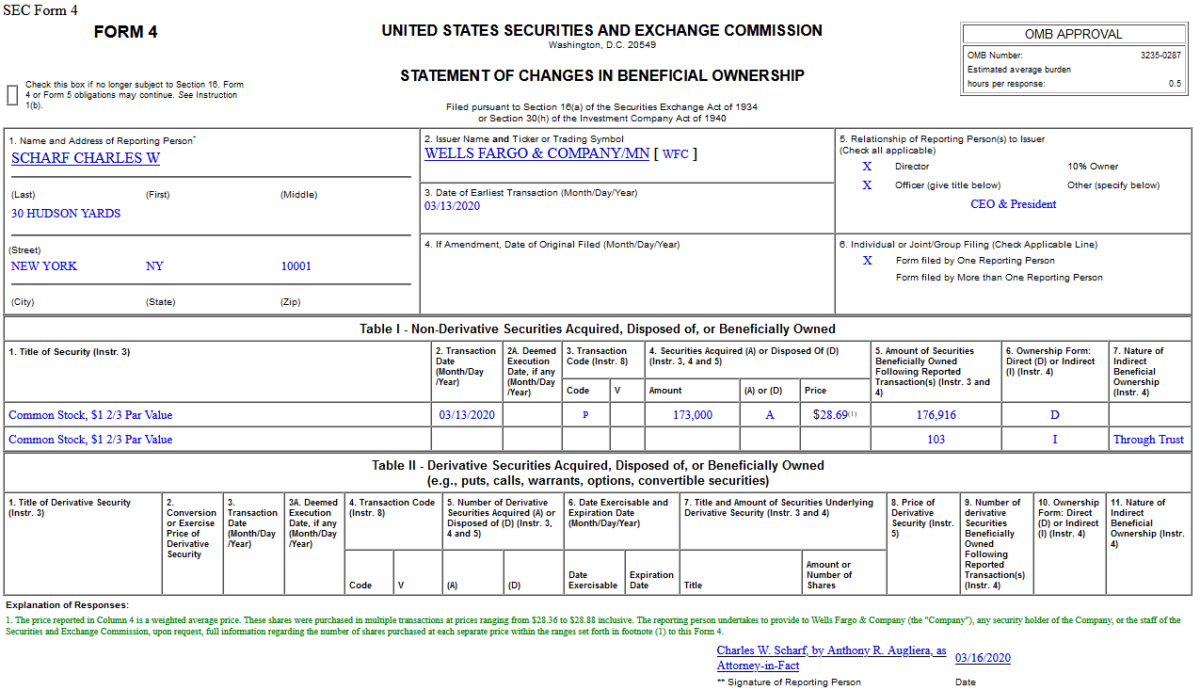

On March 13, 2020, Charles Scharf – CEO & President of Wells Fargo & Company (WFC) – purchased 173,000 shares of WFC at $28.69. His out of pocket cost was $4,963,370.

Tag: Financials

Be in the know. 13 key reads for Monday…

- 18 Stocks to Buy Amid the Coronavirus Carnage, According to Barron’s Roundtable Experts (Barron’s)

- 8 Big Banks Are Halting Buybacks to Brace for More Virus Fallout (Barron’s)

- Fed Cuts Rates to Zero as Financial-Crisis Tools Return (Barron’s)

- Buffett’s Massive Cash Stash Makes Berkshire a Safe Port in the Storm (Barron’s)

- How Coronavirus Remade American Life in One Weekend (Wall Street Journal)

- The Fed and Friends: What Central Banks Did in Past 24 Hours (Bloomberg)

- Regeneron, Sanofi to evaluate Kevzara in patients hospitalized with severe COVID-19 (MarketWatch)

- Coronavirus vaccine clinical trial begins (Fox Business)

- Peter Navarro: Faced with coronavirus pandemic, Congress should pass Trump’s $800 billion payroll tax cut (Fox Business)

- Barron’s Picks And Pans: Roundtable Picks, Airline And Oil Stocks, And More (Benzinga)

- Carl Icahn Says Some Stocks Are Being ‘Given Away’ (Benzinga)

- Can Risk Parity Funds Hang in There? (Institutional Investor)

- Thinking About Airline Stocks? This Is How Air Travel Is Recovering in China. (Barron’s)

HFT VideoCast – Stock Market Commentary and Weekly Recap – Episode 18

Article referenced in VideoCast above:

Podcast – Hedge Fund Tips with Tom Hayes – Episode 8

Article referenced in podcast above:

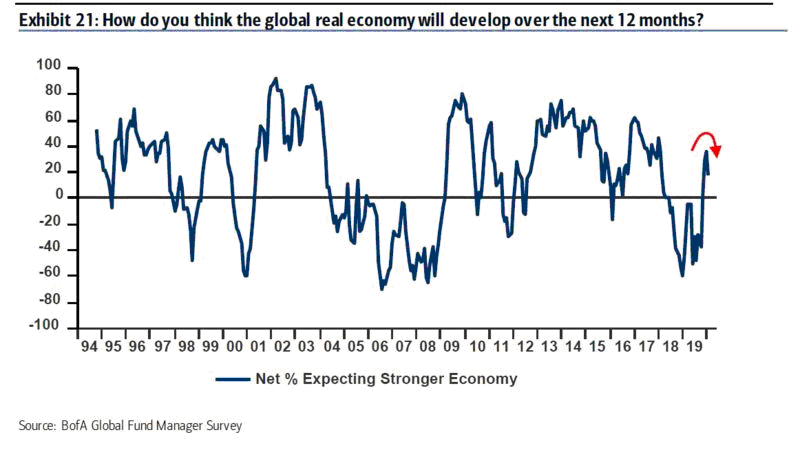

February Bank of America Global Fund Manager Survey Results (Summary)

Data Source: Bank of America

Each month, Bank of America conducts a survey of ~200 fund managers with > $600B AUM. Here are the key takeaways from the survey published on Feb 18, 2020: Continue reading “February Bank of America Global Fund Manager Survey Results (Summary)”

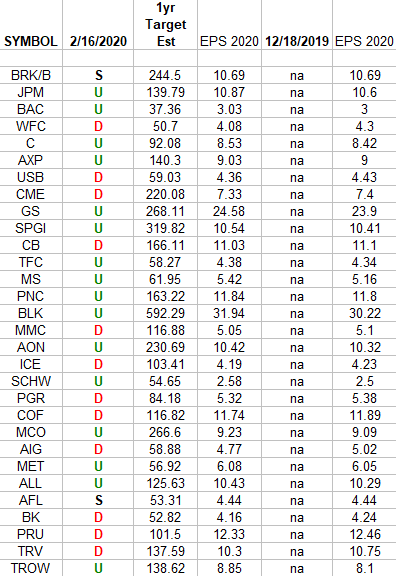

Financials (top 30 weights) Earnings Estimates/Revisions

In the spreadsheet above I have tracked the earnings estimates for the Financials Sector ETF (XLF) top 30 weighted stocks. Continue reading “Financials (top 30 weights) Earnings Estimates/Revisions”

Be in the know. 12 key reads for Friday…

- Top financiers want Biden to drop out so Bloomberg can win: ’He has no chance’ (Fox Business)

- Oil prices steady but set for weekly gain on supply cut optimism (Business Insider)

- How a Small-Cap Fund Finds Exceptional Growth Overseas (Barron’s)

- Labor Force Participation Rate Mystery: Why Have So Many Americans Stopped Working? (Investor’s Business Daily)

- Veteran strategist eyes health care and financials in anticipation of ‘choppy and frustrating’ markets (MarketWatch)

- FC’s celebrity investors have a chokehold on $300M dividend (New York Post)

- Judy Shelton, Trump’s Fed Nominee, Faces Bipartisan Skepticism (New York Times)

- Doubting America Can Cost You a Lot of Money (Bloomberg)

- EXCLUSIVE: Kudlow reveals when middle class can expect ‘tax cuts 2.0’ (Fox Business)

- Investor complacency sets in while coronavirus spreads (Financial Times)

- Warren Buffett loves using Valentine’s Day to explain why See’s Candies is his ‘dream business’ (Business Insider)

- Value Investing’s Time to Shine Again Is Approaching (Bloomberg)

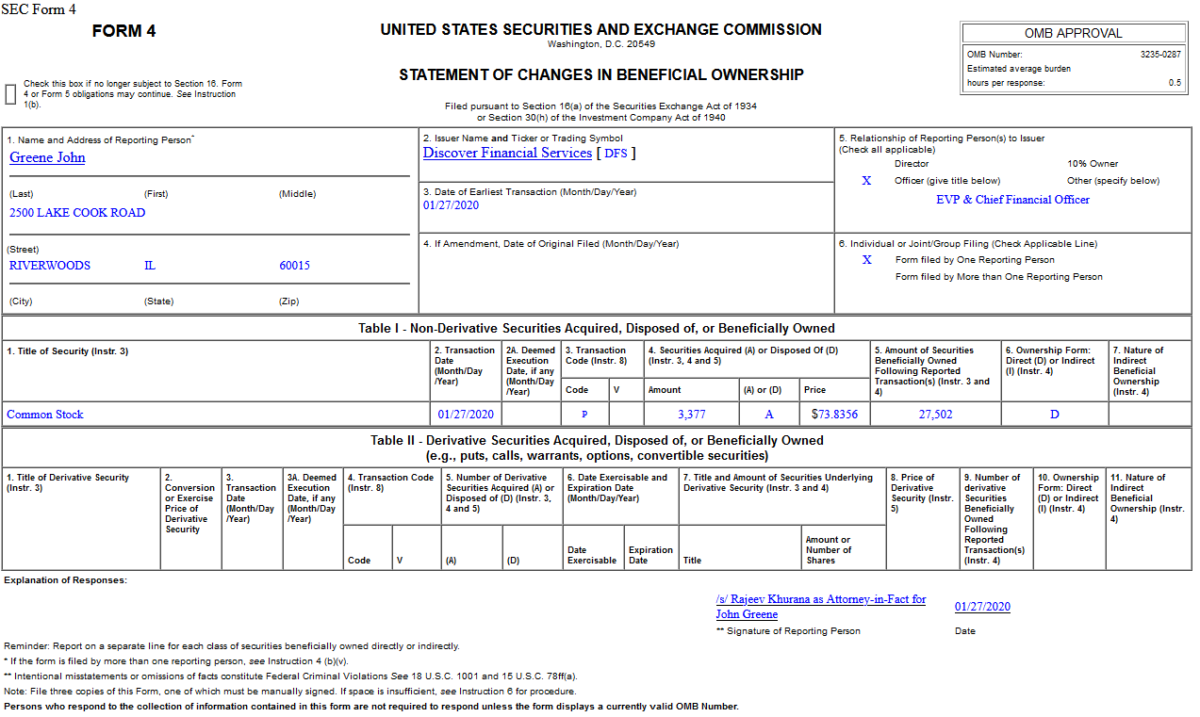

Insider Buying in Discover Financial Services (DFS)

On Jan 27, 2020, Roger Hochschild – CEO and President of Discover Financial Services (DFS) – purchased 15,000 shares of DFS at $74.12. His out of pocket cost was $1,111,821.

HFT VideoCast – Stock Market Commentary and Weekly Recap – Episode 13

Article referenced in VideoCast above:

“Are you tired of winning yet?” Stock Market (and Sentiment Results)…

Podcast – Hedge Fund Tips with Tom Hayes – Episode 3

Article referenced in podcast above:

“Are you tired of winning yet?” Stock Market (and Sentiment Results)…