- Eight Stocks Wall Street Loves for Valentine’s Day (Barron’s)

- What Denny’s CEO Tells Himself In The Mirror Every Day (Investor’s Business Daily)

- Charlie Munger Talks About Chinese Companies, Poor Investment Choices, And Why He Would Never Buy Tesla Stock (Benzinga)

- The Chris Janson “Good Vibes” Stock Market (and Sentiment Results)… (ZeroHedge)

- Kraft Heinz’s Earnings Were Only OK. Why Investors Should Be Happy. (Barron’s)

- Value-Oriented Dividend Stocks Will Pay Investors Who Wait, Strategist Says (Barron’s)

- Time for a cut? OPEC Sees Coronavirus Weighing Heavily on Oil Demand (Wall Street Journal)

- Hedging Strategy Likely Exacerbated Oil’s Fall (Wall Street Journal)

- Trump’s Rosy Economic Growth Forecast Isn’t Crazy (Bloomberg)

- 5 Contrarian Dividend Stocks to Buy as Market Rips to All-Time Highs (24/7 Wall Street)

Tag: Oil

Be in the know. 5 key reads for Wednesday…

- Oil Extends Rally Above $50 Amid Signs Virus Spread Is Easing (Bloomberg)

- Ex-Goldman CEO Lloyd Blankfein laid into Bernie Sanders after his New Hampshire win, saying he’ll wreck the economy and let Russia ‘screw up the US.’ (Business Insider)

- U.S. Home-Refinancing Applications Hit Highest Level Since 2013 (Bloomberg)

- Steve Cohen Pulled Down at Least $1.3 Billion in 2019 (Institutional Investor)

- Small-Cap Health Stocks Stand Out in 2020 (Wall Street Journal)

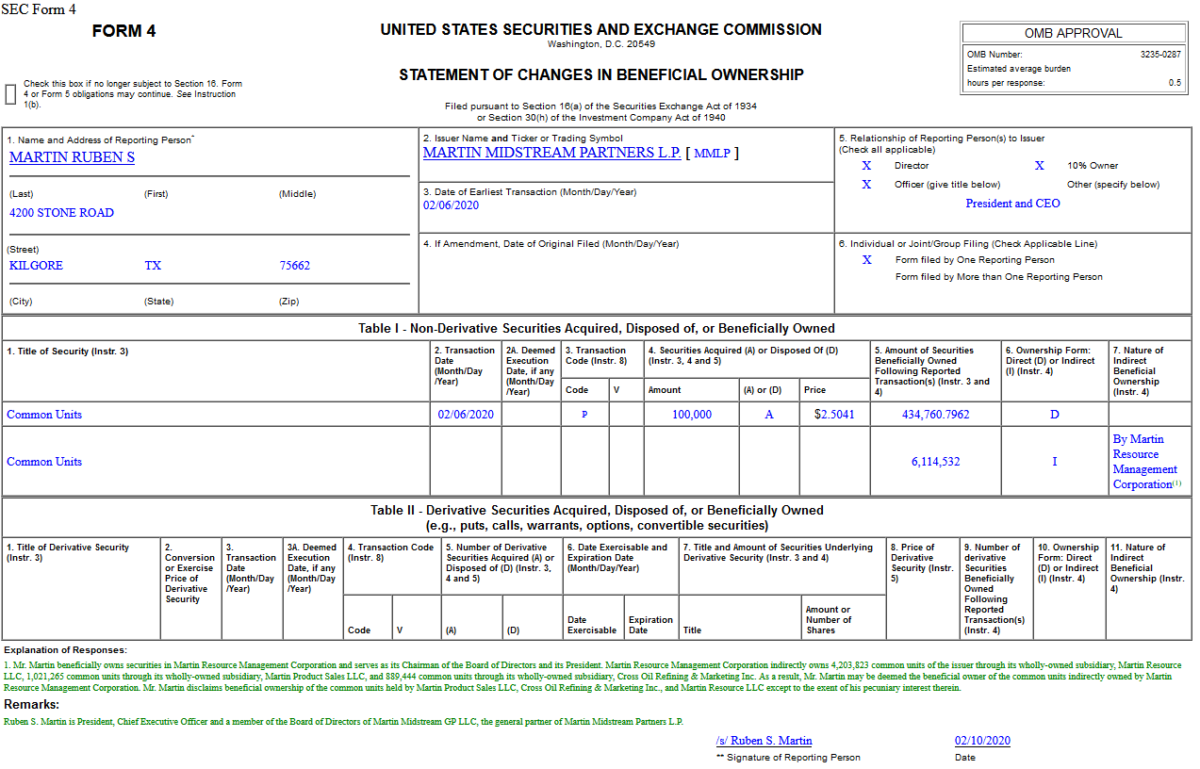

Insider Buying in Martin Midstream Partners L.P. (MMLP)

On Feb 6, 2020, Ruben Martin – President and CEO of Martin Midstream Partners L.P. (MMLP) – purchased 100,000 shares of MMLP at $2.50. His out of pocket cost was $250,410.

Be in the know. 10 key reads for Monday…

- Coronavirus sparks hectic trading in search of treatment (Financial Times)

- Barron’s Picks And Pans: GM, Kraft Heinz, Tesla, Under Armour And More (Benzinga)

- Elliott Management Raises SoftBank Stake, Pushes For Buybacks, Says Market ‘Undervalues’ Portfolio (Benzinga)

- Some Gas Left in the Tank for the Stock Market Rally? (ZeroHedge)

- Goldman Sachs says impact of coronavirus will be ‘limited,’ and these are the stocks to buy if it’s right (MarketWatch)

- Modi’s India is in a slump, but some stocks are worth buying (Barron’s)

- ‘Swing for the fences’: Warren Buffett’s advice headlines Bill and Melinda Gates Foundation’s 20th annual letter (Business Insider)

- FedEx (FDX) Could Save $300M Per Year by Shifting Traffic Through the Ground Network – Bernstein (StreetInsider)

- Simon Property Group Announces $3.6B Acquisition Of Taubman Group (Benzinga)

- Can Opec stop the slide in the oil price? (Financial Times)

Be in the know. 12 key reads for Saturday…

- Energy Stocks Might Finally Have Hit Bottom (Barron’s)

- Americans Joining Workforce at Record Rate (Wall Street Journal)

- Mike Bloomberg Wants to Build an Influencer Army (Vanity Fair)

- Moore Capital ‘Didn’t Try That Hard’ at Succession (Institutional Investor)

- 20VC: Oaktree Capital’s Howard Marks on The Most Important Skill An Investor Can Have, The Right Way To Think About Price Sensitivity & Where Are We At Today; Take More Risk or Less? (20 min VC)

- How One Value Investor Is Weathering the Strategy’s Underperformance (Institutional Investor)

- As OPEC+ Reels From China Virus, Libya Threatens Knockout Punch (Bloomberg)

- AbbVie Jumps on Strong Earnings. That’s Not the Only Reason. (Barron’s)

- The Mormon Church Amassed $100 Billion. It Was the Best-Kept Secret in the Investment World. (Wall Street Journal)

- FedEx to Start Mixing Express and Ground Operations (Wall Street Journal)

- Week Before Presidents’ Day Bullish since 1990 (Almanac Trader)

- 2020 Ford GT Adds Power And Turns Heads With Stunning ‘Liquid Carbon’ Edition (Maxim)

HFT VideoCast – Stock Market Commentary and Weekly Recap – Episode 16

Article referenced in VideoCast above:

The end of oil, or just the beginning? (and Sentiment Results)

Podcast – Hedge Fund Tips with Tom Hayes – Episode 6

Article referenced in podcast above:

The end of oil, or just the beginning? (and Sentiment Results)

Be in the know. 12 key reads for Friday…

- Kraft Heinz Could Have Bad News. It’s Time to Buy the Stock. (Barron’s)

- The No. 1 Biotech Stock Just Squashed Earnings Views — Here’s Why (Investor’s Business Daily)

- Hedge Fund and Insider Trading News: Steve Cohen, Bill Ackman, Laurion Capital, Alden Global Capital, Black Diamond Therapeutics Inc (BDTX), SkyWest, Inc. (SKYW), and More (Insider Monkey)

- Trump, Xi Reaffirm Commitment to Phase-One Trade Deal (Bloomberg)

- The ‘Dividend Aristocrats’ Add 7 New Members (Barron’s)

- Honeywell’s Chief Technology Officer Explains the Significance of 5G (Barron’s)

- Elliott Management amasses $2.5B stake in bruised SoftBank (New York Post)

- U.S. Jobs Top Estimates With 225,000 Gain, Wages Accelerate (Bloomberg)

- The Big Dirty Secret Behind Wind Power (Bloomberg)

- Encouraging banks to tap Fed discount window could prevent another repo market freeze, says Quarles (MarketWatch)

- Peak Shale Will Send Oil Prices Sky High (OilPrice)

- Natural Gas: Capital Retreat To Send Prices 50% Higher (Seeking Alpha)

Be in the know. 8 key reads for Thursday…

- The end of oil, or just the beginning? (and Sentiment Results) (ZeroHedge)

- China Just Cut Tariffs on U.S. Goods. Here Are the Products That Benefit. (Barron’s)

- U.S. oil rises as OPEC+ committee calls for deeper cuts to global output amid coronavirus (MarketWatch)

- U.S. Trade Deficit Narrows for First Time in Six Years (Wall Street Journal)

- Adopting a dog? Coors Light offering $100 toward dog adoption fees for Valentine’s Day (USA Today)

- Mattress firm Casper receives sleepy IPO reception (Financial Times)

- China cuts Oil tariffs in half (Reuters)

- Exxon Mobil Won’t Cut Its Dividend. Here’s Why. (Yahoo! Finance)

The end of oil, or just the beginning? (and Sentiment Results)

In the past week, sentiment on the Energy Sector has sunk to an all-time low (despite having the highest estimated earnings growth of any sector – for 2020). Several prominent market figures have even called for the end of the sector.

Mark Twain once said, “Reports of my death have been greatly exaggerated.”

Continue reading “The end of oil, or just the beginning? (and Sentiment Results)”