- Investors Got the Fed’s Rate Cut Wrong. ‘Putting Some Money to Work Isn’t a Bad Idea.’ (Barron’s)

- The Fed Just Cut Interest Rates. Get Ready to Refinance Your Mortgage. (Barron’s)

- This $5 Billion Stock Fund’s Manager Thinks Like a Founder. It’s Working. (Barron’s)

- Saudis Want OPEC+ to Cut More Than 1 Million Barrels a Day (Bloomberg)

- Here’s how billionaire investor Howard Marks is telling clients to ride out coronavirus volatility (MarketWatch)

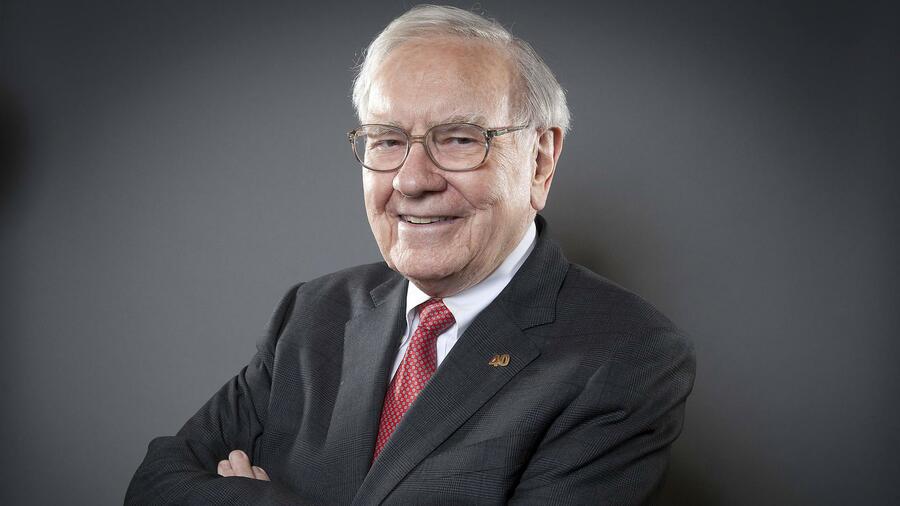

- Warren Buffett Can’t Resist This Bargain As He Buys Amid Coronavirus Correction (Investor’s)

- Fed rate cut to boost homebuyers’ spending power (Fox Business)

- iPhone Maker Foxconn Expects 15% Q1 Revenue Hit From Coronavirus, Says Production Rebounding (Benzinga)

- US Fed’s coronavirus rate cut is first move in a dance with markets (Financial Times)

- Private payrolls up 183,000 as hiring shows no signs of coronavirus scare (CNBC)

Tag: Oil

Be in the know. 10 key reads for Tuesday…

- Chevron to Give Up to $80 Billion to Investors Over 5 Years (Bloomberg)

- OPEC’s oil cut proposal would boost price to $60 a barrel – Russia’s Lukoil (Yahoo! Finance)

- 4 Stocks Yielding 6% or More to Buy Now as Yields Plunge to Historic Lows (24/7 Wall Street)

- Jack Welch, G.E. Chief Who Became a Business Superstar, Dies at 84 (New York Times)

- OPEC Tries to Head Off Oil Glut as Coronavirus Saps Demand (New York Times)

- Luke Bryan gets into the beer game with new Two Lane American Golden Lager (USA Today)

- Gilead Sciences to Buy Forty Seven for $4.9 Billion (Wall Street Journal)

- G-7 Pledges to Fight Virus, Stops Short of Specific Action (Bloomberg)

- Executives are buying their own companies’ beaten-down stocks — here are nine with large purchases (MarketWatch)

- Pfizer Announced a Plan to Identify a Possible Coronavirus Treatment (MarketWatch)

Be in the know. 17 key reads for Monday…

1. Didn’t Sell Before the Big Plunge? Here’s the Good News. (Barron’s)

2. Why U.S. Markets Could Recover Quickly From Coronavirus Hit (Barron’s)

3. Energy Stocks Have Plunged. Here’s an ETF to Play a Rebound. (Barron’s)

4. A China Expert Explains Why Coronavirus Fears Are Overblown (Barron’s)

5. Immigration Is Helping Shield Canada From Global Slowdown (Wall Street Journal)

6. Archery Dodgeball Delivers Exactly What It Promises (Wall Street Journal)

7. Wall Street Has Lost Its Nerve. What Will It Take to Get It Back? (New York Times)

8. Central Banks Pledge to Ensure Stability as OECD Sounds Alarm (Bloomberg)

9. Boeing Goes on Hiring Spree in High-Stakes Gamble on 737 Max (Bloomberg)

10. Italy Shows How to Tackle the Coronavirus Impact (Bloomberg)

11. Investors cannot sit on the fence after coronavirus stock rout — it’s time to buy stocks, Bernstein says (MarketWatch)

12. Surgeon general wants you to stop buying masks to protect yourself from coronavirus: ‘They are not effective’ (MarketWatch)

13. ‘Once you really hate yourself, buy lower than you thought was possible’ — history suggests this approach pays off (MarketWatch)

14. Oil rebounds sharply as traders pin hopes on OPEC cuts this week (MarketWatch)

15. Italy unveils €3.6bn stimulus to tackle coronavirus (Financial Times)

16. Energy Stocks Kinder Morgan, Energy Transfer See Big Insider Buys (Yahoo! Finance)

17. Market Technicians Think the Selloff Isn’t Over (Wall Street Journal)

Be in the know. 25 key reads for Sunday…

- Singapore Emerges as Litmus Test for Coronavirus Containment by Philip Heijmans (Bloomberg)

- What will ‘Super Tuesday’ mean for US investors? (Financial Times)

- Here’s A List Of Who Was Puking Stocks This Week (ZeroHedge)

- Jim Rogers Says Investors Should Buy Now! (The Street)

- Typical March Trading: Slow Start, Mid-Month Surge & Uninspiring Finish (Almanac Trader)

- No, You DO NOT Need Face Masks For Coronavirus—They Might Increase Your Infection Risk (Forbes)

- Daily Oversold Readings Could Support Rebound (John Murphy)

- Stock market coronavirus drop was painful, but buying opportunities may arise (New York Post)

- ‘SNL’ Cold Open (Daily Beast)

- 2020 Corvette Stingray: First Drive Review (Maxim)

- Danielle DiMartino Booth on the Federal Reserve (Podcast) (Bloomberg)

- Options markets point to a potential bounce for U.S. stocks (Reuters)

- Apple glasses could solve one of VR’s biggest issues, patent suggests (techradar)

- Fox Business Skips Commercial Breaks to Cover Coronavirus (But Still Has a Sponsor) (Variety)

- Phil Knight on the Surprising Origin Story of Nike’s Name and Swoosh (Medium)

- The Rise And Fall (And Rise?) Of NASCAR (NPR Planet Money)

- What Biden’s Big South Carolina Win Might Mean For Sanders (FiveThirtyEight)

- Inside The Crazy Story of Iraq’s Debt (Podcast) (Bloomberg)

- Powell: Fed poised to act if needed on ‘evolving’ virus risk (Pensions & Investments)

- A Morgan Stanley Manager Who Sold Before Rout Says He’s Buying (Bloomberg)

- WHO chief on coronavirus: Global markets ‘should calm down and try to see the reality’ (CNBC)

- OPEC may fight coronavirus price slide with deeper oil supply cuts (Fox Business)

- Thomas Lee, founder of Fundstrat Global Advisors is forecasting a “V”-shaped, or sharp, recovery for the market (MarketWatch)

- The Mystery of What Drives Bob Iger (Wall Street Journal)

- Jim Cramer: I Don’t Know Where It Will Bottom, I Do Know What to Buy and Sell (TheStreet)

Be in the know. 10 key reads for Tuesday…

- Libya Oil Shut-In Cost Nation Over $2 Billion Since January (Bloomberg)

- Gilead’s Drug Leads Global Race for Coronavirus Treatment (Bloomberg)

- No OPEC Decision Yet on Oil Cuts, Saudi Energy Minister Says (Bloomberg)

- Breaking Down the Buffett Formula: Berkshire Hathaway’s Returns by the Numbers (Barron’s)

- He Went to a Hockey Game Expecting Dinner. He Wound Up Getting the Win. (Wall Street Journal)

- Supreme Court Seems Ready to Back Pipeline Across Appalachian Trail (New York Times)

- OPEC hasn’t run out of ideas, Saudi energy minister insists as oil prices slump (CNBC)

- Natural gas is crushing wind and solar power — Why isn’t anyone talking about it? (Fox Business)

- Conspiracy Theorists Ask ‘Who Owns the New York Fed?’ Here’s the Answer. (Institutional Investor)

- Krispy Kreme launches ‘national doughnut delivery’ starting Feb. 29 (USA Today)

Podcast – Hedge Fund Tips with Tom Hayes – Episode 8

Article referenced in podcast above:

Unusual Options Activity – Occidental Petroleum Corporation (OXY)

Data Source: barchart

Today some institution(s)/fund(s) purchased 10,614 contracts of Sept $42.5-47.5 strike calls (or the right to buy 1,061,400 shares of Occidental Petroleum Corporation (OXY) at ($42.5-47.5). Continue reading “Unusual Options Activity – Occidental Petroleum Corporation (OXY)”

Be in the know. 20 key reads for Wednesday…

- Leon Cooperman says the market has become too pessimistic on energy stocks, too euphoric on Tesla (CNBC)

- Junk bond king’s pardon ‘is spectacular’ for Wall Street (Financial Times)

- Record Wall Street rally triggers boom in options (Financial Times)

- Q4 13F Roundup: How Buffett, Einhorn, Ackman And Others Adjusted Their Portfolios (Benzinga)

- The Michael Milken Project (Institutional Investor)

- ‘Very Big Trade Deal’ With India In Progress Ahead Of Visit, Trump Says (Benzinga)

- Building Permits Surge To 13 Year Highs Thanks To Warm Weather In Northeast (ZeroHedge)

- China’s virus-hit industrial cities start to ease curbs, restore production (Reuters)

- Oil up on slowing pace of coronavirus, Venezuela sanctions (Reuters)

- It’s Michael Milken’s World. The Rest of Us Just Live in It. (Barron’s)

- Hedge Funds Keep Backpedaling From S&P 500’s Biggest Winners (Bloomberg)

- What Warren Buffett Might Tell Investors in His Annual Letter This Week (Barron’s)

- Gilead’s Coronavirus Drug Trial Slowed by Lack of Eligible Recruits (Wall Street Journal)

- Fed’s Balance Sheet Dominates What to Watch For in FOMC Minutes (Bloomberg)

- Why Teva’s Grand Turnaround Could Just Be Getting Started (24/7 Wall Street)

- Pound Climbs After Inflation Tempers Risk of a Rate Cut (Bloomberg)

- SoftBank plans to borrow up to $4.5 billion using its domestic telecom’s shares as collateral. (Business Insider)

- Billionaire investor Leon Cooperman ramps up his criticism of Bernie Sanders, calling him a ‘bigger threat’ to the stock market than coronavirus (Business Insider)

- February Bank of America Global Fund Manager Survey Results (Summary) (Hedge Fund Tips)

- It’s never been this hard for companies to find qualified workers (CNBC)

Podcast – Hedge Fund Tips with Tom Hayes – Episode 7

Article referenced in podcast above:

The Chris Janson “Good Vibes” Stock Market (and Sentiment Results)…

Be in the know. 12 key reads for Friday…

- Top financiers want Biden to drop out so Bloomberg can win: ’He has no chance’ (Fox Business)

- Oil prices steady but set for weekly gain on supply cut optimism (Business Insider)

- How a Small-Cap Fund Finds Exceptional Growth Overseas (Barron’s)

- Labor Force Participation Rate Mystery: Why Have So Many Americans Stopped Working? (Investor’s Business Daily)

- Veteran strategist eyes health care and financials in anticipation of ‘choppy and frustrating’ markets (MarketWatch)

- FC’s celebrity investors have a chokehold on $300M dividend (New York Post)

- Judy Shelton, Trump’s Fed Nominee, Faces Bipartisan Skepticism (New York Times)

- Doubting America Can Cost You a Lot of Money (Bloomberg)

- EXCLUSIVE: Kudlow reveals when middle class can expect ‘tax cuts 2.0’ (Fox Business)

- Investor complacency sets in while coronavirus spreads (Financial Times)

- Warren Buffett loves using Valentine’s Day to explain why See’s Candies is his ‘dream business’ (Business Insider)

- Value Investing’s Time to Shine Again Is Approaching (Bloomberg)