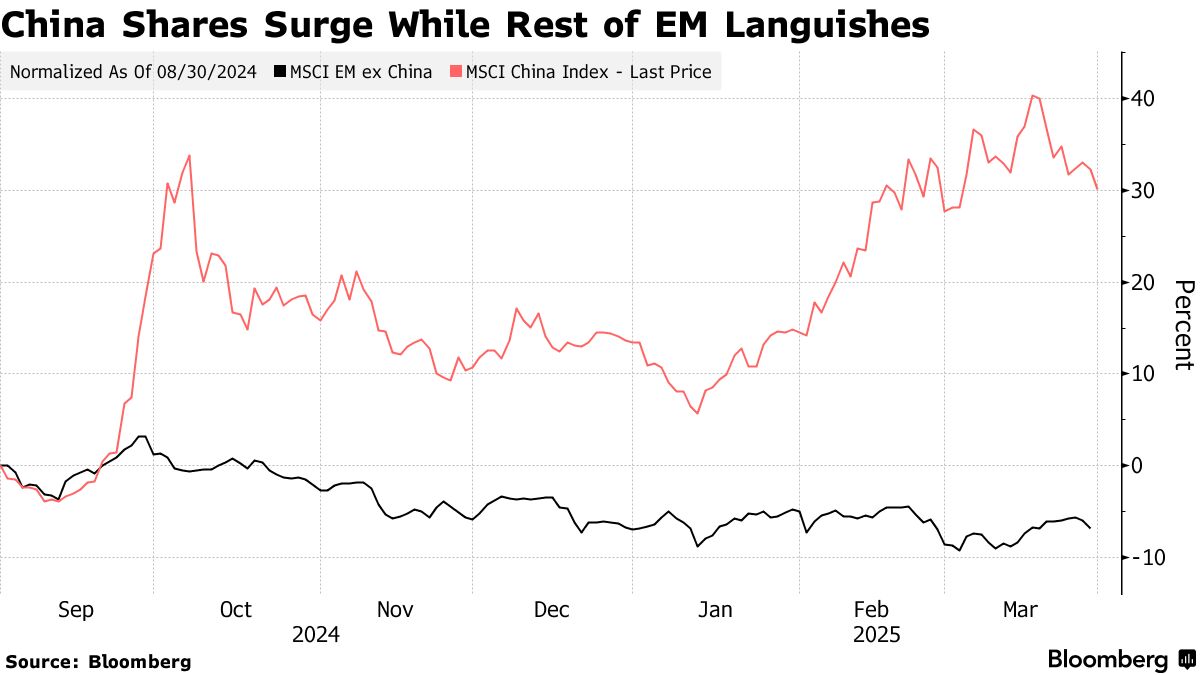

- Chinese Stocks Power Ahead of Emerging Peers Amid AI Frenzy (bloomberg)

- China’s factory activity growth at 1-year high, official survey shows, as stimulus measures kick in (cnbc)

- A Wild Quarter for U.S. Stocks Sends Investors Abroad (wsj)

- This Investing Trend Is Your Friend—Until It Isn’t (wsj)

- Consumers Are Worried About the Economy. Why It Isn’t all Gloom and Doom. (barrons)

- Car Shoppers Outracing Trump Tariffs Poised to Lift Auto Sales (bloomberg)

- The Housing Market Will Have Some Bargains This Spring (bloomberg)

- The M&A Boom Wall Street Wanted Is Here, if You Know Where to Look (wsj)

- BOC Aviation Buys 120 Single-Aisle Jets From Airbus, Boeing (bloomberg)

- Last Week Saw The 2nd Largest Selling Of Tech Stock By Hedge Funds In 5 Years (zerohedge)

- Goldman Sees More Fed Cuts This Year as Tariffs Dent Growth (bloomberg)

- China’s Big State Banks to Get $71.6 Billion Capital Injection (wsj)

- Make Europe Great Again trades are gaining traction (reuters)

- Alibaba.com Records Double-Digit Order Growth in the USA During March Expo (morningstar)

- Disney is raising the stakes with bold new menu in bid to lure more customers (nypost)

- Markets could have the ‘right pieces’ for a bottom this week, says Fundstrat’s Tom Lee (youtube)

Tag: StockMarket

Indicator of the Day (video): Bullish Percent Real Estate

Our Applied Stock Market Indicator of the Day is:

Bullish Percent Real Estate

Be in the know. 17 key reads for Sunday…

- How Diageo CEO Debra Crew’s time in military intelligence shaped her leadership style at the Johnnie Walker and Guinness maker (fortune)

- How Disney creates a ‘Disney Bubble’ around its theme parks (fastcompany)

- BofA maintains Walt Disney stock Buy rating, $140 target (investing)

- Ducks Team Up with Vans for Exclusive Player-Designed Sneakers on Sale Sunday, March 30 (nhl)

- Ducks and Vans Join Forces for Special Shoes Collaboration (thehockeynews)

- Can foreign investors learn to love China again? (economist)

- Tmall Doubles Down on Brand Growth with Expanded Resources (alizila)

- How PayPal, Sam’s Club, and Nordstrom Plan to Grow Their Ad Businesses (adweek)

- Altra President Jen McLaren Shares Go-Forward Plan (shopeatsurf)

- Advance Auto Parts to open 30 new stores in 2025; 100 through 2027 (foxbusiness)

- Used Cars Love Tariffs. So Do Auto Parts Stocks. (ibd)

- The AI Data-Center Boom Is Coming to America’s Heartland (wsj)

- Homebuilder inventory hits 2009 levels: These are the housing markets where you can find deals (fastcompany)

- Europe’s Stock Surge Outpaces Wall Street in Historic Run (bloomberg)

- Maserati Just Unveiled a Program That Lets You Design Your Own One-of-a-Kind Sports Car (robbreport)

- Aston Martin’s Vanquish Volante Is The World’s Fastest Front Engine Convertible (maxim)

- 8 simple tips for improving your golf game (golf)

Hedge Fund Tips with Tom Hayes – VideoCast – Episode 284

Article referenced in VideoCast above:

“The Times They Are A-Changin’” Stock Market (and Sentiment Results)…

Hedge Fund Tips with Tom Hayes – Podcast – Episode 284

Article referenced in Podcast above:

“The Times They Are A-Changin’” Stock Market (and Sentiment Results)…

Indicator of the Day (video): S&P 500 Health Care Stocks Above 20 EMA

Our Applied Stock Market Indicator of the Day (in 60 Seconds or Less) is:

S&P 500 Health Care Stocks Above 20 EMA

Be in the know. 16 key reads for Saturday…

- Car Buyers Who Fear Tariff Price Hikes Are Rushing to Dealers (bloomberg)

- Selling Your House This Spring? You Might Need to Cut the Price (wsj)

- AI Agents Are a Moment of Truth for Tech (wsj)

- Americans Feel Bad About the Economy. Whether They Act on It Is What Really Matters. (wsj)

- How the Reversal of the ‘American Exceptionalism’ Trade Is Rippling Around the Globe (wsj)

- Forget the Mag 7. The ‘Terrific 10’ Are the Tech Bet for 2025. (barrons)

- Intel Board Members Leaving as Chipmaker Looks to Add Expertise (bloomberg)

- Intel Received $1.9 Billion From Final Close of SK Hynix Deal (barrons)

- Exclusive: Buyout, aerospace firms close in on $8 billion-plus Boeing navigation unit, sources say (reuters)

- Wall Street Analysts Adore Amazon, Microsoft, and Nvidia. Here’s Why That’s Problematic. (barrons)

- Disney Stock Is Under Pressure. Why Wall Street Is Singing Hakuna Matata. (barrons)

- Can ESPN and Major League Baseball Still Play Ball? (vanityfair)

- The United States remained the world’s largest liquefied natural gas exporter in 2024 (eia.gov)

- Xi Jinping pitches China to global CEOs as protector of trade (ft)

- US car tariffs help Chinese EVs to race ahead (ft)

- Nvidia Stock Falls. It Has Problems at Home and Abroad. (barrons)

Where is money flowing today?

Data Source: Finviz

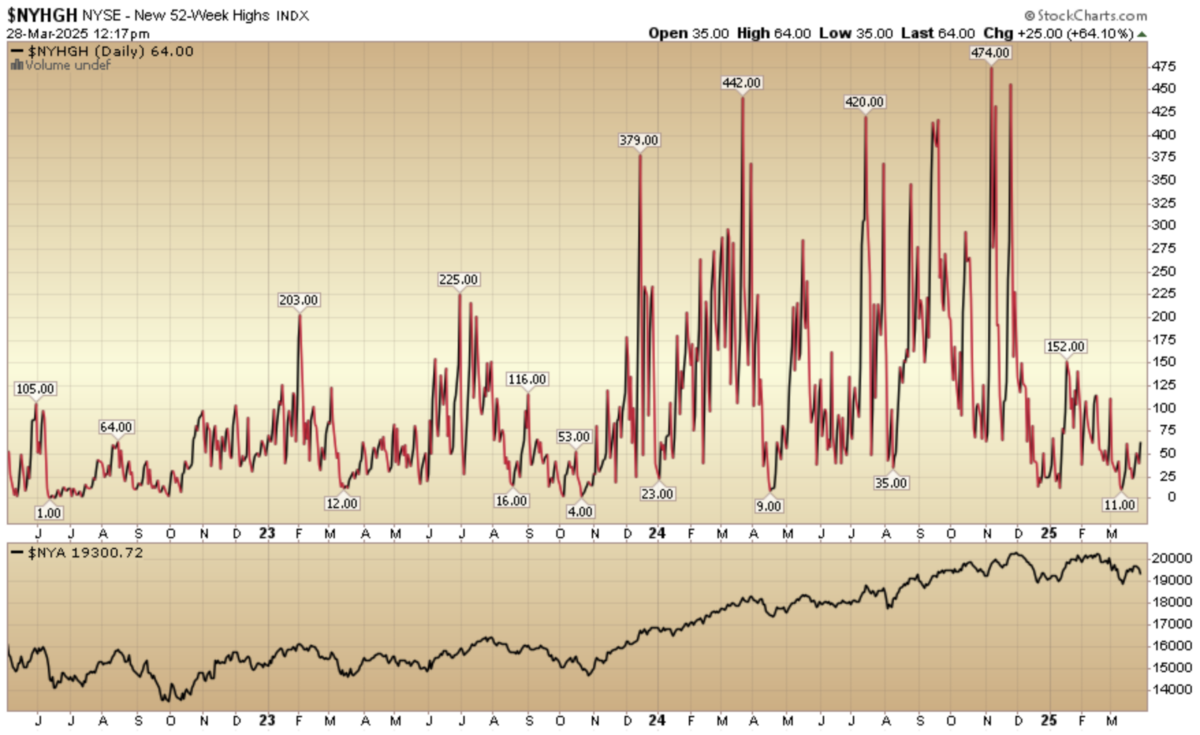

Indicator of the Day (video): NYSE New 52 Week Highs

Our Applied Stock Market Indicator of the Day is:

NYSE New 52 Week Highs