- Tiger Cubs, the Next Generation: Meet Chase Coleman’s Proteges (Bloomberg)

- 3 Pieces to the 2020 Earnings Puzzle (and Sentiment Results) (Zero Hedge)

- Adding a Chronograph Makes This Already-Great Watch Even Better (Bloomberg)

- Exclusive: U.S. pushing India to buy $5-6 billion more farm goods to seal trade deal – sources (Reuters)

- European stocks climb as economic data fuels growth hopes (Reuters)

- 3 Oil and Gas Equipment Stocks in Possible New Uptrend (Investopedia)

- Legendary investor Bill Miller scored 120% returns though he did ‘nothing’ in the last months of 2019 (Business Insider)

- Trump is studying ‘numerous’ middle-class tax cut plans ahead of election, White House says (Business Insider)

- If You Missed Out on Tesla, Consider This Chinese Car Maker (Barron’s)

- Vietnam’s Economy Is Booming. Just Don’t Expect to Find Its Stocks In Your Emerging Markets Fund. (Barron’s)

- Help! I’m Trapped Inside TikTok and I Can’t Get Out (Wall Street Journal)

- Activist Investors and the Art of the Deal (Wall Street Journal)

Tag: Estimates

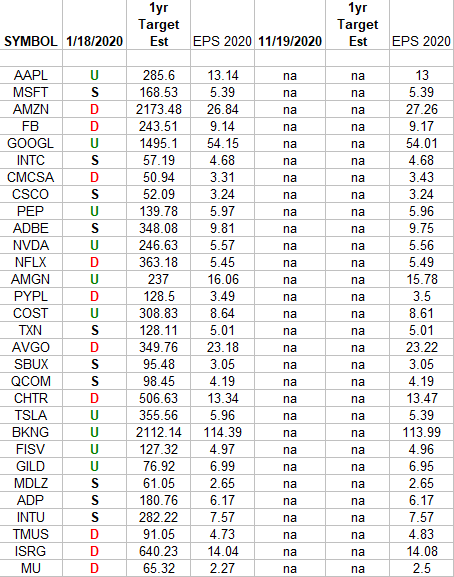

NASDAQ (top 30 weights) Earnings Estimates/Revisions

In the spreadsheet above I have tracked the earnings estimates for the top 30 weighted Nasdaq stocks. I have columns for what the 2020 estimates were on 11/19/2019 today. Continue reading “NASDAQ (top 30 weights) Earnings Estimates/Revisions”

HFT VideoCast – Stock Market Commentary and Weekly Recap – Episode 13

Article referenced in VideoCast above:

“Are you tired of winning yet?” Stock Market (and Sentiment Results)…

Podcast – Hedge Fund Tips with Tom Hayes – Episode 3

Article referenced in podcast above:

“Are you tired of winning yet?” Stock Market (and Sentiment Results)…

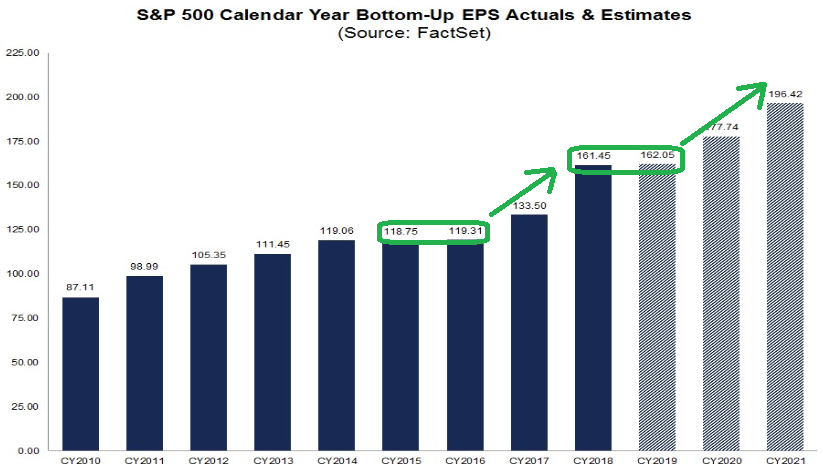

2020 Earnings Guidance moves UP!

Data Source: Factset

For the last 4 weeks I have been pounding the table that, “what no one is expecting is the possibility that earnings estimates for 2020 (S&P 500) will actually start to go UP (as the China deal is passed and CEO/CFO visibility and confidence returns)!” Continue reading “2020 Earnings Guidance moves UP!”

“Are you tired of winning yet?” Stock Market (and Sentiment Results)…

James Branch Cabell, “The optimist claims we live in the best of all possible worlds, and the pessimist fears this is true.”

In many of his campaign rallies, President Trump said, “you’re going to start winning so much that you’re going to beg that I can’t take it anymore!”

Well that was quite a tall order, but regardless of what side of the political spectrum you lie on, Wednesday’s “Phase 1” deal was a big win for the U.S., for China, and the rest of the world. Continue reading ““Are you tired of winning yet?” Stock Market (and Sentiment Results)…”

Bloomberg Interview Clips from Today and Yesterday

Yesterday I had the pleasure of being interviewed by Alisa Parenti of Bloomberg News for about 10-15 minutes.

They then cut up clips of the phone interview and play them not only on Bloomberg Radio, but also a couple hundred iHeart and CBS stations across the country.

Locally, you can hear the reports at :26 and :56 past the hour on 1010 WINS or :25 and :55 past the hour on WCBS today.

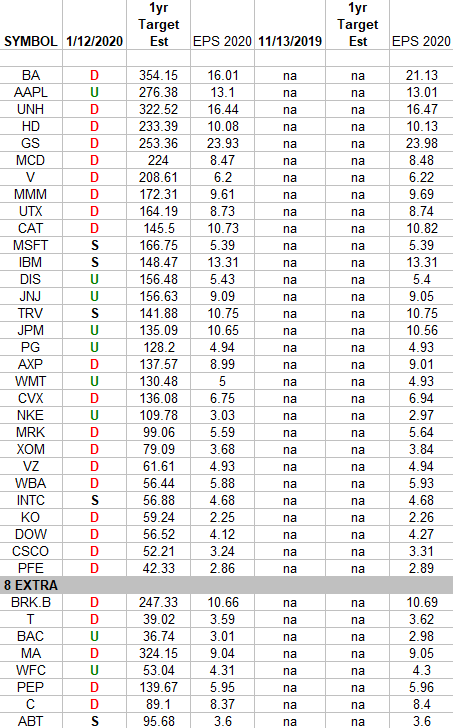

DOW + (8 S&P 500 top weights) Earnings Estimates/Revisions

In the spreadsheet above I have tracked the earnings estimates for the DOW 30 PLUS 8 of the S&P 500 top 30 weights [that are not either included in the DOW 30 or in the top 30 weights of the Nasdaq]. Continue reading “DOW + (8 S&P 500 top weights) Earnings Estimates/Revisions”

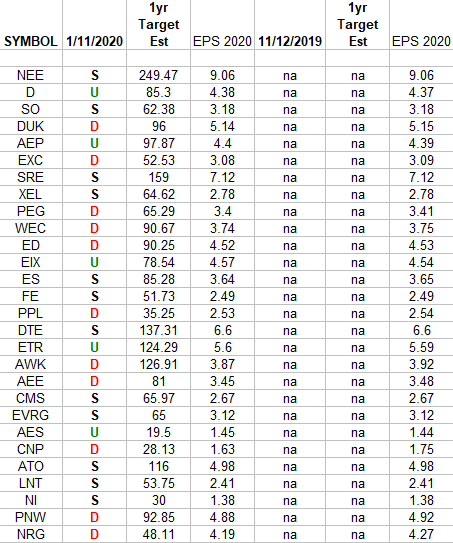

Utilities Earnings Estimates/Revisions

In the spreadsheet above I have tracked the earnings estimates for the Utilities Sector ETF (XLU) top weighted stocks. Continue reading “Utilities Earnings Estimates/Revisions”

HFT VideoCast – Stock Market Commentary and Weekly Recap – Episode 11

Article referenced in VideoCast above:

The CAKE “Short Skirt, Long Jacket” Stock Market (and Sentiment Results)

In this episode we cover:

- Jobs Report

- Rig Count

- Harold Hamm on Oil Prices

- General stock market commentary.

- Hemline Indicator

- Valueline Geometric Index – Long Term Implications

- Positioning and sentiment.

- Increased Guidance on tap?

- Fed Liquidity.

- AAII sentiment.

- NAAIM positioning.

- Earnings by Sectors: Energy, Gold Miners, REITs

- S&P and Euro Stoxx 600 earnings.

- Where to find value? What’s Cheap?

- India Small Caps

- Commodities/CRB

- Exploration & Production

- Servicers?