- Regeneron (REGN) Upgraded to “Top Pick for 2020†and “Outperform†by Credit Suisse (TheFly)

- US and China agree to phase one trade deal, December Chinese tariffs canceled (Fox Business)

- 100 Books Everyone Should Consider Reading (AOM)

- Fed Statement on Repo Operations (NY Fed)

- Fed Aims a Half-Trillion Dollar Liquidity Hose at Year-End Risks (Bloomberg)

- Johnson secures crushing UK election victory (Financial Times)

- Watch Out, China: Why Investors May Flock to India Next (Institutional Investor)

- Shares and sterling soar as trade and Brexit fog lifts (Reuters)

- Trump says Britain, U.S. free to strike new trade deal after Brexit (Reuters)

- Are Energy Stocks Hot Again? (Oil Price)

- Emerging Markets Cut Rates With Russia Following Turkey, Brazil (Bloomberg)

- Happy birthday, Taylor Swift! (New York Post)

- The Hedge Fund CQS Is Looking at Unloved Parts of the Credit Market for 2020 (Barron’s)

- Big Pharma’s Coming Back in 2020. ()

- Navy SEAL: How To Pick Yourself Back Up From Failure (Investor’s Business Daily)

Tag: Energy

Where is money flowing today…

Data Source: Finviz

Be in the know. 15 key reads for Thursday…

- Trump meets with top trade advisers to strategize before major China tariff deadline (Fox Business)

- Saudi Aramco touches $2tn valuation on second day of trading (Financial Times)

- Why Exxon’s Stock Could Hit $100 In 2020 (Oil Price)

- The “Crazy Rich Asians” Stock Market (and Sentiment Results) (ZeroHedge)

- Continental Resources founder Harold Hamm steps down as CEO (Financial Times)

- U.S. producer prices unchanged; underlying inflation soft (Reuters)

- Oil prices rise on OPEC deficit forecast (Reuters)

- The Fed Did Everything It Needed To By Doing Nothing (Barron’s)

- The Fed could consider buying other short-term Treasuries, Powell says (Barron’s)

- Supercar maker McLaren to skip electric vehicles. Here’s why — and what it will build instead. (USA Today)

- Cisco says its new silicon, software, router products will ‘change the economics of the Internet’ (Yahoo! Finance)

- Apple (AAPL) China iPhone Shipments in Nov Declined Sharply – Credit Suisse (Street Insider)

- Japan and the Art of Making the Same Mistakes Over and Over Again (Wall Street Journal)

- Britain Votes in an Election That Will Set the Course of Brexit (Wall Street Journal)

- US weekly jobless claims race to a more than 2-year high (CNBC)

The “Crazy Rich Asians” Stock Market (and Sentiment Results)

“Crazy Rich Asians” is a 2018 American romantic comedy film directed by Jon M. Chu. The film chronicles a Chinese-American professor who travels to meet her boyfriend’s family and is surprised to discover they are among the richest in Asia. Continue reading “The “Crazy Rich Asians” Stock Market (and Sentiment Results)”

Where is money flowing today?

Data Source: Finviz

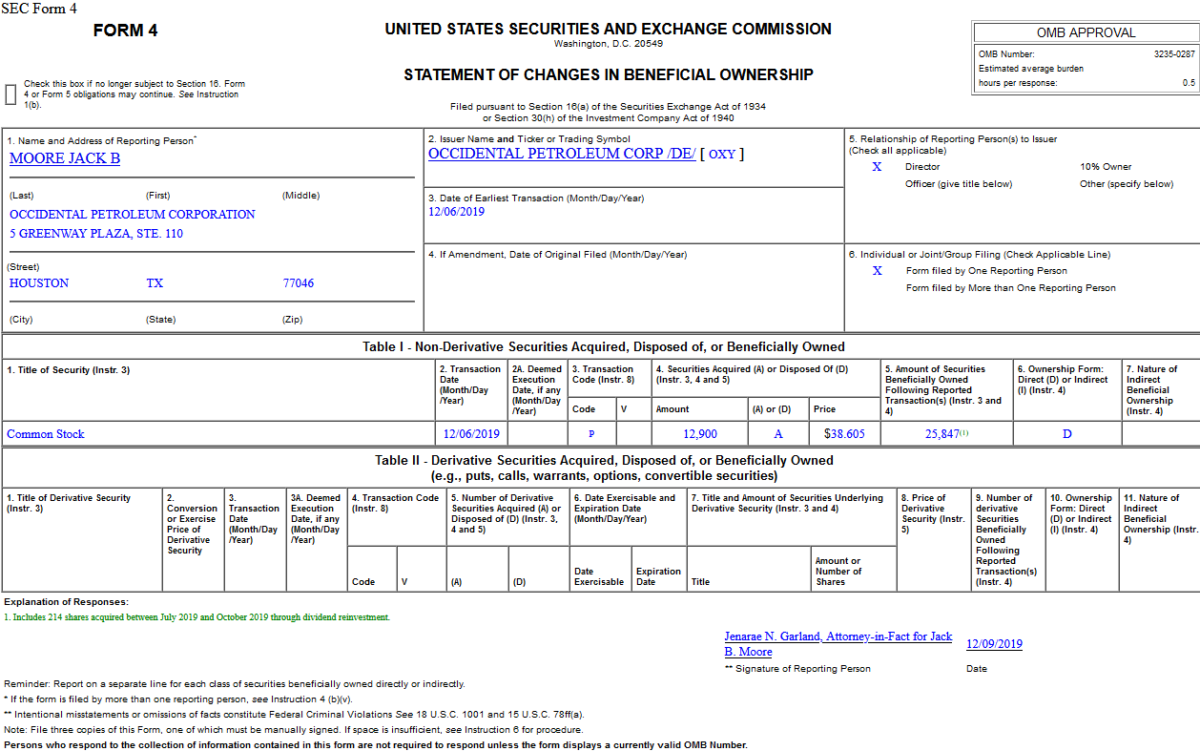

Insider Buying in Occidental Petroleum Corporation (OXY)

On December 6, 2019, Jack Moore – Director of Occidental Petroleum Corporation (OXY) – purchased 12,900 shares of OXY at $38.61. His out of pocket cost was $498,005. Continue reading “Insider Buying in Occidental Petroleum Corporation (OXY)”

Where is money flowing today?

Data Source: Finviz

Be in the know. 12 key reads for Tuesday…

- 6 Strong Buy Oil and Gas Stocks Called to Surge in 2020 (24/7 Wall Street)

- Here’s What It’s Like To Drive a $210,000 McLaren (Barron’s)

- The Time to Buy Home Depot Stock Is Now, Analysts Say (Barron’s)

- JP Morgan is bullish on Vietnamese banks, says sector offers high growth and profitability (CNBC)

- The Federal Reserve’s Meeting Starts Today. Here’s What You Need to Know. (Barron’s)

- The Fed will stay in hibernation until at least summer: CNBC survey (CNBC)

- Big-name US investors take aim at beaten-up energy sector (Financial Times)

- Democrats and the Trump administration near a tentative North American trade deal (CNBC)

- There’s no better place to put your money than the U.S., says hedge-fund manager Kyle Bass (MarketWatch)

- Ross: US close to largest trade deal in history of the world, 170,000 jobs (Fox Business)

- US and Chinese trade negotiators planning for delay of December tariff Fox Business)

- Next Oil Rally May Be Made in Texas, Not Vienna (Wall Street Journal)

Unusual Options Activity in Chesapeake Energy Corporation (CHK)

Data Source: barchart

Today some institution/fund purchased 1,505 contracts of July $1 strike calls (or the right to buy 150,500 shares of Chesapeake Energy Corporation (CHK) at $1). The open interest was 1,065 prior to this purchase.

![]()

Continue reading “Unusual Options Activity in Chesapeake Energy Corporation (CHK)”

Be in the know. 15 key reads for Monday…

1. Hedge funds key in exacerbating repo market turmoil, says BIS (Financial Times)

2. RPT-U.S. banks’ reluctance to lend cash may have caused repo shock – BIS (Yahoo! Finance)

3. Now Repo Distortions Are Emerging in Europe’s $9 Trillion Market (Bloomberg)

4. Will sterling hold its gains through the UK general election? (Financial Times)

5. UK property investors pull cash at fastest rate this year (Financial Times)

6. Top DoubleLine investor sees opportunity in Brazil amid tariff threat (Yahoo! Finance)

7. Jeffrey Gundlach extended interview with Yahoo Finance [TRANSCRIPT] ()

8. The Taylor Swift “Bad Blood†Energy Market (and Sentiment Results) (ZeroHedge)

9. Big-name US investors take aim at beaten-up energy sector (Financial Times)

10. JPMorgan Sees $410 Billion Bump to Stocks’ Demand-Supply Balance (Bloomberg)

11. Japan’s economy expanded at a much faster-than-initially-reported pace in the third quarter. (Business Insider)

12. China says hopes it can reach trade agreement with US as soon as possible. (Business Insider)

13. Here’s the hard-money call for why the boom in the economy and stock market will continue (MarketWatch)

14. Not the sign of a Top: Investors Bail on Stock Market Rally, Fleeing Funds at Record Pace (Wall Street Journal)

15. Pound Rally Gets Nod From Signal That’s Been Right for a Decade (Bloomberg)