “2020 Earnings Estimates: US down modestly, Europe UP”

Where is money flowing today?

Data Source: FinViz

Be in the know. 10 key reads for Friday…

- Top 10 Tasks for Boeing’s New CEO (Wall Street Journal)

- China’s cabinet plans further action to boost manufacturers: state media (Reuters)

- The Power of Social Media in Predicting Stock Returns (Institutional Investor)

- Ten Strategists on What U.S.-Iran Escalation Means for Markets (Bloomberg)

- Why Battered Oilfield Services Stocks Could Be Big 2020 Winners (24/7 Wall Street)

- Why You Should Keep An Eye On These 5 Leading Health Care Stocks (Investor’s Business Daily)

- Macau casinos’ luck may change. Two stocks that could win (Barron’s)

- The U.S. killed an Iranian General—and the Riskiest Oil Stocks Are Flying (Barron’s)

- Boris Johnson’s chief adviser posted a bizarre advert calling for ‘super-talented weirdos’ to help run the UK government (Business Insider)

- U.S. shale producers to tap brakes in 2020 after years of rapid growth (Reuters)

Where is money flowing today?

Data Source: Finviz

Be in the know. 15 key reads for Thursday…

- China Moves to Steady Its Slowing Economic Growth (New York Times)

- The Earth, Wind & Fire “Shining Star” Stock Market (and Sentiment Results) (ZeroHedge)

- These 6 charts compare the US and China economies (CNBC)

- Irrational exuberance? Why last year’s stellar returns may have been a reversal of ‘excessive pessimism’ (MarketWatch)

- Goldman Sachs Was the Worst Dow Stock of 2018. It Was One of the Best in 2019. (Barron’s)

- FedEx Stock Ended 2019 With a Loss. One Director Bought Up Shares in December. (Barron’s)

- The highest-paid CEOs of 2019 (USA Today)

- The Dollar’s Losses May Just Be Getting Started (Bloomberg)

- Almost Everything Wall Street Expects in 2020 (Bloomberg)

- OPEC Output Falls as Gulf Nations Step Up Delivery of Oil Cuts (Bloomberg)

- This is what the Warren Buffett empire looks like, in one giant chart (MarketWatch)

- Treasury’s Mnuchin to head U.S. delegation to Davos conclave (Reuters)

- 7 Excellent Value Stocks to Buy for 2020 (Yahoo! Finance)

- Twilio CEO Lawson Tinkers Until Solving Customers’ Problems (Investor’s Business Daily)

- MAX Crashes Strengthen Resolve of Boeing to Automate Flight (Wall Street Journal)

The Earth, Wind & Fire “Shining Star” Stock Market (and Sentiment Results)

Continue reading “The Earth, Wind & Fire “Shining Star” Stock Market (and Sentiment Results)”

Be in the know. 15 key reads for New Year’s Day…

- Three Neglected Parts of the Stock Market That Could Win in 2020 (Barron’s)

- How investors see 2020 shaping up in US financial markets (Financial Times)

- Stock Market Caps Bullish Year With Modest Gains; Which Sectors Will Lead In 2020? (Investor’s Business Daily)

- Steve Cohen one of few bright spots in bad year for hedge funds (New York Post)

- Chill, It Might Not Be That Bad: The Optimist’s Guide to 2020 (Bloomberg)

- India Stocks Rise as Investors Bank on Economic Recovery in 2020 (Bloomberg)

- Oil Caps Strongest Year Since 2016 on OPEC Cuts, Trade Truce (Bloomberg)

- UK is set to exit the EU next month: Here are some important Brexit-related dates of 2020 (CNBC)

- Warren Buffett turned down a chance to buy Tiffany’s (Business Insider)

- 11 Top Merrill Lynch Stock Picks for 2020 (24/7 Wall Street)

- Here are the best and worst Dow and S&P 500 stocks of 2019 (MarketWatch)

- These are the 20 best-performing stocks of the past decade, and some of them will surprise you (MarketWatch)

- These 10 S&P 500 stocks were lousy in 2019, but they could return 40% or more in 2020 (MarketWatch)

- Dow, Exxon Mobil and IBM top the ‘Dogs of the Dow’ list as 2019 ends (MarketWatch)

- Oil analysts bet on modest price gains in 2020 as supply shrinks: Reuters poll (Yahoo! Finance)