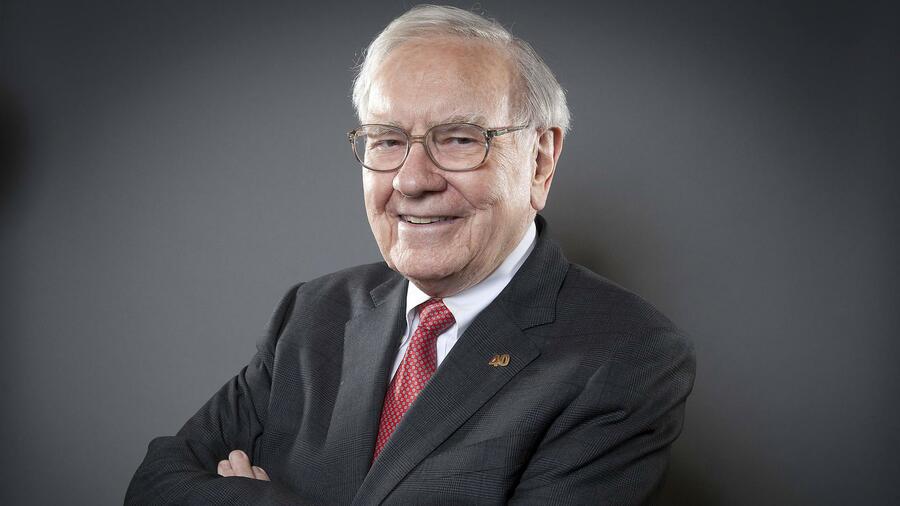

- Be Like Warren Buffett in Times Like These. Here’s How. (Barron’s)

- Federal Reserve Retools Capital Rules for Largest U.S. Banks (Wall Street Journal)

- Market-Beating Bank CEOs Are a Rare Breed (Wall Street Journal)

- Cramer’s most trusted market indicator says to start buying stocks (CNBC)

- Larry Kudlow Says ‘We’re Not Going to Panic’ Over the Economy (Bloomberg)

- Capitulation Moment? ‘We are giving up on energy’, say Jefferies analysts, who compare beaten-down sector to ‘62 Mets (MarketWatch)

- Oil prices rise on report OPEC agrees 1.5 million barrel-per-day production cut (MarketWatch)

- Buffett-Backed 30-Year-Old Goes to War With Latin American Banks (Bloomberg)

- Exxon CEO sticks to spending targets despite oil downturn (Reuters)

- The Old Dominion “Snapback” Stock Market? (and Sentiment Results) (ZeroHedge)

Tag: Federal Reserve

The Old Dominion “Snapback” Stock Market? (and Sentiment Results)

The theme of this week’s market commentary is “Snapback.” I picked it:

1. Because I like the Country band – Old Dominion.

2. To explore the question of whether in fact this is a “Snapback” rally or actually a fake out. Continue reading “The Old Dominion “Snapback” Stock Market? (and Sentiment Results)”

Be in the know. 10 key reads for Wednesday…

- Investors Got the Fed’s Rate Cut Wrong. ‘Putting Some Money to Work Isn’t a Bad Idea.’ (Barron’s)

- The Fed Just Cut Interest Rates. Get Ready to Refinance Your Mortgage. (Barron’s)

- This $5 Billion Stock Fund’s Manager Thinks Like a Founder. It’s Working. (Barron’s)

- Saudis Want OPEC+ to Cut More Than 1 Million Barrels a Day (Bloomberg)

- Here’s how billionaire investor Howard Marks is telling clients to ride out coronavirus volatility (MarketWatch)

- Warren Buffett Can’t Resist This Bargain As He Buys Amid Coronavirus Correction (Investor’s)

- Fed rate cut to boost homebuyers’ spending power (Fox Business)

- iPhone Maker Foxconn Expects 15% Q1 Revenue Hit From Coronavirus, Says Production Rebounding (Benzinga)

- US Fed’s coronavirus rate cut is first move in a dance with markets (Financial Times)

- Private payrolls up 183,000 as hiring shows no signs of coronavirus scare (CNBC)

Be in the know. 25 key reads for Sunday…

- Singapore Emerges as Litmus Test for Coronavirus Containment by Philip Heijmans (Bloomberg)

- What will ‘Super Tuesday’ mean for US investors? (Financial Times)

- Here’s A List Of Who Was Puking Stocks This Week (ZeroHedge)

- Jim Rogers Says Investors Should Buy Now! (The Street)

- Typical March Trading: Slow Start, Mid-Month Surge & Uninspiring Finish (Almanac Trader)

- No, You DO NOT Need Face Masks For Coronavirus—They Might Increase Your Infection Risk (Forbes)

- Daily Oversold Readings Could Support Rebound (John Murphy)

- Stock market coronavirus drop was painful, but buying opportunities may arise (New York Post)

- ‘SNL’ Cold Open (Daily Beast)

- 2020 Corvette Stingray: First Drive Review (Maxim)

- Danielle DiMartino Booth on the Federal Reserve (Podcast) (Bloomberg)

- Options markets point to a potential bounce for U.S. stocks (Reuters)

- Apple glasses could solve one of VR’s biggest issues, patent suggests (techradar)

- Fox Business Skips Commercial Breaks to Cover Coronavirus (But Still Has a Sponsor) (Variety)

- Phil Knight on the Surprising Origin Story of Nike’s Name and Swoosh (Medium)

- The Rise And Fall (And Rise?) Of NASCAR (NPR Planet Money)

- What Biden’s Big South Carolina Win Might Mean For Sanders (FiveThirtyEight)

- Inside The Crazy Story of Iraq’s Debt (Podcast) (Bloomberg)

- Powell: Fed poised to act if needed on ‘evolving’ virus risk (Pensions & Investments)

- A Morgan Stanley Manager Who Sold Before Rout Says He’s Buying (Bloomberg)

- WHO chief on coronavirus: Global markets ‘should calm down and try to see the reality’ (CNBC)

- OPEC may fight coronavirus price slide with deeper oil supply cuts (Fox Business)

- Thomas Lee, founder of Fundstrat Global Advisors is forecasting a “V”-shaped, or sharp, recovery for the market (MarketWatch)

- The Mystery of What Drives Bob Iger (Wall Street Journal)

- Jim Cramer: I Don’t Know Where It Will Bottom, I Do Know What to Buy and Sell (TheStreet)

The “Curb Your Enthusiasm” Stock Market

In last week’s note, “The 10:3 (Risk to Reward) Stock Market” we made the case that while there was limited upside, the downside risks had increased materially. You can review it here: Continue reading “The “Curb Your Enthusiasm” Stock Market”

Be in the know. 10 key reads for Tuesday…

- Libya Oil Shut-In Cost Nation Over $2 Billion Since January (Bloomberg)

- Gilead’s Drug Leads Global Race for Coronavirus Treatment (Bloomberg)

- No OPEC Decision Yet on Oil Cuts, Saudi Energy Minister Says (Bloomberg)

- Breaking Down the Buffett Formula: Berkshire Hathaway’s Returns by the Numbers (Barron’s)

- He Went to a Hockey Game Expecting Dinner. He Wound Up Getting the Win. (Wall Street Journal)

- Supreme Court Seems Ready to Back Pipeline Across Appalachian Trail (New York Times)

- OPEC hasn’t run out of ideas, Saudi energy minister insists as oil prices slump (CNBC)

- Natural gas is crushing wind and solar power — Why isn’t anyone talking about it? (Fox Business)

- Conspiracy Theorists Ask ‘Who Owns the New York Fed?’ Here’s the Answer. (Institutional Investor)

- Krispy Kreme launches ‘national doughnut delivery’ starting Feb. 29 (USA Today)

Be in the know. 8 key reads for Sunday…

- 2020 Corvette Stingray first drive review: Born to dance (Digital Trends)

- Warren Buffett drops a hint about the future of Berkshire’s leadership (CNN Business)

- Milton Friedman, An ‘Elfin Libertarian’ Giant (Hoover Institution)

- Keanu Reeves Rarely Talks About Money — but When He Does, It’s Life-Changing (Medium)

- Episode 974: Michael Milken (NPR Planet Money)

- 40 Years Later: 20 Facts About the ‘Miracle on Ice’ (Mental Floss)

- Uncut Gems Explains Why People Go Crazy for Jewels (Podcast) (Bloomberg)

- Warren Buffett acknowledges he won’t live forever, tells investors: ‘Don’t worry’ (Fox Business)

Be in the know. 15 key reads for Saturday…

- It’s Time to Build a Stake In Caterpillar (Barron’s)

- Wells Fargo Agrees to Pay $3 Billion to Settle Fake-Account Claims (Barron’s)

- Stocks Drop on the Week but Still Look Bubbly. Time to Prepare for a Correction. (Barron’s)

- What the E*Trade Deal Tells You About the New Investing Game (Wall Street Journal)

- Hot Wheels launches Cybertruck toy — with optional cracked window (New York Post)

- America’s Coal Country Isn’t Dead — It’s Preparing for a Comeback (Bloomberg)

- Warren Buffett just became the longest-serving CEO of an S&P company. Take a look inside his incredible life and career. (Business Insider)

- Richard Branson launches his luxury, adults-only cruise ship (CNN Business)

- Richard Turner — The Magical Phenom Who Will Blow Your Mind (#411) (Tim Ferriss Podcast)

- Yale Activists Want Divestment. David Swensen Isn’t Budging. (Institutional Investor)

- Election Year March: Performance Haunted By Steep 1980 Declines (Almanac Trader)

- In next downturn, Fed may opt for quick, strong action (Reuters)

- 30 Most Popular Stocks Among Hedge Funds: 2019 Q4 Rankings (Insider Monkey)

- Maserati’s New Mid-Engine Supercar Is Called the MC20 and It’s Coming This Spring (Robb Report)

- Where to Eat, Drink, Stay and Play in the Maldives (Maxim)

Be in the know. 20 key reads for Wednesday…

- Leon Cooperman says the market has become too pessimistic on energy stocks, too euphoric on Tesla (CNBC)

- Junk bond king’s pardon ‘is spectacular’ for Wall Street (Financial Times)

- Record Wall Street rally triggers boom in options (Financial Times)

- Q4 13F Roundup: How Buffett, Einhorn, Ackman And Others Adjusted Their Portfolios (Benzinga)

- The Michael Milken Project (Institutional Investor)

- ‘Very Big Trade Deal’ With India In Progress Ahead Of Visit, Trump Says (Benzinga)

- Building Permits Surge To 13 Year Highs Thanks To Warm Weather In Northeast (ZeroHedge)

- China’s virus-hit industrial cities start to ease curbs, restore production (Reuters)

- Oil up on slowing pace of coronavirus, Venezuela sanctions (Reuters)

- It’s Michael Milken’s World. The Rest of Us Just Live in It. (Barron’s)

- Hedge Funds Keep Backpedaling From S&P 500’s Biggest Winners (Bloomberg)

- What Warren Buffett Might Tell Investors in His Annual Letter This Week (Barron’s)

- Gilead’s Coronavirus Drug Trial Slowed by Lack of Eligible Recruits (Wall Street Journal)

- Fed’s Balance Sheet Dominates What to Watch For in FOMC Minutes (Bloomberg)

- Why Teva’s Grand Turnaround Could Just Be Getting Started (24/7 Wall Street)

- Pound Climbs After Inflation Tempers Risk of a Rate Cut (Bloomberg)

- SoftBank plans to borrow up to $4.5 billion using its domestic telecom’s shares as collateral. (Business Insider)

- Billionaire investor Leon Cooperman ramps up his criticism of Bernie Sanders, calling him a ‘bigger threat’ to the stock market than coronavirus (Business Insider)

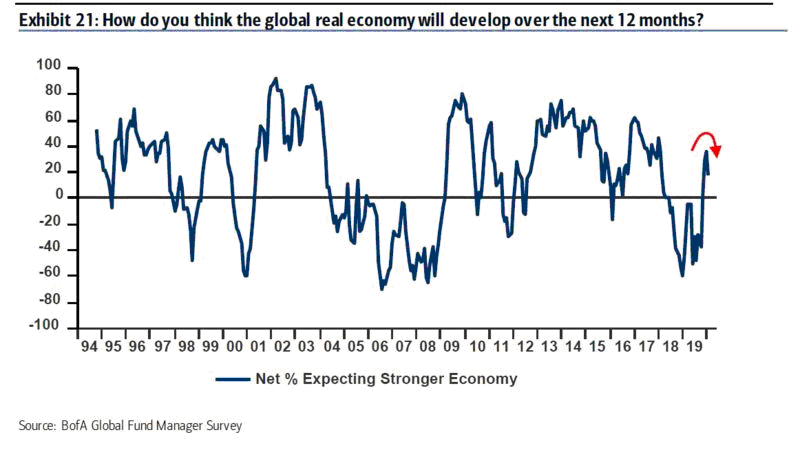

- February Bank of America Global Fund Manager Survey Results (Summary) (Hedge Fund Tips)

- It’s never been this hard for companies to find qualified workers (CNBC)

February Bank of America Global Fund Manager Survey Results (Summary)

Data Source: Bank of America

Each month, Bank of America conducts a survey of ~200 fund managers with > $600B AUM. Here are the key takeaways from the survey published on Feb 18, 2020: Continue reading “February Bank of America Global Fund Manager Survey Results (Summary)”