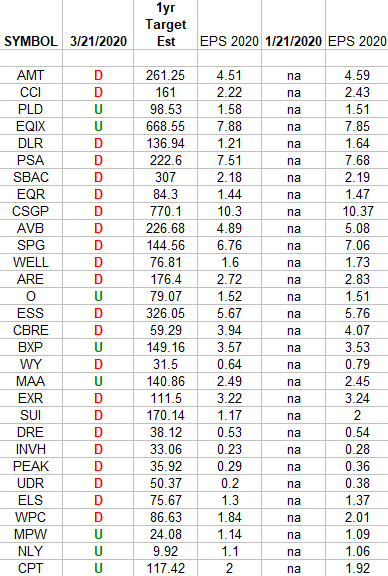

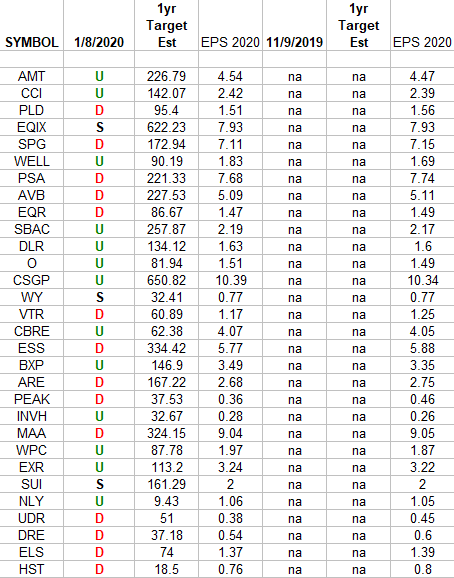

In the spreadsheet above I have tracked the earnings estimates for the Real Estate (REIT) Sector ETF (IYR) top 30 weighted stocks. Continue reading “Real Estate Earnings Estimates/Revisions”

Tag: REIT

Be in the know. 15 key reads for Saturday…

- 5 Blue Chip Stocks in Wall Street’s Penalty Box Have Massive Upside Potential Bottom ofTop of FormBottom of Form (24/7 Wall Street)

- Warren Buffett Is One of a Kind. What That Will Mean for Berkshire Hathaway When He’s Gone. (Barron’s)

- Warren Buffett more than doubled its investment in Occidental Petroleum (OXY) In Q4 (MarketWatch)

- Musk’s Boring Co. Celebrates Breakthrough at Las Vegas Tunnel (Bloomberg)

- Boeing Argues It Doesn’t Need to Move 737 Max Wiring Bundles (Bloomberg)

- Short-Sellers Give Oil a Break Following Coronavirus Concerns (Bloomberg)

- Kraft Heinz Stockholders Find Good News Can Be Bad News (Barron’s)

- Hedge-Fund Investor Dan Loeb Bought Stock in Amazon and 2 More Companies (Barron’s)

- Consumer sentiment hits highest level since 2018 despite coronavirus outbreak (Business Insider)

- White House considering tax incentive for more Americans to buy stocks, sources say (CNBC)

- Stocks are near record highs, but people are still not investing (CNN Business)

- Hedge Fund and Insider Trading News: Ken Griffin, Dan Loeb, Ray Dalio, Davidson Kempner, PCB Bancorp (PCB), Taylor Morrison Home Corp (TMHC), and More (Insider Monkey)

- Hedge Fund ‘Cubs’ Share Information — And Alpha (Institutional Investor)

- An Astronaut’s Guide to Mental Models (Farnam Street)

- Brookfield: inside the $500bn secretive investment firm (Financial Times)

HFT VideoCast – Stock Market Commentary and Weekly Recap – Episode 11

Article referenced in VideoCast above:

The CAKE “Short Skirt, Long Jacket” Stock Market (and Sentiment Results)

In this episode we cover:

- Jobs Report

- Rig Count

- Harold Hamm on Oil Prices

- General stock market commentary.

- Hemline Indicator

- Valueline Geometric Index – Long Term Implications

- Positioning and sentiment.

- Increased Guidance on tap?

- Fed Liquidity.

- AAII sentiment.

- NAAIM positioning.

- Earnings by Sectors: Energy, Gold Miners, REITs

- S&P and Euro Stoxx 600 earnings.

- Where to find value? What’s Cheap?

- India Small Caps

- Commodities/CRB

- Exploration & Production

- Servicers?

Podcast – Hedge Fund Tips with Tom Hayes – Episode 2

Article referenced in podcast above:

The CAKE “Short Skirt, Long Jacket” Stock Market (and Sentiment Results)

In this episode we cover:

- Jobs Report

- Rig Count

- Harold Hamm on Oil Prices

- General stock market commentary.

- Hemline Indicator

- Valueline Geometric Index – Long Term Implications

- Positioning and sentiment.

- Increased Guidance on tap?

- Fed Liquidity.

- AAII sentiment.

- NAAIM positioning.

- Earnings by Sectors: Energy, Gold Miners, REITs

- S&P and Euro Stoxx 600 earnings.

- Where to find value? What’s Cheap?

- India Small Caps

- Commodities/CRB

- Exploration & Production

- Servicers?

Real Estate Earnings Estimates/Revisions

In the spreadsheet above I have tracked the earnings estimates for the Real Estate (REIT) Sector ETF (IYR) top 30 weighted stocks. Continue reading “Real Estate Earnings Estimates/Revisions”

HFT VideoCast – Stock Market Commentary and Weekly Recap – Episode 10

Article referenced in VideoCast above:

The Earth, Wind & Fire “Shining Star” Stock Market (and Sentiment Results)

In this episode we cover:

- general stock market commentary

- positioning and sentiment

- CNBC and Fox Business quotes from this week

- Increased Guidance on tap?

- Earnings by Sectors

- Energy E&P thesis

- CEO/CFO sentiment

- Fed Liquidity

- AAII sentiment

- NAAIM positioning

- S&P and Euro Stoxx 600 earnings

- Dogs of Dow

- Transports

- Jude Clemente Energy Article in Forbes

- Rig count

Podcast – Hedge Fund Tips with Tom Hayes – Episode 1

Article referenced in podcast above:

The Earth, Wind & Fire “Shining Star” Stock Market (and Sentiment Results)

In this episode we cover:

- general stock market commentary

- positioning and sentiment

- CNBC and Fox Business quotes from this week

- Increased Guidance on tap?

- Earnings by Sectors

- Energy E&P thesis

- CEO/CFO sentiment

- Fed Liquidity

- AAII sentiment

- NAAIM positioning

- S&P and Euro Stoxx 600 earnings

- Dogs of Dow

- Transports

- Jude Clemente Energy Article in Forbes

- Rig count

Where is money flowing today?

Data Source: FinViz

Be in the know. 15 key reads for Thursday…

- China Moves to Steady Its Slowing Economic Growth (New York Times)

- The Earth, Wind & Fire “Shining Star” Stock Market (and Sentiment Results) (ZeroHedge)

- These 6 charts compare the US and China economies (CNBC)

- Irrational exuberance? Why last year’s stellar returns may have been a reversal of ‘excessive pessimism’ (MarketWatch)

- Goldman Sachs Was the Worst Dow Stock of 2018. It Was One of the Best in 2019. (Barron’s)

- FedEx Stock Ended 2019 With a Loss. One Director Bought Up Shares in December. (Barron’s)

- The highest-paid CEOs of 2019 (USA Today)

- The Dollar’s Losses May Just Be Getting Started (Bloomberg)

- Almost Everything Wall Street Expects in 2020 (Bloomberg)

- OPEC Output Falls as Gulf Nations Step Up Delivery of Oil Cuts (Bloomberg)

- This is what the Warren Buffett empire looks like, in one giant chart (MarketWatch)

- Treasury’s Mnuchin to head U.S. delegation to Davos conclave (Reuters)

- 7 Excellent Value Stocks to Buy for 2020 (Yahoo! Finance)

- Twilio CEO Lawson Tinkers Until Solving Customers’ Problems (Investor’s Business Daily)

- MAX Crashes Strengthen Resolve of Boeing to Automate Flight (Wall Street Journal)

The Earth, Wind & Fire “Shining Star” Stock Market (and Sentiment Results)

Continue reading “The Earth, Wind & Fire “Shining Star” Stock Market (and Sentiment Results)”