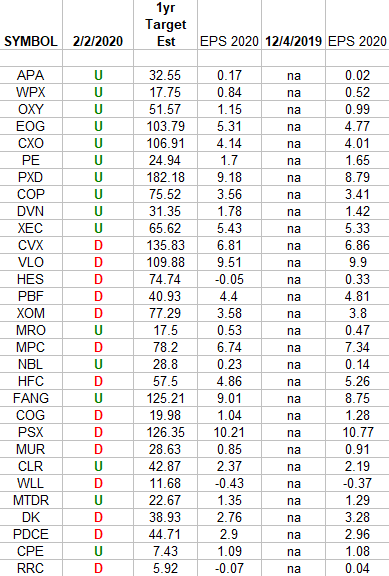

Thank you to Julie Hyman @juleshyman Adam Shapiro @Ajshaps and Pamela Mitchell (producer) for having me on @YahooFinance this morning to talk #energy $XOP $XLE

Thank you to .@juleshyman .@Ajshaps and Pamela Mitchell (producer) for having me on .@YahooFinance this morning to talk #energy $XOP $XLE https://t.co/8kZ40RVkZL

— Thomas J. Hayes (@HedgeFundTips) February 5, 2020