Fox Business Appearance – Thomas Hayes – Chairman of Great Hill Capital – June 7, 2021

Tag: StockMarket

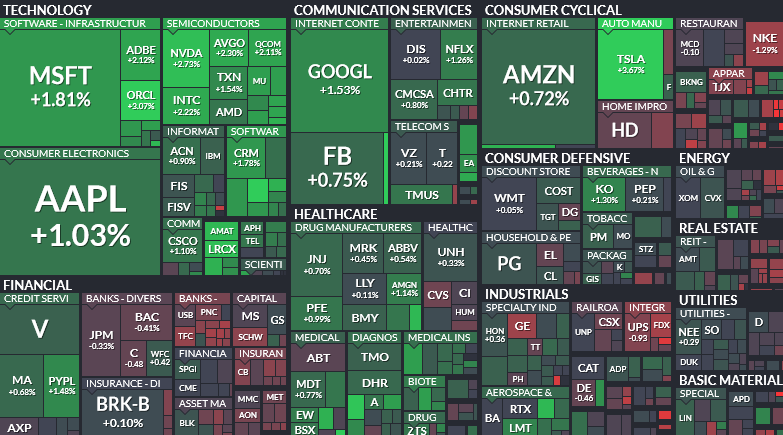

Where is money flowing today?

Data Source: Finviz

Be in the know. 10 key reads for Monday…

- Leisure and Hospitality Wages Are Soaring. It’s the Economy Returning to Normal. (Barron’s)

- This Former Merck Company Could Have Big Potential (Barron’s)

- Amazon’s Jeff Bezos Is Going to Space (Barron’s)

- Google fined $268M in French antitrust case, will change ad practices (New York Post)

- The 5 Highest-Paying S&P 500 Dividend Stocks All Yield 5% or More (247wallst)

- Investors cash in on dividend stocks as recovery gathers pace (Financial Times)

- Carnival stock gains after confirming restart of cruises from U.S. port in less than a month (MarketWatch)

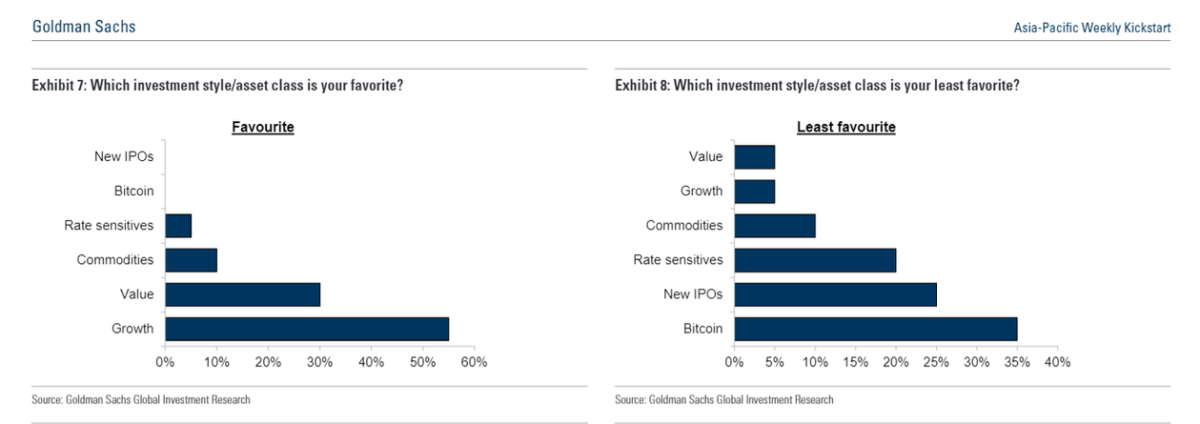

- Goldman chart reveals what hedge fund investment chiefs really think about bitcoin (MarketWatch)

- $70.00 Again. The Energy Report 06/07/2021 (Phil Flynn)

- BP Expects Strength in Global Oil Demand to Last, CEO Says (Bloomberg)

Be in the know. 20 key reads for Sunday…

- Big First 5 Months Gains Consolidate Over Worst Months (Almanac Trader)

- The great private jet shortage? (Financial Times)

- Here’s Why the Fed Isn’t Frightened by the Jobs Report (Wall Street Journal)

- 2021 Porsche 718 Cayman GTS 4.0: Targeting The Driving Enthusiast (Forbes)

- 10 Best Stocks that will Benefit from Biden’s $6 Trillion Plan (Insider Monkey)

- Verizon CEO Hans Vestberg on why he tracks every hour of his day and the power of the ‘boss contract’ (Fortune)

- The big-pharma firm that saw the future (The Economist)

- The Czinger 3-D-Printed, 1250 HP Hypercar Has a Top Speed of 281 MPH (Robb Report)

- 5 Standout Yachts From This Year’s Venice Boat Show (Robb Report)

- Autonomous vehicle startup Aurora in final talks to merge with Reid Hoffman’s newest SPAC (Tech Crunch)

- Not every SPAC is pure garbage (Tech Crunch)

- Here’s Why You Have Zero Chance Of Winning At 3-Card Monte (digg)

- ‘Wedding Crashers’ Sequel To Begin Production in August With Original Cast (Maxim)

- Guy Fieri Praised After Leaving $5,000 Tip at Miami Restaurant For Entire Staff (Maxim)

- Xpeng says its self-driving tech outperforms Tesla’s (technode)

- What’s driving the surge in food prices and what are the knock-on effects? (MoneyWeek)

- Only 39% of Americans would switch to an EV — here’s why (TNW)

- China Has Triggered a Bitcoin Mining Exodus (Wired)

- The 23 greatest classic films on HBO Max (Mashable)

- How JetBlue Founder David Neeleman Launched a New Airline During a Pandemic (Inc.)

Be in the know. 40 key reads for Saturday…

- Guy Fieri’s Bacon-Wrapped Danger Dogs Are a Ticket to Flavortown (Bloomberg)

- Manchin warns Dems about going it alone on Biden’s spending plan (Fox Business)

- Investors Need to Watch the Labor Shortage. Here’s Why. (Barron’s)

- Tiger Cubs: How Julian Robertson built a hedge fund dynasty (Financial Times)

- Lumber Prices Slump As Historic Boom Hits A Wall (ZeroHedge)

- The Best Investment of All: The People You Love the Most (New York Times)

- Fund Managers Are Ignoring Meme Stocks. That’s a Good Thing. (Barron’s)

- Brinker Stock Looks Set to Soar on Chili’s Comeback (Barron’s)

- Hedge fund stars shy away from the limelight (Financial Times)

- Banks Need Loan Growth to Keep Rallying. These Stocks Already Have It. (Barron’s)

- Why Boeing Could Fly High Again (Barron’s)

- Charlie Munger’s Book Recommendation List (CMQ)

- Driving the undriveable Ferrari (Financial Times)

- Payne: When I was a kid, getting a job was like winning the lottery (Fox Business)

- 4 Undervalued Stocks With Momentum (Morningstar)

- Dividends Are the Next Oil Catalyst. Here Are the Stocks that Could Benefit. (Barron’s)

- Natural-Gas Prices Stir Heading Into Summer (Barron’s)

- Peter Lynch on Common Investor Mistakes (Novel Investor)

- One stunning chart shows just how much faster the US labor market is recovering now compared to the financial crisis (Business Insider)

- A Wave of Global Spending Is Great News for Humanity (and Investors) (Barron’s)

- The Stock Market’s Long Run of Nothing Continued Last Week. What to Know. (Barron’s)

- Solar Power’s Land Grab Hits a Snag: Environmentalists (Wall Street Journal)

- Facebook’s Marketplace Faces Antitrust Probes in EU, U.K. (Wall Street Journal)

- iPhone? AirPods? MacBook? You Live in Apple’s World. Here’s What You Are Missing. (Wall Street Journal)

- Why Does Anyone Care About a Superyacht? (Wall Street Journal)

- Bill Gates, Warren Buffett building nuclear reactor in coal-rich Wyoming (New York Post)

- G-7 Strikes Historic Deal to Revamp Global Tax on Tech Firms (Bloomberg)

- How Ronald Read managed to accumulate a dividend portfolio worth $8 million (DGI)

- Emerging-Market Stocks in Pole Position to Gain as World Reopens (Bloomberg)

- Rosneft Warns of ‘Severe’ Oil Shortage Amid Hasty Energy Shift (Bloomberg)

- Bonds Aren’t Freaking Out About Inflation (Bloomberg)

- S.-China Trade Relationship Significantly Imbalanced, Tai Says (Bloomberg)

- Crypto investor Vignesh Sundaresan: ‘It’s the NFT that changed the world’ (Financial Times)

- Royal Caribbean sets 2021 cruises in Florida, Texas and Alaska (CNBC)

- Interactive Brokers founder says problem with AMC Entertainment memes: ‘People…will lose a very substantial amount of money’ (MarketWatch)

- Pete Najarian Sees Unusual Options Activity In Tapestry And IQIYI (Benzinga)

- Electric Car Batteries Are Turning This Country Into an Actual Hellscape (Futurism)

- Bill Ackman’s SPAC Is in Talks to Buy a Stake in Universal Music —But So Far It’s Not Music to Investors’ Ears (Institutional Investor)

- The Pied Piper of SPACs (New Yorker)

- Lots of Liquidity (Yardeni)

Tom Hayes – The Claman Countdown – Fox Business Appearance – 6/4/2021

Fox Business Appearance – Thomas Hayes – Chairman of Great Hill Capital – June 4, 2021

Where is money flowing today?

Data Source: Finviz

Hedge Fund Tips with Tom Hayes – VideoCast – Episode 85

Article referenced in VideoCast above:

Be in the know. 25 key reads for Friday…

- FDA’s Call on Biogen’s Alzheimer’s Drug Is Coming Soon (Barron’s)

- Viva Las Vegas: Sin City Presses Its Luck in the Postpandemic Era (Barron’s)

- May’s Employment Report Is Another Disappointment (Barron’s)

- Buy Take-Two Interactive Because a Whole Lot of Videogames Are in the Works (Barron’s)

- Alibaba, Alphabet, and Amazon Stock Are Bargains, This Value Manager Says (Barron’s)

- How Pitchers Are Conquering Baseball’s Home Run Revolution (Wall Street Journal)

- Ant to Change How It Makes Loans With New Consumer-Finance Company (Wall Street Journal)

- Services Boom? You Ain’t Seen Nothing Yet (Wall Street Journal)

- Biden Narrows Infrastructure Request, but Hurdles Remain for Bipartisan Deal (New York Times)

- The Momentum Is With Active Fund Managers for Now (Bloomberg)

- Texas Rising: Hedge Funds, Big Tech Drive Lone Star Wealth Boom (Bloomberg)

- Palantir gets aggressive in SPAC investments, backing digital health, aviation and robot companies (CNBC)

- Billionaire hedge-fund manager Julian Robertson endorses high-flying US tech stocks — and says their valuations aren’t lofty (Business Insider)

- Apple’s Big Show May Not Be Enough (Wall Street Journal)

- Cloud Software’s Low-Hanging Fruit Is a Tempting Target (Wall Street Journal)

- Apple stock on track for longest weekly losing streak in more than 2 1/2 years (MarketWatch)

- Is the Fed ‘tightening cycle’ already happening? (MarketWatch)

- Italian Artist Sells Invisible Sculpture For $18,000 (ZeroHedge)

- Strong Inflows to Cash Continue, Largest Selling of Tech Stocks Since December 2018 – BofA’s Flow Show (Street Insider)

- Northrop Grumman (NOC) Upgraded to ‘Buy’ at Stifel on Compelling Valuation (Street Insider)

- Apple’s (AAPL) WWDC Unlikely to Blunt the Deceleration Narrative – Wolfe Research (Street Insider)

- Biden open to dropping corporation tax rise in infrastructure talks (Financial Times)

- UK approves Pfizer jab for younger adolescents (Financial Times)

- Tiger’s Julian Robertson bets big tech stocks will keep marching higher (Finaicial Times)

- Washington to bar US investors from 59 Chinese companies (Financial Times)