Article referenced in VideoCast above:

The Carly Pearce “I Hope You’re Happy Now” Stock Market (and Sentiment Results)…

Article referenced in VideoCast above:

The Carly Pearce “I Hope You’re Happy Now” Stock Market (and Sentiment Results)…

Article referenced in podcast above:

The Dua Lipa “Did a full 180” Stock Market (and Sentiment Results)…

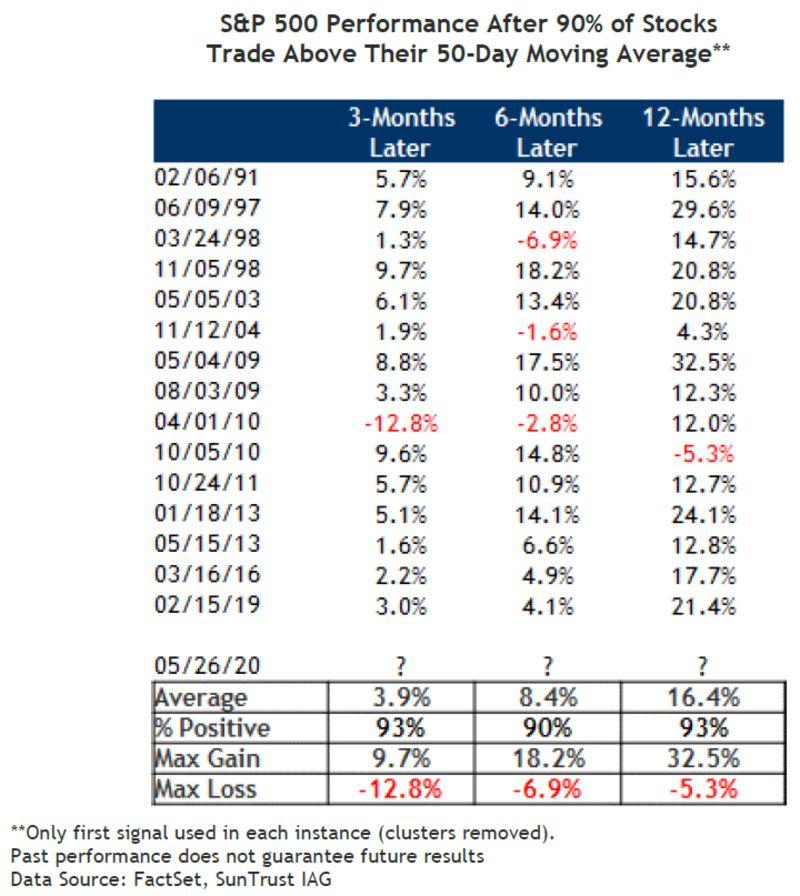

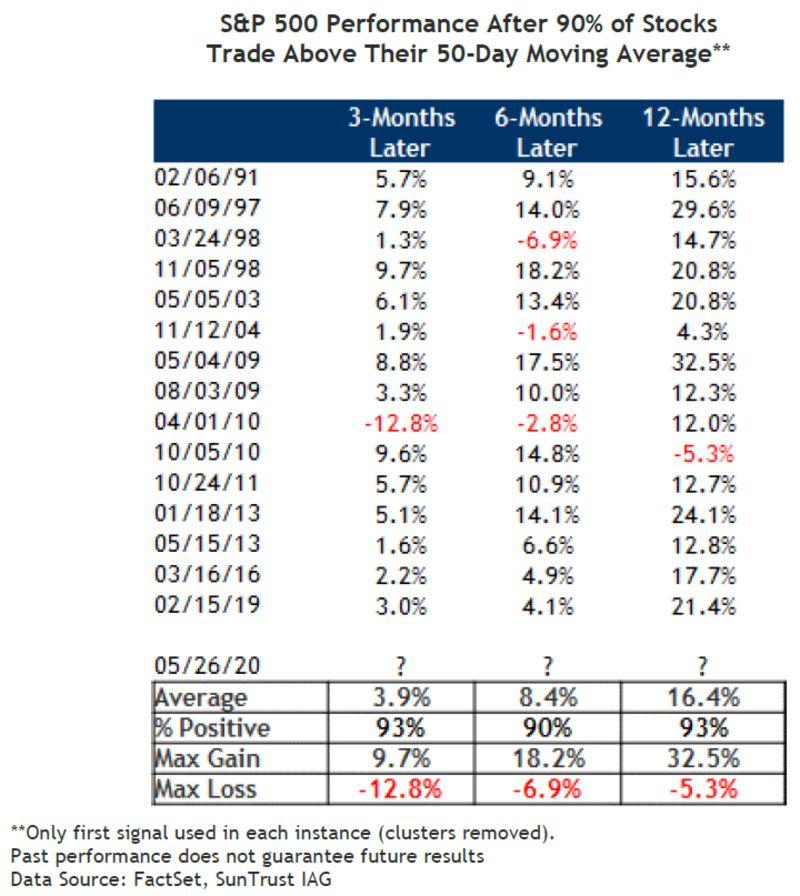

Added Data Table Referenced in this Episode:

Article referenced in podcast above:

The Dua Lipa “Did a full 180” Stock Market (and Sentiment Results)…

Added Data Table Referenced in this Episode:

Article referenced in podcast above:

The Chainsmokers “Don’t Let Me Down” Stock Market (and Sentiment Results)…