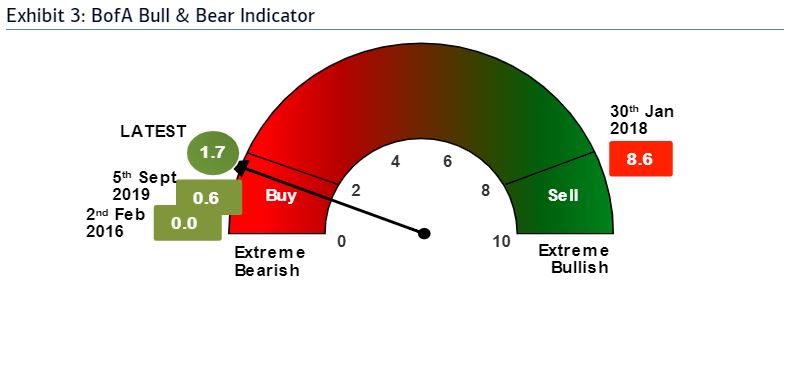

Data Source: Bank of America

Each month, Bank of America conducts a survey of ~200 fund managers with > $500B AUM. Here are the key takeaways from the survey published on March 16, 2020: Continue reading “March Bank of America Global Fund Manager Survey Results (Summary)”