Tag: StockMarket

Be in the know. 23 key reads for Monday…

- Jack Ma-Backed Ant Touts AI Breakthrough Using Chinese Chips (bloomberg)

- Trump Ally Visits Beijing to Pave Way for Xi Summit (wsj)

- China’s open-source embrace upends conventional wisdom around artificial intelligence (cnbc)

- Beijing pledges greater market access as top global CEOs gather at the China Development Forum (cnbc)

- Global Investors Tout Improving China Sentiment at Milken (bloomberg)

- Chinese Stocks Show Signs of Rotation From Small-Caps to Large (bloomberg)

- And the Winner Is….China! (zerohedge)

- BYD sales surge 29% on strong Chinese demand for hybrid cars (ft)

- Emerging-Market Assets Rebound on Signs of Targeted Tariffs (bloomberg)

- Dollar Weakness Becomes Profit Boon for US Multinationals (bloomberg)

- UK PMI Hits Six-Month High in Early Sign of Economic Turnaround (bloomberg)

- Euro-Zone Private Sector Picks Up as Germany Fuels Recovery (bloomberg)

- It’s been 25 years since European stocks beat U.S. rivals this way. Deutsche Bank still prefers ‘MEGA’ to ‘MAGA.’ (marketwatch)

- EU Trade Chief Sefcovic to Meet Greer, Lutnick in US Tuesday (bloomberg)

- Americans Are Choosing Smaller Vehicles (kbb)

- Disney’s ‘Snow White’ Tops Weekend Box Office, Despite Controversies (barrons)

- Americans Are Rushing to Get Off the Grid (bloomberg)

- US planning to exclude sector-specific tariffs on April 2, Bloomberg News, WSJ report (reuters)

- Exclusive: Airbus, Boeing eye fast output as plastics loom for future jets (reuters)

- Acting FAA Administrator on hiring air traffic controllers, airspace congestion and Boeing progress (youtube)

- BofA Securities resumes Generac stock with Buy, $182 target (investing)

- Google’s $32 billion Wiz deal may signal a turning point for slow IPO, M&A markets (cnbc)

- Shell CEO Seen Honing In on LNG at Strategy Day in New York (bloomberg)

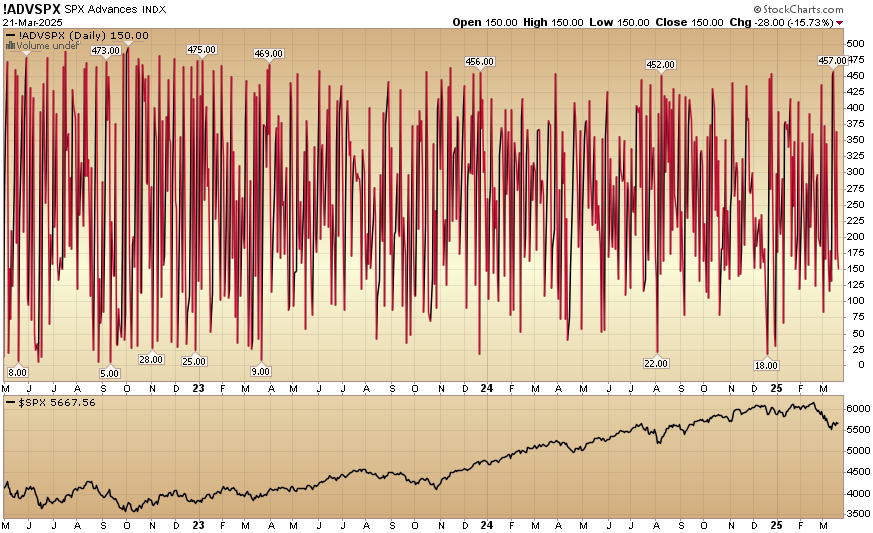

Indicator of the Day (video): S&P 500 Advances

Our Applied Stock Market Indicator of the Day (in 60 Seconds or Less) is:

S&P 500 Advances

Quote of the Day…

Be in the know. 16 key reads for Sunday…

- Beneath investors’ feet, the ground is shifting (economist)

- Why everyone is harping on about Guinness (economist)

- Carmakers rush to ship vehicles to US ahead of new round of April tariffs (ft)

- New-Vehicle Average Transaction Price Decreases Year Over Year and Incentives Increase (coxauto)

- Record 1.3 Million Electric Vehicles Sold (coxauto)

- Intel has great risk and great opportunity, strategist says (yahoo)

- Will Trump’s tariffs turbocharge foreign investment in America? (economist)

- U.S. tower stock valuations refreshed at MoffettNathanson (yahoo)

- Boeing’s double dose of good news: Fighter jets and cash (foxbusiness)

- Disney CEO Defends Park Pricing, Unveils New Tech and Plans 7 More Cruise Ships (yahoo)

- What might save China’s economy (npr)

- Just More Bull Market Stuff (allstarcharts)

- What Are AI Agents? Here’s How They Can Help You Get Stuff Done (inc)

- As Ovechkin nears the NHL goals record, the hockey world leans in to savor the moment (npr)

- Bugatti Just Made the New Tourbillon Hypercar Even Better (robbreport)

- 5 collector cars to put into your garage this week (classicdriver)

Hedge Fund Tips with Tom Hayes – VideoCast – Episode 283

Article referenced in VideoCast above:

EXCLUSIVE: CEO Interview Cooper Standard (and Markets Update)…

Hedge Fund Tips with Tom Hayes – Podcast – Episode 283

Indicator of the Day (video): S&P 500 Percent Above 50-Day SMA

Our Applied Stock Market Indicator of the Day (in 60 Seconds or Less) is:

S&P 500 Percent Above 50-Day SMA

Quote of the Day…

Be in the know. 15 key reads for Saturday…

- Boeing Wins Next-Generation Jet Fighter Contract (wsj)

- Can Healthcare Stocks Keep Outperforming the Market? (morningstar)

- Wall Street Investors With Diversified Bets Are Winning at Last (bloomberg)

- South-east Asian markets roiled as investors turn to China (ft)

- US Trade Chief Greer Set for China Counterpart Call Next Week (bloomberg)

- Home sales see a bump in February thanks to higher-income buyers (marketwatch)

- Booze faces big tobacco moment (ft)

- Stocks & Rate-Cut-Hopes Rebound As Tariff ‘Flexibility’ Trumps FedSpeak (zerohedge)

- Traders Bet on Weaker US Dollar for First Time Since Trump’s Win (bloomberg)

- Carnival Says All Signs Point to Robust Cruise Demand Continuing (bloomberg)

- The North Face’s Latest High-Fashion Collab is Already Nearly Sold Out (shopeatsurf)

- Majority of AI Researchers Say Tech Industry Is Pouring Billions Into a Dead End (futurism)

- Housing Can Be Trump’s Legacy. Just Follow Lincoln’s Example. (barrons)

- Nike Stock Sinks. Its ‘Win Now’ Strategy Is Turning Into ‘Win Later.’ (barrons)

- Tesla Stock Sees 9th Straight Weekly Drop. Wall Street Is Worried. (barrons)