- Alibaba and Tencent Consider Opening Up Their ‘Walled Gardens’ (Wall Street Journal)

- How This Top Financial Advisor Lured $270 Billion In Assets (Investor’s Business Daily)

- AMC Stock Has Given Up Most of Its Gains Since June (Barron’s)

- China Is on Track to Meet Its Growth Target for 2021. What to Know. (Barron’s)

- Taiwan Semiconductor Reports 11% Profit Rise and Sees Strong Chip Demand (Barron’s)

- Netflix Gaming Plan Clashes With Meme Stock GameStop (Barron’s)

- Businesses See Above-Average Price Increases, Worry About Lingering Inflation, Fed Beige Book Says (Wall Street Journal)

- Wells Fargo Emerges From Pandemic Slump (Wall Street Journal)

- Citigroup Profit Soars as Consumers Rebound (Wall Street Journal)

- OPEC Reaches Compromise With U.A.E. Over Oil Production (Wall Street Journal)

- Powell Says Fed Still Expects Inflation to Ease (Wall Street Journal)

- Powell: Progress toward full employment, 2% inflation is “still a ways off,” hinting Fed may not be on verge of cutting bond-buying stimulus (USA Today)

- NHL offseason tracker: Analyzing the moves in what promises to be a busy offseason (USA Today)

- New York Manufacturing Expands at Record Pace, Price Gauge Rises (Bloomberg)

- Aston Martin’s Upcoming Valhalla Supercar Tops Out at 217 Miles Per Hour (Bloomberg)

- Moderna Looks at Potential of mRNA to Fight Flu, Cancer, HIV (Bloomberg)

- Netflix Plans to Offer Video Games in Push Beyond Films, TV (Bloomberg)

- 19 dividend stocks to help you combat inflation (MarketWatch)

- Citigroup Is Closing in on Peers in One Key Way (Wall Street Journal)

- Cliff Asness Is Back Doing What He Does Best: Defending Value (Bloomberg)

Tag: StockMarket

The “Whole Lotta Nothin'” Stock Market (and Sentiment Results)…

If it feels like the market is running in place, you’re right. Look at the Small Caps (Russell 2000) above and the Dow Jones below, and your suspicions are confirmed: Continue reading “The “Whole Lotta Nothin’” Stock Market (and Sentiment Results)…”

Tom Hayes – CGTN America Appearance – 7/14/2021

CGTN America – Thomas Hayes – Chairman of Great Hill Capital – July 14, 2021

Watch Directly on CGTN America

Unusual Options Activity – Discovery, Inc. (DISCK)

Data Source: barchart

Today some institution/fund purchased 5,065 contracts of Dec $30 strike calls (or the right to buy 506,500 shares of Discovery, Inc. (DISCK) at $30). The open interest was just 1,242 prior to this purchase. Continue reading “Unusual Options Activity – Discovery, Inc. (DISCK)”

Where is money flowing today?

Data Source: Finviz

Be in the know. 18 key reads for Wednesday…

- The Market Trusts Powell to Keep the Punch Bowl in Place (Barron’s)

- Fundstrat’s Thomas Lee Sees Treasury Yields Rebounding. This Sector Will Benefit the Most. (Barron’s)

- Buy Airbnb Shares to Play a Post-Pandemic Pickup in European Travel (Barron’s)

- Child Tax Credits Arrive This Week. These 16 Stocks and ETFs Could Benefit. (Barron’s)

- Inflation Accelerates Again in June as Economic Recovery Continues (Wall Street Journal)

- Humanoid Robot Keeps Getting Fired From His Jobs (Wall Street Journal)

- China Clears Tencent-Sogou Deal (Wall Street Journal)

- Inflation Hits Some Prices More Than Others (Wall Street Journal)

- S. Senate Democrats agree to $3.5 trln for budget reconciliation bill (Reuters)

- Citigroup profit beats estimates on reserve release (Reuters)

- Wells Fargo profit tops expectations with boost from release of money set aside for loan losses (CNBC)

- JPMorgan CEO Jamie Dimon: Coronavirus in ‘rear-view mirror’ for consumers (FoxBusiness)

- Taper tensions: Jay Powell under pressure as US inflation surges (Financial Times)

- Fed’s Powell says economy ‘a ways off’ from bond taper, inflation to ease (Reuters)

- Record Natural Gas Prices Give Power Markets a Jolt (Wall Street Journal)

- Weekly mortgage refinances spike 20% after interest rates drop to February low (CNBC)

- China Traders to Scrutinize Maturing Mega Loan for Policy Clues (Bloomberg)

- UAE Denies Reports That OPEC+ Deal Has Been Reached, Oil Slides (ZeroHedge)

Unusual Options Activity – Las Vegas Sands Corp. (LVS)

Where is money flowing today?

Data Source: Finviz

Be in the know. 15 key reads for Tuesday…

- Chinese Tech Stocks Jump After Tencent Gets Deal Approval (Bloomberg)

- Boom Time for Trading Is Over, JPMorgan Chase Earnings Show (Barron’s)

- Exclusive-Alibaba, others explore bids for Unisplendour stake worth up to $7.7 billion -sources (Reuters)

- Analysts expect earnings to be great. One bank says estimates are still too low. (MarketWatch)

- Inflation Heated Up in June, Defying Expectations (Barron’s)

- Nokia Expects to Revise Up Guidance After a Strong First Half (Barron’s)

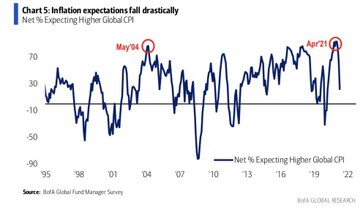

- Fund Managers Have Unwound Their Postelection and Vaccine Bets, Survey Finds (Barron’s)

- How to Solve the Mystery of Falling Bond Yields (Wall Street Journal)

- How Do You Stop Robocalls? (New York Times)

- The Percent Of Small Businesses Raising Prices Just Hit Its Highest Level Since 1981 (Bloomberg)

- Goldman Dealmakers’ Bumper Quarter Counters Slump in Trading (Bloomberg)

- JPMorgan’s Bankers Notch Record Quarter on Merger Flurry (Bloomberg)

- Lumber Wipes Out 2021 Gain With Demand Ebbing After Record Boom (Bloomberg)

- China’s Monetary Policy Slips a Gear Into Neutral (Wall Street Journal)

- BofA Securities Makes Big Midsummer Changes to US 1 List of Top Stock Picks (24/7 Wall Street)

July Bank of America Global Fund Manager Survey Results (Summary)

270 panelists – with $805 billion in assets under management – participated in the BofA Global Research fund manager survey, taken July 2 to 8, 2021. Continue reading “July Bank of America Global Fund Manager Survey Results (Summary)”