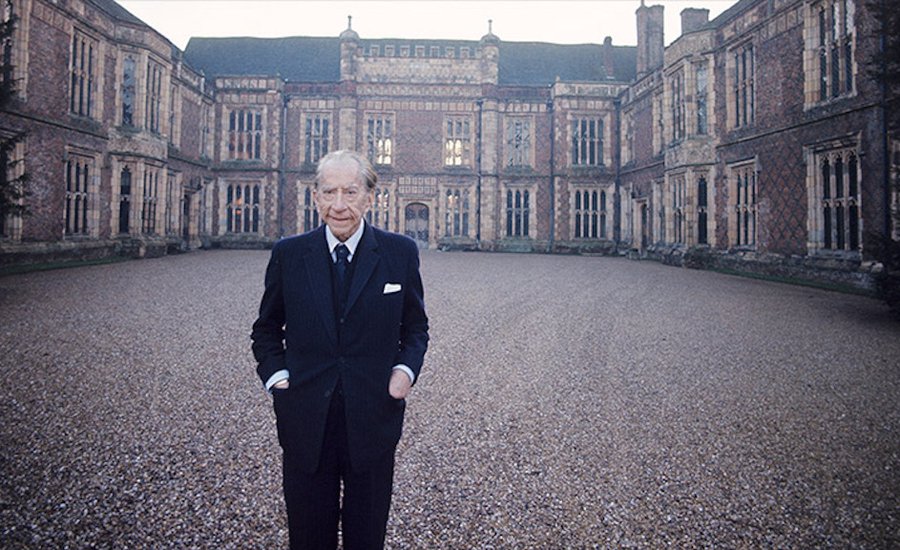

In 1965, J. Paul Getty – once the richest man in America – published his book, “How To Be Rich.” His intent with this book was to lay out his “formula” for success and pass it on to future generations.

Continue reading “The J. Paul Getty (Energy) Stock Market (and Sentiment Results)”