- Ten U.S. states developing ‘reopening’ plans account for 38% of U.S. economy (Reuters)

- Signs That New Virus Cases Have Peaked Push Stocks Higher (Barron’s)

- IPhone Sales Surged in China (Barron’s)

- States Move to Coordinate on Reopening Plans (Wall Street Journal)

- Private Equity Firms Plead With Government to Help Salvage Oil and Gas Industry (Institutional Investor)

- FDA approves coronavirus saliva test (Fox Business)

- Trump Negotiating to Lease Oil Storage Space to Nine Companies (Bloomberg)

- World Watches China’s Economy for Signs of Life After Lockdown (Bloomberg)

- Exxon borrows $9.5 billion as investment-grade companies race to fill war chests ahead of earnings (MarketWatch)

- Wells Fargo Earned 1 Penny in the First Quarter. Why the Stock Is Rising Anyway. (MarketWatch)

Tag: Financials

HFT VideoCast – Stock Market Commentary and Weekly Recap – Episode 25

Article referenced in VideoCast above:

The Rodney Atkins, “Keep On Going” Stock Market (and Sentiment Results)…

Hedge Fund Tips with Tom Hayes – Episode 15

Article referenced in podcast above:

The Rodney Atkins, “Keep On Going” Stock Market (and Sentiment Results)…

Hedge Fund Tips with Tom Hayes – Episode 14

Article referenced in podcast above:

Be in the know. 20 key reads for Thursday…

- Oil jumps as Trump talks up truce hopes for Saudi-Russia price war (StreetInsider)

- No One Is Betting in Casinos—Or on Their Stocks ()

- Trump says expects Russia-Saudi oil deal soon, invites US oil chiefs to White House (Reuters)

- Oil rallies as Trump spurs hopes for Russia-Saudi pact (Financial Times)

- Detroit To Be The First City To Roll Out Abbott’s 5-Minute Coronavirus Tests (Benzinga)

- Kroger’s sales jump 30% as shoppers stock up amid coronavirus crisis New York Post)

- Retailers Under Growing Pressure to Let Workers Wear Masks New York Times)

- Mapping the Coronavirus Outbreak Across the World (Bloomberg)

- Walgreens earnings top estimates, says it can’t forecast the impact of coronavirus pandemic (CNBC)

- Trump To Talk Aid For Oil As Big Shale Firm Files For Bankruptcy (Investor’s Business Daily)

- Big Banks Get Temporary Reprieve (Barron’s)

- These 8 Aristocrats Have Safe Dividends. (Safe Being a Relative Term Right Now). (Barron’s)

- A Top Occidental Petroleum Executive Is Out as Company Grapples With Oil Rout (Wall Street Journal)

- The Fed Is Settling Into Its Role as the World’s Central Bank (Wall Street Journal)

- 5 Blue Chip Stocks to Buy Now With Huge Piles of Cash and Very Low Debt (24/7 Wall Street)

- Trump May Join Oil Talks Between Russia And Saudi Arabia (Yahoo! Finance)

- Workers Return to China’s Factories, but Coronavirus Hurts Global Demand (Wall Street Journal)

- Coronavirus Tests Aren’t Hard to Find Everywhere (Wall Street Journal)

- Telemedicine, Once a Hard Sell, Can’t Keep Up With Demand (Wall Street Journal)

- How a Mailman Still Carries On During Coronavirus (Wall Street Journal)

Be in the know. 20 key reads for Saturday…

- Evidence over hysteria — COVID-19 (Medium)

- OPEC, U.S. Shale Producers Open Talks Amid Oil Rout (Wall Street Journal)

- Washington Needs to Act (Barron’s)

- Fed Going All In to Save Economy. Here’s What Could Come Next (Bloomberg)

- Coronavirus-Triggered Downturn Could Cost 5 Million U.S. Jobs (Wall Street Journal)

- Coronavirus Recession Looms, Its Course ‘Unrecognizable’ (New York Times)

- Doug Ramsey’s Best Case for Stocks and Other Views of the Future (Bloomberg)

- Google Coronavirus Website Launches (Bloomberg)

- Bond-Market Strains Keep Traders on Edge (Wall Street Journal)

- Country Music Legend Kenny Rogers Dies at 81 (Bloomberg)

- Big Banks Are Getting a Real-Life Stress Test (Barron’s)

- Read Our Free Coronavirus Coverage Here (Bloomberg)

- Bank stocks are ‘very cheap,’ traders say — here’s where they see signs of stabilization (CNBC)

- The Coronavirus’s $4 Trillion Hit to US Corporations (Bridgewater – Greg Jensen)

- What the Fed Could Do Next to Try to Prevent an Economic Unraveling (New York Times)

- Germany to raise €356bn in new borrowing to fight coronavirus (Financial Times)

- Wall Street takes late tumble as US shutdown widens (Financial Times)

- Warren Buffett discussed coronavirus, Coca-Cola, and past market crashes in a recent interview. Here are his 12 best quotes. (Business Insider)

- Rethinking the Coronavirus Shutdown (Wall Street Journal)

- Wells Fargo asks Fed to lift cap on growth to support customers: FT (Reuters)

HFT VideoCast – Stock Market Commentary and Weekly Recap – Episode 22

Article referenced in VideoCast above:

The Spanish Flu – Coo coo ca choo – Stock Market (and sentiment results)…

Hedge Fund Tips with Tom Hayes – Episode 12

Article referenced in podcast above:

The Spanish Flu – Coo coo ca choo – Stock Market (and sentiment results)…

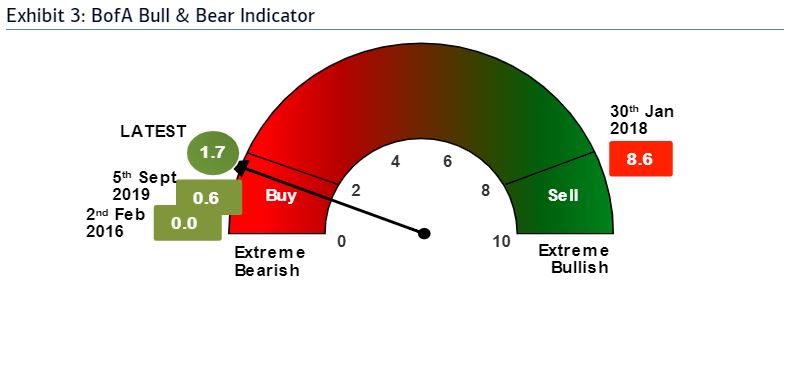

March Bank of America Global Fund Manager Survey Results (Summary)

Data Source: Bank of America

Each month, Bank of America conducts a survey of ~200 fund managers with > $500B AUM. Here are the key takeaways from the survey published on March 16, 2020: Continue reading “March Bank of America Global Fund Manager Survey Results (Summary)”

Unusual Options Activity – Wells Fargo & Company (WFC)

Data Source: barchart

Today some institution/fund purchased 800 contracts of Jan 2022 $27.5 strike calls (or the right to buy 80,000 shares of Wells Fargo & Company (WFC) at $27.50). The open interest was just 383 prior to this purchase. Continue reading “Unusual Options Activity – Wells Fargo & Company (WFC)”