Data source: Finviz

Tag: StockMarket

Be in the know. 20 key reads for Friday…

- Is this the Manchin rally? Bonds are rising and stocks at record high as spending expectations wane (MarketWatch)

- ‘Ferris Bueller’s Day Off’ turns 35: Secrets behind the most iconic lines (New York Post)

- Didi Chuxing, China’s Ride-Hailing Giant, Unveils U.S. IPO Filing (Wall Street Journal)

- S. Lifts Some Iran Sanctions Amid Stalled Nuclear Talks (Wall Street Journal)

- Pay Attention to Profit Margins. Here’s Why. (Barron’s)

- Banks Are About to Hand Out Cash. How to Play It. (Barron’s)

- Vertex Shares Fall as Drug Fails. Analysts Say It’s Time to Buy. (Barron’s)

- S. Inflation Is Highest in 13 Years as Prices Surge 5% (Wall Street Journal)

- Amazon Faces Possible $425 Million EU Privacy Fine (Wall Street Journal)

- China Passes Law to Counter Foreign Sanctions (Wall Street Journal)

- Earmarks Are Back, Baby (Wall Street Journal)

- Another reason for worker shortages: Americans are starting businesses (USA Today)

- Merkel Says Biden Shows Multilateralism Is Back: G-7 Update (Bloomberg)

- Powell Gets Wall Street Buy-In to View That Inflation Won’t Last (Bloomberg)

- What the World’s Most Successful Real Estate Investor Is Buying (Bloomberg)

- Big Tech Is Going Public in India (Wall Street Journal)

- Great value rotation may already be over as investors embrace tech again (CNBC)

- Why the 5 Highest-Yielding Dow Stocks Are Great Second-Half Buys (24/7 Wall Street)

- The bond market says ‘meh’ (Financial Times)

- Meme Stocks’ Latest Frenzy Isn’t About a Short Squeeze (Wall Street Journal)

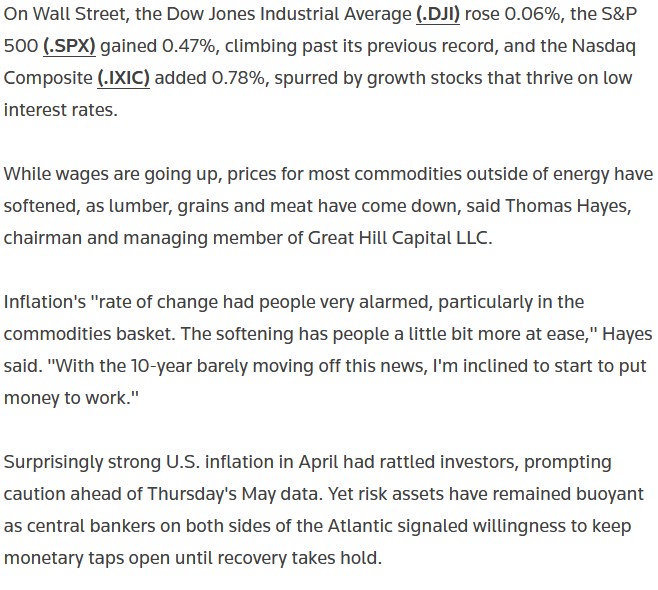

Tom Hayes – Quoted in Reuters article – 6/10/2021

Thanks to Herb Lash for including me in his article on Reuters today. You can find it here:

Click Here to View The Full Article on Reuters

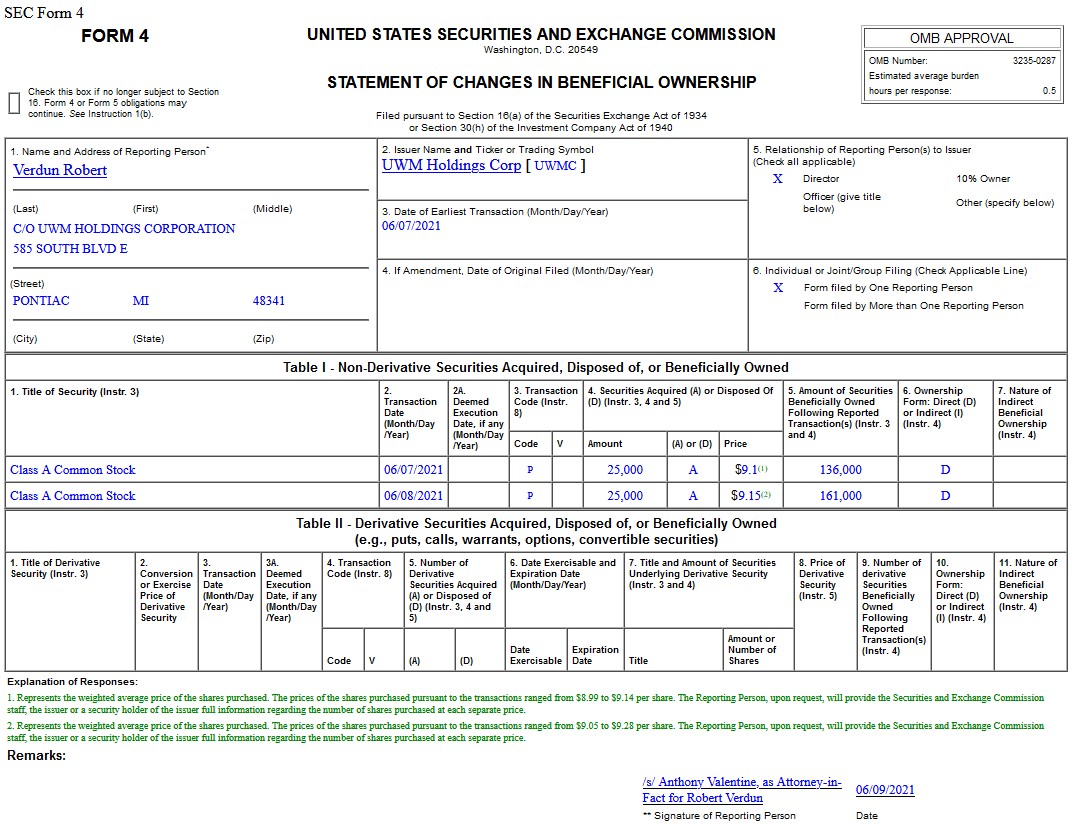

Insider Buying in UWM Holdings Corporation (UWMC)

On June 7-8, 2021, Robert Verdun – UWM Holdings Corporation (UWMC) – purchased 50,000 shares of UWMC at $9.10-9.15. His out of pocket cost was $456,250.

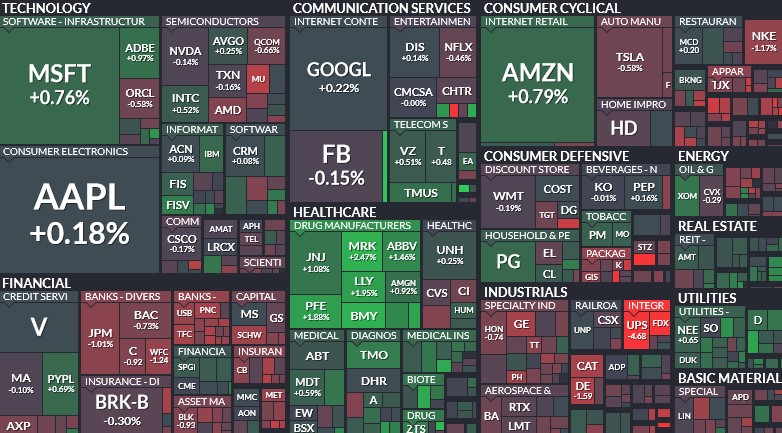

Where is money flowing today?

Data Source: Finviz

Be in the know. 20 key reads for Thursday…

- Trump’s TikTok, WeChat Actions Targeting China Revoked by Biden (Wall Street Journal)

- John Rogers Is Winning (Institutional Investor)

- OPEC sticks to forecast of oil demand surge in second half of 2021 (Reuters)

- How To Lose $50 Million Hedging Inflation… (ZeroHedge)

- AMC Insiders Sell Another $4 Million in Shares Amid Reddit Rally (Bloomberg)

- CPI shows retail prices soared again last month, lifting U.S. inflation rate to 13-year high (MarketWatch)

- ECB Keeps Stimulus at High Pace, Ruling Out Immediate Tapering (Barron’s)

- Don’t Expect $100 Oil Anytime Soon (Barron’s)

- Inflation Is Here. But It Won’t Doom Stocks. (Barron’s)

- China Is the Elephant in the Room as Europe Targets American Tech (Barron’s)

- Virgin Galactic founder Richard Branson may try to beat Bezos to space: report (New York Post)

- China’s Surging Manufacturing Prices Put Pressure on Beijing to Do Something About Them (Wall Street Journal)

- Draft Antitrust Bills Would Restrict Online Platforms (Wall Street Journal)

- China Tempers Climate Change Efforts After Economic Officials Limit Scope (Wall Street Journal)

- Technology Fills the Gap as Jobs Lag GDP (Wall Street Journal)

- Campbell Plans to Raise Prices as Higher Costs Cut into Profits (Wall Street Journal)

- Markets Are Ignoring the Main Driver of Today’s Inflation (Bloomberg)

- Weak consumption is a ‘major problem’ for China’s recovery, says analytics firm (CNBC)

- Finance professor Aswath Damodaran warns investors not to get cocky, dismisses bitcoin as a currency or store of value, and blasts the Fed in a new interview. Here are the 11 best quotes. (Business Insider)

- China says it arrested over 1,100 suspects and busted 170 criminal gangs in a crypto-related money-laundering crackdown (Business Insider)

How to lose $50 million hedging inflation…

In early 2019, during his 2018 annual letter, annual meeting and media appearances surrounding it, Warren Buffett made a few key points that seem more salient today than ever before: Continue reading “How to lose $50 million hedging inflation…”

Unusual Options Activity – Tencent Music Entertainment Group (TME)

Data Source: barchart

Today some institution/fund purchased 6,397 contracts of Oct $15 strike calls (or the right to buy 639,700 shares of Tencent Music Entertainment Group (TME) at $15). The open interest was 2,076 prior to this purchase. Continue reading “Unusual Options Activity – Tencent Music Entertainment Group (TME)”

Where is money flowing today?

Data Source: Finviz

Be in the know. 15 key reads for Wednesday…

- Senate OKs Bill to Address Competition From China (Barron’s)

- What a 15% Global Minimum Corporate Tax Rate Means for the Stock Market (Barron’s)

- Say Hello to the ‘She-covery’: Post-Covid Rebound Accelerates Women’s Job Gains (Barron’s)

- FDA Approves Pfizer’s New Pneumococcal Vaccine, Setting Up Clash With Merck (Barron’s)

- Why stock traders say ‘never short a dull market’ (MarketWatch)

- Bill Hwang had been eyeing $100B club before blow up: sources (New York Post)

- FDA Approval of New Alzheimer’s Drug May Boost Prospects of Other Treatments (Wall Street Journal)

- Discount Chain Big Lots Invests in New Stores as Stimulus Checks Boost Sales (Wall Street Journal)

- The Retreat of Exxon and the Oil Majors Won’t Stop Fossil Fuel (Bloomberg)

- From Cashier to Mortgage Billionaire: The Rise of Anthony Hsieh (Bloomberg)

- European banks are in a much better position now than when the pandemic first hit, Goldman says (CNBC)

- China’s producer prices rise faster than consumer prices by the most on record (CNBC)

- Cathie Wood agrees with Fundstrat’s Tom Lee that a demographic boom led by millennials will drive the stock market higher for years to come (Business Insider)

- 10Y Yields Plunge Below 1.50% As Record Short Squeeze Accelerates (ZeroHedge)

- Colgate-Palmolive is following in the footsteps of Pepsi and P&G to a ‘mega-cap turnaround’ (MarketWatch)