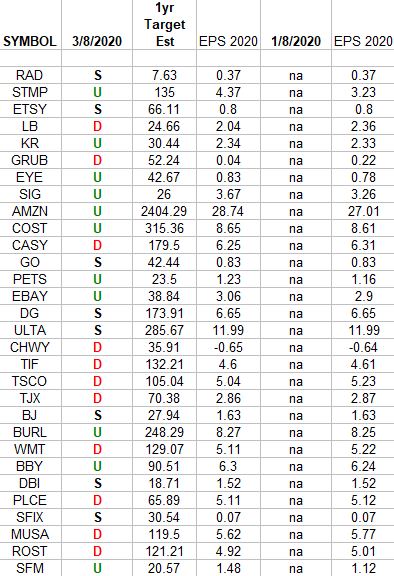

In the spreadsheet above I have tracked the earnings estimates for the Retail Sector ETF (XRT) top 30 weighted stocks. Continue reading “Retail Earnings Estimates/Revisions”

Tag: Estimates

Technology Earnings Estimates/Revisions

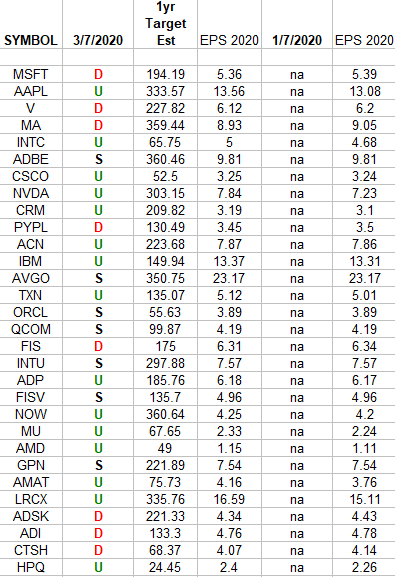

In the spreadsheet above I have tracked the earnings estimates for the Technology Sector ETF (XLK) top 30 weighted stocks. Continue reading “Technology Earnings Estimates/Revisions”

HFT VideoCast – Stock Market Commentary and Weekly Recap – Episode 20

Article referenced in VideoCast above:

The Old Dominion “Snapback” Stock Market? (and Sentiment Results)

Podcast – Hedge Fund Tips with Tom Hayes – Episode 10

Article referenced in podcast above:

The Old Dominion “Snapback” Stock Market? (and Sentiment Results)

The “Curb Your Enthusiasm” Stock Market

In last week’s note, “The 10:3 (Risk to Reward) Stock Market” we made the case that while there was limited upside, the downside risks had increased materially. You can review it here: Continue reading “The “Curb Your Enthusiasm” Stock Market”

Communication Services Earnings Estimates/Revisions

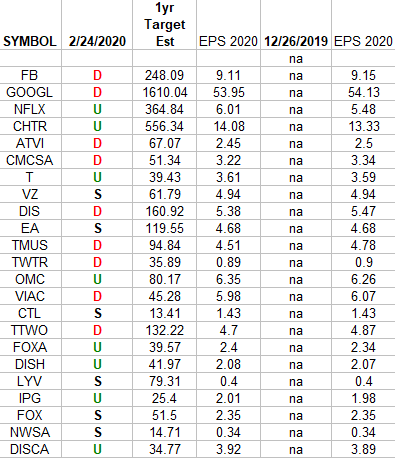

In the spreadsheet above I have tracked the earnings estimates for the Communication Services Sector ETF (XLC). Continue reading “Communication Services Earnings Estimates/Revisions”

Podcast – Hedge Fund Tips with Tom Hayes – Episode 8

Article referenced in podcast above:

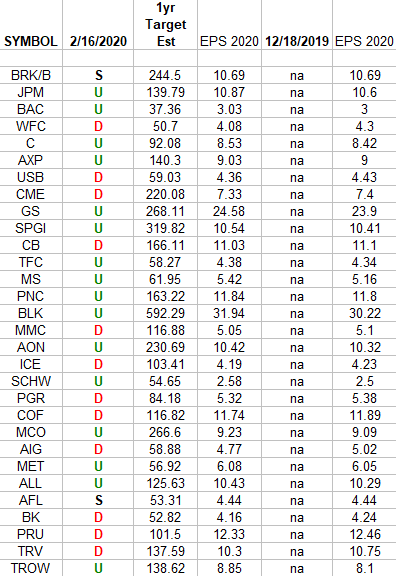

Financials (top 30 weights) Earnings Estimates/Revisions

In the spreadsheet above I have tracked the earnings estimates for the Financials Sector ETF (XLF) top 30 weighted stocks. Continue reading “Financials (top 30 weights) Earnings Estimates/Revisions”

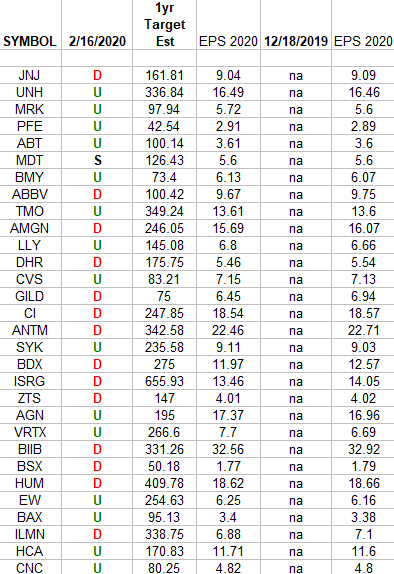

Healthcare (top 30 weights) Earnings Estimates/Revisions

In the spreadsheet above I have tracked the earnings estimates for the Healthcare Sector ETF (XLV) top 30 weighted stocks. Continue reading “Healthcare (top 30 weights) Earnings Estimates/Revisions”

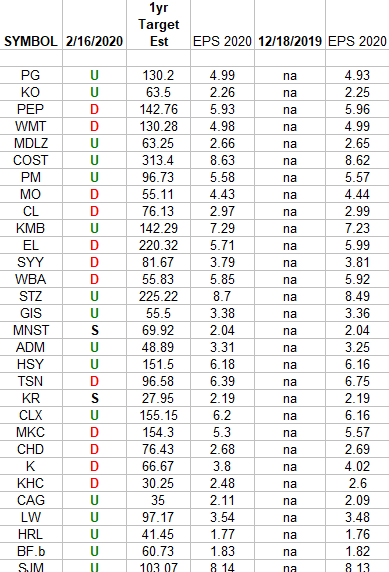

Consumer Staples (top 30 weights) Earnings Estimates/Revisions

In the spreadsheet above I have tracked the earnings estimates for the Consumer Staples Sector ETF (XLP) top 30 weighted stocks. Continue reading “Consumer Staples (top 30 weights) Earnings Estimates/Revisions”