- Shale Activist Hunts for New Target in ‘Uninvestable’ Sector (Bloomberg)

- Coronavirus Is Roughing Up the Market. Why It’s Time to Refinance Your Mortgage. (Barron’s)

- Disney’s New CEO Is a Theme Park Whiz Who Gets Hollywood, Too (Barron’s)

- Every Adult in Hong Kong to Get Cash Handout of $1,284 (Bloomberg)

- New Chinese billionaires outpace U.S. by 3 to 1: Hurun (Reuters)

- $45 Billion: That’s What This Study Says Pensions Lost in Private Equity Gains (Institutional Investor)

- Junk bond spreads surge as investors consider virus risks (Financial Times)

- Lowe’s Reports Q4 Earnings Beat (Benzinga)

- Why one quantitative analyst says stocks may have seen their ‘darkest day’ (MarketWatch)

- New Cases Drop in China as Virus Spreads Globally (Wall Street Journal)

Tag: Natural Gas

Be in the know. 10 key reads for Tuesday…

- Libya Oil Shut-In Cost Nation Over $2 Billion Since January (Bloomberg)

- Gilead’s Drug Leads Global Race for Coronavirus Treatment (Bloomberg)

- No OPEC Decision Yet on Oil Cuts, Saudi Energy Minister Says (Bloomberg)

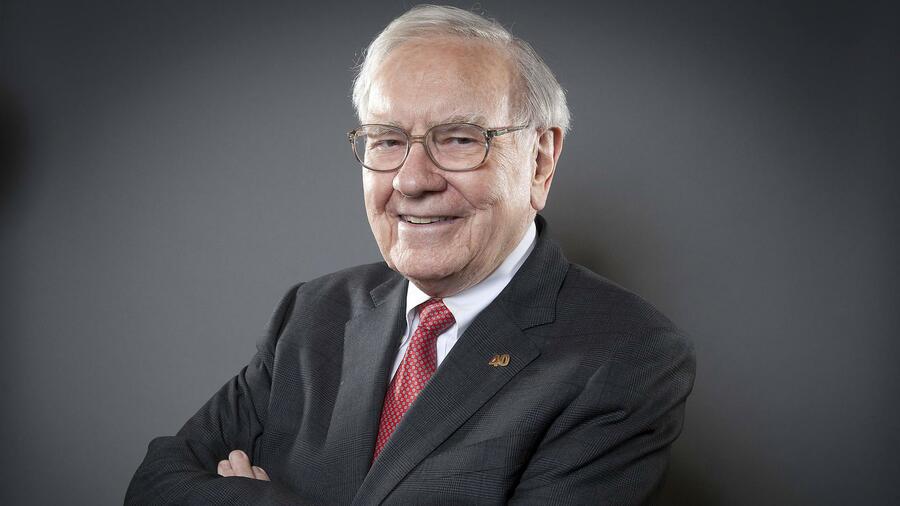

- Breaking Down the Buffett Formula: Berkshire Hathaway’s Returns by the Numbers (Barron’s)

- He Went to a Hockey Game Expecting Dinner. He Wound Up Getting the Win. (Wall Street Journal)

- Supreme Court Seems Ready to Back Pipeline Across Appalachian Trail (New York Times)

- OPEC hasn’t run out of ideas, Saudi energy minister insists as oil prices slump (CNBC)

- Natural gas is crushing wind and solar power — Why isn’t anyone talking about it? (Fox Business)

- Conspiracy Theorists Ask ‘Who Owns the New York Fed?’ Here’s the Answer. (Institutional Investor)

- Krispy Kreme launches ‘national doughnut delivery’ starting Feb. 29 (USA Today)

Be in the know. 8 key reads for Monday…

- Gilead’s Remdesivir May Be Effective Against Coronavirus, WHO Says (The Street)

- Natural-Gas Exporters Struggle to Lock Up Buyers Despite ‘Freedom Gas’ Pitch (Wall Street Journal)

- Warren Buffett is cheering the current selloff, saying investors ‘should want the stock market to go down.’ (Business Insider)

- Here are the biggest takeaways from Warren Buffett’s annual letter (Business Insider)

- Wells Fargo (WFC) Confirms $3B Settlement with DOJ and SEC (Street Insider)

- Buffett calls coronavirus outbreak ‘scary,’ but says he won’t be selling stocks (Reuters)

- Trump Says U.S.-India to Sign $3 Billion in Defense Deals (Bloomberg)

- Warren Buffett Buys Record Amount Of The Ultimate Buffett Stock (Investor’s Business Daily)

HFT VideoCast – Stock Market Commentary and Weekly Recap – Episode 16

Article referenced in VideoCast above:

The end of oil, or just the beginning? (and Sentiment Results)

Podcast – Hedge Fund Tips with Tom Hayes – Episode 6

Article referenced in podcast above:

The end of oil, or just the beginning? (and Sentiment Results)

Be in the know. 12 key reads for Friday…

- Kraft Heinz Could Have Bad News. It’s Time to Buy the Stock. (Barron’s)

- The No. 1 Biotech Stock Just Squashed Earnings Views — Here’s Why (Investor’s Business Daily)

- Hedge Fund and Insider Trading News: Steve Cohen, Bill Ackman, Laurion Capital, Alden Global Capital, Black Diamond Therapeutics Inc (BDTX), SkyWest, Inc. (SKYW), and More (Insider Monkey)

- Trump, Xi Reaffirm Commitment to Phase-One Trade Deal (Bloomberg)

- The ‘Dividend Aristocrats’ Add 7 New Members (Barron’s)

- Honeywell’s Chief Technology Officer Explains the Significance of 5G (Barron’s)

- Elliott Management amasses $2.5B stake in bruised SoftBank (New York Post)

- U.S. Jobs Top Estimates With 225,000 Gain, Wages Accelerate (Bloomberg)

- The Big Dirty Secret Behind Wind Power (Bloomberg)

- Encouraging banks to tap Fed discount window could prevent another repo market freeze, says Quarles (MarketWatch)

- Peak Shale Will Send Oil Prices Sky High (OilPrice)

- Natural Gas: Capital Retreat To Send Prices 50% Higher (Seeking Alpha)

The end of oil, or just the beginning? (and Sentiment Results)

In the past week, sentiment on the Energy Sector has sunk to an all-time low (despite having the highest estimated earnings growth of any sector – for 2020). Several prominent market figures have even called for the end of the sector.

Mark Twain once said, “Reports of my death have been greatly exaggerated.”

Continue reading “The end of oil, or just the beginning? (and Sentiment Results)”

Be in the know. 10 key reads for Wednesday…

- Chesapeake Energy’s stock bounces off 26-year low after production update (MarketWatch)

- For Fed’s Policy Meeting, Balance-Sheet Plans Take Focus (Barron’s)

- How to Profit From Stock Buybacks (Barron’s)

- 4 Big Dividend Oil Stocks to Buy Now With Crude Down Almost 20% in January (24/7 Wall Street)

- House Democrats call for $760 billion in infrastructure spending over five years (Reuters)

- Johnson & Johnson starts developing vaccine for coronavirus (Yahoo! Finance)

- USMCA to create 600,000 jobs, US Energy Secretary tells FOX Business (Fox Business)

- Red Flags in Alluring Private Equity Track Records (Institutional Investor)

- More affordable iPhone 11 is unlikely star of Apple earnings (Financial Times)

- Boeing Just Reported a Massive Loss. Why Its Stock Is Gaining. (Barron’s)

Be in the know. 10 key reads for Saturday…

- How the stock market has performed during past viral outbreaks, as epidemic locks down 16 Chinese cities (MarketWatch)

- Sam Zell — Strategies for High-Stakes Investing, Dealmaking, and Grave Dancing (#407) (Tim Ferriss)

- Sports Gambling Will Be Huge. Buy These Stocks. (Barron’s)

- Stocks Catch a Cold After Fed Stops Expanding Its Balance Sheet (Barron’s)

- Porsche’s first Super Bowl ad since 1997 features car chase with its all-electric Taycan (CNBC)

- EIA expects U.S. net natural gas exports to almost double by 2021 (EIA)

- Life is Short (safalniveshak)

- Seth Klarman passionately defends value investing and said its time is coming again soon (CNBC)

- You Can Buy Into These Sports Teams. But the Valuations Are Lofty. (Barron’s)

- Opinion: Here’s what the Super Bowl ‘Predictor’ sees for stocks in 2020, depending on whether the 49ers or the Chiefs win (MarketWatch)

Be in the know. 5 key reads for Friday…

- Peak Permian Oil Output Is Closer Than You Think, Investor Says (Yahoo! Finance)

- Gap Stock Is Soaring After Company Scraps Old Navy Spinoff (Barron’s)

- TikTok Revenues Are Exploding (Barron’s)

- The U.S. Natural Gas Boom Is On Its Last Legs (Yahoo! Finance)

- Here Are the Emerging-Market Bonds to Watch If Oil Spikes Again (Barron’s)