This week we chose Luke Combs Billboard hit “Forever After All” to capture the current sentiment of the stock market. The lyrics that stood out were: Continue reading “The Luke Combs, “Forever After All” Stock Market (and Sentiment Results)…”

Tag: StockMarket

Unusual Options Activity – Alibaba Group Holding Limited (BABA)

Data Source: barchart

Today some institution/fund purchased 1,746 contracts of June $215 strike calls (or the right to buy 174,600 shares of Alibaba Group Holding Limited (BABA) at $215). The open interest was just 739 prior to this purchase. Continue reading “Unusual Options Activity – Alibaba Group Holding Limited (BABA)”

Where is money flowing today?

Data Source: Finviz

Be in the know. 17 key reads for Wednesday…

- OPEC Meets Thursday. What It Means for Oil Prices. (Barron’s)

- Buffett, Munger on Zoom, Robinhood, and Lessons From the Pandemic (Barron’s)

- Didi Prices Its IPO at $14. Shares of the Chinese Ride-Hailing Giant Start Trading on Wednesday. (Barron’s)

- Private Equity Gears Up for the Siege of Japan Inc. (Wall Street Journal)

- Warren Buffett and Charlie Munger slam Robinhood, blast Archegos’ lenders, and reflect on their iconic friendship in a new interview. Here are the 15 best quotes (Business Insider)

- The rotation into value stocks will get a new lease of life as the US economy booms, JPMorgan strategist says (Business Insider)

- How Twitch became the go-to platform for creators to make money (USA Today)

- It’s going to get trickier for the stock market. Here’s what to watch now, says HSBC strategist. (Market Watch)

- United Airlines Bets on Post-Pandemic Growth With Its Biggest-Ever Jet Order (Wall Street Journal)

- Supreme Court Rules New Jersey Can’t Block Natural-Gas Pipeline (Wall Street Journal)

- Carried Interest Tax Break Unites PE Firms as Congress Takes Aim (Bloomberg)

- BofA Securities Makes Big Summer Changes to US 1 List of Top Stock Picks (24/7 Wall Street)

- Private payrolls rise 692,000 in June, easily topping expectations (CNBC)

- Buffett reflects on his first meeting with Munger: ‘I’m not going to find another guy like this’ (CNBC)

- Lumber prices dive more than 40% in June, biggest monthly drop on record (CNBC)

- General Mills (GIS) Tops Q4 EPS by 7c (Street Insider)

- Banks turn to blockchains to reform costly bond market (Financial Times)

Where is money flowing today?

Data Source: Finviz

Be in the know. 14 key reads for Tuesday…

- Fannie and Freddie Overhaul Reboot Benefits Many Mortgage Players (Wall Street Journal)

- Companies Are Giving Earnings Guidance Again. Why That’s Good for Stocks. (Barron’s)

- How Nadella Shook Up the Company’s Strategy—and Saw Big Gains (Barron’s)

- Boeing Gets Huge MAX Order. It’s a Bigger Deal Than the Latest Bad News. (Barron’s)

- Morgan Stanley and Wells Fargo Doubled Their Dividends. What It Means for Their Stocks. (Barron’s)

- A top Fed official says digital currency may be the money equivalent of parachute pants. (New York Times)

- Don’t Count on Needing a Covid Booster Shot, WHO Scientist Says (Bloomberg)

- Big tech and healthcare stocks stand to lose most from potential Biden tax hikes, BlackRock says (Business Insider)

- SEC’s Gensler aims to be ‘transformational’ Wall Street cop (Fox Business)

- Royal Caribbean Cruises (RCL) Sell Off Creates Buying Opportunity, Thoughts from CFO Meeting – Stifel (Street Insider)

- Costly New Alzheimer’s Drug Could Force Medicare to Restrict Access (Wall Street Journal)

- Full FDA approval of Pfizer’s and Moderna’s COVID-19 shots would reinvigorate the U.S. vaccination push — but it could still be months away (MarketWatch)

- Reflation trade unwind wrongfoots several big-name hedge funds (Financial Times)

- Fired by Bot at Amazon: ‘It’s You Against the Machine’ (Bloomberg)

Where is money flowing today?

Data Source: Finviz

Be in the know. 15 key reads for Monday…

- United Airlines Drops a Profit Bomb. It Will Make Money in July. (Barron’s)

- Money Losers Are Flooding the Market With New Shares (Barron’s)

- OPEC+ Expected to Boost Oil Production This Week (Barron’s)

- Big Banks Seen Increasing Dividends by 10% on Average (Barron’s)

- Commodities Remain a Popular Bet Despite Recent Declines (Wall Street Journal)

- Americans Are Leaving Unemployment Rolls More Quickly in States Cutting Off Benefits (Wall Street Street)

- Latest ‘Fast & Furious’ Movie Leads Weekend Box Office (Wall Street Journal)

- During Covid-19, Most Americans Got Richer (Wall Street Journal)

- U.S. Conducts Airstrikes in Syria and Iraq Against Iranian-Backed Militias (Wall Street Journal)

- ‘Drill, Baby, Drill’ Is the Future (Wall Street Journal)

- ‘If Content is King in Streaming, Netflix (NFLX) Still Wears The Crown’: Credit Suisse Upgrades to ‘Outperform’ (Street Insider)

- Fed’s Kashkari says inflation will be temporary, workers will return (Street Insider)

- Goldman Sachs Has 5 Red-Hot Natural Gas and LNG Stocks To Buy Now (24/7 Wall Street)

- US shale patch resists temptation for new drilling rush (Financial Times)

- Gene Editing Data Look Good for Intellia. How It Made History. (Barron’s)

Be in the know. 16 key reads for Sunday…

Source: Bloomberg

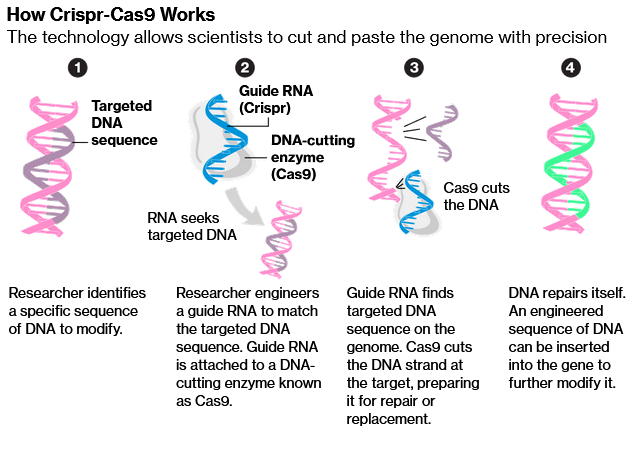

- Liver Study Results Show How Crispr Could Transform Treatment (Bloomberg)

- CRISPR injected into the blood treats a genetic disease for first time (sciencemag)

- Joe Moglia on Going From Football to Wall Street (Podcast) (Bloomberg)

- Dumb Money No More: How David Ellison Became a Hollywood High Flier (New YorkTimes)

- NASDAQ’s Mid-Year Rally Begins Early (Almanac Trader)

- The ‘Great Reshuffling’ Is Shifting Wealth to the Exurbs (Wall Street Journal)

- Remote Learning Threatens the $670 Billion College-Industrial Complex (Wall Street Journal)

- Billionaire Leon Cooperman is Crazy About these 10 Stocks (Insider Monkey)

- These Are Ten Stocks With Largest Number Of Hedge Fund Buyers (ValueWalk)

- ECRI Weekly Leading Index Update (Advisor Perspectives)

- ‘The Market Is Red Hot’: Flying Privately Is Reaching Record Highs as Personal Travel Surges (Robb Report)

- Here’s What’s in the Six Antitrust Bills That Could Finally Break Up Big Tech (gizmodo)

- The Precautionary Principle: Better Safe than Sorry? (Farnam Street)

- Hyun Song Shin on CBDCs and the Future of Central Banking (Bloomberg)

- The Global IPO Market Has Never Been Hotter Than It Is Right Now (Bloomberg)

- Iran says nuclear site images won’t be given to IAEA as deal has expired (CNBC)

Be in the know. 20 key reads for Saturday…

- NextEra Is the Country’s Biggest Electric Utility—and a Leader in Renewables (Barron’s)

- Inner Game with Steven Cohen (Stray Reflections)

- Feds accelerating crypto world crackdown (Fox Business)

- OPEC+ Expected to Boost Oil Production Next Week (Barron’s)

- The Banks Passed Stress Tests. Now They Get to Announce Payouts. (Barron’s)

- Pfizer Developed a Vaccine in Less Than a Year. There’s More to Come. (Barron’s)

- Larry Culp Is Building a Leaner, Meaner, More Profitable GE (Barron’s)

- Jamie Dimon on JPMorgan Chase: ‘There Isn’t a Single Area Where We Can’t Grow.’ (Barron’s)

- Larry Fink Made BlackRock a Powerhouse. Why He’s Bullish on China. (Barron’s)

- Progressive’s CEO Has Grown the Auto Insurer. Warren Buffett Approves. (Barron’s)

- Brian Moynihan Has Run Bank of America Conservatively. Shareholders Have Prospered.(Barron’s)

- Lightning return to Stanley Cup Final with Game 7 win vs. Islanders (USA Today)

- Two Energy Stocks See Large Insider Share Buys (Barron’s)

- 3 Reasons Nike Stock Is Soaring After Earnings (Barron’s)

- Our Top CEOs: Meet 30 Leaders Who Turned Crisis Into Opportunity (Barron’s)

- General Dynamics CEO Phebe Novakovic Believes in Patriotism and Resilience (Wall Street Journal)

- Haters Everywhere in Stock Market After S&P 500’s Big First Half (Bloomberg)

- Consumer Spending Is Primed to Fuel Summer Growth (Wall Street Journal)

- 2021 Tesla Model S Plaid: Feel the Force—0-60 in 2 Seconds (Wall Street Journal)

- Why Wall Street loves Joe Manchin right now (CNN)