Article referenced in podcast above:

The Earth, Wind & Fire “Shining Star” Stock Market (and Sentiment Results)

In this episode we cover:

- general stock market commentary

- positioning and sentiment

- CNBC and Fox Business quotes from this week

- Increased Guidance on tap?

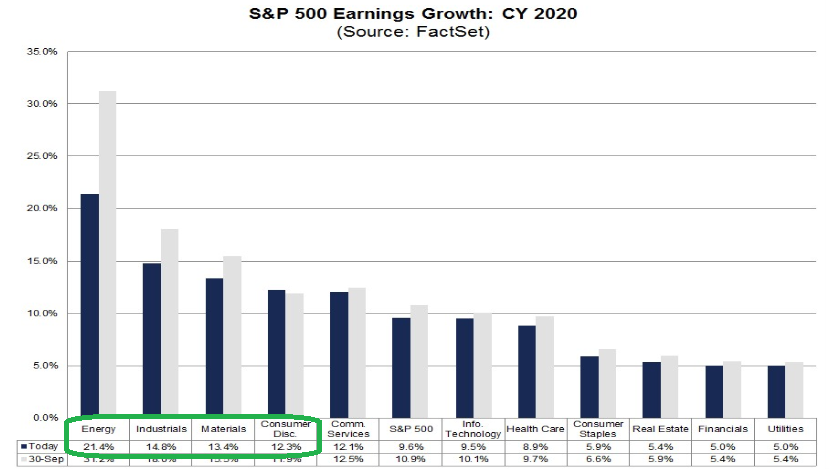

- Earnings by Sectors

- Energy E&P thesis

- CEO/CFO sentiment

- Fed Liquidity

- AAII sentiment

- NAAIM positioning

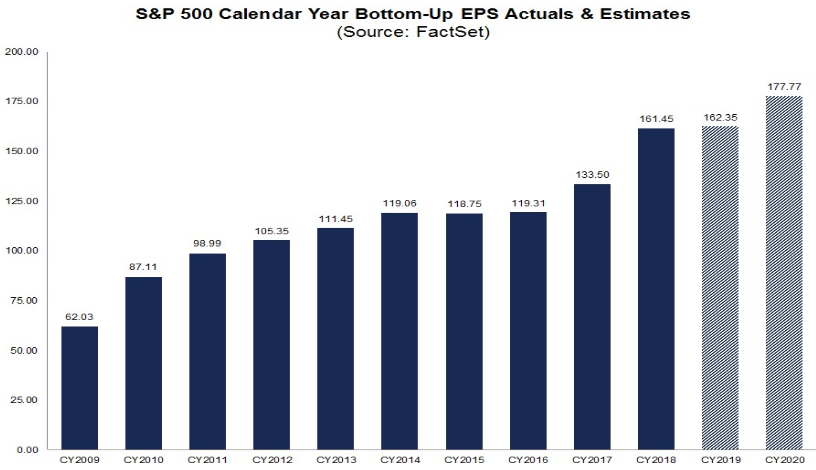

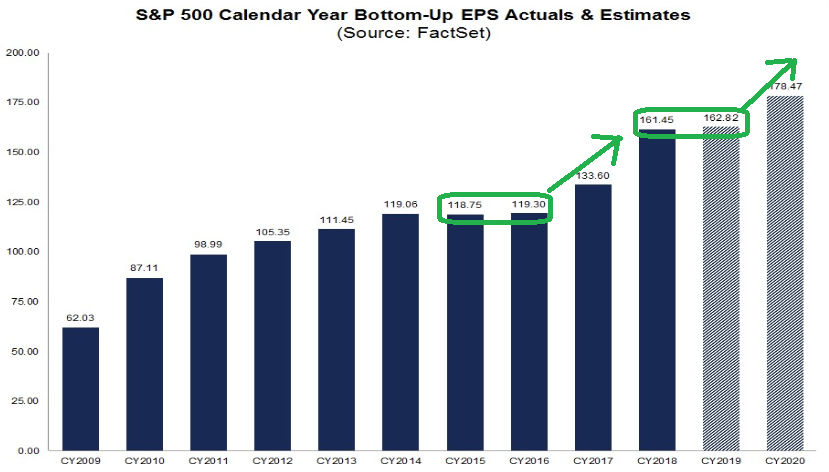

- S&P and Euro Stoxx 600 earnings

- Dogs of Dow

- Transports

- Jude Clemente Energy Article in Forbes

- Rig count