For those of you who have followed us for some time, you know we have been putting out bullish notes since the August 2019 lows. You can review each weekly note under the “Sentiment” category of the site. We called for the end of year “melt-up” just a few weeks after the 2/10 yield curve inverted in early August 2019. Continue reading “The ‘Short Term’ 10:3 (Risk to Reward) Stock Market”

Tag: Investing

HFT VideoCast – Stock Market Commentary and Weekly Recap – Episode 17

Article referenced in VideoCast above:

The Chris Janson “Good Vibes” Stock Market (and Sentiment Results)…

Podcast – Hedge Fund Tips with Tom Hayes – Episode 7

Article referenced in podcast above:

The Chris Janson “Good Vibes” Stock Market (and Sentiment Results)…

The Chris Janson “Good Vibes” Stock Market (and Sentiment Results)…

This week’s Stock Market commentary and sentiment can best be described by country star Chris Janson’s song, “Good Vibes:”

I ain’t watchin’ TV today

Bad news, it can just stay away

If you ain’t got anything good to say

Then shut your mouth

I got my windows down and my blinders on

Radio set to my favorite song

All green lights on the road I’m on

Man, there ain’t no doubt

Continue reading “The Chris Janson “Good Vibes” Stock Market (and Sentiment Results)…”

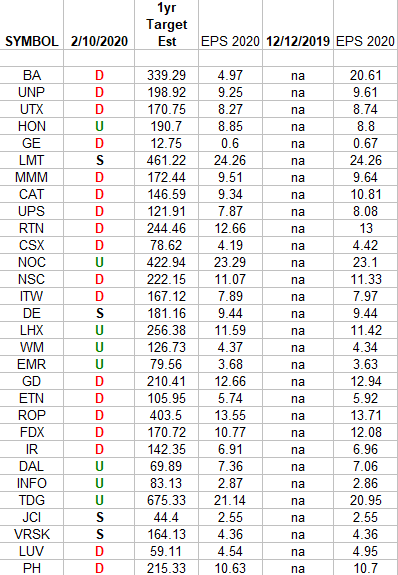

Industrials (top 30 weights) Earnings Estimates/Revisions

In the spreadsheet above I have tracked the earnings estimates for the Industrials Sector ETF (XLI) top 30 weighted stocks. The column under the date 2/10/2020 has a letter that represents the movement in 2020 earnings estimates since the most recent print (12/12/2019). Continue reading “Industrials (top 30 weights) Earnings Estimates/Revisions”

Some Gas Left in the Tank for the Stock Market Rally?

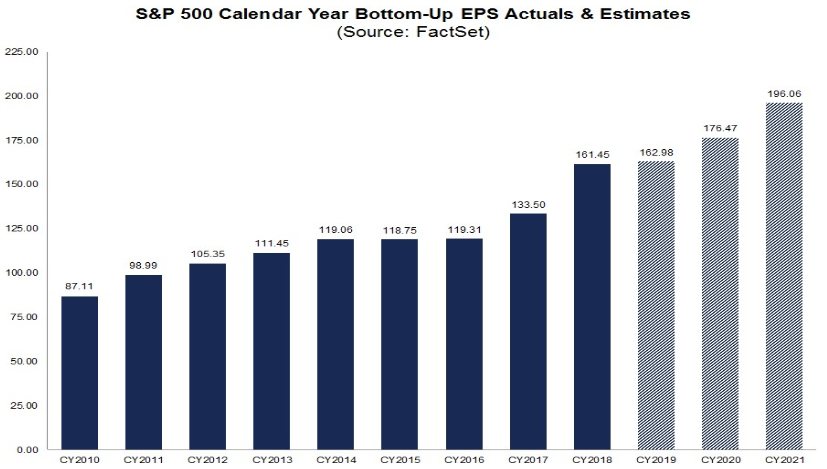

2020 Earnings Estimates for the S&P 500 came down modestly this week from $177.51 to $176.47. At the time of writing, the S&P 500 is trading at 3,327, which implies a forward earnings multiple of 18.85. This is high relative to the five year average of 16.7x, but low relative to the multiple usually achieved in the latter parts of a cycle (low 20’s).

Despite trading at an elevated multiple, relative to the ten year yield (currently 1.58%) equities are somewhat fairly priced. In order for the market to move sustainably higher, we will need to see an improvement in earnings. This can come from three potential catalysts:

- Guidance: According to a Duke survey in early December 2019, CEO/CFO pessimism was at its highest level since 2009 and 2002. Both of these periods marked “bottoms” in the market versus “tops.” The pessimism was largely attributable to the uncertainty around the trade deal with China. One week later, the Phase 1 deal was signed. Up until last week earnings estimates have held in strong, but the advent of coronavirus has taken a slight shave to the numbers in the past seven days. This is likely a short term blip that the market will look through as greater clarity on the drugs used to cure the virus becomes available.

- U.S. Dollar: This month the Bank of America Global Fund Manager Survey found that 53% of managers felt the U.S. Dollar was overvalued. The last time there was a reading this high was 2002 and the dollar proceeded to fall by 40% in coming years. While we do not expect the Dollar to weaken to this magnitude, a drop of even a few percentage points year on year would have a material benefit to S&P 500 earnings – as approximately 40-50% of revenues come from abroad.

- Boeing: Boeing could truly be the “make or break” for the markets in 2020. Due to the debacle of the 737 Max plane, Boeing’s 2020 earnings estimates have come down $15.99 in the last 60 days. Despite this abrupt decline in earnings power, the S&P 500 estimates have held relatively stable – which means that the vast majority of remaining components have improved and picked up the slack. Should the 737 Max issue get resolved sooner than expected (by mid-year), that lost earnings power would come back online almost immediately – as they operate in a duopoly environment and do not have to look far to regain customers. Furthermore, the impact on the S&P 500 Earnings Per Share would be dramatic – taking estimates as high as $190. If this happens, the stock market is currently under-priced because the multiple would drop from 18.8x down to 17.2x – which is more in-line with the five year historic average.

The Federal Reserve:

From 2016-2018, the Federal Reserve raised interest rates nine consecutive times in an effort to cool growth in the economy. Simultaneously, they engaged in a program of Quantitative Tightening (reducing the balance sheet) that sucked $785B of liquidity from the system. After over two years of non-stop effort, they achieved their goal and in December 2018, they nearly crashed the stock market yielding a ~20% correction in a couple of months (informally known as the Christmas Eve massacre). Within a week of the lows, they realized the damage they had done and immediately did an “about-face” promising not to continue raising rates. But the damage was done…

Over the next three quarters, earnings for the S&P 500 were negative year on year – also known as an “earnings recession.” This error was not unique to the current Federal Reserve members. It has happened many times historically. The Fed over-tightens and justifies the mistake by saying they are “data dependent.” The problem is that the data they are “depending” on is in the rear view mirror. The effect of the “tightening policies” (raising rates and reducing the balance sheet) are not felt in the economy immediately because there is a tailwind of previous momentum. By the time they realize they have overdone it, it is too late because they have choked off credit (as evidenced by an inverted yield curve and negative earnings growth). The lagged effect is “seen” in the economy 6-9 months AFTER they stop tightening.

That’s the bad news. The good news is that in Summer of 2019, the Federal Reserve realized the error of their ways and changed course. They cut rates three times in a row and also added ~$400B of liquidity back into the system over the next few months. While this is a good start, they have unwound less than half of the tightening they implemented over a two year period. They have plenty of room to add further liquidity to the system and restore significant growth – as they are still beneath their symmetric 2% inflation target.

Just as it took the Federal Reserve two straight years of tightening policy to choke off growth in the economy, it will take 6-9 months to feel the effect of the accommodative policy they put into place last Summer. We should start to experience the benefits of increased growth by the second quarter – provided they don’t make the same mistake twice and pull back on liquidity expansion too early – particularly when there is no material inflation.

I am of the belief that Chairman Powell will not make the same mistake twice due something he said at the December 2019 Fed meeting. Chair Powell stated that he is committed to helping the “forgotten men and women” who have not yet benefited from the post-crisis economic recovery. They are known as “discouraged workers” who are no longer counted in the workforce because they have stopped looking for work.

The pre-crisis Labor Force Participation rate was over 67% of the population. Post-crisis it fell to 63% and in recent periods has started to bounce. In today’s Labor Report, that number bounced to 63.4%. Larry Kudlow estimated that as many as six million more workers could be brought back into the labor force. The number one way this can be accomplished is for Chairman Powell to let the economy run hot for a sustained period of time. This will yield enough wage inflation to attract these “discouraged workers” back into the labor force, and enough labor competition for employers to overlook “marks” on a resume that may have historically deterred them from making the hire.

While a 3.6% unemployment rate is something to celebrate, it pales in comparison to the growth and economy we can achieve by bringing a few million people back into the labor force with jobs. This result is 100% up to Chairman Powell and will be achieved only if he continues to add liquidity and unwind the remainder of the $785B of quantitative tightening program what was implemented from 2016-2018.

So while we may have to digest the impressive gains off the August lows at some point in coming months, there is much to look forward to in the back half of 2020. With positive signs coming from the FAA this week regarding Boeing and an expectation that Chairman Powell’s actions will be consistent with his commitment to put millions back to work, the best may in fact be – yet to come…

HFT VideoCast – Stock Market Commentary and Weekly Recap – Episode 16

Article referenced in VideoCast above:

The end of oil, or just the beginning? (and Sentiment Results)

Podcast – Hedge Fund Tips with Tom Hayes – Episode 6

Article referenced in podcast above:

The end of oil, or just the beginning? (and Sentiment Results)

The end of oil, or just the beginning? (and Sentiment Results)

In the past week, sentiment on the Energy Sector has sunk to an all-time low (despite having the highest estimated earnings growth of any sector – for 2020). Several prominent market figures have even called for the end of the sector.

Mark Twain once said, “Reports of my death have been greatly exaggerated.”

Continue reading “The end of oil, or just the beginning? (and Sentiment Results)”

HFT VideoCast – Stock Market Commentary and Weekly Recap – Episode 15

Article referenced in VideoCast above:

The “‘Great Wall’ of Worry” Stock Market (and Sentiment Results)…