- Banks Make $10B in Fees in Phase 1 of PPP (Fool)

- Big Banks Pull Ahead in U.S. Small-Business Aid After Stumbles (Bloomberg)

- Global Stocks Advance as Focus Returns to Reopenings (Barron’s)

- What Might Gilead’s Covid-19 Drug Cost — $10 or $4,500? (Barron’s)

- Drive-Throughs Are Now a Lifeline for Fast-Food Chains (New York Times)

- Carnival Plans to Sail Again in August, Maybe (New York Times)

- ‘Trolls’ streaming success to usher in more new movies at home (USA Today)

- Wall Street’s Elite Bond Club Is Cracking at the Worst Possible Time (Bloomberg)

- Cash on the Sidelines Could Limit Stocks’ Slide, Yardeni Says (Barron’s)

- Smaller Banks Doled Out Bulk of PPP Loans, Fed Data Show (Barron’s)

- NBCUniversal to Combine TV, Streaming Operations in Broad Restructuring (Wall Street Journal)

- Italy Starts Easing Lockdown, Rebooting Its Stricken Economy (Wall Street Journal)

- A Surprising Way to Stay Resilient (Wall Street Journal)

- Small Businesses Were at a Breaking Point. Small Banks Came to the Rescue. (Wall Street Journal)

- Test, trace, isolate: Governments need to do these three things before reopening economies, expert warns (CNBC)

- Israel Will Reopen Malls to Revive Economy as Virus Cases Drop (Bloomberg)

- TikTok is winning over millennials and Instagram stars as its popularity explodes (CNN)

- Tesla stock rise appears to qualify CEO Musk for $700 million payday (StreetInsider)

- 5 BofA Securities Yield Advantage Dividend Stocks for Worried Investors (24/7 Wall Street)

- Open for lunch: California counties with few coronavirus cases re-start their economies (Reuters)

Tag: Financials

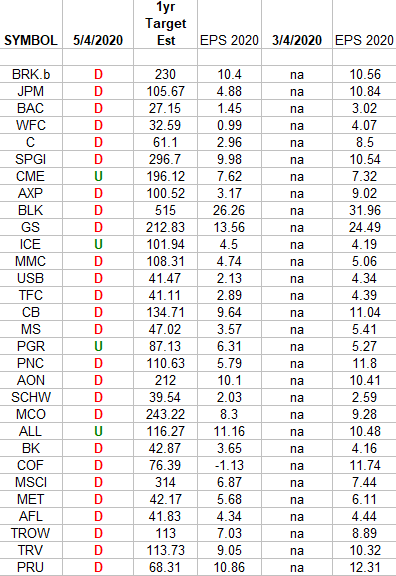

Financials (top 30 weights) Earnings Estimates/Revisions

In the spreadsheet above I have tracked the earnings estimates for the Financials Sector ETF (XLF) top 30 weighted stocks. Continue reading “Financials (top 30 weights) Earnings Estimates/Revisions”

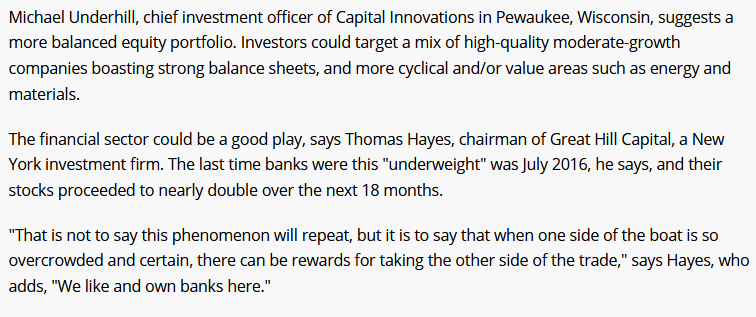

Hedge Fund Tips with Tom Hayes – VideoCast – Episode 28

Article referenced in podcast above:

My quotes in Kiplinger Thursday:

Thanks to Ellen Chang for including me in her article in Kiplinger today, “Sell in May and Go Away: Should You in 2020?”

Unusual Options Activity – Wells Fargo & Company (WFC)

Data Source: barchart

Today some institution/fund purchased 2,613 contracts of Jan 2022 $60 strike calls (or the right to buy 261,300 shares of Wells Fargo & Company (WFC) at $60). The open interest was 1,805 prior to this purchase. Continue reading “Unusual Options Activity – Wells Fargo & Company (WFC)”

HFT VideoCast – Stock Market Commentary and Weekly Recap – Episode 27

Article referenced in VideoCast above:

The Kanye West, “Drive Slow” Stock Market (and Sentiment Results)…

The Kanye West, “Drive Slow” Stock Market (and Sentiment Results)…

For the past three weeks we’ve utilized Country Music songs to represent the theme and sentiment of the stock market at the time. Continue reading “The Kanye West, “Drive Slow” Stock Market (and Sentiment Results)…”

HFT VideoCast – Stock Market Commentary and Weekly Recap – Episode 26

Article referenced in VideoCast above:

The Morgan Wallen, “Whiskey Glasses” Stock Market (and Sentiment Results)…

Hedge Fund Tips with Tom Hayes – Episode 16

Article referenced in podcast above:

The Morgan Wallen, “Whiskey Glasses” Stock Market (and Sentiment Results)…

The Morgan Wallen, “Whiskey Glasses” Stock Market (and Sentiment Results)…

Each week I attempt to pair the lyrics from a popular song to the current feeling and sentiment in the stock market. When you look at the data that has come out on the U.S. economy in recent days, one might suggest you need more than “Beer Goggles” to see the green shoots, you need “Whiskey Glasses!” Continue reading “The Morgan Wallen, “Whiskey Glasses” Stock Market (and Sentiment Results)…”