- Building-Products Distributor QXO Clinches Deal for Beacon Roofing (wsj)

- China is tackling weak consumption with child care subsidies (cnbc)

- Boeing Sees Cash Flow Improve as Jet Factories Stabilize (bloomberg)

- Exclusive: Air India in talks for dozens of new widebody jets from Airbus, Boeing, sources say (reuters)

- BofA: Boeing’s March deliveries set for end of quarter surge (streetinsider)

- Fed Projections See an Economy Dramatically Reset by Trump’s Election (wsj)

- The Fed Pencils in 2 Rate Cuts. Anything Could Happen. (barrons)

- A Housing Expert Sizes Up the Outlook for Home Sales, Mortgage Rates, and Tariff Impacts (barrons)

- Is this the start of a period of European exceptionalism in markets? (ft)

- Hold the Obituary: Europe Comes to Life as U.S. Stumbles (wsj)

- US natural gas prices up on record flows to LNG export plants, cooler weather forecasts (reuters)

- Disney and Universal Prepare for a Theme Park Brawl. What’s at Stake in Orlando. (barrons)

- Temu-Owner PDD’s Revenue Misses Estimates as Expansions Slow (bloomberg)

- Nike’s Earnings Are Here. Expect News About Its Turnaround. (barrons)

- Signs of an Office Market Bottom: ‘The Worst Is Probably Over’ (nytimes)

- The Dream Team With a ‘Miracle’ Coach: Can Anyone Stop This Hockey Powerhouse? (wsj)

Tag: StockMarket

EXCLUSIVE: CEO Interview Cooper Standard (and Markets Update)…

EXCLUSIVE: Cooper Standard (Ticker: CPS) Interview and Background

I had the pleasure to interview the Chairman and CEO of Cooper Standard – Jeff Edwards (CPS is one of our largest holdings). I am very grateful to him for taking the time out and participating in this long-form format. It enabled us to get granular on the details of the business, where we’ve come from and more importantly – where we are going!

Continue reading “EXCLUSIVE: CEO Interview Cooper Standard (and Markets Update)…”

Where is money flowing today?

Data Source: Finviz

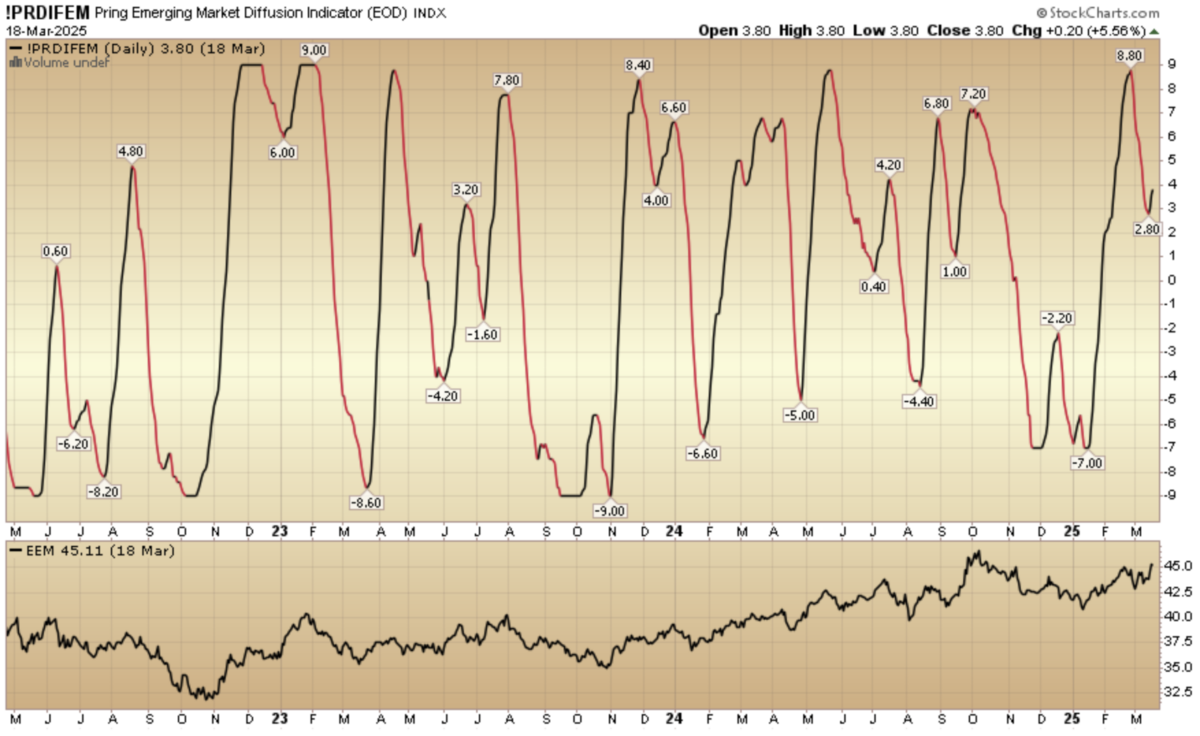

Indicator of the Day (video): Pring Emerging Market Diffusion Indicator

Our Applied Stock Market Indicator of the Day (in 60 Seconds or Less) is:

Pring Emerging Market Diffusion Indicator

Quote of the Day…

Be in the know. 20 key reads for Wednesday…

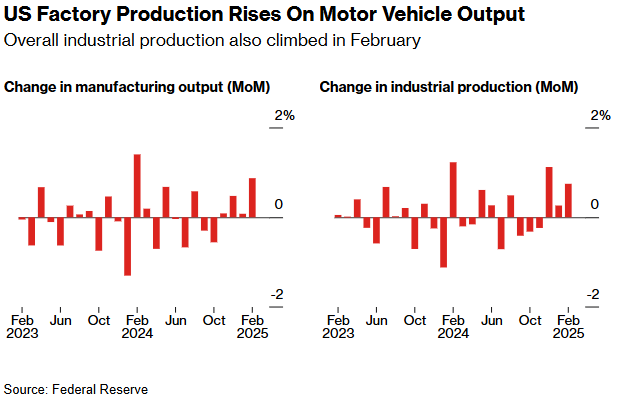

- US Factory Production Rises by Most in a Year on Auto Output (bloomberg)

- Investors Are Ditching U.S. Stocks. When That Could Be a Buy Signal. (barrons)

- China markets are set to outperform Wall Street as U.S. exceptionalism comes to a pause (cnbc)

- China Banks Cut Consumer Loan Rates to Record Low to Spur Demand (bloomberg)

- Confidence in German economy surges as parliament approves huge spending plan (marketwatch)

- Tencent AI Plans Seen as Key for Further China Tech Stock Gains (bloomberg)

- Retail investors ditch buy-the-dip mentality during the market correction (cnbc)

- Big Tech’s data center boom poses new risk to US grid operators (reuters)

- The ‘Energy Transition’ May Be Disappearing, but Renewable Energy Isn’t (barrons)

- Why China is suddenly flooding the market with powerful AI models (ft)

- China Electric Vehicles Roar (Silently) (chinalastnight)

- Dollar Is In The Crosshairs As Europe Jumps US Ship (zerohedge)

- Japan Airlines to buy 17 more Boeing 737-8s (reuters)

- Ram Owner Wants to Bring Cheaper Pickup Back to US (bloomberg)

- Dell CEO explains why he thinks the PC refresh cycle is starting (cnbc)

- The North Face Just Took an Era-Defining ’90s Jacket Off Ice (gq)

- Nike Returns to Sports While Investors Impatiently Await Reset (bloomberg)

- 10 Best Value Stocks to Buy for the Long Term (morningstar)

- March Dot Plot to Highlight Fed Officials’ Outlook (wsj)

- Nvidia Was Once a Hot Stock, Why It’s Now Leaving the Market Cold. (barrons)

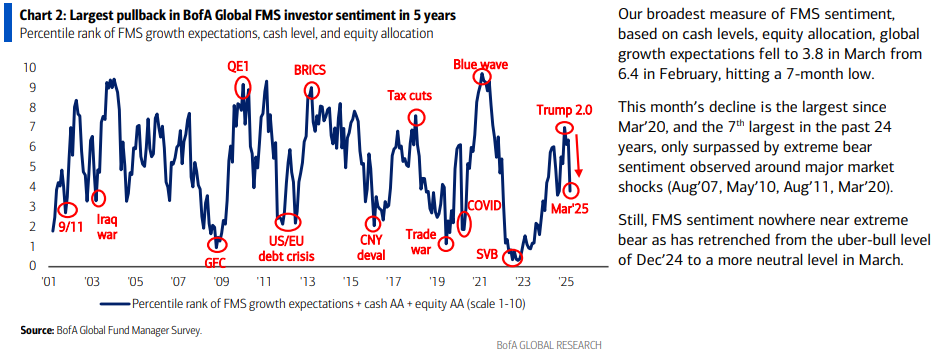

March 2025 Bank of America Global Fund Manager Survey Results (Summary)

The March survey covered 205 institutional fund managers with $477 billion under management. Continue reading “March 2025 Bank of America Global Fund Manager Survey Results (Summary)”

Where is money flowing today?

Data Source: Finviz

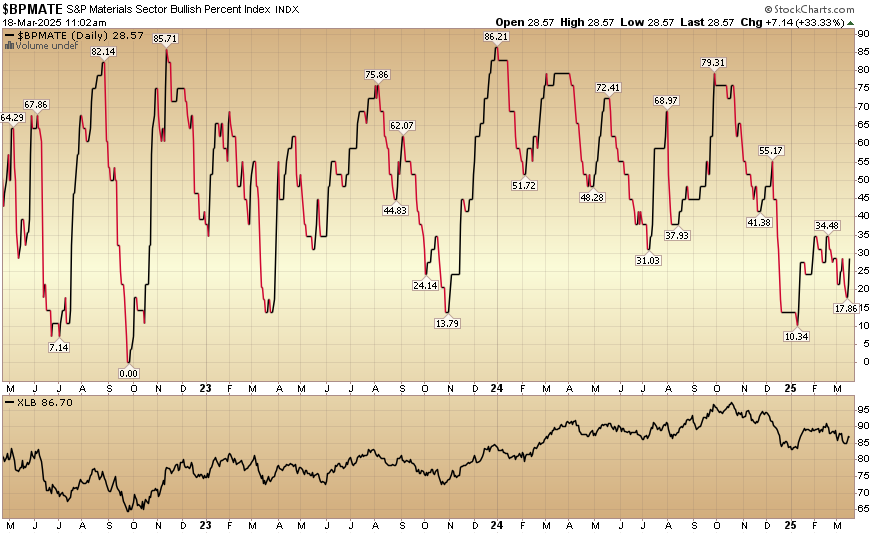

Indicator of the Day (video): Bullish Percent Materials

Our Applied Stock Market Indicator of the Day is:

Bullish Percent Materials