- Tiger Cubs, the Next Generation: Meet Chase Coleman’s Proteges (Bloomberg)

- 3 Pieces to the 2020 Earnings Puzzle (and Sentiment Results) (Zero Hedge)

- Adding a Chronograph Makes This Already-Great Watch Even Better (Bloomberg)

- Exclusive: U.S. pushing India to buy $5-6 billion more farm goods to seal trade deal – sources (Reuters)

- European stocks climb as economic data fuels growth hopes (Reuters)

- 3 Oil and Gas Equipment Stocks in Possible New Uptrend (Investopedia)

- Legendary investor Bill Miller scored 120% returns though he did ‘nothing’ in the last months of 2019 (Business Insider)

- Trump is studying ‘numerous’ middle-class tax cut plans ahead of election, White House says (Business Insider)

- If You Missed Out on Tesla, Consider This Chinese Car Maker (Barron’s)

- Vietnam’s Economy Is Booming. Just Don’t Expect to Find Its Stocks In Your Emerging Markets Fund. (Barron’s)

- Help! I’m Trapped Inside TikTok and I Can’t Get Out (Wall Street Journal)

- Activist Investors and the Art of the Deal (Wall Street Journal)

Tag: Oil

Be in the know. 6 key reads for Martin Luther King Day…

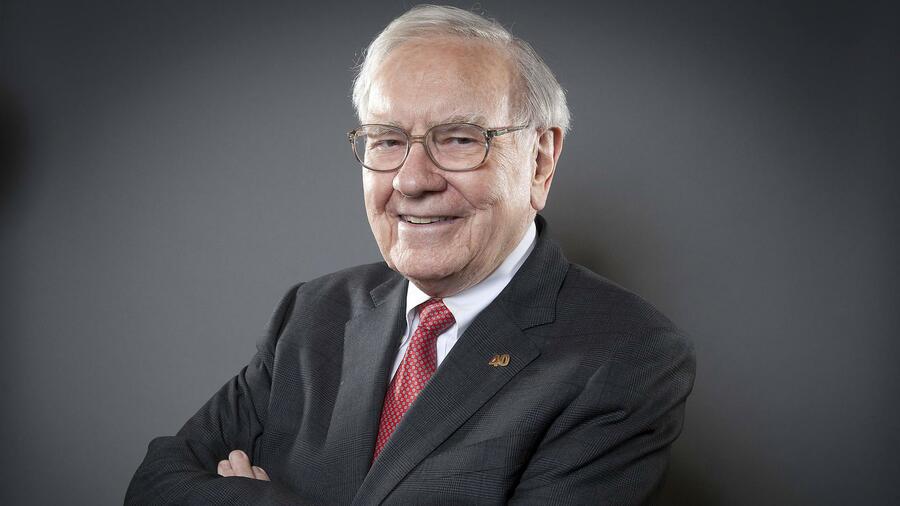

- ‘Took me right out of my seat’ — Warren Buffett was inspired by a Martin Luther King Jr. speech to push for civil rights (Business Insider)

- Hedge-Fund Titans Hohn, Mandel Lead $178 Billion Year of Profits (Bloomberg)

- Hedge Funds That Bet on Big Trends Are Trying to Bounce Back (Bloomberg)

- OPEC oil production cuts likely to continue for the ‘whole of 2020’: Wood Mackenzie (CNBC)

- Oil climbs above $65 after an escalation in Libya’s civil war forces the shutdown of 2 major oilfields (Business Insider)

- British Pound Shows Signs of Strength Before Brexit (Bloomberg)

Be in the know. 15 key reads for Saturday…

- Tepper, Druckenmiller Say They’re ‘Riding’ Market Rally (Bloomberg)

- OPEC secretary general says oil demand has ‘upside potential’ (CNBC)

- Tesla and 25 Other Stock Picks from Barron’s Roundtable Panelists (Barron’s)

- Here’s what Elon Musk said when Jack Dorsey asked him how to fix Twitter (CNN Business)

- Netflix earnings, Trump speaks at Davos, IBM reports: 3 things to watch for on Tuesday (CNBC)

- Ex-Millennium Trader Quadruples Hedge Fund Assets to $1 Billion (Bloomberg)

- Emerging Markets Could Be Poised to Outperform U.S. Stocks for a Very Long Time (Barron’s)

- Barron’s Beat the Stock Market Last Year. Here’s How We Did It. (Barron’s)

- These Leaders and CEOs Will Be in Davos Next Week. What They Say May Move Markets. (Barron’s)

- Pharma and Biotech Aren’t Worried About Democrats’ Attacks Against Drugmakers (Barron’s)

- Oil’s Minnows Need to Start Earning Their Keep (Bloomberg)

- Intel earnings: How Intel figures in data-center recovery is key (MarketWatch)

- Can HBO Maintain its Dominance in the Streaming Wars? (Vanity Fair)

- Bob Iger — CEO and Chairman of Disney (#406) (Tim Ferriss Show)

- Value Investing Isn’t Dead Yet, Research Associates Argues (Institutional Investor)

Podcast – Hedge Fund Tips with Tom Hayes – Episode 3

Article referenced in podcast above:

“Are you tired of winning yet?” Stock Market (and Sentiment Results)…

Be in the know. 5 key reads for Friday…

- Peak Permian Oil Output Is Closer Than You Think, Investor Says (Yahoo! Finance)

- Gap Stock Is Soaring After Company Scraps Old Navy Spinoff (Barron’s)

- TikTok Revenues Are Exploding (Barron’s)

- The U.S. Natural Gas Boom Is On Its Last Legs (Yahoo! Finance)

- Here Are the Emerging-Market Bonds to Watch If Oil Spikes Again (Barron’s)

“Are you tired of winning yet?” Stock Market (and Sentiment Results)…

James Branch Cabell, “The optimist claims we live in the best of all possible worlds, and the pessimist fears this is true.”

In many of his campaign rallies, President Trump said, “you’re going to start winning so much that you’re going to beg that I can’t take it anymore!”

Well that was quite a tall order, but regardless of what side of the political spectrum you lie on, Wednesday’s “Phase 1” deal was a big win for the U.S., for China, and the rest of the world. Continue reading ““Are you tired of winning yet?” Stock Market (and Sentiment Results)…”

Where is money flowing today?

Data Source: Finviz

Be in the know. 12 key reads for Tuesday…

- Oil Companies Are Finally Pumping Out Cash. That’s Good News for Their Stocks. (Barron’s)

- Buy Occidental Petroleum Stock, Morgan Stanley Says. Its Dividend Is ‘Best-In-Class.’ (Barron’s)

- JPMorgan posts record profit in strong start to US earnings season (Financial Times)

- Citigroup earnings beat expectations on 49% fixed-income trading surge (CNBC)

- For Howard Marks, Investing Is Like a Game (Institutional Investor)

- Hedge fund puts $550m into technology stock option financing (Financial Times)

- EXCLUSIVE: JPMorgan CEO Jamie Dimon praises ‘phase one’ US-China trade deal (Fox Business)

- 2 GM engineers arrested after 100-mph Kentucky joyride in new Corvettes (USA Today)

- Big Commitments for China Energy/Ag Buys in Phase 1 Trade Deal (Reuters)

- Worry over ‘Japanification’ of the economy is overblown (Barron’s)

- Warren Buffett Should Buy FedEx. It’s Cheap and Elephant-Sized. (Barron’s)

- Xi Strikes Optimistic Tone After Riding Out Trade War With Trump (Bloomberg)

Be in the know. 20 key reads for Saturday…

- Biotech Looks for Fireworks in First Quarter to Regain Momentum (Bloomberg)

- Bet on the Big Banks — and Bank of America (Barron’s)

- Davos? Meet Me at Butternut Instead. (Barron’s)

- A New Hot Spot for Oil Could Boost These 4 Companies (Barron’s)

- Davos? Meet Me at Butternut Instead. (Barron’s)

- Biogen Awaits a Decision on a Key Patent. At Risk Is Its Biggest Drug (Barron’s)

- Trump Allies Explore Buyout of Conservative Channel Seeking to Compete With Fox News (Wall Street Journal)

- New Sanctions Power Could Squeeze Remaining Iranian Trade Channels (Wall Street Journal)

- The Internet of Things Is Changing the World (Wall Street Journal)

- Trump Says Iran Had Planned to Attack Four U.S. Embassies (Bloomberg)

- Hummer is back as GM revives name for electric pickup (USA Today)

- S&P 5,000? Why one fund manager says that milestone may be reached sooner than you would expect (MarketWatch)

- These were the most talked-about products at CES (CNN Business)

- Mark Zuckerberg Says He Hunts Wild Boar With a Bow and Arrow (Futurism)

- Penn Jillette on Magic, Losing 100+ Pounds, and Weaponizing Kindness (#405) (Podcast)

- The Four Traits of Successful Asset Managers (Institutional Investor)

- Gradual Improvements Redux (theirrelevantinvestor)

- Client for Life (The Reformed Broker)

- Is Vulnerability a Choice? (Farnam Street)

- Eight lessons from market history (Evidence Investor)

HFT VideoCast – Stock Market Commentary and Weekly Recap – Episode 11

Article referenced in VideoCast above:

The CAKE “Short Skirt, Long Jacket” Stock Market (and Sentiment Results)

In this episode we cover:

- Jobs Report

- Rig Count

- Harold Hamm on Oil Prices

- General stock market commentary.

- Hemline Indicator

- Valueline Geometric Index – Long Term Implications

- Positioning and sentiment.

- Increased Guidance on tap?

- Fed Liquidity.

- AAII sentiment.

- NAAIM positioning.

- Earnings by Sectors: Energy, Gold Miners, REITs

- S&P and Euro Stoxx 600 earnings.

- Where to find value? What’s Cheap?

- India Small Caps

- Commodities/CRB

- Exploration & Production

- Servicers?