- Krispy Kreme’s Sales Rise Ahead of Its Planned IPO (Bloomberg)

- 5 Stocks to Buy Now That May Be Huge 2021 Summertime Winners (247wallst)

- Reopen! The Energy Report 06/01/2021 (Phil Flynn)

- MLB, players’ union facing all-star lawsuit for pulling game out of Atlanta (Fox Business)

- The New York Office Market Is Coming Back. Here’s the Stock to Bet On. (Barron’s)

- Al Gore’s Firm Doubled Down on Alibaba (Barron’s)

- EQT CEO Says Natural Gas Is Key to Cleaner Energy (Barron’s)

- China Three-Child Policy Aims to Rejuvenate Aging Population (Wall Street Journal)

- Jobs Report Could Be Pivotal for Federal Reserve (Wall Street Journal)

- Small Businesses Have Surged in Black Communities. Was It the Stimulus? (New York Times)

- Employees Are Quitting Instead of Giving Up Working From Home (Bloomberg)

- Oil Highest Since 2018 With Iran Deal Elusive and OPEC Talks Due (Bloomberg)

- Investing legend Bill Gross says the Fed risks sinking the dollar if it persists with its ultra-easy policies (Business Insider)

- Dolly Parton Still Swears by Cheap Makeup (Wall Street Journal)

- Mark Cuban predicts DAOs will transform companies. Warren Buffett’s Berkshire Hathaway embraced the core ideas behind the latest crypto trend decades ago. (Business Insider)

- Brazil manufacturing PMI rebounds in May to three-month high -IHS Markit (Reuters)

- AMC Raises $230.5M Through Private Placement To Hedge Fund Mudrick: What Investors Need To Know (Benzinga)

- Nio Vs. XPeng: How Chinese EV Duo’s May Deliveries Stack Up (Benzinga)

- SPAC Pullback Pressures Creators to Find Quality Mergers (Wall Street Journal)

- How to Know When Inflation Is Here to Stay (Wall Street Journal)

Tag: StockMarket

Be in the know. 10 key reads for Memorial Day…

- Reopening Bets Pay Off Big for Stock Pickers (Wall Street Journal)

- China Factory Activity Nudges Down On Slower Demand, Services Strong (Barron’s)

- Al Gore’s Firm Doubled Down on Alibaba. It Sold Airbnb and One Chip Stock. (Barron’s)

- This Just-Approved Amgen Drug Is the First to Hit a Hard Target in Cancer (Barron’s)

- Why once-hot hedge-fund stock picks are now the ‘pain trade’ of 2021 (MarketWatch)

- China Moves to Three-Child Policy to Boost Falling Birthrate (Bloomberg)

- OECD raises growth forecasts on vaccine rollouts, U.S. stimulus (Reuters)

- Putin Is Betting Coal Still Has a Future (Yahoo! Finance)

- US regulators signal bigger role in crypto market (Financial Times)

- European stocks set to seal fourth consecutive month of gains (Financial Times)

Be in the know. 20 key reads for Sunday

- From Junk Bond King To SPAC Whale: How Michael Milken Became A Big Investor In The SPAC Boom (Forbes)

- Unpacking President Biden’s Big Budget (NPR Planet Money)

- The Profound Potential of Elon Musk’s New Rocket (Nautilus)

- Big oil is under pressure to cut production – what does that mean for investors? (moneyweek)

- 2022 Maserati MC20: The Italian Supercar Reinvented the Smart Way (Road and Track)

- The Biggest Surprises (And Disappointments) From Round 1 Of The Stanley Cup Playoffs (fivethirtyeight)

- Carson Block on the Short-Selling Market (Podcast) (Bloomberg)

- 5 Sizzling Energy Stocks Trading Under $10 With Oil Closing in on $70 a Barrel (24/7wallst)

- Days After Memorial Day Improving (Almanac Trader)

- China, U.S. can find common ground on tariff exclusions, Chinese think tank says (Reuters)

- 10 Best Cheap Stocks to Buy According to Billionaire Mario Gabelli (Insider Monkey)

- The 1750 HP SSC Tuatara, the World’s Fastest Car, Just Got Even More Powerful (Robb Report)

- Watch: Elon Musk’s Other Company Tests Its Tesla Tunnel System in Las Vegas With Real Passengers (Robb Report)

- Rolls-Royce’s Newest Car Features Its Own Cocktail Tables for Alfresco Dining (architecturaldigest)

- Alibaba is making its cloud OS compatible with multiple chip architectures (Tech Crunch)

- Tesla Roadster Will Hit 60 MPH in Just 1.1 Seconds, Says Elon Musk (Maxim)

- The 212-MPH McLaren 720S Supercar Gets Racy Special Edition (Maxim)

- Flamboyant 1968 Lamborghini Miura P400 S Expected to Fetch $1.1 Million at Auction (TheDrive)

- Marques Brownlee Gives His First Impressions Of The Ford F150 Lightning Electric Truck, And It Was Better Than He Thought (digg)

- JD revenue grows 39%, Ali-backed new retail eyes IPO: Retailheads (Tech Node)

Be in the know. 25 key reads for Saturday…

- Thrill-seeking traders send ‘meme stocks’ soaring as crypto tumbles (Financial Times)

- The rise of crypto laundries: how criminals cash out of bitcoin (Financial Times)

- White House Budget Shows Focus on Wealth Redistribution, Not Growth (Bloomberg)

- This Just-Approved Amgen Drug Is the First to Hit a Hard Target in Cancer (Barron’s)

- Housing Supply Shortage Hits Pending Home Sales in April (Barron’s)

- GM Restarts Several Assembly Plants as Global Chip Shortage Begins to Ease (Barron’s)

- Watch CNBC’s full interview with Liberty Media’s John Malone on WarnerMedia-Discovery deal (CNBC)

- Big Oil Had a Bad Week. Why That’s Good News for Investors. (Barron’s)

- Natural Gas Prices Are Rising. Here Is the Stock to Play It. (Barron’s)

- Apple Stock Could Drop 30% If iPhones Sales Slow, Analyst Says (Barron’s)

- Biogen’s Alzheimer’s Drug Faces Its Moment of Truth. Biotech Investors Are Watching. (Barron’s)

- From Graham to Buffett and Beyond (Columbia)

- This Might Be the Most Bizarre Baseball Highlight in Years (Wall Street Journal)

- U.S. Corporate Bond Spreads Hit 14-Year Low as Economy Resurges (Bloomberg)

- Market sentiment readings suggest investors are fearful even as the S&P 500 nears record high (Business Insider)

- Costco is seeing inflation abound, impacting a slew of consumer products (CNBC)

- Millions of Americans in 24 states are set to lose unemployment benefits (CNBC)

- Here’s the firepower the Pentagon is asking for in its $715 billion budget (CNBC)

- President Biden is banking on a $3.6 trillion tax hike on wealthy Americans and big corporations. (New York Times)

- Carnival gets OK from CDC on port plans to restart cruising (USA Today)

- Why NASA Scientists Are So Excited by New Hints of Organic Compounds on Mars (Futurism)

- Scientists Say This Is the Maximum Human Lifespan (Futurism)

- Better Thinking & Incentives: Lessons From Shakespeare (Farnam Street)

- Americans Will Hit the Road With Highest Fuel Price Since 2014 (Bloomberg)

- Sam Zell’s success in business in seven rules (mrzepczynski)

Where is money flowing today?

Data Source: Finviz

Hedge Fund Tips with Tom Hayes – VideoCast – Episode 84

Article referenced in VideoCast above:

The “Astronaut in the Ocean” Stock Market (and Sentiment Results)…

Be in the know. 20 key reads for Friday…

- A Temporary U.S.-China Trade Truce Starts to Look Durable (New York Times)

- What Biden’s $6 Trillion Budget Means for Markets (Barron’s)

- Pinduoduo Is a Bet on China’s Continued Growth (Barron’s)

- Bet Big on the Recovery in Las Vegas With These Stock Picks. (Barron’s)

- It’s Time to Shift More Money to European Stocks, Fund Manager Says (Barron’s)

- Salesforce Stock Rallies as Earnings Top Expectations (Barron’s)

- Royal Caribbean Plans Vaccinated Cruise From Florida in June (Barron’s)

- Chesapeake, Once Bankrupt, Is Winning Fans (Barron’s)

- The Oracle of Omaha bets on Cincinnati: Warren Buffett becomes No. 3 holder in Kroger (USA Today)

- Japan’s Top Central Banker Joins Chorus of Bitcoin Critics (Bloomberg)

- SPACs Were Hot in 2020 and Are Hotter Now. Here’s Why (Bloomberg)

- U.S. banks are poised for ‘record level’ earnings in 2021, says IIF (CNBC)

- Rolls-Royce launches the ‘most ambitious’ car it’s ever created (CNBC)

- A Pressure Valve Opens for Bank Stocks (Wall Street Journal)

- Biden Expected to Propose $6 Trillion Budget (Wall Street Journal)

- ‘God Told Me to Put Money Into Hertz’: Small Investors Are Winning Big Again (Wall Street Journal)

- Popular US inflation gauge climbs at fastest rate since 2008 in April (Business Insider)

- New Street Research Downgrades Apple (AAPL) to Sell, ‘Brace for a 12S Downcycle’ (Street Insider)

- Immunity to the coronavirus may persist for years, what it could mean for vaccination efforts (Yahoo! Finance)

- Investors are underestimating Europe’s upturn (Financial Times)

Hedge Fund Tips with Tom Hayes – Podcast – Episode 74

Article referenced in podcast above:

The “Astronaut in the Ocean” Stock Market (and Sentiment Results)…

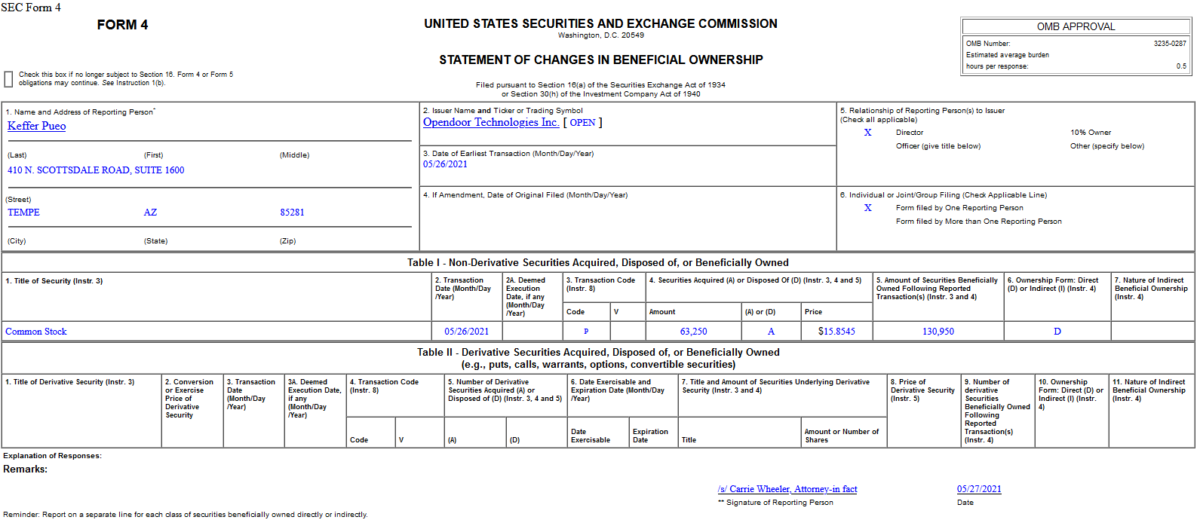

Insider Buying in Opendoor Technologies Inc. (OPEN)

On May 26, 2021, Pueo Keffer – Director of Opendoor Technologies Inc. (OPEN) – purchased 63,250 shares of OPEN at $15.85. His out of pocket cost was $1,002,797.

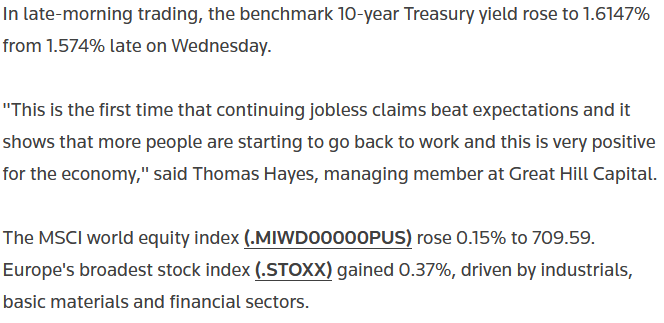

Tom Hayes – Quoted in Reuters article – 5/27/2021

Thanks to Chibuike Oguh for including me in his article on Reuters today. You can find it here: